allou/iStock via Getty Images

Introduction

Earlier this month, FMC Corporation (NYSE:FMC) reported its third-quarter earnings. The company beat both EPS and revenue expectations despite severe inflation headwinds. The good news doesn’t stop there. The agriculture giant sees lasting strong demand and easing inflation and supply headwinds. While this is good news for the company, it also tells us a lot about the state of global agriculture, supply chains, inflation, and everything else investors in this industry want to know.

I remain bullish on FMC and expect the company to outperform its basic materials peers.

Now, let’s dive into the details!

What’s FMC?

FMC is flying under the radar for many reasons. Size isn’t one of them. The company is a $15.9 billion agriculture giant operating in the agricultural inputs industry, a part of the basic materials sector.

What makes FMC fly under the radar is its products. The company doesn’t produce tractors or similar equipment. It also does not produce fertilizers, which are a big part of the ongoing agriculture bull case. FMC produces pesticides. These are extremely important for the global population surge, yet it’s a boring topic that most people ignore.

According to the company:

FMC Corporation is a global agricultural sciences company dedicated to helping growers produce food, feed, fiber, and fuel for an expanding world population while adapting to a changing environment. FMC’s innovative crop protection solutions – including biologicals, crop nutrition, digital and precision agriculture – enable growers, crop advisers, and turf and pest management professionals to address their toughest challenges economically without compromising safety or the environment. FMC is committed to discovering new herbicide, insecticide, and fungicide active ingredients, product formulations, and pioneering technologies that are consistently better for the planet.

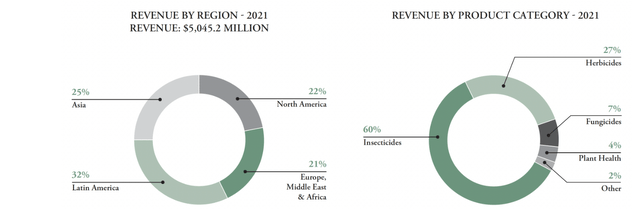

The company has a well-balanced sales breakdown with diversified products and sales regions. The company sells roughly 22% of its products in North America. In EMEA countries, it has 21% exposure. The exposure in emerging markets is even bigger.

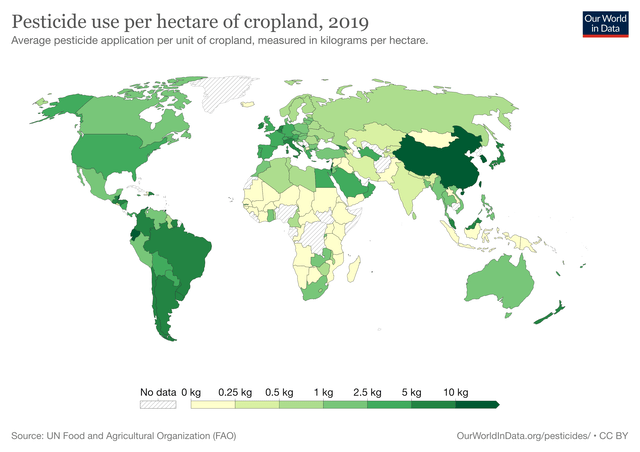

I already expected it a bit, and after searching the web for a few minutes, I found out why the company has so much emerging market exposure. Most emerging markets have looser rules for pesticides, as the map below shows. I expect that divergence to grow as developed nations are starting to push for more organic farming.

Hence, what makes FMC so interesting is its ability to tell us a lot about agricultural sentiment, prices, and supply chain issues as the company is part of a complex international chemical supply chain.

With that said, let’s dive into the numbers.

Why 3Q22 Matters So Much

Let’s start this part by highlighting the headline numbers. In its third quarter, FMC reported $1.23 in adjusted EPS. That was $0.12 higher than expected.

Total revenue came in at $1.38 billion. That was $50 million higher than expected and 16.0% higher compared to the prior-year quarter.

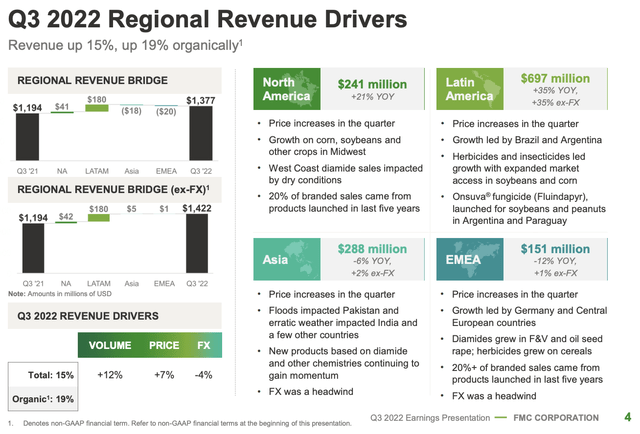

In the third quarter, volume growth was 12%, a truly fantastic number. Pricing gains were 7%. Forex headwinds were 4% due to the strong dollar.

On top of that, the company raised its full-year outlook with only one quarter left in the fiscal and calendar year. As reported by Seeking Alpha:

- Raises revenue outlook to a range of $5.6 to $5.8 billion, reflecting 13 percent growth at the midpoint versus 2021 from prior outlook of $5.5B-$5.7B vs. $5.63B consensus.

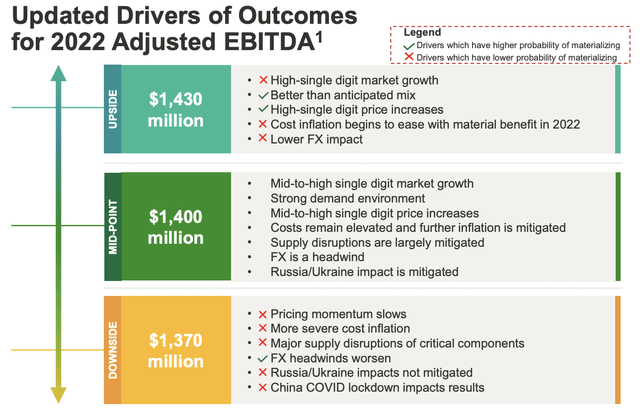

- Narrows adjusted EBITDA outlook to a range of $1.37 to $1.43 billion, reflecting 7 percent growth at the midpoint versus 2021.

- Narrows adjusted earnings per diluted share outlook to a range of $7.10 to $7.60 (from prior outlook of $7.00-$7.70 vs. $7.41 consensus), reflecting 7 percent growth at the midpoint versus 2021, excluding any impact from potential 2022 share repurchases.

With that said, the top line was fantastic. 19% organic revenue growth is one of the company’s best quarters. The company reported high sales growth in North America and Latin America, boosted by high corn-related demand in the Midwest. In Brazil, the company benefited from increasing acres, strong commodity prices, and high grower confidence, allowing farmers to boost spending.

According to the company:

FMC has been investing in expanding market access by adding commercial resources and developing new broader relationships with large cooperatives and distributors. These investments are focused on key row crops, such as soybean and corn and we are starting to realize the results benefit from these increased sales.

In EMEA nations, sales were down 12%. This is due to the huge impact of the dollar. Excluding forex, sales are up 1%. This could have been even higher, yet FMC decided to exit the Russian market. Moreover, droughts significantly impacted pesticide usage, which also pressured these numbers.

In Asia, the company generated 2% organic sales growth. Pricing gains more than offset forex headwinds while floods in Pakistan and erratic weather in India and other nations also impacted the performance. However, the company sees strong demand for new products based on diamides and other chemistries, and growth in underrepresented nations like Indonesia, Vietnam, and Thailand.

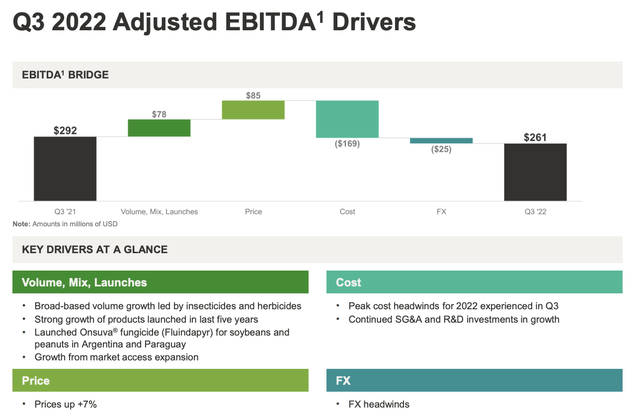

With that said, the EBITDA bridge is highly interesting as it shows the impact of costs. Adjusted EBITDA was $261 million, a decline of 11% despite high volumes and new product launches, adding $78 million to the third-quarter EBITDA. While EBITDA is still $6 million above the high end of FMC’s guidance, cost and forex headwinds more than offset price increases.

The good news is that the company believes that peak inflation occurred in the third quarter.

We are seeing initial signs of decelerating inflation, and we are confident that cost headwinds in ’22 have peaked in the third quarter. FX was a $25 million EBITDA headwind in the quarter due to weakening of several currencies around the world.

Moreover:

Cost increases are forecasted to be lower in Q4 compared to Q3. The combination of sales growth and lower cost headwinds is anticipated to result in EBITDA growth of 15% at the midpoint with EPS up 9% at the midpoint year-over-year.

Additionally, easing supply disruptions are now a part of the company’s base case for 2022 adjusted EBITDA. The same goes for full mitigation of the Russia exit.

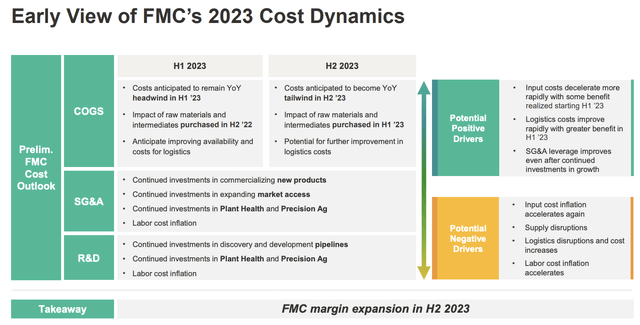

Moreover, the company’s early 2023 view included a few interesting notes.

The company sees flat acreage growth, and strong commodity prices for corn, soybeans, and wheat. That’s what I expect as well.

Here, the company expects volatile currencies and strong prices for both corn and soybeans. The company also sees higher planting areas. LATAM is expected to be the company’s strongest market in 2023.

In Asia, the company expects volatile forex, flat growing area growth, but strong prices for cereals and rice crops.

Here, the company expects flat growing areas, forex volatility, and regulatory constraints pressuring pesticide use. Especially the last issue is set to last, as the European Green New Deal is looking to slowly but steadily get rid of pesticides. That won’t happen anytime soon, but it is a risk.

Yet, despite these challenges, growth is expected to be positive due to strong pricing for cereals and corn.

Moreover, the company did not only comment on peak inflation, expected to occur in 3Q22 but also on the timing when inflation turns into a tailwind. That is set to happen in the second half of 2023. This includes input costs and logistics.

So, what does this mean for the valuation?

Valuation

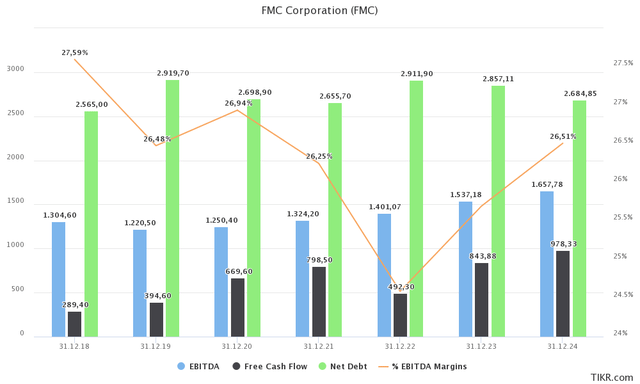

2022 is expected to be a bottom when it comes to pricing and supply chain headwinds. Free cash flow is expected to bottom at roughly $500 million, with EBITDA margins falling to 24.5%. However, EBITDA is still expected to be higher than in 2021. Next year, margins are expected to accelerate before reaching 26.5% in 2024.

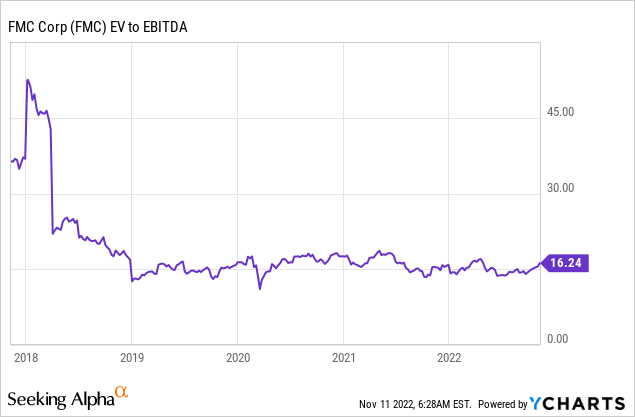

With that said, FMC is trading at a 12.5x 2023E EBITDA of $1.5 billion multiple. That’s based on its $18.8 billion enterprise value, consisting of $15.9 billion in market equity value and $2.9 billion in 2023E net debt of 2.9 billion (less than 2.0x EBITDA).

This is a very fair valuation.

Also note that FMC is up 15% year-to-date, despite the market entering a bear market this year. Investors are pricing in the 2023 recovery, which makes sense.

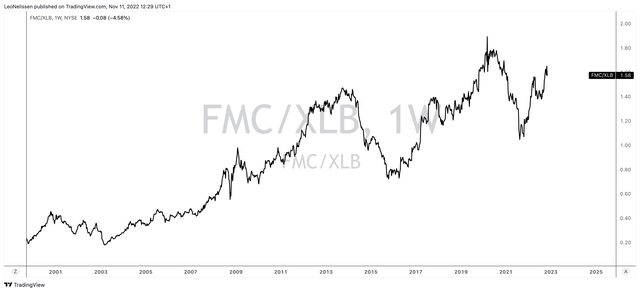

I expect that FMC has more upside. The stock should not be trading below $145 (currently $126). Moreover, I believe that FMC will continue to outperform the basic materials ETF (XLB) thanks to its ability to benefit from emerging market volumes and pricing power when it matters most.

The only reason why I am not long FMC Is that I already have significant agriculture, basic materials, and (related) energy exposure.

Takeaway

FMC’s third quarter was great. While cost headwinds caused adjusted EBITDA to decline and forex headwinds reduces sales growth, the company is benefiting from strong volume growth in key markets, its ability to use pricing to partially offset inflation, and its estimates that we’re now beyond peak inflation in the industry.

Moreover, 2023 is expected to be another strong year as agriculture fundamentals remain favorable. If the company is right, it could benefit from pricing tailwinds in the second half of 2023. Hence, we’re looking at a steep increase in margins.

I remain bullish on FMC and expect that agriculture companies will increasingly hint at the fading supply chain and inflation headwinds in the months ahead.

(Dis)agree? Let me know in the comments!

Be the first to comment