DAX, FTSE, Oil Talking Points:

- Crude oil reclaims the $100 p/b mark, higher probability of additional sanctions against Russia support higher prices

- FTSE 100 marches towards 7,600

- DAX 40 trades sideways, psychological resistance caps upside move.

DAX 40 side-steps along key technical levels

The German Dax is currently trading in a relatively tight range as bulls aim to reclaim the 15,000 handle which remains as critical resistance.

After rising above 14,500 late last month, failure to gain traction above 14,951 allowed bears to drive prices back below the descending trendline before finding support above 14,330 (the 23.6% Fibonacci level of the 2020 – 2021 move). As the battle between buyers and sellers persists, these key technical levels have proven to provide firm levels of support and resistance for both long and short-term moves.

A hold above 14,330 and a break above trendline resistance could see the 14,800 handle coming back into play with the potential to retest 15,000.

DAX Daily Chart

Chart prepared by Tammy Da Costa using TradingView

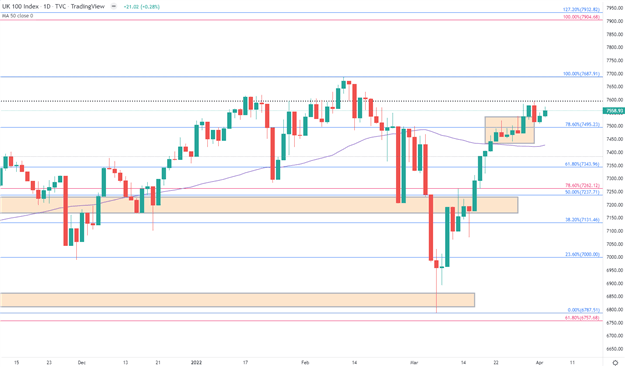

FTSE 100 marches towards the 7,600 mark

Meanwhile for the FTSE 100, a break of the 7,495 level has allowed bulls to push prices higher in an effort to rise above the next level of resistance at 7,600. With prices trading comfortably above the 50-day MA (moving average), the uptrend may continue to hold, provided that risk-on sentiment prevails.

If bulls are successful in conquering 7,600, the next level of resistance resides at the 16 Feb high of 7,630 which leaves the door open for the Feb high at 7,687.

FTSE Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Oil prices find temporary relief above $100

Crude oil has started the week on a positive footing as prices continue to whipsaw around the key psychological level of $100.

After the United States announced a massive release of 1M barrels of oil per day from the SPR (Strategic Petroleum Reserves) last week, increasing pressure on the member states of the IEA (International Energy Agency) to follow suit saw oil plunge, driving prices back towards the $100 p/b mark, which continues to hold as critical support for both WTI and Brent.

Although technical levels continue to provide an additional catalyst for price action, the uncertain geopolitical backdrop and the potential for further sanctions to be imposed against Russia limited oil losses, allowing bulls to regain temporary control of the imminent move.

While the upward trajectory currently remains in tact for the broader commodity market, a weaker US Dollar has provided additional support for both Oil and Gold (XAU) with the latter rising back above $1,930.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Be the first to comment