SDivin09/iStock Editorial via Getty Images

Investment Thesis: While growth across the Formula 1 segment has been encouraging, I take a wait-and-see approach on the company at this time.

The Formula One Group (NASDAQ:FWONA), also known as Liberty Media, is a mass media company that has ownership stakes in Formula One, SiriusXM, and the Atlanta Braves Major League Baseball team.

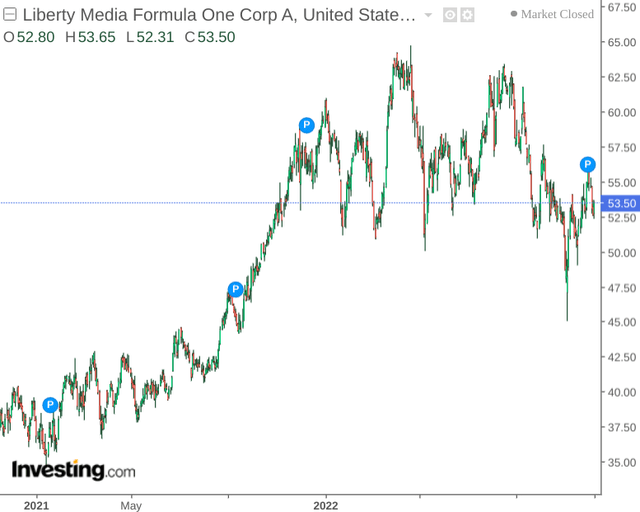

The stock saw a significant upside in 2021 but has oscillated in a largely stationary manner for this year.

The purpose of this article is to investigate whether Formula One Group could see an upside going forward.

Performance

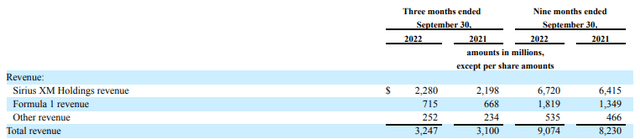

When looking at the most recent quarterly results for Formula One Group, we can see that all business segments showed growth over a nine-month basis as compared to September 2021.

Liberty Media Corporation 10-Q for the quarterly period ended September 30, 2022.

Additionally, it is also notable that while Formula 1 revenue accounted for just over 16% of total revenue in September 2021 – this had increased to just over 20% in September 2022.

Among the major contributors to the boost in Formula 1 revenue were numerous broadcast extensions such as that with Sky Sports covering the UK, Ireland, German, and Italian markets, along with ESPN and ServusTV through to 2025 for the United States and Austria, respectively.

SiriusXM, which Liberty Media holds an 82.4% stake in as of October – is a major broadcasting company in America which provides satellite and online radio services across a wide range of stations encompassing news, music, and entertainment. While growth across this segment was more modest in percentage terms (at just over 4% on a nine-month basis as compared to 34% and 14% for Formula 1 revenue and other revenue) – the fact that Formula 1 revenue has been seeing strong growth is encouraging as it further diversifies the company’s revenue stream.

From a balance sheet standpoint, we can see that while the quick ratio remains below 1 – the ratio has increased significantly from 0.55 in December 2021 to 0.81 in September 2022. This indicates that the company is in a better position to service its current liabilities using its existing liquid assets.

| Dec 2021 | Sep 2022 | |

| Cash and cash equivalents | 2814 | 2542 |

| Trade and other receivables, net | 828 | 826 |

| Total current liabilities | 6610 | 4164 |

| Quick ratio | 0.55 | 0.81 |

Source: Figures sourced from Liberty Media Corporation 10-Q for the quarterly period ended September 30, 2022. Figures provided in USD millions, except the quick ratio. Quick ratio calculated by author.

With that being said, we can also see that the long-term debt to total assets ratio has increased slightly over this period.

| Dec 2021 | Sep 2022 | |

| Long-term debt | 15699 | 17066 |

| Total assets | 44351 | 43235 |

| Long-term debt to total assets ratio | 35.40% | 39.47% |

Source: Figures sourced from Liberty Media Corporation 10-Q for the quarterly period ended September 30, 2022. Figures provided in USD millions, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Looking Forward

Going forward, continued growth across the Formula 1 segment will be welcoming – as it would allow the company to bolster overall revenue given that growth across Sirius XM Holdings shows signs of being more mature.

It is reported that SiriusXM may be in plans to reduce its headcount due to lower-than-expected sales growth. Particularly, with Pandora having seen a decline of nearly 200,000 subscribers from Q3 2021 and a decline in satellite radio subscribers to 34.17 million, it is unclear as to whether current economic conditions may lead to a further drop in subscriptions and thus hinder revenue growth.

Of course, the same could be said for the drivers of Formula 1 revenue growth to date.

While we have seen quite encouraging revenue growth driven by numerous broadcast extensions for major sporting channels across the United States and Europe – there is always the risk that recessionary conditions might cause subscribers to cancel access to sports channels in favor of a more basic TV package.

Moreover, with the 2023 Formula 1 World Championship not set to start until March, we could see a potential decline in quarterly revenues for December.

Conclusion

To conclude, Formula One Group has shown encouraging growth across Formula One revenue, which has helped diversify revenue growth from more modest performance across Sirius XM Holdings.

While I take the view that revenue growth across this segment has potential for longer-term growth, it is unclear as to whether a potential seasonal decline as well as growth pressures on Sirius XM Holdings might give investors pause. For this reason, I take a wait-and-see approach on the stock at this time.

Be the first to comment