Bim

With Inflation Set to Remain Elevated for a While, Investors Need to Look for Valuable Hedging Solutions

Further rate hikes by the US Federal Reserve will be required before US inflation returns to the 2% target from 7.7% in October.

It would be nice for shareholders if their investment in US-listed stocks could provide hedging versus elevated inflation.

FMC Corporation (NYSE:FMC) may be one.

The company supplies crop protection products and plant nutrients characterized by ever-growing demand driven by the presence of long-lasting economic or social conditions.

FMC Corporation leverages its position as a major international competitor in the global crop protection and fertilizer industry and will increase its earnings earmarked for dividends. FMC Corporation will prove to be a valuable tool to protect against high inflation as it grows.

The Role of FMC Corporation in the Global Agricultural Inputs Industry

Farmers use FMC Corporation’s products to improve crop yield and crop quality.

These ever-increasing crop yields will be crucial to counteract the severe food crisis in the Horn of Africa and other poor regions of the world and to meet the consumption needs of society in developed countries.

Starving populations will continue to suffer from the effects of warlike activities, the hoarding of resources and raw materials, and the extreme weather events that are increasingly occurring as a result of climate change.

In contrast, thanks to the improvement in the economic conditions of the population and strong advertising power, people in most developed countries can afford even what they do not always need.

As higher crop yields become increasingly necessary to meet global food demand and consumption, the outlook for crop protection and nutrition markets cannot but be bright. These prospects are unlikely to displease FMC Corporation’s shareholders, as they should lead to steady growth in revenues and margins.

Fortune Business Insights forecasts that global demand for crop protection products, valued at more than $57 billion in 2020, will grow nearly 4.7% over the next few years to nearly $82 billion in 2028.

The global industry of crop protection products and nutrients is characterized by the presence of many competitors, but this should not be a concern for shareholders of FMC Corporation.

The company has an established position that has grown in almost 140 years of activity and is now one of the main competitors dominating the global market.

The Financial Results for the Third Quarter of 2022

Third quarter 2022 results show that FMC was able to increase sales through a higher pricing policy, which allowed the company to fully offset raw material sourcing costs that had become more expensive due to the conflict in Ukraine.

Demand for herbicides and insecticides was particularly robust in South America, and sales also grew in North America, although growth was mixed there.

In Asia, sales decreased slightly organically due to meteorological factors, as monsoon rains were heavier than usual this year, probably due to climate change, which of course neither FMC nor any other company can control.

Sales in Europe were driven by German demand for diamide insecticides, a new class of ryanodine-based insecticides. This is an alkaloid derived from the Ryania plant that is particularly toxic to a variety of insects, up to the point of paralysis and death.

Additionally, sales have not fared very well in the Middle East and Africa, where a stronger dollar against local currencies has likely hurt not only FMC, but other major international competitors as well.

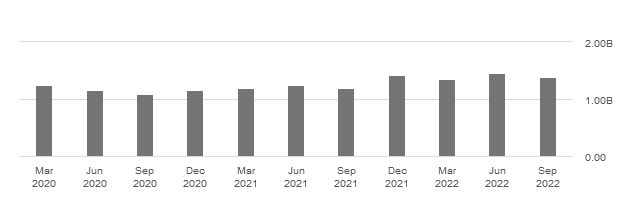

As such, the revenue of $1.38 billion for the third quarter of 2022 represented a 15% jump year over year.

//seekingalpha/symbol/FMC/income-statement

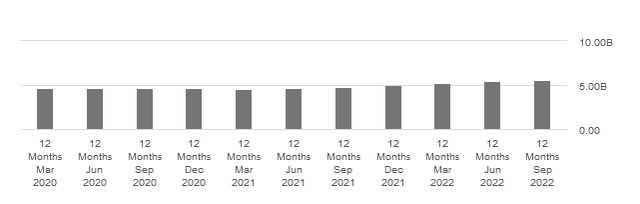

Revenue for the trailing twelve-month period [TTM] grew 17% year over year to $5.59 billion as of September 30, 2022.

//seekingalpha/symbol/FMC/income-statement

Adjusted EBITDA of $261 million and adjusted earnings per diluted share of $1.23 were impacted by headwinds from higher raw material costs and unfavorable foreign exchange.

These negative factors should subside once the US Federal Reserve stops raising interest rates and the crisis in Ukraine ends.

It is difficult to predict when Ukraine and Russia will begin negotiations to end hostilities. While, monetary tightening could end sometime next year, as some analysts predict an economic recession in the second half of 2023.

The Outlook for the Full Year 2022

Looking ahead to the full year 2022, FMC Corporation has adjusted guidance ranges at $5.6 billion – $5.8 billion for revenue, $1.37 billion – $1.43 billion for Adjusted EBITDA and $7.10 – $7.60 for Adjusted Earnings per diluted share.

These represent an increase from the midpoint of the previous forecast range. Perhaps most importantly to the shareholder, these forecasts will represent the following increases over 2021: Revenue will be up 10.9-14.9%, Adjusted EBITDA will be up 3.5-8%, and adjusted earnings per diluted share will be up 2.5-9.7%.

Between $440 million and $560 million is the expected free cash flow that FMC Corporation can use to meet financial obligations, pay dividends and fund a budget of up to $200 million for the repurchase of its own common stock.

Free cash flow will be lower year over year due to the impact of inflation on working capital, but that shouldn’t rule out another dividend hike that could be very positive for the stock price in the near term.

How About Dividends

Past performance is no guarantee of future results, but the chart below suggests that FMC Corp’s dividends are resilient.

The chart shows how, over a very long period of 10 years, the company has steadily increased budget for dividend payments, even though levered free cash flow [ie cash flow after financial obligations] and especially net earnings have not always been regular.

://seekingalpha/symbol/FMC/cash-flow-statement

While earnings have grown 12.60% per year over the past 5 years, FMC Corp’s dividend has grown 29.96% per year.

With analysts expecting the stock’s earnings to grow in the years to come, the dividend should follow the same path and climb at a faster rate based on past trends, which will benefit shareholders.

Analysts estimate earnings annual growth at 12.3% YoY in 2023 and 9.06% YoY over the next 5 years.

The company currently pays a quarterly dividend of $0.53 per common share, the last of which was paid on October 20. That equates to a dividend yield [FWD] of 1.68% as of this writing, versus the S&P 500’s 1.64% yield. The S&P 500 is a benchmark index for the US market.

The Stock Valuation: The Shares Could Go Cheap

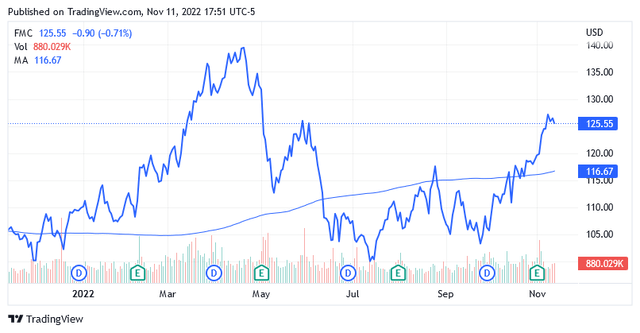

Shares of FMC Corporation are trading at around $125.55 per unit at the time of this writing and have ranged from a lower price of $98.24 to a higher price of $140.99 for the last 52 weeks.

The current valuation is not low as it is above the long-term trend of the 200-moving average of $116.67 and is also trading in the second half of the 52-week range.

Additionally, the stock has a non-GAAP P/E [TTM] of 17.56x versus the industry median of 11.62x and a price-to-sales [TTM] ratio of 2.86x versus the industry median of 1.13x. Those indices could mean that FMC is more expensive than some of its closest competitors as a result of last month’s stock price rally.

Given the upside potential outlined above, this stock is certainly a Buy. But not at this level as the stock could get cheaper than current valuations. Perhaps the long-term trend of the 200-day simple moving average could provide a useful indicator to assess whether the stock price is more or less affordable.

Inflation has had some impact on working capital, the market has taken this factor into account but probably overreacted to it. Many investors dumped the stock when inflation was at its peak, but rational thinking was not the deciding factor. This stock continued to generate income that is on track to close the year significantly above 2021 levels, providing a hedge against inflation.

As soon as signs of slowing inflation began to appear, investors regained confidence in FMC and the share price even rose.

However, inflation could pick up again after the Christmas shopping season, which traditionally starts on Black Friday in the US. Black Friday falls on November 25 this year. It is known that people spend more during this period.

If the correlation between high inflation and falling FMC shares is correct, the stock price should fall after the Christmas shopping season, potentially leading to a more attractive entry price for this stock.

Conclusion – This Stock has Solid Growth Prospects, but its Share Price Could be More Attractive Than its Current Level

FMC Corporation supplies products whose demand will be solid over the years for economic and social reasons.

FMC Corp will capitalize on its leading position in the global market for crop protection products and fertilizers by continuing to grow sales, generate profits and pay dividends.

The shares are not trading low but could go cheap due to the Christmas shopping season.

Be the first to comment