eyegelb/iStock via Getty Images

The Q4 and FY2021 Earnings Season is finally over, and one of the most recent companies to report its results was Galiano Gold (NYSE:GAU). Often, the worst is saved for last, which was certainly the case with this junior producer. The company reported a miss on production guidance, rising costs, and a negative revision to its reserve base. There’s no disputing that Galiano is cheap at an enterprise value of $80 million. Still, I’ve never found much value in buying a cheap and risky stock unless there was a positive catalyst on the horizon. In Galiano’s case, it’s hard to find one; hence I continue to see better opportunities elsewhere.

Unless otherwise noted, all figures are on a 100% basis for the Asanko Gold Mine JV. The Joint Venture is split 50/50 for the 90% economic interest, with Ghana holding 10%. Therefore, all figures are attributable on a 45% basis to Galiano.

Asanko Gold Mine – Galiano Gold Operations (Company Website)

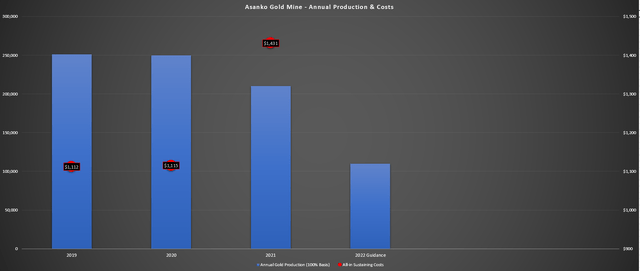

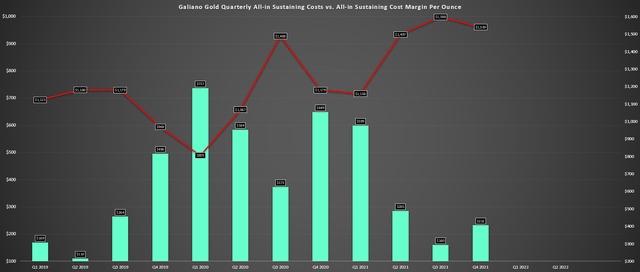

Galiano Gold released its Q4 and FY2021 results last month, reporting annual production of ~210,200 ounces of gold, a significant miss vs. its guidance mid-point of 235,000 ounces at all-in sustaining costs of $1,300/oz. This was evidenced by production of just ~210,200 ounces at all-in sustaining costs [AISC] of $1,431/oz at its Asanko Gold Mine [AGM] Joint Venture. While this was a disappointment, though not surprising given the guidance cut mid-year, the negative surprise was on reserves, which were not present in the updated Reserve & Resource estimate. Let’s take a closer look below:

Asanko Gold Mine – Annual Production & Operating Costs (Company Filings, Author’s Chart)

Galiano Gold released its updated Reserve & Resource estimate in March after noting in the previous month that it had detected an increase in gold grades in tailings product that was leaving the processing facility. The assays indicated that gold grades were approximately 0.40 grams per tonne in the tailings product, well above the historical and expected gold grade of 0.10 grams per tonne gold.

The company has begun work to figure out the cause of the elevated grades, which includes:

- confirmatory analysis of plant stream producers at independent labs

- diagnostic analyses on plant composite samples

- a review of past metallurgical work

- a complete plant survey

- additional drilling in key areas of the Esaase Pit

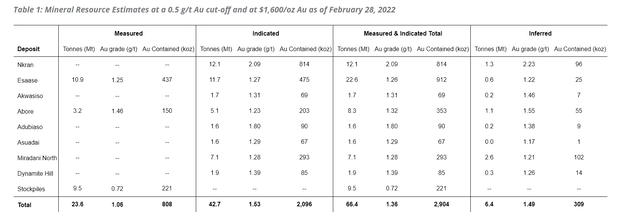

In the release, Galiano noted that the impact of the lower recovery was uncertain. Unfortunately, this impact has shown up in the updated Reserve & Resource estimate for the AGM. The results are not pretty, with the AGM not reporting any mineral reserves in the 2022 update due to the metallurgical uncertainty of material mined from the Esaase Pit. For those unfamiliar, Esaase made up a large portion of the December 2019 reserve base and life of mine plan, with reserves of ~1.46 million ounces of gold vs. a total reserve base of ~2.38 million ounces of gold. Hence, a possible issue with this deposit is certainly not ideal.

As shown in the below table, Esaase’s updated resources came in at 22.6 million tonnes at 1.26 grams per tonne of gold, translating to 912,000 ounces of gold. This is a massive decline from 43.2 million tonnes at 1.69 grams per tonne of gold reported at the end of 2019, translating to a significant drop in grades and tonnage. So, while Galiano reported a maiden resource at Miradani North which it’s been busy drilling, the decline in resources at Esaase more than offset the ~300,000-ounce increase at Miradani North.

Asanko Gold Mine – Updated Resource Estimate (Company News Release)

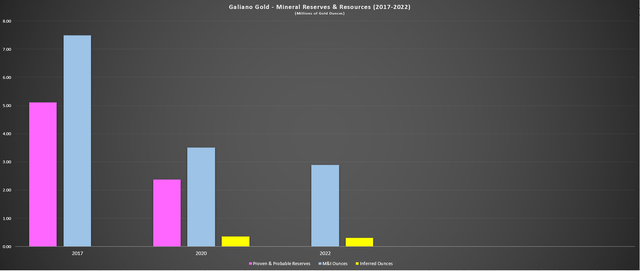

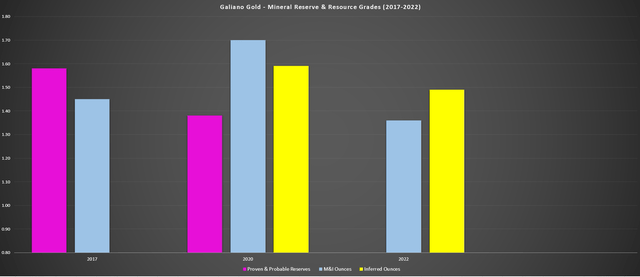

This resulted in an updated resource estimate of ~2.91 million ounces of gold at 1.36 grams per tonne gold in the measured & indicated [M&I] category, down from ~3.50 million ounces of gold at 1.70 grams per tonne in the Q1 2020 report. Let’s look at the progression of mineral reserves and resources below. We can see that it’s not a pretty trend. There are no reserves reported currently (pink bars), and measured & indicated resources have been declining rapidly (blue bars), with no real increase in inferred resources. In fact, inferred resources also declined on a two-year basis to 309,000 ounces (Q4 2019: 357,000 ounces).

Galiano – Reserves & Resources (2017-2022) (Company Filings, Author’s Chart)

Moving over to reserve and resource grades below, we can see that the culprit for the lower resources was gold grades, with M&I grades slipping from 1.70 grams per tonne gold to 1.36 grams per tonne gold. A 20% increase is a massive decline, especially with limited growth in tonnage, and while Miradani North helps with tonnage, its grades are below the average resource base. If we exclude stockpiles from the Q4 2019 and Q1 2022 resource bases, tonnage was actually down as well, evidenced by total M&I tonnes of 56.9 million tonnes vs. 61.8 million tonnes in Q4 2019.

Galiano – Reserve & Resource Grades (Company Filings, Author’s Chart)

Overall, this negative revision is not positive, and given the work required to support a new mineral reserve at the AGM, annual production will be much lower. This is based on FY2022 guidance of 100,000 to 120,000 ounces due to the cessation of mining in Q2 followed by processing lower-grade stockpiles in H2. The only good news is that Galiano is in a position of strength with no debt and ~$50 million in cash, so the lack of free cash flow generation this year will not lead to further share dilution.

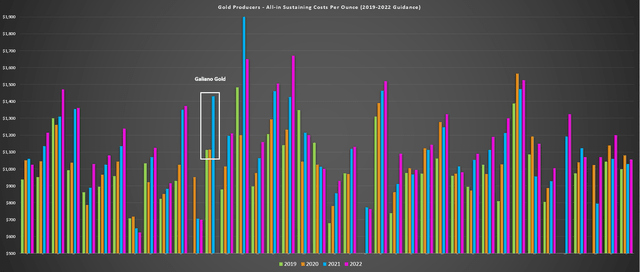

Gold Producers – All-in Sustaining Costs Per Ounce (2019 – 2022 Estimates) (Company Filings, Author’s Chart)

Having said that, if we look at the above chart, Galiano Gold has already seen a sharp rise in costs from 2019 to 2021 relative to its peers, with AISC up 29% in the period ($1,436/oz vs. $1,112/oz). So, with lower production expected this year, Galiano will continue to be a much higher-cost producer, and we will likely see a second consecutive year of margin compression for the company. This is not ideal when most other producers are reporting margin expansion with the higher gold price more than offsetting the single-digit increase in costs due to inflationary pressures. Let’s look at the valuation to see whether the stock is worth buying after its 70% decline.

Galiano Gold – AISC Margins (TC2000.com)

Valuation & Summary

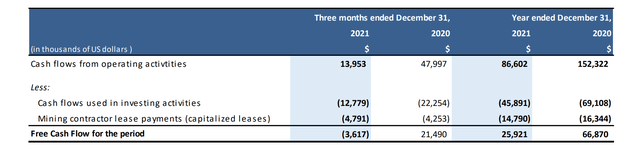

Based on ~234 million fully diluted shares, Galiano Gold has a market cap of ~$129 million, a valuation typically reserved for an early-stage developer, not a gold producer. This valuation becomes more attractive if we subtract out $50 million in cash, leaving Galiano valued at $80 million for its 45% ownership in the AGM. Even if we use attributable M&I ounces (ex-stockpiles), Galiano is valued at approximately $66/oz based on ~1.21 million ounces of gold. Finally, on a free cash flow basis, Galiano trades at a double-digit free cash flow yield based on ~$26 million in free cash flow generated on a 100% basis in FY2021.

AGM – Free Cash Flow Generation (100% Basis) (Company Filings)

At first glance, this would suggest that Galiano is a Buy, given that it has one of the cheapest valuations for a producer sector-wide. However, it’s important to note that 2022 will be a much weaker year for the company due to a 45% decline in production, with costs increasing. While I would argue that much of this is priced into the stock, I have never found much value in buying a high-risk stock simply because it’s cheap. Instead, I believe the formula for turnaround stories is having a catalyst in place to end the downtrend in the stock price.

Given that Galiano is a relatively insignificant Tier-3 jurisdiction producer with costs well above the industry average, it has been on my Avoid list. This certainly hasn’t changed with the news of a negative revision to reserves. With lower production, lower margins, and a less impressive resource base, I don’t see any positive catalysts on the horizon, except for a higher gold price. However, this is not a company-specific factor because nearly every producer should benefit from a higher gold price. In fact, Galiano will benefit because its production is halved this year, while other producers will have exposure to the gold price at similar production levels.

AGM Operations (Company Website)

Given the risk of single-asset producers in unfavorable jurisdictions as is, and the lack of an upside catalyst to end this current downtrend, I continue to see much better ways to play the sector. This doesn’t mean that the stock can’t go higher, but owning GAU could be an opportunity cost in a sector where many miners are returning significant capital to shareholders. So, while there’s less downside risk after this decline, I continue to favor great growth stories like Alamos Gold (AGI) or Nomad Royalty (NSR).

Be the first to comment