Chun han/E+ via Getty Images

It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”― Harry S. Truman

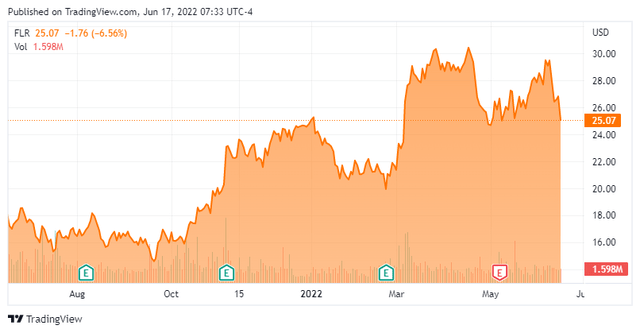

We put the spotlight on Fluor Corporation (NYSE:FLR) today. The stock has been pulling back in recent weeks, along with most equities as the Federal Reserve commences an aggressive monetary tightening effort and investors’ fears that a recession is on the horizon seem to be growing by the day. The shares did see some rare insider buying in May, however. An analysis follows below.

Company Overview:

Fluor Corporation is based just outside of Dallas. The company provides professional and technical solutions, including design and build services to deliver large construction projects to clients around the world. The company is the large Engineering & Construction (E&C) concern in the S&P 500. Its focus has traditionally been on the oil & gas sectors along with power generation. After the pandemic had substantial negative impacts on the company’s business and profits, leadership has been pushing the firm to expand in areas such as energy transition, high-demand metals, and infrastructure as well as large projects for governments, both U.S. and Foreign.

Fluor is set up as a holding company with various subsidiaries and joint ventures. The company’s main business segments are Energy, Urban and Mission Solutions. The stock currently trades just over $25.00 a share and sports an approximate $3.8 billion market capitalization.

Ten days after first quarter results were posted, Fluor stock took a hit when it was disclosed that National Nuclear Security Administration or NNSA canceled a proposed 10-year, $28 billion contract. This was for the company’s joint venture with Amentum to manage the agency’s main nuclear weapons production sites. To avoid potential conflict of interests, the NNSA will now award contracts for operating each facility separately.

First Quarter Results:

On May 6th, Fluor posted first quarter results. The company earned 16 cents a share on a non-GAAP basis, which was more than nickel a share under expectations. Segment profit did nearly double to $115 million. Revenues fell just under seven percent to just over $3.1 billion, approximately $20 million above the consensus. The company booked some $1.9 billion in new orders during the quarter, in line with its expectations. Its order backlog now stands at $19.3 billion.

Leadership guided to between $1.15 and $1.40 of EPS in FY2022.

Revenues from its traditional Energy Solutions business rose from $1 billion to $1.2 billion while profit segment grew from just $2 million to $54 million. Backlog decreased from $11.1 billion to $8.5 billion.

Sales from its Urban Solutions business dropped from $1.2 billion a year ago to $1 billion this quarter. This was due to the closeout of data center projects in Europe and mining projects in South America. Profit from this segment dropped from $30 million a year ago to $15 million in the quarter.

Mission Solutions posted a profit of $58 million during the quarter from $44 million in the year-ago period even as revenue dropped to $593 million from $753 million in 1Q2021. The company credited the profit increase to the closeout of a U.S. Army Corps of Engineers project in Puerto Rico and for a project providing humanitarian support for Afghan evacuees in the United States.

Analyst Commentary & Balance Sheet:

Both Credit Suisse ($29 price target, up from $26 previously) and Citigroup ($31 price target, up from $29 previously) maintained Hold ratings on FLR after first quarter results came out. Albeit, both contained slight upward price target revisions. Robert W. Baird maintained its Buy rating with $32 a share price target.

Over 11% of the outstanding float in the shares is currently held short. A director bought just over $1 million worth of shares on May 10th and May 11th. It was the first insider purchase in this name in some three years. An officer sold $15,000 worth of shares in late February. It was the first insider to sell in over three years as well as the stock has little insider activity. The company ended the first quarter with $2.1 billion in cash and marketable securities on its balance sheet, against just under $1 billion in long-term debt.

Verdict:

The current analyst consensus has Fluor making roughly $1.15 a share in profit in FY2022 as revenues rise in the low teens to $13 billion. Earnings are projected to rise to just over $1.50 a share in FY2023 as revenues approach $14 billion.

The company has done a good job recovering from the pandemic where Fluor posted a net loss for the year and ended dividend payouts. That said, the stock still trades north of 20 times forward earnings even after the recent decline in the equity. Shares are more reasonably priced on a price to sales or price to order backlog basis. The company appears to have a pristine balance sheet.

Despite the recent insider purchases, the stock does not seem to be a bargain. Earnings are ‘lumpy‘ in this industry and the sector is cyclical to a large degree. Not an area an investor should be in when a recession seems most likely on the horizon. Probably a good reason analysts are not sanguine on Fluor right now and over 10% of the shares are held short at the moment. Fluor is historically a much better bet coming out of a recession and we may revisit it should that scenario play out.

During recession greed dies, frugality survives.”― Amit Kalantri

Be the first to comment