Justin Sullivan

Following a strong 2Q-22, Ford Motor (NYSE:NYSE:F) increased its quarterly dividend by 50% to $0.15 per share, returning it to pre-pandemic levels.

Ford Motor also reaffirmed its 2022 free cash flow guidance. Ford Motor’s dividend yield now stands at 3.9%, but despite the fact that the dividend is supported by free cash flow, investors appear to be oblivious to the risks that an investment in Ford Motor represents at this time.

With cyclical automakers facing serious threats from a deeper recession and inflation, I believe Ford Motor provides no recession value to investors.

Ford Motor Brings Back The Dividend

In July, Ford Motor increased its dividend to $0.15 per share, bringing the stock yield to around 3.9%. In order to conserve cash during an unprecedented consolidation brought on by Covid-19, the automaker suspended dividend payments in 2020.

Even though Ford Motor has increased its dividend, recession risks have clearly increased in 2022, and the dividend alone may not keep investors invested in the stock for long.

Recession Risks Are Growing

Ford Motor Company has been aggressively pursuing the electric-vehicle transformation, and the company is introducing new EVs such as the F-150 Lightning, which appears promising. Reservations increased to 200K until December 2021, when Ford Motor Company closed its reservation book due to high demand. Ford Motor expects to produce 150K F-150 Lightnings at its factory in Dearborn annually, starting in 2023.

Even though I can see Ford doing well with the popular F-150 series in the EV market, recession risks have grown considerably in 2022.

Inflation remains very high, prompting Ford Motor to announce significant price increases (up to $9K for certain trims) for the F-150 Lightning. Aside from inflation, the economy is obviously a major risk factor, having entered a recession in the second quarter.

With inflation on the rise and economic activity slowing, cyclical automakers may face temporary declines in car sales as they try to ramp up EV production. As a result, the risks associated with Ford Motor’s free cash flow have increased.

Furthermore, from a cost-benefit standpoint, electric vehicles may become less appealing to buyers. Electricity prices have risen in 2022, particularly in Europe, which may cause some buyers of electric vehicles to be hesitant.

Electricity prices in Germany, for example, have recently increased by more than 500%, putting people’s budgets under serious strain.

Germany Electricity Prices (EEX)

Reaffirmed Free Cash Flow For 2022

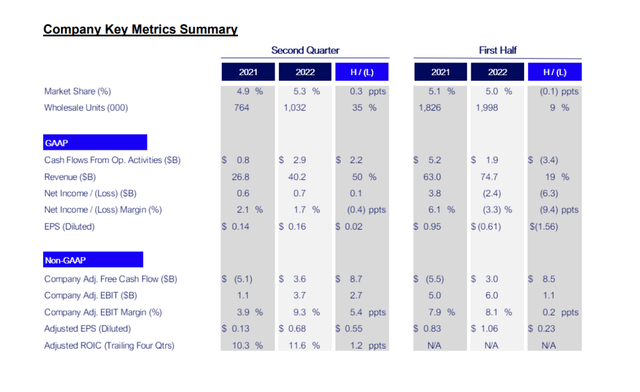

Ford Motor had a pretty good second quarter, with an $8.7 billion swing in free cash flow despite a strengthening car market. Ford Motor’s free cash flow was solid in 2Q-22, at $3.6 billion, especially when compared to the previous quarter, when the company lost $5.1 billion due to supply-chain issues.

Key Metrics Summary (Ford Motor Company)

In 2022, management expects adjusted free cash flow of $5.5 billion to $6.5 billion, and the company reaffirmed its free cash flow forecast in its most recent earnings release. However, if the state of the US economy deteriorates and potentially enters stagflation, Ford Motor’s free cash flow guidance would probably no longer be viable.

Average EPS Estimate Is Expected To Decline

Based on a stock price of $15.26, the market forecasts $1.96 earnings per share for next year, implying an 8.0x P/E ratio. However, average EPS is expected to fall 6% next year, implying that 2023 will most likely be less profitable than this year. Earnings per share are expected to be $2.08 in 2022, according to the market.

As earnings fall, Ford’s P/E ratio could skyrocket, making the stock significantly more expensive, especially if the recession deepens and inflation remains high.

Earnings Estimate (Yahoo Finance)

Why Ford Motor Could See A Higher Valuation

However, if the recession is avoided, Ford Motor Company may do well. First-time claims for state unemployment benefits increased to 232,000 in the week ending August 27, indicating that the labor market remains strong and that recent interest rate increases have not yet resulted in labor market weakness.

As long as the United States’ labor market remains strong and inflation remains under control, the country may avoid a recession, which would obviously benefit Ford Motor Company’s (EV) sales prospects.

My Conclusion

Despite the fact that Ford Motor Company recently increased its dividend by 50%, I believe the market is ignoring recession risks due to high inflation and a weakening economy.

These recession risks disproportionately affect cyclical automakers, which rely heavily on consumer spending.

Rising electricity prices are posing a new macroeconomic challenge for consumers, potentially pointing to more downside for Ford Motor Company’s stock.

Be the first to comment