MF3d/E+ via Getty Images

Fluence (NASDAQ:FLNC) provides energy storage products, services, and digital applications for batteries and renewables.

Siemens (OTCPK:SIEGY) and AES (AES) launched Fluence as a joint venture to combine forces in the energy storage sector. The backing by these two giants improves Fluence’s credibility, but they are also important customers. They both still hold 68.4% of the economic interest and 91.5% of the voting power. The share structuring is complex. This shareholder structure is both a risk and an asset for Fluence.

I’ve mentioned Fluence before in my Energy Storage Stocks Overview.

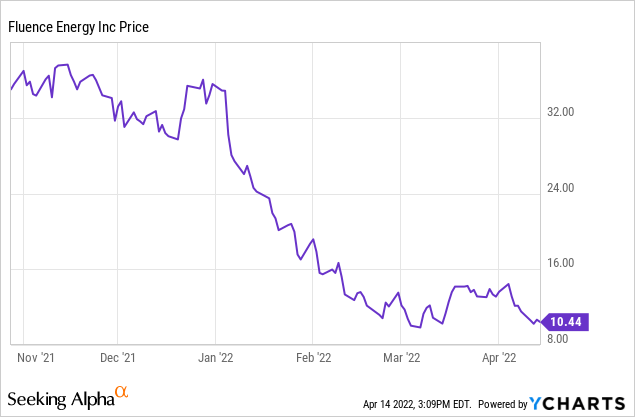

The share price had a rough time since the IPO. The IPO happened at the top of the market, and growth stocks have dropped since then. The bad quarterly results from Fluence didn’t help either and pushed it down further. The recent Russia-Ukraine war could improve energy storage demand as countries want to become more energy independent, but it hasn’t moved the share price significantly yet.

The company’s fiscal year ends on September 30, so the fiscal first quarter of 2022 ended on December 31.

Growth

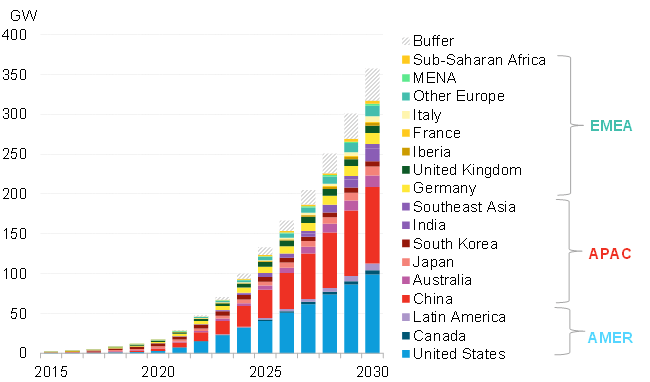

BloombergNEF

Battery storage demand will grow exponentially over the next decade. It addresses the variability of solar PV and wind energy, stabilizes the grid, and meets rising demand flexibility. The demand growth for energy storage is a comfortable tailwind for Fluence.

Quarterly growth is lumpy. Delays in the supply chain and clients deferred revenue from the first quarter to the rest of the year. It makes sense as the most significant chunk of revenue comes from battery hardware projects. Revenues grew 50% in Q1. It came in lower than analysts’ expectations but in line with its guidance of $165M – $195M (15% of the full-year outlook).

Fluence expects to grow fast. For fiscal 2022 (ending September 30, 2022), it guides for $1.1B-$1.3B revenue or 60%-90% year-on-year growth.

Three Business Segments

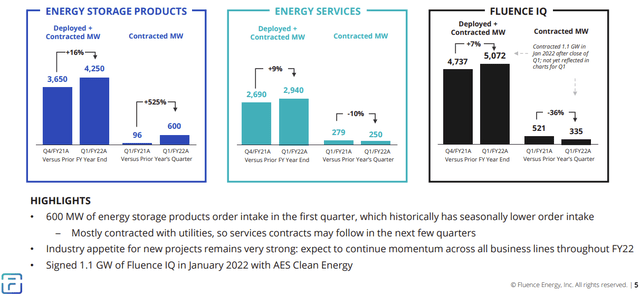

- Energy Storage Products is by far the most critical segment today. It’s the manufacturing, delivery, and installation of energy storage products. These products grow fast, have low margins, and give immediate revenues.

- Energy Services are the recurring operational and maintenance services for these hardware products. These services have better margins and grow moderately as the product portfolio grows.

- Fluence IQ is a digital application for optimizing the profits and features of energy storage products. Digital services are the most promising, with high margins and strong growth.

Fluence provides a split in MW for the three segments but doesn’t specify the revenues.

An analyst on the earnings call mentions a $3M to $4M revenue target for Fluence IQ. Every GW in Fluence IQ would be worth $1M-$2M in annual revenue, depending on the mix between energy storage and renewables.

Margins And Profit Outlook

Fluence operated with a negative gross margin of 31% in the most recent quarter. It had a significant net loss of $111M or 63.4% of revenue. The company blames cost overruns on projects, shipping costs, and omicron-related delays for the low gross profit margin. It expects an easing in H2 of 2022, but the current situation could keep expenses high.

It foresees an improving gross margin throughout the year. In Q4, it expects to achieve a 5% gross margin. As the company scales up, the margins should improve further. Analysts expect net profitability in 2023 Q3-Q4.

Balance Sheet

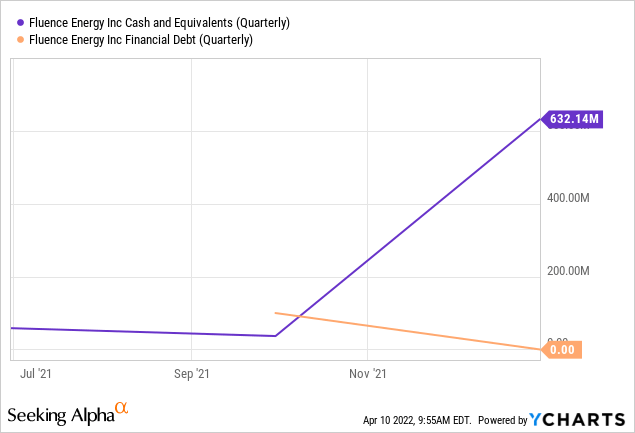

Fluence has a rock-solid balance sheet.

It has no debt and $632M in cash. It used some of the cash to secure inventory in recent quarters. The company does not need further cash raises at this point.

Valuation

The company is cheaply valued for its growth. It has a forward PS ratio of 1.5 based on the midpoint of its revenue outlook. There is enough cash to bridge towards profitability. Other metrics like profits, free cash flow, or EBITDA are negative and can’t be used to value the company yet.

The company looks cheap at this PS ratio and with a net cash position of $3.7 per share.

Comparison To Stem (STEM)

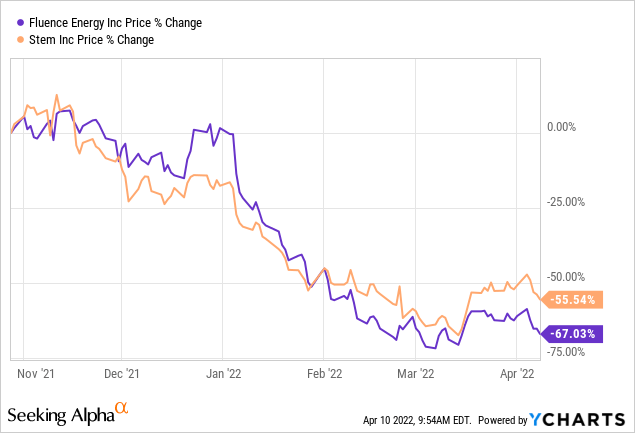

The companies’ share prices moved in sync since Fluence went public. I’ve written extensively about Stem before.

The negative evolution is mainly due to market sentiment. The popularity of energy storage faded over the past few months. Both companies’ last quarter results came in below expectations. They expect to pick the deferred revenue up in the next couple of quarters.

The software systems are tough to compare. Both provide different information and make it impossible to compare their offerings. Stem just added solar to its offering. Fluence already had wind and solar included in Fluence IQ.

| Fluence | Stem | |

| Market cap | $1.8B | $1.5B |

| PS Ratio | 1.7 | 3.6 |

| 2022 expected revenue growth | 75% | 204% |

| 2022 expected gross margin | -10% – 0%* | 15% – 20% |

*Author’s estimate

It’s a tough comparison as they provide different metrics to evaluate both companies. Stem focuses on the software revenues with high margins, whereas Fluence offers a broad approach to the energy storage value chain. Both companies are set to be successful in their areas.

Risks

The principal shareholders, Siemens and AES, are a risk to investors. They could pursue their own goals, not in line with other shareholder interests. Investing in Fluence is trusting AES and Siemens to act in the best interest of Fluence.

Increasing raw material prices are a struggle. Its current contracts are hedged through fixed-price agreements with suppliers and customers. It also introduces raw material indices-based pricing for new contracts on the supply and demand sides. It still makes systems more expensive and could postpone growth. The Russia-Ukrainian war could aggravate this effect.

Conclusion

Fluence Energy has a broad approach to energy storage. The company has hardware, maintenance, and software solutions that win contracts. It has a strong growth outlook and is relatively cheaply valued. The development of energy storage will be enormous over the coming decades.

The upside is clear if it executes better than in the past two quarters and delivers on its 2022 expectations. The shareholder structure with Siemens and AES could impair other investors.

Be the first to comment