Marcus Lindstrom

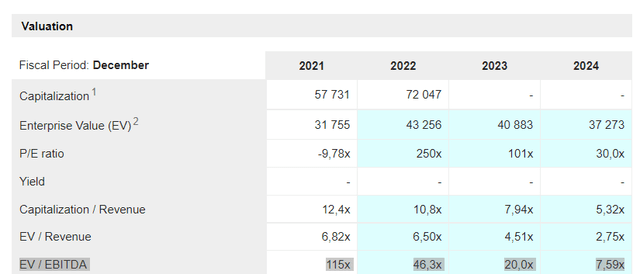

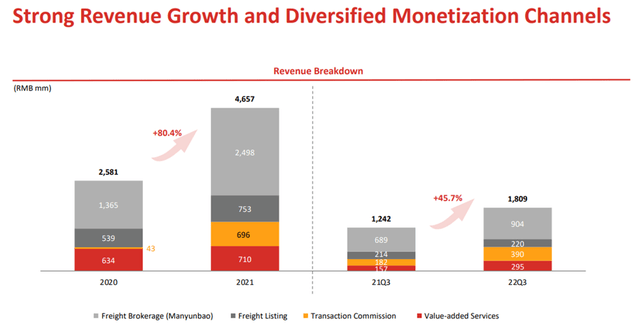

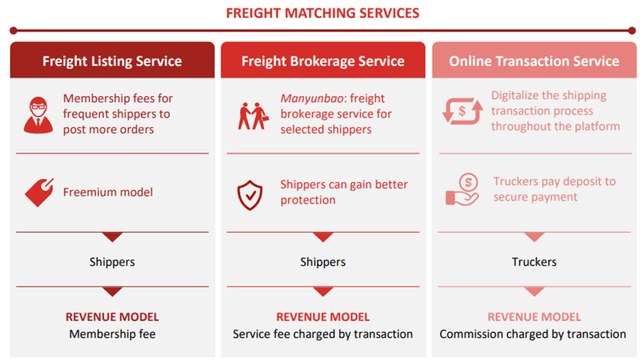

A product of the Yunmanman/Huochebang merger in 2017, Full Truck Alliance (NYSE:YMM) is the leading China-based digital freight platform, with operations spanning freight listing, freight brokerage, online transaction, and value-added services to shippers and truckers. Despite the massive addressable market opportunities at hand, the stock has underperformed YTD on regulatory concerns (the suspension of new user acquisition) and a COVID-driven freight demand slowdown. Yet, the more accommodative policy shift post-June and the recent quarterly rebound show the fundamentals remain intact, with growth and margins outperforming despite the lockdowns. At ~8x fwd EBITDA, the stock screens favorably relative to growth expectations, presenting a compelling entry point, in my view.

A Gradual Recovery in Q3

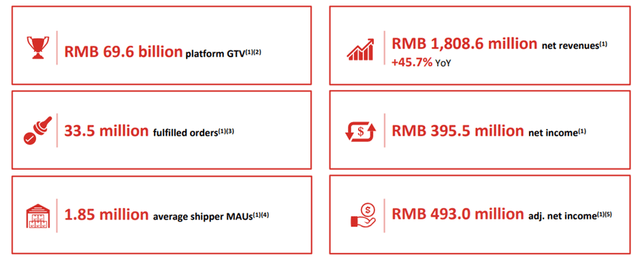

Given the impact of the COVID lockdowns throughout the quarter and the unfavorable seasonality, Full Truck Alliance’s latest quarterly outperformance was commendable. Not all metrics were higher, though. For instance, gross merchandise value fell by ~5% YoY, but the higher order fulfillment ratio at ~25% (vs. 20% in Q2) picked up the slack. Of note, fulfillment numbers are still running below last year, as driver supply conditions were temporarily tight due to the unfavorable weather. Yet, new user growth continued post-resumption of new user registration in June, with the monthly active users up to 1.85m (+320k shippers). Combined with the strong retention rate of the existing paying shipper and trucker base on the platform, the take rate remained at a solid ~6% (flat QoQ).

In line with the fundamental upswing in key user metrics, total revenue growth reached an impressive 46% YoY to Rmb1.8bn, exceeding even the upper end of the prior guidance. Transaction commission revenue was the key segmental revenue driver at +114% YoY to RMB390m, as expanded commission coverage to ~50% and a ~1% (and growing) take rate contributed. Trucker brokerage revenue also outperformed at +31% YoY to RMB904m on the accelerated adoption of the freight brokerage service, Manyunbao, while the overall take rate remained stable. These two segments more than offset any weakness in freight listing revenue, which was up a modest ~3% YoY, as a lower take rate offset the ongoing membership growth here.

Margin Expansion Continues Amid Monetization Ramp-up

Like most platforms, Full Truck Alliance’s asset-light business model offers massive margin expansion potential as it gains scale. For context, the company has two high-margin revenue streams, listing and commission revenues, while freight brokerage revenues are typically lower margin at a high-single-digit % gross profit margin. The latter could see further compression in the coming quarters as the take rate is strategically lowered to attract more shippers. That said, compliance could also be a key offsetting factor for the freight brokerage side – with large shippers increasingly focused on compliance (e.g., on invoices), the Full Truck Alliance platform is well-positioned to meet these needs.

Overall, gross margins still accelerated QoQ to 47% on a favorable revenue mix shift toward commission revenue, while the timing difference of tax refunds related to the freight brokerage also contributed. If we were to further exclude the freight brokerage segment, the gross margin in Q3 would have improved an impressive ~4%pts YoY to 85%. The runway is extensive – monetization remains well below e-commerce and ride-hailing platforms, so as the gap narrows in the coming years, expect more upside to profitability. The platform’s ability to scale across its segments will also be key to unlocking positive operating leverage benefits over the long run, while in the near term, a further revenue mix shift towards high-margin commission revenue should be accretive to the overall margin profile.

A More Accommodative Policy Backdrop

On the policy front, Full Truck Alliance stands to benefit from a favorable shift in stance by the Chinese regulators toward the platform economy. While the focus had previously been on cracking down on unregulated activities, regulation appears to have settled on an enhanced framework to support steady industry development. Case in point – the resumption of new user registration for the platforms like Full Truck Alliance in June this year, which supports the case for a more stable policy outlook from here. The only concern I have is the social insurance cost burden and the company’s potential liability down the line. Given Full Truck Alliance’s role as a platform with limited labor relations engagement with the drivers, though, it seems unlikely that it will be held liable for coverage.

Bottoming Out

Despite the on-again/off-again lockdowns in China throughout Q3, Full Truck Alliance delivered decent revenue growth, led by an improved fulfillment rate and a steady ramp-up in commissions. Also helping is that regulation appears to be turning more accommodative towards the Chinese platform economy, with new user acquisition now resumed. Perhaps more importantly, Full Truck Alliance has played a key role in improving the efficiency of the domestic trucking industry, as well as creating jobs and income opportunities for drivers. Thus, the platform is aligned with the government’s ‘common prosperity goals.

With the government also easing up on its ‘zero COVID’ policy recently and moving forward with stimulus packages to boost the economy, expect a further rebound in freight demand into the coming year. Post the YTD correction in the stock price, concerns around the regulatory overhang and near-term demand weakness have likely been priced in. At ~8x fwd EBITDA and mid-double-digit % profit growth potential, the stock is worth a look.

Be the first to comment