whitebalance.oatt

“I used to advertise my loyalty and I don’t believe there is a single person I loved that I didn’t eventually betray.” – Albert Camus, The Fall

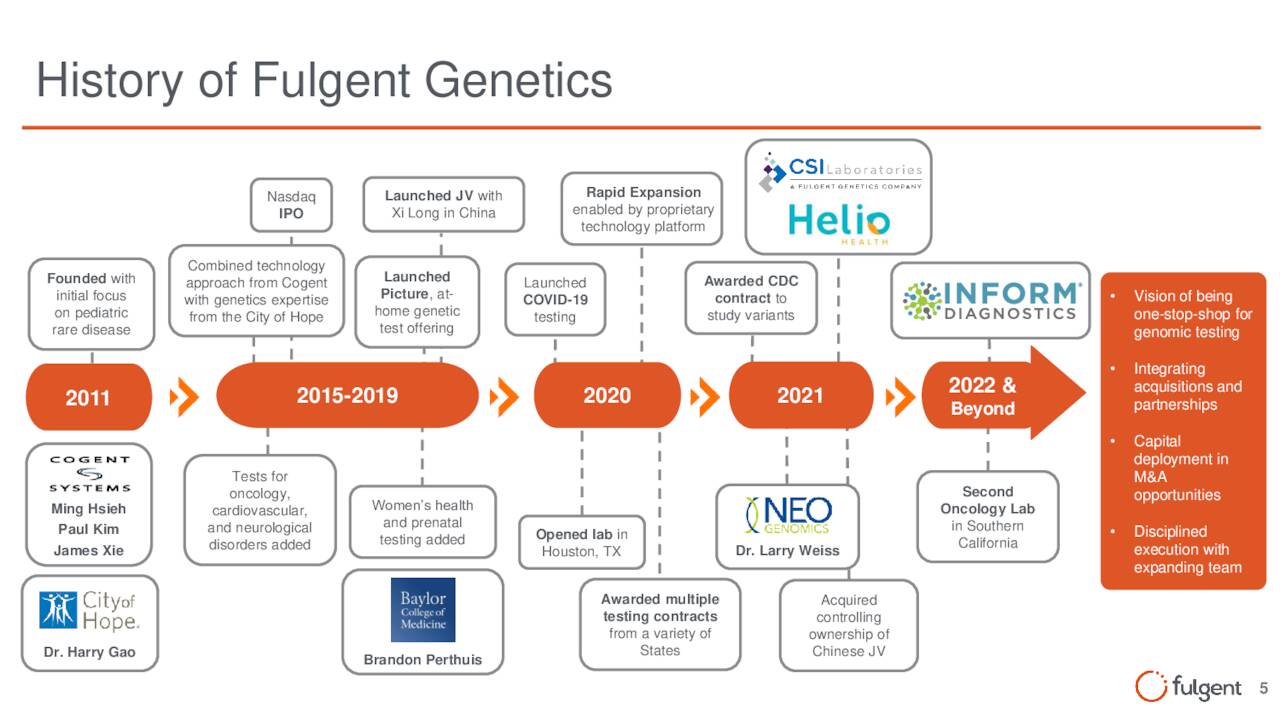

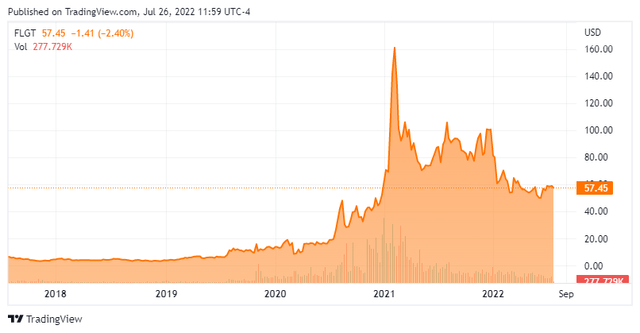

Today, we are putting Fulgent Genetics (NASDAQ:FLGT) in the spotlight. The company has been a huge beneficiary of the pandemic. Covid-19 testing revenues powered a thirteen-fold increase in overall sales in the company’s 4Q2020 earnings report as a good example of the magnitude of the benefit. Subsequently, the stock rocketed up from $10 a share in March 2020 to $160 in January 2021.

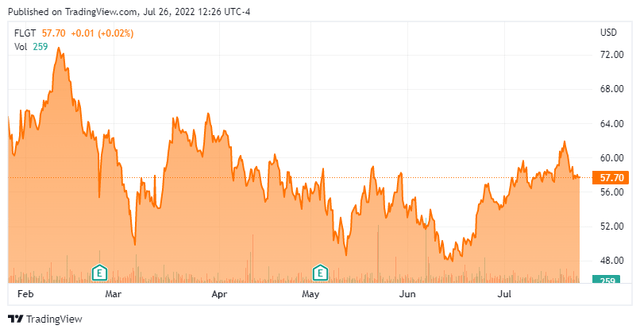

However, as pandemic fears have ebbed considerably lately, the stock has sold off some 45% since late last year and is down nearly two-thirds from its all-time highs. Time to accumulate some shares in this diagnostic testing concern? An analysis follows below.

Company Overview:

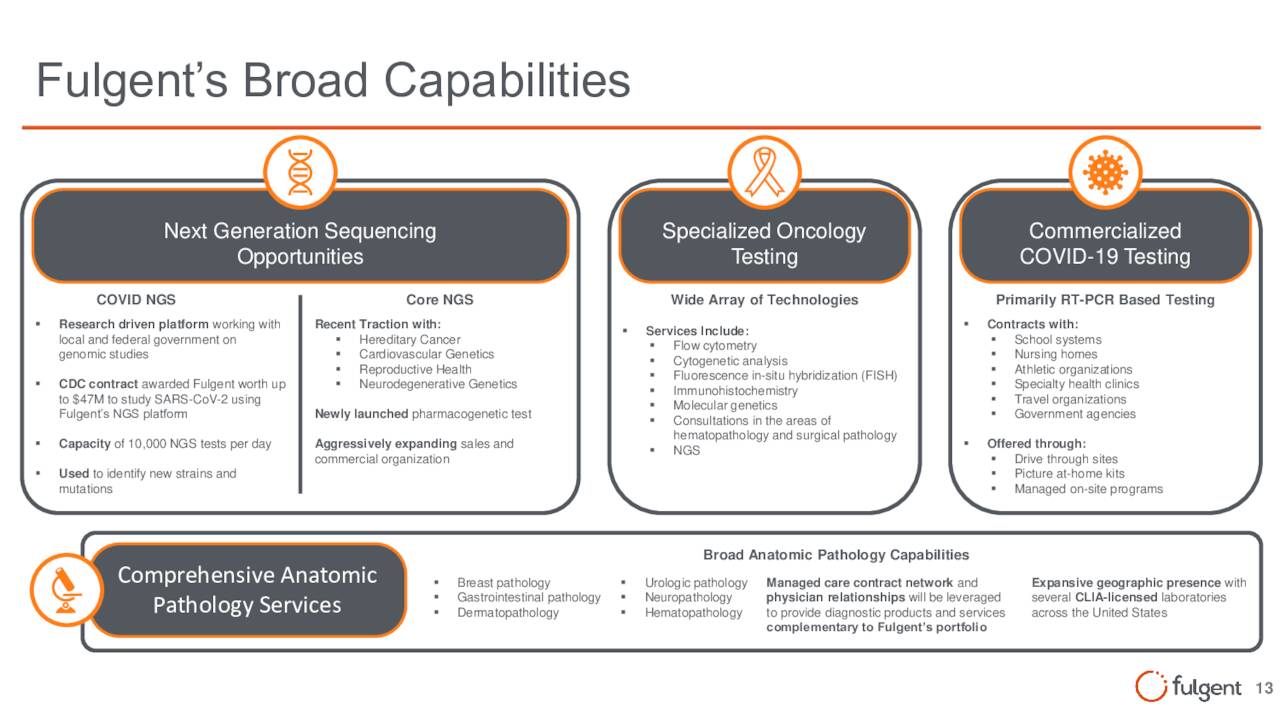

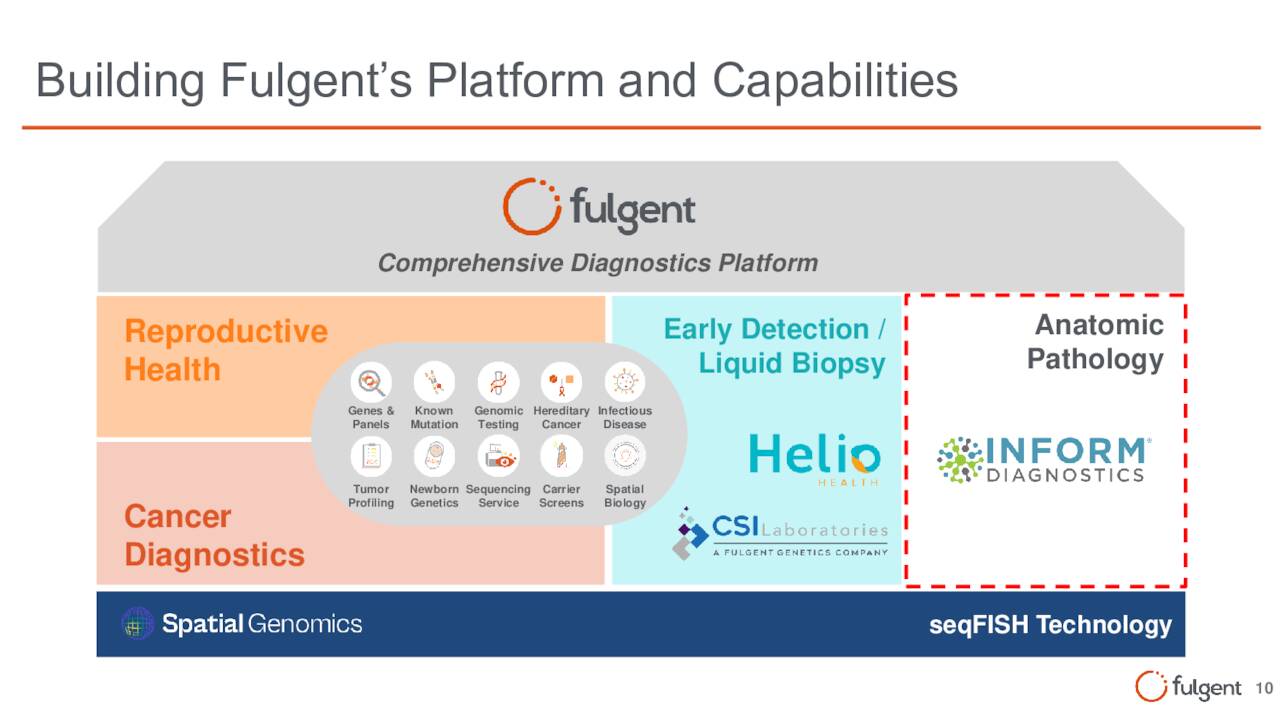

Fulgent Genetics provides numerous tests and testing services and is based just outside of Los Angeles. Its product portfolio includes Covid-19, molecular diagnostic, and genetic testing. As noted above, the majority of revenues are coming from Covid-19 testing, its specialized oncology and other tests are what the company calls its ‘core‘ revenue-generating part of the company.

May Company Presentation

The stock sells for around $58.00 a share and sports an approximate market capitalization of $1.75 billion.

May Company Presentation

First Quarter Results:

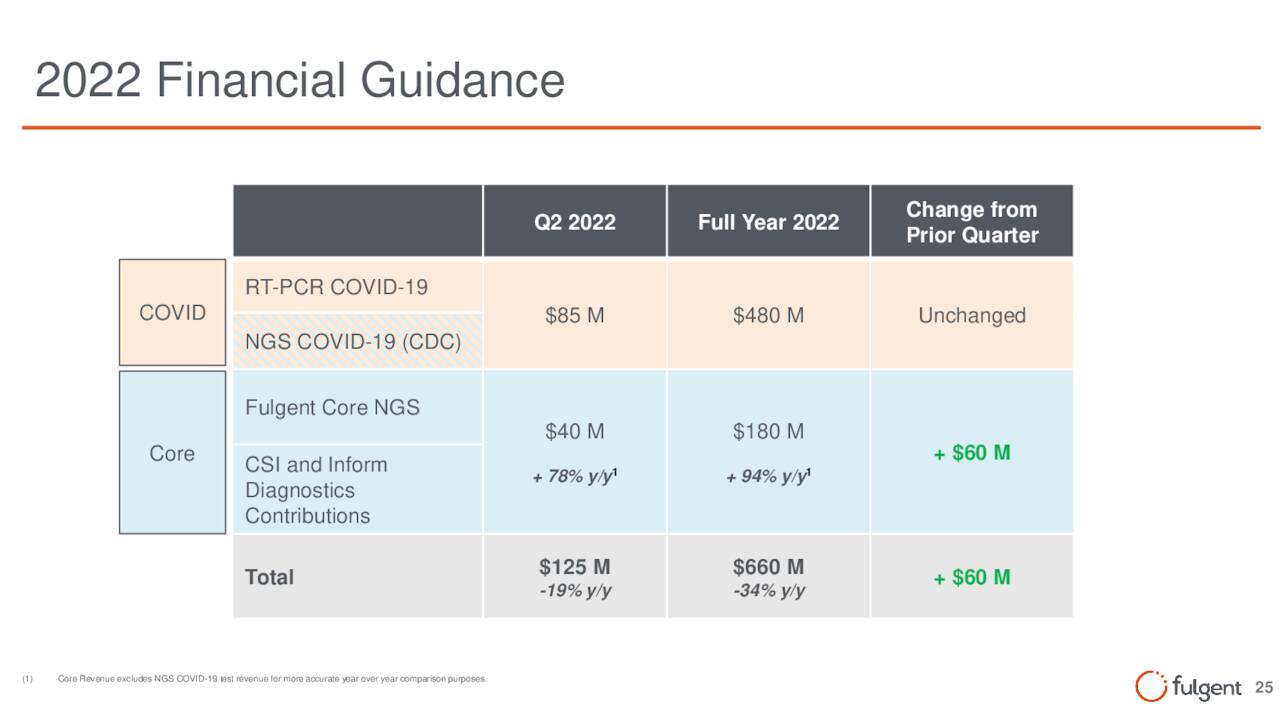

On May 3rd, Fulgent posted first quarter numbers. The company had non-GAAP earnings of $5.12 a share on revenues of $320 million. Both top and bottom line results easily beat expectations. GAAP profits per share were $4.83. Revenue was down from nearly $360 million in the same period a year ago, solely as a result of a decrease from Covid testing. ‘Core’ revenue was up 59% to $25.1 million. Management raised its full-year guidance to $660 million worth of sales but took down full year non-GAAP income a buck to $6.00 a share.

May Company Presentation

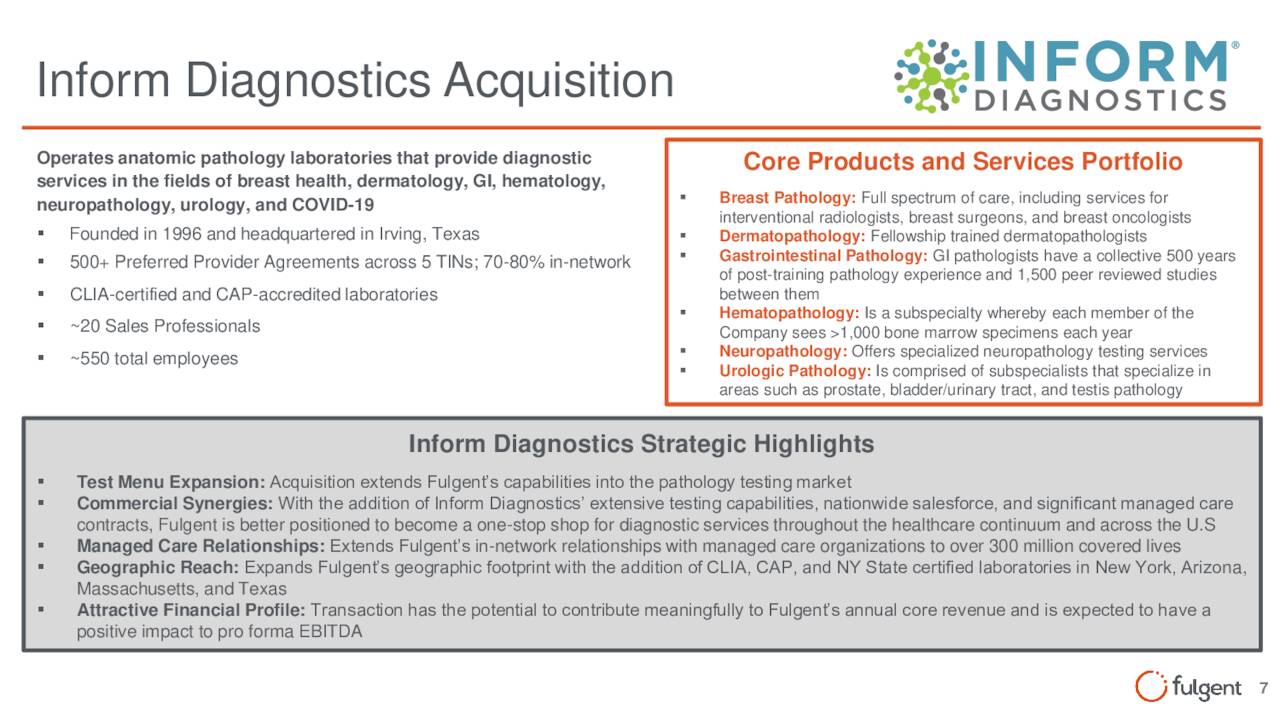

Shortly after the quarter closed, Fulgent acquired Inform Diagnostics, a national independent pathology laboratory based in Irving, Texas, for $170 million.

May Company Presentation

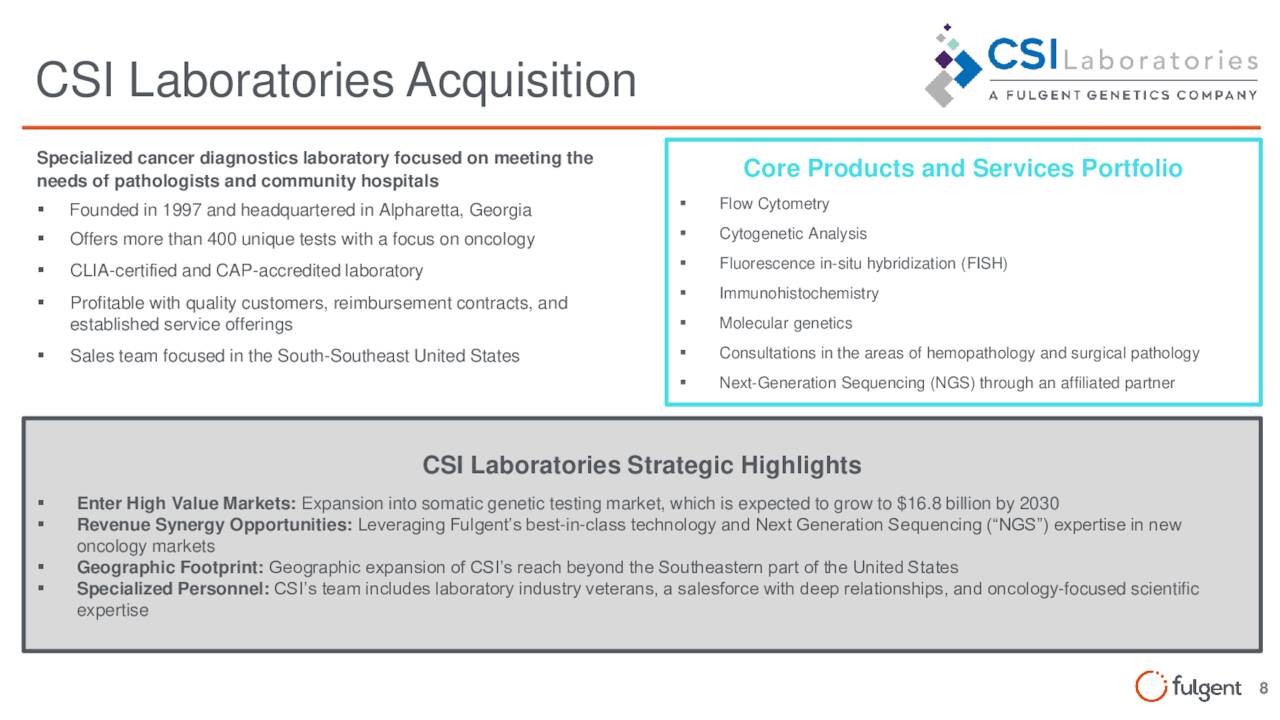

Fulgent Genetics also purchased CSI Laboratories in 2021.

May Company Presentation

This triggered leadership to move up their estimate of ‘core‘ revenue for FY2022 to approximately $175 million from $120 million previously. At its earnings call in early May, the leadership moved up its estimate for core revenue further to $180 million.

May Company Presentation

Analyst Commentary & Balance Sheet:

Despite a decent-sized market cap, Fulgent Genetics gets short shrift from Wall Street. On January 25th, maintained its Buy rating on FLGT but lowered its price target from $141 to $125 a share. In late May, Piper Sandler reissued its Buy rating after meeting with management. Piper’s analyst stated that he was:

Impressed with the company’s core growth, potential in its COVID business, and “optionality” with its $1.1B in cash. The analyst believes Fulgent is setting itself up to add growth via acquisitions, particularly as other labs struggle with cash management.”

Those are the only two analyst firm ratings I can find on the company so far in 2022. Approximately seven percent of the outstanding float is currently held short. Several insiders have been frequent but small sellers of the equity recently. So far, they have disposed of just over $300,000 of shares in aggregate. There has been no insider buying in the shares in over three years.

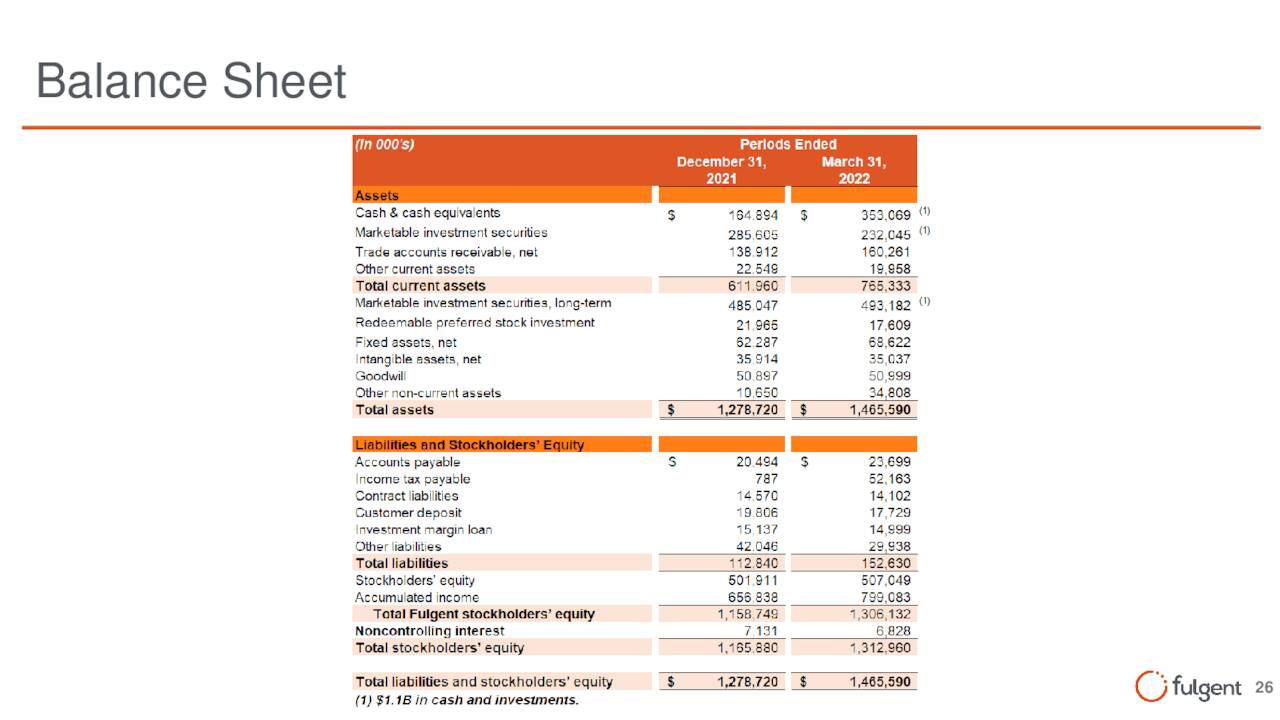

May Company Presentation

The company’s balance sheet is in rock-solid shape, ending the first quarter with approximately $1.1 billion in cash and marketable securities. Part of this cash hoard was used to purchase Inform Diagnostics in April, as previously noted. The company also announced a $250 million stock purchase authorization in March.

Verdict:

The biggest question around Fulgent is how fast Covid-19 testing revenues fall off in the quarters and years ahead. After the Inform Diagnostics purchase, the company has just over $900 million of net cash on hand. This leaves the share priced at just over five times ‘core‘ revenues, with a lot of optionality around Covid testing sales in 2023 and beyond.

May Company Presentation

I expect Fulgent to continue to use its cash hoard to make further strategic ‘bolt-on‘ acquisitions in the quarters/years ahead as it builds out a comprehensive diagnostics platform. It is impossible to predict how fast Covid testing revenues will decline going forward. However, core revenues are growing smartly, and the company has a fortress balance sheet. With the stock looking like it is building a base here, I took a small ‘watch item‘ holding in Fulgent this week using covered call orders as options in the name are both liquid and lucrative.

“We men and women are all in the same boat, upon a stormy sea. We owe to each other a terrible and tragic loyalty.” – G.K. Chesterton

Be the first to comment