eyegelb

Just over two months ago, I wrote on Fortuna Silver (NYSE:FSM), noting that the weaker Q2 earnings were mostly priced in, suggesting pullbacks below $2.30 would provide buying opportunities. While the stock overshot this support level briefly, it has since seen a sharp recovery, rallying above $3.00 last week. Unfortunately, while Fortuna had a solid quarter operationally and from an exploration standpoint in Q3, this has been largely overshadowed by weaker metals prices, which are set to put additional pressure on margins. However, with considerable resource upside at Seguela, and a reasonable valuation, I would view any pullbacks below $2.27 as buying opportunities.

Fortuna Silver Operations (Company Presentation)

Q3 Production

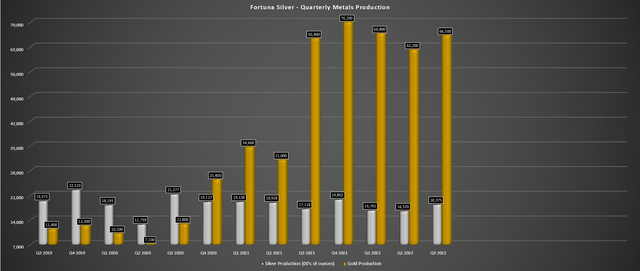

Fortuna Silver (“Fortuna”) released its preliminary Q3 results last week, reporting quarterly production of ~66,300 ounces of gold and ~1.84 million ounces of silver, a 1% and 7% increase vs. Q3 2021 levels, respectively. The higher gold production was helped by a strong quarter out of Lindero, with much better performance from its crushing/stacking circuits. Meanwhile, silver production benefited from higher tonnes processed at San Jose and Caylloma and a slight improvement in silver grades at San Jose. This has placed the company well on track to meet its FY2022 guidance mid-point (~262,000 ounces of gold / ~6.55 million ounces of silver). Let’s take a closer look at the quarter below:

Fortuna – Gold & Silver Production (Company Filings, Author’s Chart)

Looking at the below chart, we can see that Lindero had a very solid quarter in Q2, producing ~30,000 ounces of gold and nearly 90,000 ounces year-to-date. As noted, this was helped by 100% of tonnes placed on the pad in Q3 coming from its crushing/stacking circuits, and the company noted that it saw 5%+ positive grade reconciliation in Q3 and is benefiting from productivity gains. Meanwhile, at San Jose, although gold grades were down and silver grades were only up marginally (196 grams per tonne vs. 195 grams per tonne), the asset benefited from higher tonnes processed, with ~267,200 tonnes milled in the period. This led to the production of ~1.55 million ounces of silver, up from ~1.44 million ounces in the same period last year.

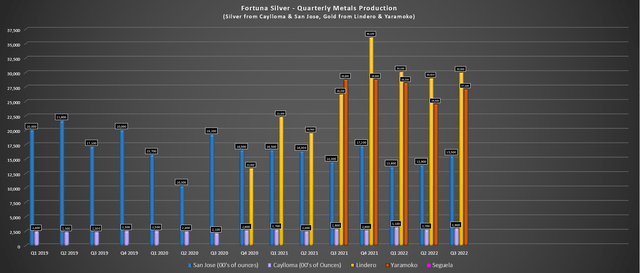

Fortuna Silver – Quarterly Production by Mine (Company Filings, Author’s Chart)

Finally, looking at its two smaller contributors, Caylloma had a decent quarter, with silver production higher offset by much lower gold production (91 ounces vs. 1,529 ounces) due to lower gold grades. Meanwhile, Yaramoko had a decent quarter, with higher tonnes milled, making up for the much lower grades in the period. The negative for this asset is that grades continue to decline sharply, and this is not expected to improve without a new meaningful high-grade discovery. As we can see, grades have slid from 11.0+ grams per tonne of gold in FY2018 to less than 6.5 grams per tonne year-to-date, making this a much higher-cost operation, especially when factoring inflationary pressures into the mix.

Overall, these production results were solid, and Fortuna noted that it is tracking towards the high end of silver guidance, heading into Q4 with ~5.16 million ounces of silver produced. On the gold side, the company will need a very strong quarter to beat its guidance mid-point (262,000 ounces), with production needing to come in at 66,300 ounces in the quarter. This might be achievable, but I would not be surprised to see a slight miss at closer to 260,000 ounces for the year. This isn’t anything to be concerned with, with the higher silver production offsetting any miss for full-year gold production.

Metals Prices

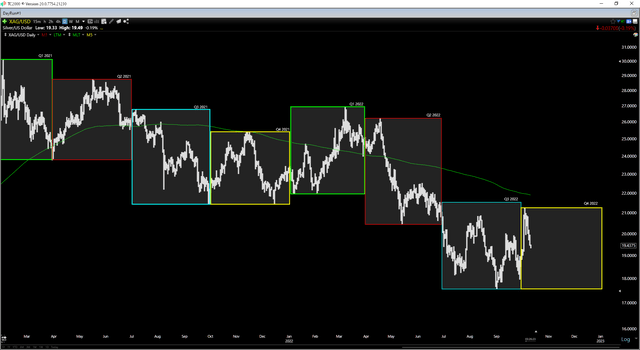

Unfortunately, while Fortuna did a solid job at what it could control, the company hasn’t gotten any help from precious metals prices, which trended down for nearly all of Q3. Based on quarter-end figures, the average realized gold price could come in below $1,750/oz, while the average realized silver price for the quarter could come in at $20.30/oz or lower, a significant step down from Q2 2022 levels (Q2 2022 silver price: $22.90/oz). This is certainly not ideal from a margin standpoint, and if gold prices don’t recover, it paints a bleak outlook for Yaramoko, which is expected to see its costs rise sharply over the next several years.

Silver Futures Price (TC2000.com)

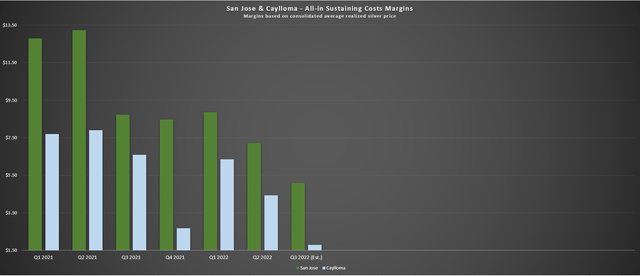

Beginning with the silver business, we can see that margins were already trending sharply lower at San Jose and Caylloma, impacted by difficult comps as the company lapped the benefit of the silver squeeze last year. However, with higher costs due to inflationary pressures, we are seeing a further decline in margins. In fact, Caylloma’s all-in-sustaining cost margins could head below $2.25/oz in Q3 (Q2 2022: $4.43/oz), a nearly 50% decline on a sequential basis. Meanwhile, San Jose’s margins might improve sequentially due to higher production but will also dip sharply towards $5.00/oz, a nearly 40% decline year-over-year and up to 25% sequentially. This is not ideal and doesn’t paint a great picture for H2 2022 margins, given that metals prices have remained under pressure.

San Jose/Caylloma – AISC & AISC Margins + Forward Estimates (Company Filings, Author’s Chart & Estimates)

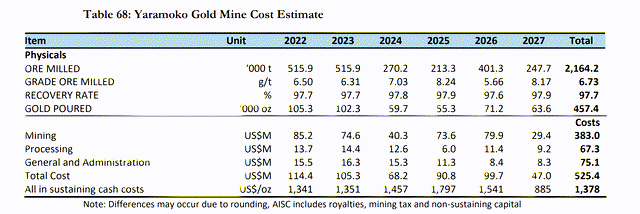

Moving over to Yaramoko, the asset should finish FY2022 with $425/oz+ margins, assuming an average realized gold price of $1,775/oz and all-in sustaining costs of $1,350/oz. However, if we look at average all-in sustaining costs from 2023-2026, they are expected to come in above $1,500/oz, which means that this asset will be producing at costs north of $1,700/oz on an all-in cost basis. This is certainly not ideal when the gold price is currently sitting below $1,700/oz, and we still see some inflationary pressures sector-wide. So, while I think the asset provides nice leverage, the outlook is not great at current gold prices without a new major high-grade discovery. Let’s look at recent developments:

Yaramoko Mine Plan (Company Technical Report)

Recent Developments

Beginning with the negative, Fortuna lost its Chief Operating Officer (West Africa), Paul Criddle, during Q3, which I consider a negative given his strong background. The previous COO had considerable operating experience in Africa as Chief Operating Officer of Yaramoko for five years at Roxgold, with exceptional performance and helping bring the asset online on time and within budget; and would have been a great leader for Seguela. He also worked at Perseus Mining (OTCPK:PMNXF) in Africa for years. The silver lining is that David Whittle has been promoted to COO, who knew Yaramoko well and has 30 years of mining operations experience in several jurisdictions. While this fills the role, the Roxgold team (Weedon, Criddle, Whittle) was one of Fortuna’s added strengths, and it’s now down to just two from three.

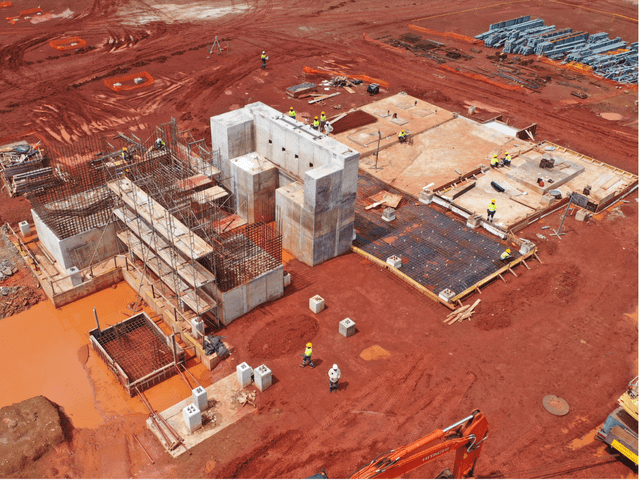

The bigger news, which is certainly exciting, is that Seguela is now 78% complete (up from 68% in June); the build remains on budget and schedule, and this high-grade asset should begin production within nine months. Seguela will be a key asset for Fortuna, given that it should enjoy all-in-sustaining costs below $850/oz and add more than 130,000 ounces of gold production per annum. However, the bigger news is that the team continues to add high-grade ounces to a mine life that’s made up of just ~1.09 million ounces at 2.80 grams per tonne of gold based on the 2021 Feasibility Study.

Seguela Process Plant Construction (Company Presentation)

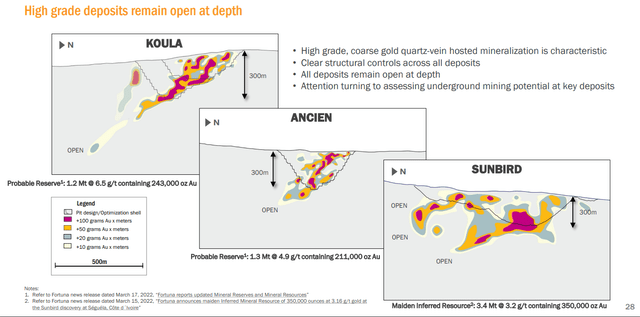

As shown below, the three highest-grade deposits (Koula, Ancien, Sunbird) continue to grow, and Sunbird is not even in the 2021 Feasibility Study, but it looks like it could grow to 800,000+ ounces of resources. This is based on high-grade mineralization added down-plunge and the strike length growing to more than 1.1 kilometers. Meanwhile, at Koula, the company has identified high-grade mineralization in the hanging wall, suggesting resource growth at this deposit as well. Finally, Ancien looks to have near-mine upside at depth, and the company hasn’t even contemplated underground mining long-term, which could potentially double the resource.

Seguela Exploration Upside (Company Presentation)

Since 58% of reserves in the FY2021 mine plan were at relatively low-grade deposits (Antenna, Agouti, Boulder), continued resource growth at its highest-grade deposits could potentially increase production, lower operating costs, and boost NPV (5%). Hence, I think the NPV (5%) of ~$330 million (adjusted for higher capex vs. 2021 FS and inflationary pressures) understates the true potential of this future mine. Hence, my view that this asset should get credit for at least $150 million in exploration upside seems to be panning out, but this was already contemplated in my previous estimates. New discoveries at targets like Kestrel, P14, G7, and others could add further upside down the road.

Valuation

Based on an estimated ~294 million fully diluted shares at year-end and a share price of US$2.80, Fortuna trades at a market cap of ~$824 million. This is below its fair value of US$3.50 based on an estimated net asset value of $1.02 billion, which includes some exploration upside at Sunbird. While this does point to a 25% upside from current levels, I prefer a minimum 35% discount to fair value when buying small-cap producers with operations in less favorable jurisdictions. So, while I think Fortuna is still reasonably valued after its recent rally, the low-risk buy zone for the stock would come in at $2.27 or lower.

Some investors might argue that this fair value of US$3.50 is too low compared to other silver producers or that the stock is a buy if the fair value is 25% higher. However, I think it’s important to look at relative value and be realistic with assumptions. Fortuna Silver receives most of its revenue from gold, and it operates in Tier-2/Tier-3 jurisdictions in its gold business, and even producers with scale in similar jurisdictions typically trade at less than 0.80x P/NAV, like Endeavour Mining (OTCQX:EDVMF). Meanwhile, though it deserves some premium for its silver operations, San Jose’s mine life is relatively short. San Jose’s declining reserve trend won’t be helped by weaker silver prices and potentially higher cut-off grades due to inflationary pressures.

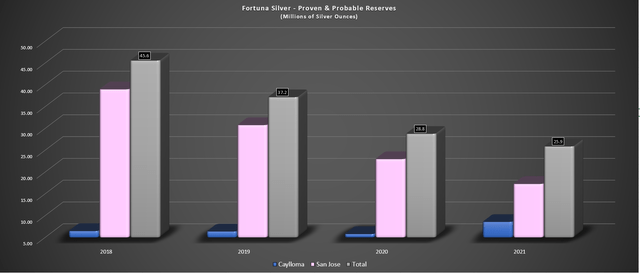

Fortuna – Declining Silver Reserves (Company Filings, Author’s Chart)

Given this setup (minimal silver premium, large portion of gold production from Tier-3 jurisdictions), I believe a 0.90x P/NAV multiple for Fortuna is actually generous. So, when names like Endeavour Mining can be bought for less than 0.80x P/NAV with quadruple the production profile, a nearly 4.0% dividend yield, an aggressive buyback program, and much higher margins, I see the latter as being much more attractive. That said, if FSM declines below $2.27, I would consider it from a swing-trading standpoint.

Summary

Fortuna Silver had a solid Q3 report, and exploration success continues at Seguela, which suggests that this asset could boast an NPV (5%) of $500 million on its own at some point. However, with declining reserves at two assets (San Jose/Yaramoko) and Yaramoko’s margins set to become razor-thin if the gold price doesn’t recover, Fortuna is a Lindero/Seguela story. After subtracting $260 million in corporate G&A from its Mine/Project NPV (5%), I don’t see enough upside here to justify going long at 0.80x P/NAV. Hence, if I were looking to buy the sector-wide dip, I favor i-80 (IAUX), which checks all the boxes: growing reserves, a Tier-1 jurisdiction, and an industry-leading growth profile at a huge discount to NAV.

Be the first to comment