Leon Neal/Getty Images News

I would like to start this article by thanking loyal and longtime readers (nearly 1M reads last year). This article marks my return to SA after a long absence. I plan to post more frequently in the future, continuing to focus the intersection of technology and business. In the coming weeks, we will reexamine what went right, what went wrong, and where the opportunities are.

This blog has been a hobby of mine in the past, but it will be receiving much more focus in the future. I now have greater freedom to say and post what I want, when I want… Buckle up.

The FTX Crisis Explained in Detail

With the flood of details merging out of FTX’s (FTT-USD) collapse, you may be asking “what happened?” Perhaps it would be best to start with a lengthy-but-necessary recap. The collapse of FTX may be a defining moment, creating a secular shift away from other centralized exchanges, such as Coinbase (NASDAQ:COIN).

Preceding FTX, Bankman-Fried founded founded crypto trading firm Alameda Research in 2017, after a stint at HFT firm Jane Street Capital. Alameda had early success arbitraging geographical discrepancies in the price of Bitcoin (BTC-USD). Bankman-Fried founded FTX in 2019, with Caroline Ellison taking the helm of Alameda Research. Ellison also worked at Jane Street Capital, where she was a junior trader.

It was an overnight success. FTX reaped the benefits of massive crypto trading volumes, funneling the profits into marketing efforts, such as a FTX Arena in Miami, and a $210M Esports naming rights deal. FTX attracted blockbuster backing from venture capitalists, raising $900M in July 2021. FTX raised another $400M in a Series C in January of this year, valuing the company at $32B. FTX backers include SoftBank (OTCPK:SFTBY), Tiger Global, Thoma Bravo, Sequoia, BlackRock (BLK), Temasek, and Binance (BNB-USD).

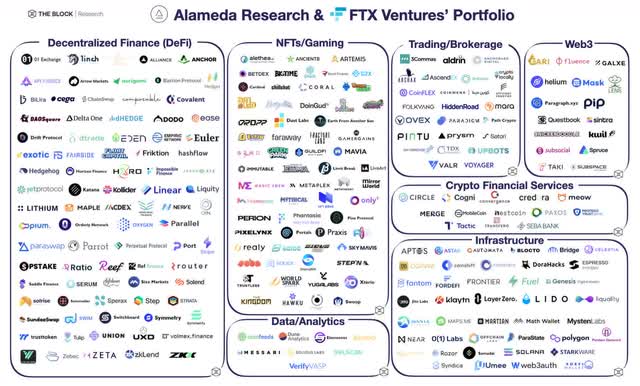

The FTX & Alameda Portfolio (The Block / Twitter)

FTX launched its own token, FTT, which peaked at a $9.6B market cap. FTX launched a $2B venture capital fund and created a sprawling network of over 130 companies. FTX was an early investor in Solana (SOL-USD), one of the most promising crypto projects in recent years. CEO Sam Bankman-Fried was featured on the cover of Forbes and hailed on the cover of Fortune as “the next Warren Buffett“.

As for Alameda, it “was the recipient of nearly a third of all [Tether] USDT (USDT-USD) ever printed—and 86% of that was minted in the last year.” Alameda was reported to have $14.6B in assets as recently as June 2022.

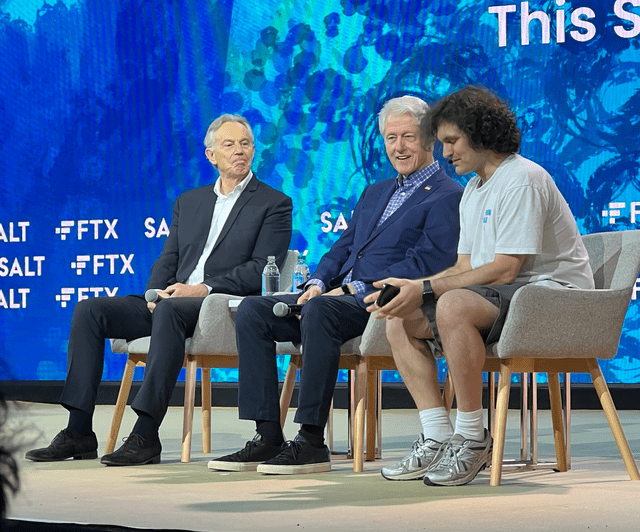

FTX CEO Sam Blankmen-Fried sits on stage with Bill Clinton and Tony Blair (NY Post / Twitter)

FTX was highly political right from the get go. FTX was launched, perhaps uncoincidentally, less than two weeks after the Biden presidential campaign was launched. Bankman-Fried’s mother, a professor at Stanford, is the co-founder of a Super PAC for Democratic candidates. Bankman-Fried was the second largest donor to the Democratic Party last year, behind only George Soros. In May, Bankman-Fried stated publicly that he planned to spend as much as $1B in the 2024 election.

Bankman-Fried’s brother, Gabe, was and advisor to DNC PACs and founded the lobbying organization Guarding Against Pandemics. His aunt, Linda Friend (a professor of health policy), is co-chair of the World Economic Forum’s Council on “Human Enhancement“. FTX was featured prominently on the WEF website, and funded a study that found Ivermectin to be ineffective against COVID-19.

Amy Wu, the head of FTX Ventures, worked briefly at the Clinton Foundation. Nishad Singh, director of engineering at FTX, was 4th largest donor to the Democratic Party in Oregon. Mark Wetjen, Head of Policy & Regulation at FTX, was head of the CFTC in the Obama administration.

FTX donated money to Ukrainian citizens, and managed investments on behalf of the government Ukraine. You probably won’t be surprised to learn that this has ignited rumors and conspiracies, that Ukraine used US aid to invest in FTX, which was then funneled it back into the DNC. These rumors have been denied by Ukraine’s Minister of Digital Transformation.

Rumors about FTX and Almeda’s behavior have circulated on Twitter and other venues (Twitter / @hellspawncrypto)

Throwing gasoline on the fire, FTX had a very close relationship with Alameda Research, both on a personal and professional level. FTX executives shared a $40M penthouse in the Bahamas known as “the Orchid“, where they engaged in a type of group relationship known as a “polycule“. Allegedly, the CEO of Alameda described this on what is widely believed to be her blog, likening it to an “imperial Chinese harem“. (The blog, which discusses the technical challenges of running a crypto exchange, has since been deleted. A full archived link can be found here.) On Twitter, Ellison described her experience using “amphetamines”:

nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is

– Caroline Ellison, CEO of Alameda Research, 4/5/2021

Publicly, Ellison described Alameda and FTX as being separated by a “Chinese wall“, but this was simply not the case. The Wall Street Journal reported that FTX executives lent client funds to Alameda in order to help Alameda meet liabilities stemming from the collapse of the crypto hedge fund Three Arrows Capital (3AC) in June. Reuters reported that Bankman-Fried implemented a “backdoor” allowing FTX to “alter the company’s financial records without alerting other people, including external auditors”. This allowed FTX to move $10B between FTX and Alameda, unnoticed.

Some have speculated that Alameda even traded against FTX’s clients, at the same time FTX client funds were being used to prop up Alameda.

Binance, a rival firm known for its run-ins with US regulators, jumped ahead of the curve. An article by CoinDesk unveiled that the large holdings of FTX’s FTT on Alameda’s balance sheet ‘blurred the lines’ between FTX and Alameda, sparking rumors that FTX might be insolvent. Binance promptly and publicly announced that it would liquidate its entire FTT position ($529M). Binance had previously sold its equity investment in FTX in exchange for a mix of FTT and stablecoins.

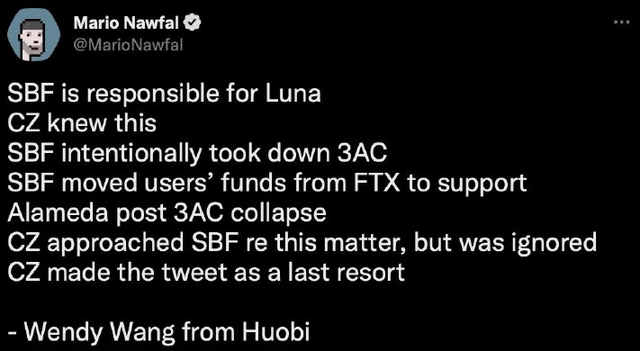

Twitter rumors have swirled up all sorts of possibilities (Twitter / Mario Nawfal)

Binance then abruptly pivoted, signing a nonbinding agreement to buy FTX. Binance then backed out of the agreement, causing FTX to collapse. FTX’s liabilities allegedly dwarf its liquid assets roughly 10:1, with some holdings as obscure as a coin called “TRUMPLOSE”. Alameda was allegedly shorting Tether, presumably hoping its own collapse would destroy crypto’s most stable refuges.

The collapse of FTX cascaded across the cryptocurrency ecosystem. Crypto lender BlockFi, backed by FTX, halted withdrawals. FTX was then hacked, with ~$600M in client funds stolen, unlikely to be recovered. This prompted FTX to move assets into cold storage, taking advantage of the blockchain’s security. Fueling the panic, news broke that the exchange Crypto.com (CRO-USD) had accidentally transferred 80% of their Ethereum balance to another exchange, Gate.io, in late October.

FTX CEO Sam Bankman-Fried was questioned by Bahamian police. He was rumored to be looking to flee to Dubai, then rumored to be en route to Argentina. Alameda Research CEO Caroline Ellison is thought to be in Hong Kong, also looking to flee to Dubai.

Coinbase: The Potemkin Village

I wanted to give a detailed explanation of what happened at FTX because it illustrates the issues in the cryptocurrency community, and should give an intuitive sense of where the industry is headed. After the collapse of FTX, the evolution towards trustless and decentralized peer-to-peer exchanges is likely to accelerate. People who have jumped into cryptocurrency without understanding blockchain technology are now learning a very important lesson, at the expense of FTX clients.

It would be a mistake to suspect that Coinbase is a looming disaster (one can only hope). Coinbase is publicly traded, and thus under much more scrutiny. It does not offer or control its own token. In addition to being under US federal jurisdiction, it is under the watch of state regulators at NYDFS, like a bank. Coinbase does not offer or control its own “native token”, though it has floated the possibility of launching one.

Unstable? No. But the business model of Coinbase, much like FTX, Voyager (OTCPK:VYGVQ), Crypto.com, and even Binance… is a cancer in the cryptocurrency ecosystem. You may recall this article from April.

The last thing that I’ll say is that if you look at what precipitated some of the 2008 financial crisis, you saw a number of bilateral bespoke non-reported transactions happening between financial counterparties. Which then got repackaged and re-leveraged again and again and again… Such that no one knew how much risk was in that system until it all fell apart.

If you compare that to what happens on FTX–or other major cryptocurrency venues–today, there’s complete transparency about the full open interest. There’s complete transparency about the positions that are held. There is a robust robust consistent risk framework applied.

-Sam Bankmen-Fried testifying to Congress in 2021

These centralized cryptocurrency exchanges have effectively become the equivalent of the financial institutions that DeFi seeks to replace, complete with the issues that cryptocurrency is meant to solve.

The model of a centralized exchange inverts the benefits of the blockchain, effectively undoing its key innovations. Coinbase may be financially robust compared to FTX, but it is inherently no different.

The business model is akin to charging people to send emails. This was a profitable business for telecom company MCI in the 1980s, but it was short-lived. Once a P2P email system was viable, it became the standard, unleashing many new possibilities along the way.

This is analogous to what is happening with the blockchain. Coinbase is making a huge spread by charging people to move data around the blockchain. With limited options, Coinbase is pursing a strategy that is reminiscent of AOL, attempting to create a walled garden that charges users for entry.

Peer-to-peer decentralized exchanges that enable users to custody and manage their own assets will become increasingly easy and intuitive to use. This will unlock the true potential of the blockchain, through the many applications that will be developed from this. I expect that many of these innovative applications are far beyond our imagination today.

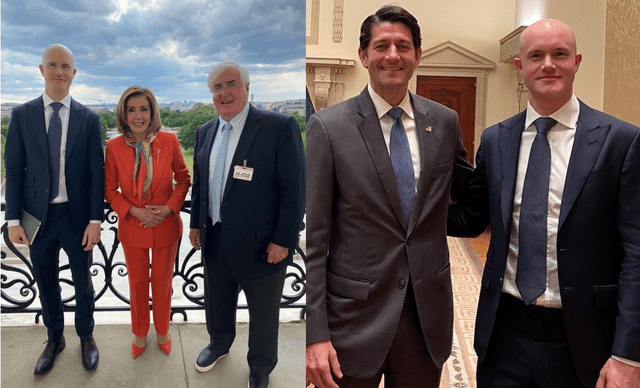

Coinbase CEO Brian Armstrong poses with government officials. (Brian Armstrong / Previous SA article: Will Developers Burn Down Coinbase?)

Centralized exchanges were necessary for cryptocurrency to become mainstream because they are bridges to the traditional banking system. However, they are unlikely to remain dominant. Perhaps they will simply become irrelevant, like many early internet companies. Lucent anyone?

Coinbase is aware of this. So much like FTX, Coinbase has lobbied the government extensively as a result. Coinbase presumably hopes to shape the regulations in a way that advantages its business, keeping it relevant.

Conclusion

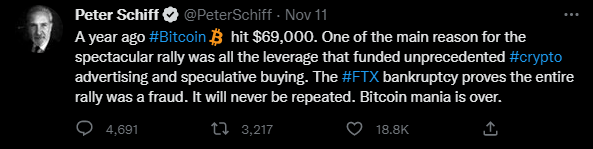

Peter Schiff / Twitter

This is hardly “the end of crypto.” The collapse of FTX is likely to drive revenue flows away from Coinbase, as development of on-chain self-custody facilities accelerates. As the costs of interacting with decentralized exchanges decreases, it will create a secular shift away from today’s highly profitable centralized exchanges.

Twitter

Though Coinbase is aware of this and has occasionally touted new initiatives, it is totally unclear how a centralized entity can collect economic rents in a decentralized system designed to make collecting them as difficult as possible, if possible at all.

My thesis is that Coinbase, among others, will become obsolete in the next cycle. That is to say, unless their lobbying efforts are able to create effective barriers that shield them from the innovations of decentralized finance.

Be the first to comment