Gaming retailer GameStop (NYSE:GME) reported earnings on March 26. The company posted an impressive 48-cent non-GAAP EPS beat, by a long stretch the widest achieved as far back as I can verify.

But given how upside-down the world has been lately due to the virus outbreak, last quarter’s above-consensus numbers will most likely go unnoticed. All attention has now turned to fiscal 2020, a year that continues to be shrouded in uncertainty for the Grapevine, Texas-based retailer.

Credit: Hot Hardware

Stores finally go dark

Results for the fiscal fourth quarter, which ended February 2, should have been largely unaffected by the COVID-related shutdown of the US economy. Yet, the revenue decline in the important holiday season was staggering: 28% below year-ago levels, on tail-spinning comps of -26%. To be fair, expectations had been well calibrated, following GameStop’s January report that post-Black Friday sales had been dismal.

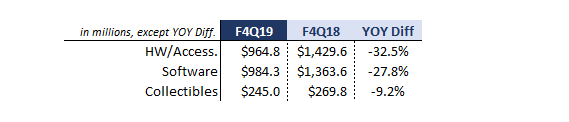

There wasn’t any strength to be found across the three main business categories. The small collectibles division performed relatively better, as it remains largely unaffected by the late stages of the current console cycle. Unfortunately, but probably for a good reason, GameStop stopped reporting accessories and pre-owned separately. I estimate that the former helped to mask a 40%-plus decline in hardware sales that had already been very weak in 2018, while the 28% decline in the combined new and used software category struck me as worse than usual.

Source: DM Martins Research, using data from earnings release

Because GameStop chose to keep its stores open past mid-March, in a controversial move to consider itself an “essential business”, the company may end up not taking as large a hit on its first fiscal quarter financial performance as many other retailers likely will. I wonder if this factor alone may justify the stock’s resilience during the COVID-19 crisis – share price has remained flat since February 19, the day that the broad market peaked.

But make no mistake: as GameStop stores finally go dark, and the retailer limits its operations to online and curbside pick-up, financial results should deteriorate substantially going forward. It is worth noting that, despite the strong economy and lavish consumer spending habits, GameStop burned through nearly half a billion dollars in cash flow in fiscal 2019. As of early February 2020, the company held that much in cash and equivalents, along with almost as much in debt.

What’s the best bull case?

The most convincing bull case for owning GME today rests on one key argument: the video game hardware line-up is about to undergo a long-awaited refresh. At that point, an angel holding a briefcase full of gold is expected to descend from heaven and kick-start a revival in mall-centric, brick-and-mortar gaming retail, launching GameStop’s stock back towards its 2007 all-time high (sorry about the sarcasm, it has been a long few weeks of social distancing).

To be fair, Microsoft (MSFT) and Sony (SNE) have shared their intentions to launch the PlayStation 5 and the X-Box Series X in the 2020 holiday season. But I remain skeptical of the proposed timeline. Both companies have deep enough pockets to hold off on the console releases, should they choose to launch the products after all COVID-19 concerns (from supply chain to consumer demand) have been addressed and put to rest. If production has been or will be disrupted substantially, or if the $500 devices fail to find enough consumers willing to spend on discretionary items in the middle of a likely recession, Microsoft and Sony may be better off waiting until 2021.

Sure, speculators can still make money by betting on (and being right about) a 2020 holiday season rebound. But at a higher level, looking at the situation through the lens of a long-term investor, I do not feel comfortable putting money into a company whose financial performance depends so heavily on a multi-year product cycle that is completely out of its control.

Don’t try to time the bottom

I will not blame those who choose to take a gamble on GME, hoping for a trend-breaking 2020 that will put an end to at least five years of relentless deterioration in GameStop’s business fundamentals. If the bet is sized properly (i.e. very small), as if GME were a call option that could either head towards zero or climb substantially, buying the stock today could be appealing to some.

But I am much more interested in investing in high-quality companies with solid business prospects, not on playing the catch-the-bottom game that has made many victims among GME shareholders over the years. For this reason, I choose to stay as far away from this stock as possible.

I do not own GME because I believe I can create superior risk-adjusted returns in the long run using a different strategy. To dig deeper into how I have built a risk-diversified portfolio designed and back-tested to generate market-like returns with lower risk, join my Storm-Resistant Growth group. Take advantage of the 14-day free trial, read all the content written to date and get immediate access to the community.

Disclosure: I am/we are long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment