ThitareeSarmkasat

The Cohen & Steers Closed End Opportunity Fund (NYSE:FOF) takes a fund-of-funds approach to investing in closed-end funds. FOF’s main selling point is its high distribution yield, currently set at $0.087 / month or an 8.8% market yield. However, investors are cautioned that FOF’s distribution appears unsustainable, as it relies heavily on ‘return of principal’ to fund its distribution. This reduces income earning assets that can be used to fund future distributions, creating a negative spiral.

Fund Overview

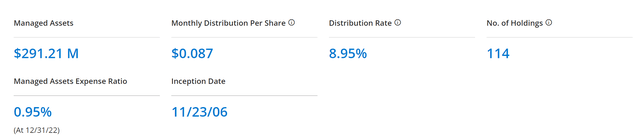

The Cohen & Steers Closed End Opportunity Fund is a closed-end fund (“CEF”) that aims to deliver high current income through investments in the common stock of other CEFs. The FOF fund has almost $300 million in assets and charges a 0.95% expense ratio (Figure 1).

Figure 1 – FOF has almost $300 million in assets (cohenandsteers.com)

Strategy

The FOF fund takes a fund-of-funds approach (hence the ticker ‘FOF’) to investing in closed-end-funds. The fund primarily invests in equity or income-producing funds with strategies like dividend, covered call, total return, balanced, limited duration, convertible, preferred, high yield, and other income-oriented strategies. FOF’s flexible mandate allows the manager to invest in funds trading at a discount with high current income, taking advantage of market inefficiencies as they occur.

Portfolio Holdings

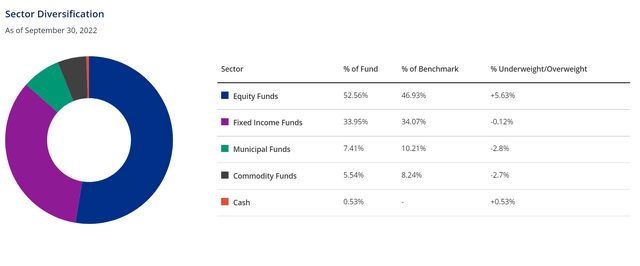

The FOF fund has 114 positions and figure 2 shows the fund’s asset class allocation. 53% of the fund’s assets are invested in equity funds while 34% is invested in fixed income funds.

Figure 2 – FOF asset class allocation (cohenandsteers.com)

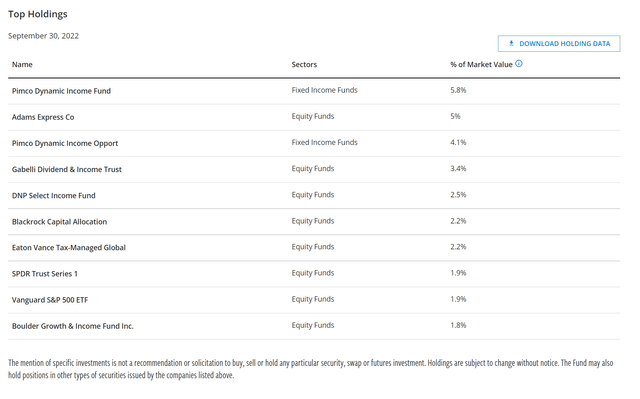

Figure 3 shows the top 10 holdings of the FOF fund which account for 30.8% of the fund’s assets. Interestingly, the Vanguard S&P 500 ETF (VOO) is listed as a top 10 holding of the FOF fund.

Figure 3 – FOF top 10 positions (cohenandsteers.com)

Returns

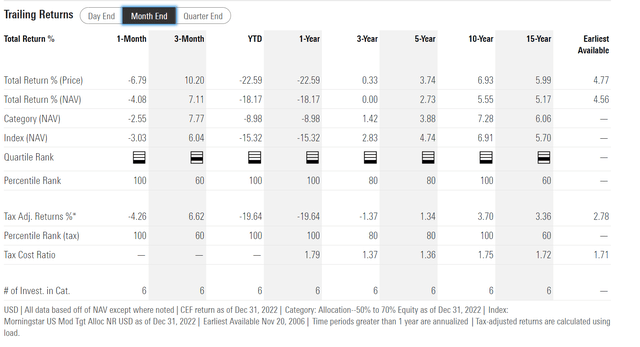

Figure 4 shows the FOF fund’s historical returns. FOF has generated modest average annual total returns in the long run with 5/10/15Yr average annual returns of 2.7%/5.6%/5.2% respectively to December 31, 2022. Short-term performance has been poor, with 2022 returns of -18.2%, leading to a 0.0% average annual total return on a 3Yr timeframe.

Figure 4 – FOF historical returns (morningstar.com)

Distribution & Yield

I believe FOF’s main selling point to investors is its high distribution yield. The FOF fund pays a monthly distribution of $0.087 / share or 8.8% market yield 9.3% yield on NAV.

From information provided on the fund’s website, we can see that FOF’s distribution is funded from a combination of net investment income (“NII”), capital gains, and return of capital (“ROC”) (Figure 5).

Figure 5 – FOF’s distribution is funded from a combination of NII, capital gains, and ROC (cohenandsteers.com)

FOF’s Distribution Rate Shows Signs Of Being Unsustainable

‘Return of capital is an accounting concept that tells investors whether a fund earns sufficient income to fund its distributions. Funds may use ROC but still have a sustainable distribution provided they earn enough from capital gains to fund the income shortfall.

A good yardstick to assess whether a fund’s distribution is sustainable is to look at the fund’s long-term NAV progression. Funds that do not earn their distributions are characterized by long-term NAV declines as distributions are funded by drawing down the NAV and are called ‘return of principal’ funds.

‘Return of principal’ funds are problematic because a portion of the NAV is liquidated every month to fund the distribution. This reduces the income earning asset base to fund future distributions, creating a negative spiral akin to a farmer eating his seed corn.

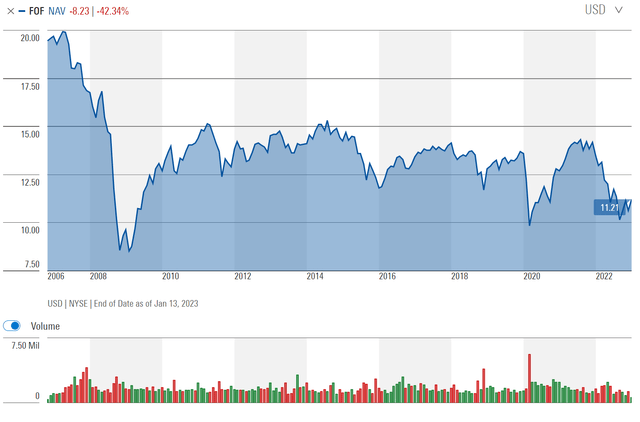

Looking at FOF, we can see the fund’s NAV has declined from $19.58 at inception to $11.21 recently (Figure 6), as the fund has only earned an average annual total return of 4.6% since inception vs. its 9.3% yield on NAV.

Figure 6 – FOF has suffered long-term NAV declines (morningstar.com)

Following its NAV decline, the FOF fund’s distribution rate has declined from a monthly $0.1175 / share in 2007 to $0.087 / share currently.

Long-term declining NAV and shrinking distributions are both hallmarks of ‘return of principal’ funds.

Conclusion

The Cohen & Steers Closed End Opportunity Fund takes a fund-of-funds approach to investing in closed-end funds. In theory, this allows the manager the opportunity to capture market inefficiencies.

I believe FOF’s main selling point to investors is its 8.8% market yield. However, I worry that FOF’s distribution is not sustainable, as the fund has only earned average annual total returns of 4.6% since inception but is paying a 9.3% of NAV yield. The earnings gap has been funded by return of investors’ own principal, which reduces income earning assets that can be used to fund future distributions, creating a negative spiral.

Be the first to comment