Aranga87

FREYR Battery (NYSE:NYSE:FREY) is increasingly looking to me to be a global contender in the battery production space as it looks to ramp up to 200 gigawatts per hour (GWh) by 2030 and converts its large base of off-take agreements into sales agreements. I look deeper into the company to see what is getting investors excited about this undiscovered battery player and provide an update on the company since the last article.

Investment thesis

I have written an earlier article on FREYR and I think that the investment thesis for it is rather simple to understand given the rapid rise of and increasing need for lithium ion batteries:

- With its ability to use 24M technology to develop and manufacture batteries, FREYR has a technology edge in making batteries.

- In addition, with the need for more environmentally options, increasing focus on ESG amongst corporates as well as growing emphasis on resilience of supply chains, FREYR provides its customers with the most clean batteries, as well as localized batteries that fortify their supply chains.

- Lastly and most importantly, FREYR has many commercial off-take agreements that it can convert to sales agreements, and this list of companies continue to grow.

Binding sales agreement with Nidec

The company recently announced that it will be expanding the current off-take agreement with Nidec (OTCPK:NJDCY), increasing the volume from 31 GWh to 38 GWh, and that the off-take agreement will also be converted to an official binding sales agreement.

This is a huge win for FREYR as the total value of the contract amounts to $3 billion and the contract is expected to run from 2025 to 2030, utilizing the Giga Arctic factory.

In addition, as part of this confirmation of the binding sales agreement, the two companies announced the formation of a joint venture where Nidec will hold a super majority. This JV will use FREYR’s battery cells, modules and packs to develop integrated downstream ESS solutions for both industrial and utility grade customers.

I think that this confirmation of the binding sales agreement and the expansion of the volume of the agreement shows the strong demand for FREYR’s batteries, particularly in the ESS space. This also marks a milestone for FREYR, as it is the first off-take agreement that was subsequently converted to an actual sales contract. Furthermore, with this agreement, there is an option to increase the volumes up to 50 GWh during the period and even add more volumes after 2030. This new binding sales agreement is also an important project financing waypoint for FREYR’s 29 GWh Giga Arctic development, as it will make up almost 50% of planned production in the gigafactory (more below).

Furthermore, the key catalyst for the stock will thus come from further conversions of its more than 125 GWh of off-take agreements into actual sales agreements. With the key milestone of converting the Nidec off-take agreement, this amounts to 30% of those agreements converted. I am of the view that the likelihood of the other off-take agreements converting into sales agreements is rather high and that therefore, there are rather positive near-term catalysts for FREYR as a result of these potential conversions.

Giga Arctic expected to be most sustainable and capital efficient gigafactory globally

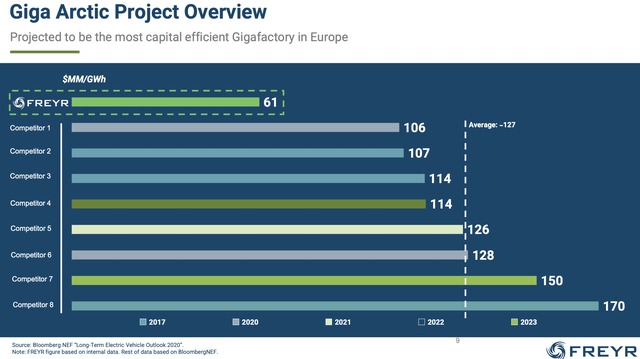

Since my last article on FREYR, we have seen progress on Giga Arctic. This is FREYR’s first 29 GWh gigafactory in Norway. For the $1.7 billion total capital expenditure expected for the gigafactory, FREYR has secured $1.6 billion in financing support from both the Norway’s government and other export credit agencies. It can then be implied that the current capital expenditure of $61 million per GWh and the 34 employees per GWh is lower than any other gigafactories in both North America and Europe.

This, in my view, could be a very exciting opportunity for FREYR if it is able to replicate such high capital efficiency for its subsequent gigafactories as well. In fact, the Giga Arctic will be a good first showcase for FREYR to demonstrate its ability in developing, executing and ramping up of giga scale factories. Also, the fact that this new Giga Arctic is expected to have capacity of 29 GWh, which is 3 times more than what FREYR initially announced for Giga 1 and 2, shows the strong demand for FREYR’s batteries as the world faces a shortage of necessary batteries needed for the green energy transition. As can be seen below, Giga Arctic is seen to be the most capital efficient gigafactory in Europe according to management’s estimates.

Most capital efficient gigafactory in Europe (Freyr 2Q22 slides)

In addition, the high capital efficiency was brought about by the use of 24M’s manufacturing technologies, which I have elaborated on in my earlier article. The 24M technology’s benefits of reducing the needed steps, reducing overall costs, and capital expenditures, as well as physical space needed, contributes to the improved capital efficiency of the Giga Arctic. Furthermore, I think that without competent management with the ability to execute, this would not be able to be made into a reality as well. As such, I am confident that FREYR will be able to achieve the most capital efficient gigafactory globally with both 24M technology advantages and the stellar execution capabilities of its management.

FREYR has already cleared the ground and is speeding up its foundational works. The company is also currently in progress to have the necessary equipment installed before the end of 2022 in its custom qualification plant, and the Giga Arctic is expected to start production in 2024.

Management also claimed that the new gigafactory will also be able to produce more than 200x the batteries per employee than what traditional lithium ion battery producers are doing at the moment. On top of that, the use of only renewable energy at the plant while having a relatively lower cost of electricity will help to improve the environmental profile of the battery as well as the general efficiency of the production process.

Growing ambitions

I must admit that I was pretty skeptical about how FREYR was going to achieve its initial target when I first read the company’s materials during its listing on the stock exchange. Since then, as I learnt more about the company, its management and the technologies it utilizes, I have growing confidence in it being an undiscovered global battery player and in its ability to meet its targets.

Firstly, due to the large quantity of conversations the FREYR team is having with customers, management said that it is more than “what we realistically can over” and as a result, it led to the goal of doubling the target capacity to 200 GWh by 2030. Key to this would be the ability of FREYR to meet customer demands and expectations by delivering the expected quality at the expected time. However, the more important issue is that this further illustrates how batteries are in short supply at least until 2025.

Second, the goal would be to double capacity to from 50 GWh in 2025 to 100 GWh in 2028 and then double it again to 200 GWH capacity by 2030. While the first facility is the Giga Arctic in Norway, the next facility is expected to be larger than the Giga Arctic and in North America. In addition, management expects that by 2030, the 200 GWh will comprise roughly half in North America and half in Europe. With regards to the cell chemistries, these are rather flexible due to the 24M technology enabling easy adaptation of systems to cater to different battery chemistries.

Valuation

We value FREYR in line with global pure-play battery peers, applying a 2.5x multiple to 2025E sales. Although FREYR is positioned in an early stage vs peers in the high-barrier battery market, we think the multiple should reflect its strong growth prospects in the second half of the decade (30% sales CAGR 25-30E vs 27% previously). We assume a WACC of 15%, reflecting funding cost from loans of ECAs and other public lenders (we estimate <5% cost of debt for Giga Arctic). As a result, we derive a 12m price target of $19 and remain Buy rated.

FREYR is currently trading at 46x 2023F EV/Sales and 1x 2024F EV/Sales. From this, you can tell that upfront, FREYR does look expensive based on next year’s sales. However, it would also imply that to price FREYR fairly, we need to take into account the execution of management given that the 2024F sales numbers have to materialize for the stock to look cheap. As a result, I apply a 2.5x sales multiple on FREYR’s 2025F sales to account for the fact that Giga Arctic will only begin production in 2024 and start ramping production in 2025.

To account for the execution risk given that there is a huge ramp up in production in 2024F and 2025F, I assume a WACC of 18. Even with a higher WACC, my target price for FREYR is $31.51, implying an upside potential of 143% from current levels. It is crucial that execution and ramp up of Giga Arctic goes smoothly according to expectations although there are certainly risks involved that are highlighted below.

Risks

Ability to convert remaining off-take agreements

While the conversion of the remaining off-take agreements into sales agreements may be a positive catalyst in the near term, there is a risk that fewer than expected or no other off-take agreements are converted into actual sales agreements. This may result in decreased confidence in FREYR’s ability to convert its off-take agreements into sales agreements.

Inflation and raw material prices

FREYR’s current estimates and forecasts are based on its current expectations for raw material prices. If there is an adverse drastic increase in raw material prices, this could result in unfavorable changes in future forecasts for the expected costs per battery, capital expenditures needed, for example.

Execution and ramp up risks

The company currently claims that it has the most capital efficient and sustainable gigafactory in the world. However, all these claims are no good if the company is unable to efficiently ramp up production when the gigafactory is built. As such, there is a risk that the ramping up phase may experience some problems and potentially some push back in the schedules if things do not go according to plan.

Policy and regulatory risks

While there are favorable policy support today, there is the risk that this policy support may dissipate over time as more gigafactories are built or when the government decides to reduce spending on clean energy. Any pivot away from clean energy spending or reduction in policy support may negatively affect FREYR.

Conclusion

As highlighted earlier, I believe that the near-term catalyst for the stock will come from further conversions of its more than 125 GWh of off-take agreements into actual sales agreements and that there is a high probability of these conversions happening in the near term. Furthermore, other catalysts for the stock are the continued progress announcements made for Giga Arctic as it looks set to begin production and ramp up in 2024. Lastly, FREYR looks set to compete against the largest battery players globally with a niche and advantage on its own. My target price for FREYR is $31.51, implying an upside potential of 143% from current levels.

Be the first to comment