Drs Producoes/E+ via Getty Images

I’ve covered fuboTV (NYSE:FUBO) twice previously for Seeking Alpha but it has been several months since my last note and I think enough has changed since then to justify revisiting the name. My fundamental view on fuboTV going back to March of 2021 has been that the core business is doomed. Earlier this year, I did see the possibility for a short squeeze given the selloff from highs and the large short position. While I did take a small loss on the short squeeze trade thesis that never panned out, it was what I said at the very end of that article that I now want to revisit:

FUBO might be worth a speculative play if you’ve been on the sidelines and have a long term vision for the company as a streaming/sports betting hybrid

I wanted to provide an update to that closing remark because the streaming/sports betting hybrid thesis is now gone. The company announced the end of its sports betting business segment earlier this month following a strategic review of the sportsbook model:

While multiple parties expressed interest in the business, none of these opportunities would have allowed Fubo to lower its funding requirements and generate sufficient returns to shareholders. As a result, FuboTV will close its Fubo Gaming subsidiary and cease operation of its owned-and-operated Fubo Sportsbook effective immediately.

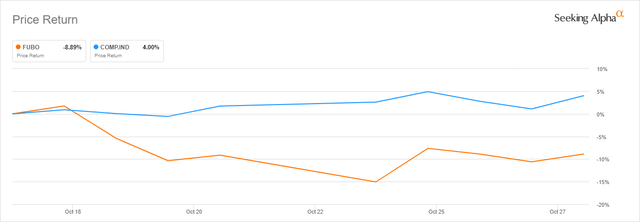

While the stock did get a small rally in response to that news, that bump was short-lived as FUBO shares are now 9% lower since the preliminary Q3 earnings release on October 17th:

Since 10/17/22 (Seeking Alpha)

Even though the company didn’t plan to book meaningful revenue from the sports betting segment until 2023, I don’t think there is any doubt sports betting was an important part of the company’s future plans. Last year CEO David Gandler said this on the synergies presented by the combined sports streaming and gambling combo offering:

We believe Fubo sits firmly at the intersection of three mega trends: the secular decline of traditional television; the shift of TV ad dollars to connected devices; and online sports wagering, a market opportunity we believe to be complementary to our sports-first live TV streaming platform

If legalized online sports betting is indeed a mega trend, it’s really unfortunate that fubo can’t find a profitable way to benefit from it. What is left is a vMVPD model that continues to lose money and a balance sheet that is foreshadowing the need for a capital raise at some point next year.

Preliminary Q3 Details

So far what we know from fuboTV’s third quarter performance is limited. The company is projecting a total of at least $215.5 million in total revenue, $210 million of which is from the North American segment. The company claims to have at least $300 million in cash and equivalents at quarter end with approximately $100 million in negative adjusted EBITDA. Given a total liabilities figure of $760 million at the end of Q2, the clock is ticking. The company is either going to have to dramatically increase margin on the streaming business through higher prices to the consumer or it will have to raise cash at a time when capital is not cheap.

Some Positives

While I’m very much unexcited about the prospects for fuboTV going forward, there are some positive signs from the company’s August investor deck.

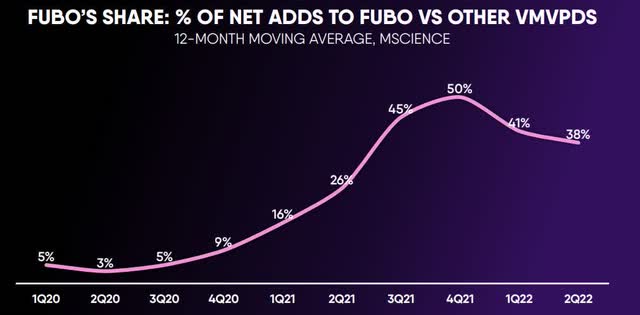

Share of vMVPD sub growth (fuboTV)

For instance, while I really don’t think the trend can be sustained, fuboTV is the growth story in the vMVPD space as it has accounted for roughly half of the vMVPD subscriber adds over the last 4 quarters. A better sign for fuboTV shareholders might be the mix of higher-priced elite bundles among new subscribers:

fuboTV

From March through July, fubo saw an increase in the higher-priced elite bundles as a percentage of total subscriber adds. This shows that there is some demand for the higher priced packages. Given what fuboTV is facing from a liquidity standpoint in the next few quarters, one has to wonder if raising prices of all plans is something the company should be considering.

Risks

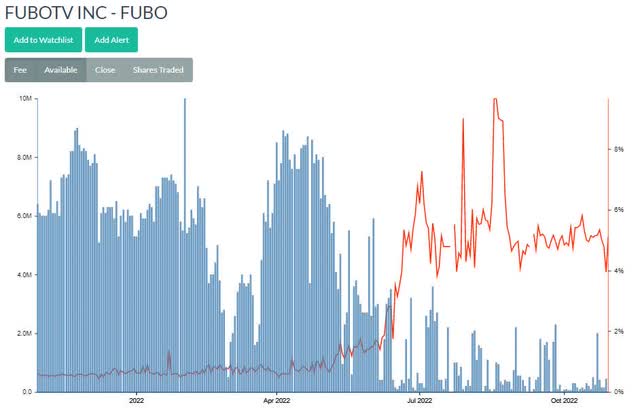

After such a dramatic decline from highs, I can’t recommend shorting a stock that already has such a high short position at 25%. Furthermore, the stock is expensive to borrow and there aren’t many shares even available to short at these depressed prices.

iBorrowDesk

But in my view it makes very little sense to go long this name in anticipation of a short squeeze. The company has too many headwinds that hinder prospects for higher prices. It is running out of cash and could even theoretically see a revenue reduction in future quarters if we are indeed entering (or already in) a global recession. In hard times marketing budgets get cut and consumers cut costs; both of which are potentially detrimental to fuboTV. Without a pivot from central banks on rate hikes and a return to easy money, I don’t think a speculative long is justified here.

Summary

There have been indications the vMVPD model is flawed for years. The PlayStation Vue service ceasing operations in 2020 with nearly a million subscribers should have been a warning sign. I think what has always been fairly self-evident is finally becoming more widely recognized; namely, the vMVPD isn’t a solution to cord-cutting, it’s the cord. The biggest winners in the streaming space are going to be the aVOD and sVOD names not the vMVPDs.

Unfortunately, vMVPDs are just far too similar to the traditional MVPDs that they are believed to be disrupting. A key difference is most of the MVPD operators also sell the broadband access as part of the bundle. fuboTV doesn’t have that luxury and is clearly running out of time. I have zero doubt fuboTV offers consumers a wonderful product. The problem is, if there isn’t a market for that product at a price point that will allow the company to generate a profit from operations, the company has to find meaningful revenue from complementary models. fuboTV just ended one of those complementary models because it turns out that one isn’t sustainable either. Don’t walk, run away from this one. Bears aren’t going to get squeezed here. They’re probably just going to be right.

Be the first to comment