Michael M. Santiago/Getty Images News

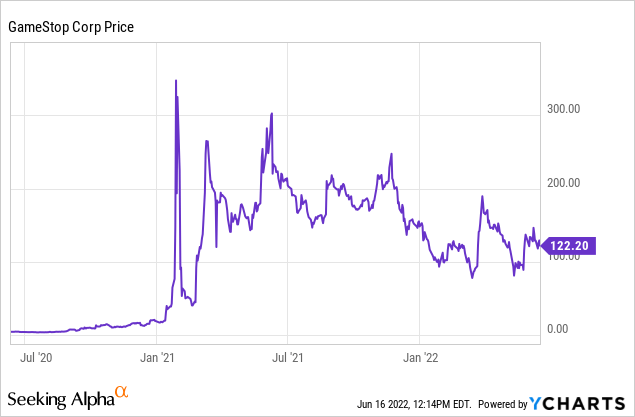

GameStop (NYSE:GME) has seen a huge increase in its share price in the first half of 2021, rising from $17 per share to as much as $300 per share. The driver of this rally was the well-known short squeeze, which eventually resulted in an entire wave of short-squeezes on the so-called “meme-stocks”.

Although GameStop’s share price has fallen more than 40% in the last 12-month period, its current price is still substantially higher than prior 2021.

We understand that the current price is not a result of strong fundamentals, therefore trying to predict the potential price target in the near term, based on the firm’s financial performance is not likely to be effective.

For this reason, in this article, we will be looking at GME’s business from a broader perspective, focusing mainly on its strategy, what it could mean for the firm in the near- and long-term, and on the potential impact of declining consumer confidence on GME’s strategy implementation.

Strategy

GameStop’s new strategy has two primary pillars: diversification and blockchain. There are other initiatives in the strategy, including enhanced domestic customer care, enhanced customer experience and loyalty programs, but we will not be covering these topics in detail now.

Diversification

The firm has outlined in their new “comeback” strategy that they are aiming to offer a wider range of products for their customers, including PC gaming, computers, monitors, game tables, mobile gaming products, and gaming TVs. Further, they are aiming at strengthening their digital presence and monetize on e-commerce.

On one hand, we believe that diversifying the business, both in terms of products and distribution channels, is a reasonable and necessary step, in order to decrease the reliance on video game and collectible sales in physical stores.

On the other hand, we expect that GME will face substantial difficulties. Let us discuss two of the difficulties that we believe are the most crucial:

1. Likely contraction of margins

Selling video games, especially used games, used to be a high-margin business, generating significant profits for GameStop. The proposed new offerings in the diversified product portfolio appear to be lower-margin items, including electronics and furniture even.

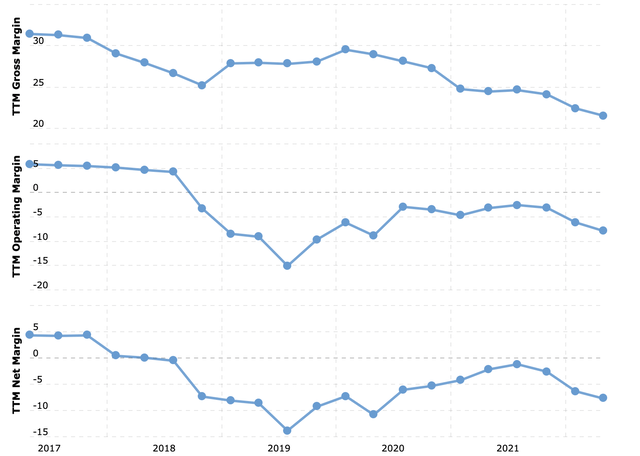

GME’s margins have already been consistently declining in the last couple of years, and with these product additions, we are not expecting to see a sharp turnaround soon.

One could argue that the proposed increase in the digital presence could have a positive impact on the margins, however, we see a different problem with that.

2. Competition

As GameStop is entering the e-commerce world, it will face even more competition from much larger, more established firms, including, for example, Amazon (AMZN) or Best Buy (BBY).

In our opinion, the closure of physical stores can definitely have a positive impact on the margins, however, we believe this impact will be partially or fully offset by the increased competition. As of now, we do not see any unique offerings from GME that would give the firm a competitive advantage over its peers. Also, we believe that GameStop’s pricing power is likely to be very limited. In terms of customer care and customer experience, we also believe that Best Buy has an advantage.

Despite GME’s increased revenue reported in the first quarter of 2022, we believe that the diversification part of the strategy is not likely to significantly help GME survive in the long run. Overall, we believe that even with the new product offerings, GME’s business is likely to become obsolete.

Further, GME has already tried diversification in the past. The firm has acquired in 2014 a retailer of wireless phones and plans, called Spring Mobile. Although the firm has been calling this segment the primary growth driver for years, they eventually decided to divest from it in 2019, in order to put the focus back on video games.

Blockchain: Cryptocurrencies and NFTs

Many firms, including larger players, like Meta Platforms (META), are betting on the growing acceptance and increasing value of cryptocurrencies and Non-fungible tokens (NFTs). GameStop is taking a similar bet.

Recently, GME has launched a self-custodial Ethereum wallet, which enables users to purchase, transfer and store cryptocurrencies. Users are also able to exchange and store NFTs. This wallet is intended to serve as a basis for the launch of GME’s NFT marketplace later this year.

In our opinion, entering the crypto and NFT world may actually be an interesting opportunity for GME in the long term. On the other hand, we again have to mention competition as a crucial headwind, especially as Robinhood (HOOD) is also planning to launch its non-custodial wallet in the near future. As Robinhood has a significantly larger product offering and an already existing user base, we see them as the better-positioned player in the field.

We also cannot ignore the recent trends in the crypto market. The prices of cryptocurrencies have been falling sharply in the recent months, as investors were looking for safer investments. This trend resulted in the tumbling of the share prices of many operators of cryptocurrency exchange platforms, e.g., Coinbase. This week, due to the significant plunge of token values, several platforms had to even pause the crypto withdrawals.

In our view, many investors are turning away from the crypto market, at least for the time being. In the near term, we do not expect cryptocurrencies to regain the momentum and popularity that they had between 2019- 2021. For this reason, we believe that this part of GME’s strategy, due to the timing of the launch, is also not too promising in the near term.

Declining consumer confidence

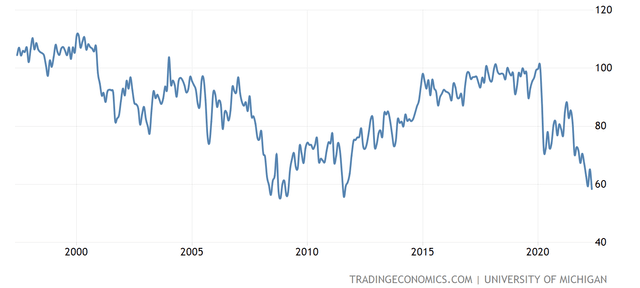

Consumer confidence has been steadily declining in the last months, reaching its 10-year low, and approaching levels seen in 2008-2009.

U.S. Consumer confidence (Tradingeconomics.com)

Low consumer confidence will likely result in the change of the spending behaviour of the customers. For example, by cutting or delaying the purchases of durable goods and non-essential, discretionary items. As GME’s current and potential new products are discretionary products, we expect the demand to decline. Further, we believe that the firm’s diversification efforts could face significant challenges and even fail as many of their potential new products could be categorised as durables including electronics (such as monitors, gaming TVs) or furniture (e.g.: game tables).

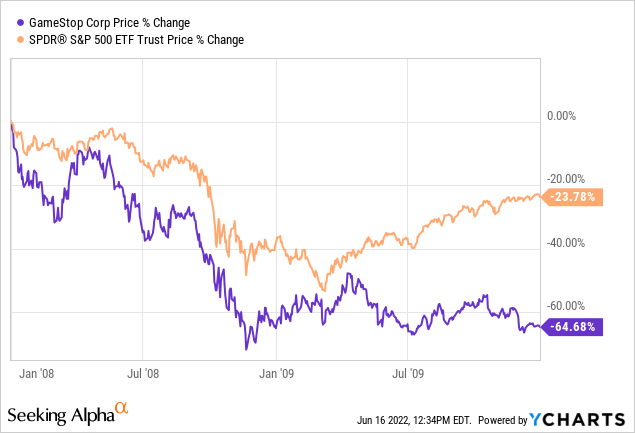

Also, in the period of 2008-2010, during the low consumer confidence, GME has significantly underperformed the broader market, by losing more than 60% of its market value.

All in all, we believe that the low consumer confidence is likely to hurt GameStop’s strategy implementation and its financial performance overall.

Key takeaways

Despite the revenue growth in the first quarter of 2022, GameStop’s stock does not appear to be attractive.

Both key pillars of GameStop’s strategy, diversification and blockchain, are likely to face significant headwinds in the near term, due to the declining consumer confidence and the current market sentiment. Also, GME has a poor track record of diversification efforts, as illustrated by the example of the Spring Mobile acquisition.

In our opinion, GameStop’s competitors are better positioned both in retail and in crypto.

We believe that GME is a sell, as the business may become obsolete, if they fail to improve their strategy and its implementation.

Be the first to comment