Stock photo and footage/iStock via Getty Images

Six weeks ago, lithium-ion battery manufacturer Flux Power Holdings (NASDAQ:FLUX) or “Flux Power” reported better-than-expected Q3/FY2022 results with both top- and bottom line results exceeding expectations.

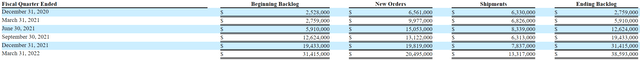

In addition, the company reported record backlog levels as its book-to-bill ratio for the quarter was substantially above 1 again:

According to statements made on the conference call, Flux Power also received a non-binding, multi-year letter of intent (“LOI”) from one of its Fortune 100 customers which is looking to secure build slots as part of its ongoing material handling fleet conversion. Potential revenue derived from this LOI might exceed $20 million over a two-year time frame.

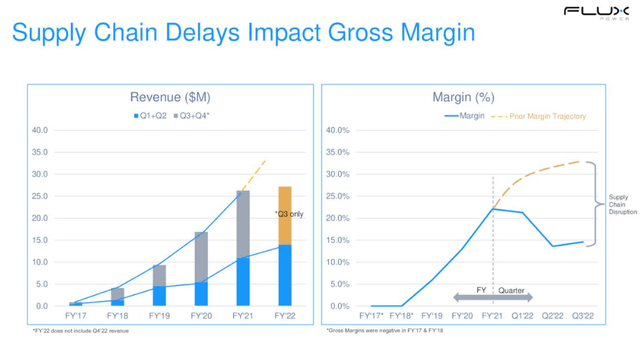

That said, the massive backlog increase experienced over the past couple of quarters has been partially caused by ongoing supply chain disruptions which have also impacted gross margins:

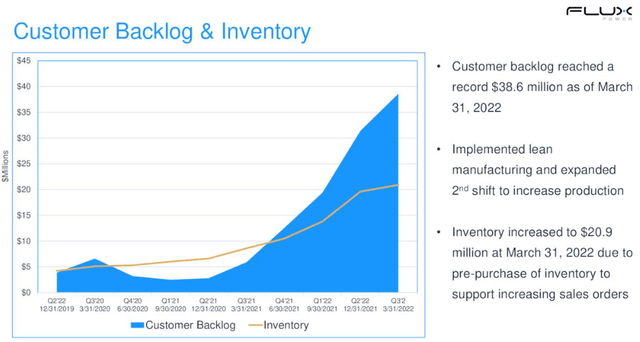

In addition, cash flows have been pressured by the requirement to secure sufficient inventory:

Free cash flow for the quarter was negative $4.1 million, a meaningful improvement from the negative $11.3 million recorded in Q2.

At the end of Q3, cash and cash equivalents were down to a paltry $3.8 million with another $2.5 million available under the company’s $6.0 million revolving credit facility with Silicon Valley Bank.

Subsequent to quarter end, the company managed to secure an aggregate $6.0 million in additional liquidity:

On May 11, Flux Power entered into an up to $5.0 million subordinated line of credit for short-term working capital purposes until December 31, 2022. As of May 12, aggregate lender commitments under the facility were $4.0 million.

That said, terms of the facility are beyond ugly with an interest rate of 15% per annum and meaningful upfront fees. In addition, lenders extracted 160,000 warrants with an exercise price of $2.53.

At the election of the company, repayments can be made in cash or common stock. The company also has the right to extend the due date by one year upon payment of a 2% commitment fee.

On June 23, Silicon Valley Bank increased the amount of the company’s revolving credit facility from $6.0 to $8.0 million in return for an increased interest rate (Prime Rate +3.5%). The bank also extracted 40,800 warrants with an exercise price of $2.23.

As a result, Flux Power has removed the recent going concern warning from its quarterly report on form 10-Q:

We believe that our existing cash and additional funding available under our SVB Line of Credit, combined with funds available to us under our new subordinated line of credit of up to $4.0 million will be sufficient to meet our anticipated capital resources to fund planned operations for the next twelve months.

On the conference call, management pointed to modest improvements in supply chain issues and projected inventory levels to decline going forward which should result in significantly reduced cash usage.

In addition, the company has taken action to move gross margins back up:

Our improvement initiatives include getting traction from our price increases, utilization of alternate vendors and lower-cost suppliers, new product designs to lower cost, reducing part count and complexity and improving serviceability of packs (…).

Bottom Line

Despite ongoing supply chain disruptions, Flux Power delivered a respectable Q3 well ahead of consensus expectations.

In addition, the company managed to secure some much-needed liquidity which in conjunction with lower working capital requirements and projected margin improvements should be sufficient to avoid further near-term shareholder dilution.

That said, the company is not out of the woods yet as liquidity remains tight and supply chain disruptions are far from being over.

In addition, with a major recession becoming an increasingly likely possibility, Flux Power’s growth trajectory might be challenged.

Given expectations for improved margins and easing liquidity pressures, I am upgrading shares from “strong sell” to “hold“.

Be the first to comment