RelaxFoto.de/E+ via Getty Images

FREYR Battery (NYSE:FREY) has done remarkably well as a stock over the last month or two. A shining sliver of green in a sea of red in my innovation portfolio. Part of it stems from Goldman Sachs (GS) and Morgan Stanley (MS) finally recognizing the company’s disciplined evolution into a yet-to-be gigafactory, raising price targets along with some noise and trading volume. In addition, management has delivered according to plan thus far – that is not something that can be said about most SPAC companies, especially in this macroeconomic environment.

FREYR remains a pre-revenue business with some serious expectations for 2023/2024. With most of the supply chain, and future capacity output sales largely secured (to the tune of 50GWh+), all that remains is execution.

It has been a few months since my last article on this stock. I have adjusted my position once or twice but FREY has remained in my portfolio since the post-target, pre-acquisition days. Holding it has required a whole lot of patience, which has been rewarded recently. With the recent price action, I imagine there are many new eyes on this stock, so here’s a fresh article on how I’m thinking about FREY as an investment at the current price.

Premise

FREYR is a Norwegian battery company with a pile of cash, some great engineers, other staff, supply-chain partners, offtake partners, and a lot of land that is currently under construction in Mo-I-Rana, Norway. As of now, it has no revenue.

The long-term goal for the company is to build gigafactories for manufacturing Lithium-Ion battery cells for ESS (Energy Storage Systems) and perhaps EV (Electric Vehicle) applications. With an exponential trend toward battery capacity demand amidst the de-carbonization of energy everywhere, someone needs to scale production to feed the monster appetite.

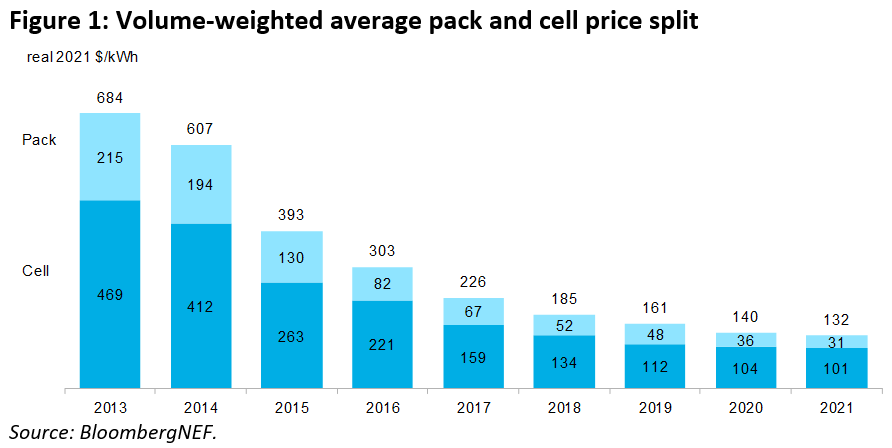

The most relevant numbers pertain to the manufacturing costs of both cells and packs for a given unit of energy capacity – in kilowatt-hours (kWh).

Battery cost curve (Bloomberg NEF)

We’ve been trending down the cost curve with economies of scale, and moving towards the golden number of $100/kWh a pack, thought to be the cost at which lower-priced EVs will match those of mass-market internal combustion engine vehicles. Beyond the mobility space, energy grids globally are being repurposed for solar and wind, which by nature require energy storage systems to modulate a steady output. For we need our lights at night and electricity when the winds don’t blow.

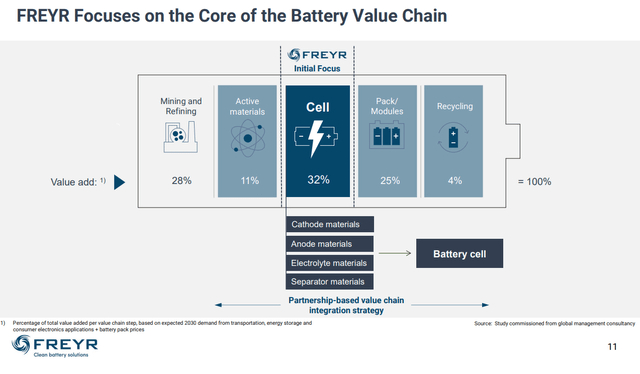

FREYR Value Chain Focus (Feb 2022 Investor Presentation)

FREYR comes into this supply chain riding the broader pack cost curve with a clear manufacturing offering on cells. They’ll get into the manufacturing train on the supply chain, and build these batteries at scale, using licensed technology from a company called 24M Technologies. 24M is an MIT PhD research spinoff company featuring a new battery design with a clay-like sludge for an electrolyte within a given cell. Aptly called “Semi-Solid”, this battery greatly reduces the material costs and layers involved in current-gen batteries and thus saves on costs. Then there’s the manufacturing process which is simpler with fewer steps too compared to the industry standard. It’s frustratingly difficult to find data on 24M’s tech specs, but the true $/kWh number will likely only come to fruition in practice when someone builds out the manufacturing process at giga-scale. FREYR mentions $62 for the cell (not pack) in 2025 but that’s perhaps best validated only after production kicks in. Meanwhile, Volkswagen (OTCPK:VWAGY) has backed 24M Tech, grabbing an equity slice as the company has expanded licensing partnerships globally.

FREYR Partners (Investor Presentation)

Speaking of partners, FREYR has a standing JV with Koch Industries, and other partnerships with Siemens, Glencore, Maersk, Scatec, and others from suppliers to buyers. The company, despite not producing any output, has offtake agreements that involve a conditional pre-sell of 50+ GWh of future capacity already. So yes, battery demand is extreme and seemingly desperate.

State Of FREYR – A Thesis Built On Hearsay

In my last article, I mentioned that my investment in FREY was built on the seemingly respectable management delivering on expectations, the ambitious plan at hand, and votes of confidence from Koch, the VW-24M partnership, and all the other partners. I’m far from a qualified evaluator of pre-sales industrial projects so I’m piggybacking on others who’ve given their votes of confidence. FREYR has been harping on about Norway’s battery material reserves and low-cost green energy ecosystem as a major advantage on manufacturing costs. I suppose that helps with the bullish long thesis. It also adds to the selling point that FREYRs batteries are actually green after peeling back the supply chain onion. Not just green at the product level.

With all these bits of information, FREYR still stands as a venture-capital style high-risk/reward investment offering no revenue yet. I have little idea of how to value this business with any kind of precision but it’s worth noting that Chinese supplier CATL which will do about 200 GWh in capacity annually in maybe 2-3 years is trading at a $140B market cap.

FREYR has a $1.7B market cap with a 2025 target of 43 GWh in capacity. If this doesn’t excite you in theory, few things will in the public markets.

Assume there’ll be future capital raises and a lot of dilution – after all, it’s a venture capital style investment and the company has a little less than $500m on balance sheet cash. That could theoretically only be enough for their first gigafactory on CapEx. With this in mind, the outcome could still be a 20x stock to be conservative long-term. 5x in 5 years seems like a lowball should FREYR moderately succeed in its current plans. Precise valuations don’t mean much when there are orders of magnitude involved. So the potential for a home run is certainly there, but the probability of it is what’s hard to determine. Finally, the manufacturing costs should be low enough for the product to be competitive and allow the company to exercise some pricing power – $62/kWh for a cell is a working estimate and merely a forecast.

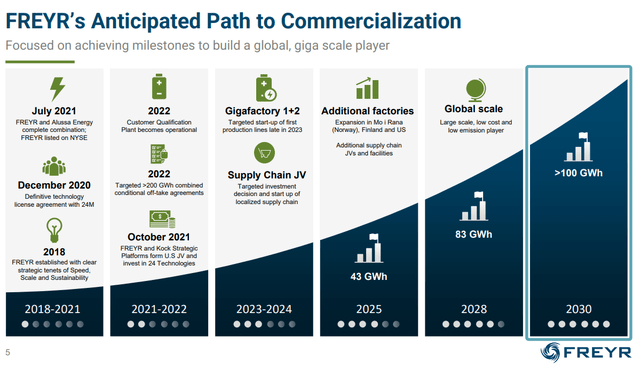

Without an income statement that makes any sense, it’s worth tracking the state of the company and the coming milestones that would define success in the next 12 months. The following excerpt highlights the plan as of early 2022.

FREYR Ambitions (Feb 2022 Investor Presentation)

Milestones Are Key

Neither new partners, nor offtake agreements are of particular interest to my thesis anymore since selling isn’t the problem. It all depends on execution. To me, there are two key execution milestones to track like a hawk for any FREYR investor. Both regard future manufacturing function targets:

- The Customer Qualification Plant (the CQP) – set to output Li-Ion samples in Q1 2023

- Gigafactory Arctic Development – The bigger gigafactory is set to produce commercial-scale output in H1 2024

Both CQP and Giga-Arctic, have been pushed by a quarter on schedule when compared to the Feb 2022 Investor Presentation.

Think of the CQP as a crucial trial run that validates whether FREYR can actually manufacture batteries. It serves to show customers that it can be done and offers a practical experiment to gain key manufacturing process information in order to optimize future production.

My presumption is that should the CQP crank out some product soon, it will act as a confidence catalyst for the stock price. An extremely important element of this to me is time. We need to see a baby gigafactory that is producing some Lithium Ion batteries by the end of Q1 2023 if we are moving according to plan. Theoretically, it would validate CEO Tom Einar Jensen’s ambitious-looking timeline for 2025 aspirations. I have no problems if there are minor delays (a quarter or two for the Giga-Arctic) since with a project like this, there’s a potential for overpromising and underdelivering of a Musk-like variety. But the output timeline should be reasonable enough in order to not break the thesis.

Fortunately, the company is doing well so far by keeping us updated with its YouTube videos. Here’s their latest on the CQP.

As you can see, the plant is white and shiny and awaiting the product manufacturing equipment to be delivered on location. After the installation, we’ll have to see where output expectations are. The plant certainly looks like it has come a long way since April which saw bulldozers about and a load of cement being poured in places.

The second milestone, let’s call it a mid-term target, is the “Gigafactory Arctic”. Previously, the plan was to build separate gigafactories, though FREYR decided to build both in one go to take advantage of faster scaling potential amidst customer interest. Giga-Arctic is set to produce 29 GWh on capacity at full-scale operations spanning a 120,000-square-meter area in Mo-i-Rana.

FREYR recently released information on their partnership with HENT, a project management and construction company to go ahead with the build. As of September, it’s a wide-ranging muddy plot of land so it’ll be quite an achievement to have a fully functioning factory by in 18 months. Tesla (TSLA) has pulled this off in incredible fashion, but this gigafactory would be a first for FREYR considering the scale.

As with most public businesses, it’s crucial to track earnings calls and presentations as they’ll reveal the status of these two milestones with respect to the near future. For my personal thesis, these are the immediate points of interest to keep track of. In addition, scanning the news on 24M Tech and other global battery developments helps contextualize FREYR’s ambitions.

Thinking in Bets For The Long Term

While I may have laid out potential business catalysts and milestones, I’d say it’s worth disregarding short-term price action altogether. I’m judging the long-term thesis against its upcoming business milestones, but not the price of the stock. For all you know, Goldman or Morgan could simply hike their price targets tomorrow and that would result in surprise moves on the price. Or the macro could halve us back to $7 as the recession talk worsens for no apparent fundamental reason.

Here’s a poker analogy that might make sense. Right now, you have a pocket of Aces. There are players in every seat across the table, and the dealer is yet to execute the flop. How much are you willing to bet pre-flop? For me, that’s a smaller portfolio position.

The vast majority of information is uncertain and yet to unfold, but we are off to a very strong start. Try to find the ratio of 2020-2021 SPAC companies that are on track with pre-acquisition plans here in late 2022 against those that are not. It’s an exceedingly tiny proportion. It all comes down to execution, and hitting business milestones quarter in and quarter out. FREYR has a long way to go, and it is certainly possible that it turns into a 200GWh gigafactory behemoth by 2030. It is also possible that problems drag on, equity and debt are raised rapidly, and we get diluted into oblivion or the company faces bankruptcy.

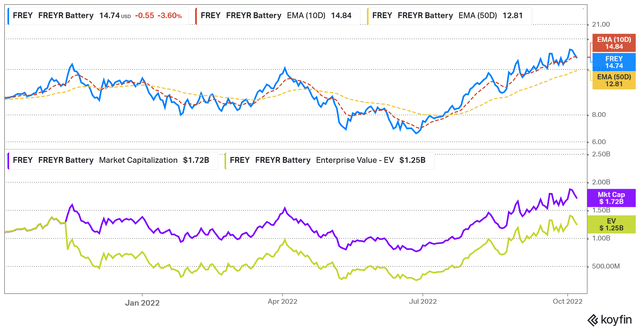

Alas, we’re now at $15/share at a $1.7B market cap and $1.25B enterprise value. I keep my eye on CATL or LG Chemical as long-term success points, both in the 10s of billions in value.

Price chart (Koyfin)

I think $15 is a great price to continue taking on FREYR’s execution risk for long-term upside. I’ve held this stock since FREYR was a target in Feb 2021, and it has been a rollercoaster. Fortunately, I’m substantially above my cost basis, I took some profits, but intend to keep my position running without concern for short-term news. In a macro-cyclical extreme market, it’s frankly refreshing to hold a stock like FREYR that will entirely succeed (or fail) on the merit of execution more so than the broader economic cycles. The world remains supply-constrained on low-cost batteries and will be for several years. If you missed the double, I’d say not to worry about it at all. We’re barely into the first innings as far as I’m concerned.

Be the first to comment