gerenme/iStock via Getty Images

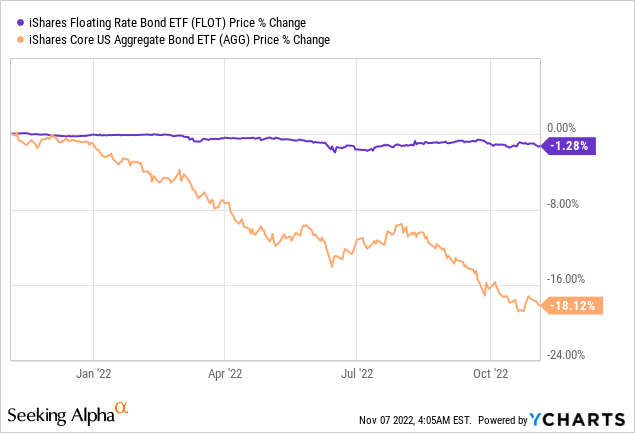

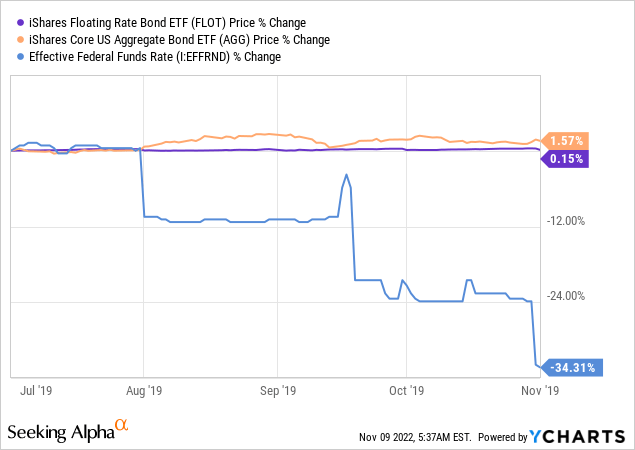

In my quest for portfolio diversification, I came across the iShares Floating Rate Bond ETF (BATS:FLOT) which as shown in the blue chart below has resisted volatility much better than the iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG) since it became evident that the Federal Reserve would have to raise rates to combat high inflation.

However, after six interest rate hikes by the U.S. Central bank, many are now expecting or hoping for a pivot, and with yields on investment grade now above 2%, more investors are being tempted by high-quality fixed income. However, this thesis is of the opinion that even after an 18% downside, the time is not ripe to enter into core bonds, unless this is done as part of a combined portfolio strategy that includes bonds that pay interest at a variable rate.

For this purpose, I will also show how a portfolio consisting of both AGG and FLOT has historically outperformed one consisting exclusively of core bonds.

I start by differentiating between fixed and variable-rate income.

Difference between AGG and FLOT

For those who are new to this space, most bonds like AGG have a fixed interest rate. You know exactly in advance the interest you will receive for the life of the bond. However, in the world of corporate debt, there are also variable interest rate bonds where the coupon payments perceived are adjusted according to a benchmark rate, such as LIBOR.

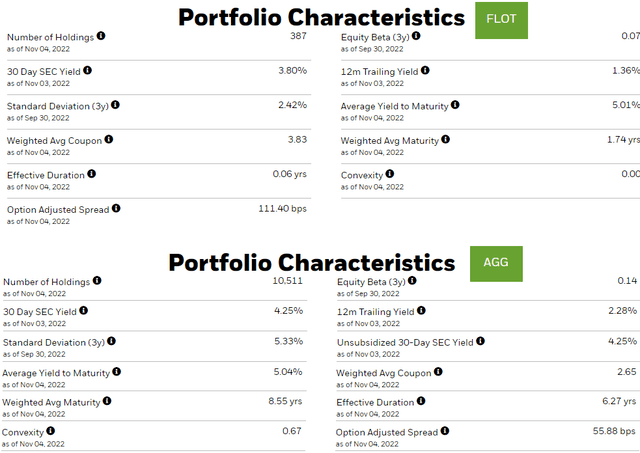

Here, one of FLOT’s advantages compared to having to look for individual issuing companies is that it groups over 380 of these as part of a single fund. These consists of shorter-term (with maturities varying from one month to five years) investment-grade bonds with a 12-month trailing yield of 1.36%.

Comparing FLOT (above) and AGG (below) (www.ishares.com)

Now, as shown above, AGG also consists of investment-grade bonds with a higher average yield of 2.28%. However, its weighted average maturity of 8.55 years is more than FLOT’s 1.74 years, signifying that AGG is more long duration.

To explain the yield differential, buying into the longer-duration core bonds, means incurring more risks, thereby explaining why investors are compensated with a higher yield. For this matter, the iShares 10+ Year Investment Grade Corporate Bond ETF (IGLB) with maturities greater than ten years pays yields of 4.90%.

On the other hand, lower-duration FLOT pays a lower 1.36% yield but its monthly payments have been rising rapidly as seen by data computed by SA, due to interest payments adjusted to reflect changes in Fed rates. By comparison, AGG’s monthly dividends have also trended higher, but, at a much slower pace, and if you consider the one-year capital depreciation of over 18% as per the introductory chart, people who invested in the ETF at the beginning of the year have been net losers.

Therefore, unless you already own shares of AGG and want to hold on to them for the long term, it is worth reading further before investing.

The rationale for investing in FLOT

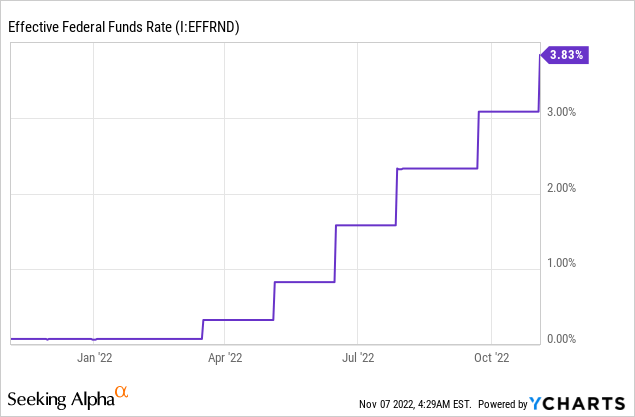

Common wisdom has it that you buy floating rates bonds only when you expect interest rates to start rising. However, there have been so many of these already and rates have already stepped higher on six occasions as shown in the chart below, and are now at 3.83%.

Now, after being raised so many times in quick succession, some market participants are questioning the rationale of further hikes in view of inflation being mostly driven by the supply side drivers.

Now, based on the adverse effect of monetary policy tightening on economic growth, you do not have to be an economist to make some forecast as to what lies ahead. One option is a pause by the Fed. Another one is that even if there is no pause, it may reduce the rate at which it is hiking, for example from 75 basis points to 50. This would be great for risk assets like equities and bonds across the board.

In this respect, the speeches made by Fed Chairman Powell have been diversely interpreted based on key economic indicators like the Consumer Price Index and job numbers. Some dovish interpretations even led to enthusiastic market reactions in July this year, but, as shown by the above chart, this has in no way prevented rates to move higher, suggesting that interpreting can prove futile.

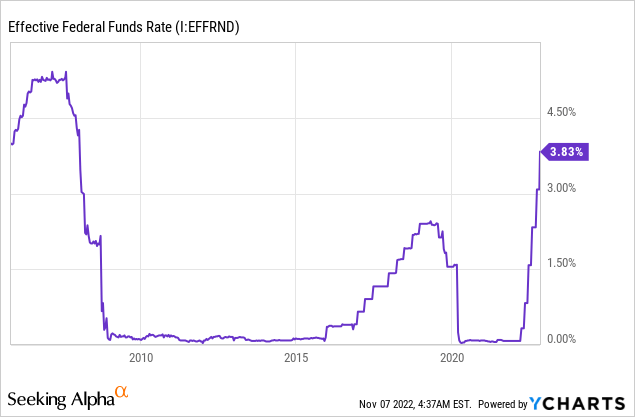

Still, the lessons have not been learned as the latest speech by Chairman Powell after the Fed raised rates by 75 basis points in the first week of November is being interpreted by some market participants as a “timid dovish pivot“. However, as per the chart below, history teaches us that interest rates can go much higher such as in the 2007-2008 period.

Thus, they can even move to above 5%.

Furthermore, in addition to the direction of future interest rate moves and the pace at which they are incremented, it is also important to factor in the terminal rates, as, they determine other benchmarks like mortgage rates. For this purpose, Larry Summers, a former Treasury Secretary who is famous for having successfully predicted that inflation won’t be transitory in December 2021, or quicker than the Fed itself, has stated that the terminal rate will be 6%. This means that there is still some way to go, which is favorable to FLOT while being detrimental to AGG.

Interestingly, this 6% prediction he made some days back is above his previous prediction of 5.5% made on November 1. The reason for the upgrade is factors like the October jobs report and the strength of the U.S. economy. However, this change from 5% to 6% shows that economic conditions are very dynamic and may rapidly change the other way around, prompting economists to lower expectations about the terminal rate.

Reasons for also considering AGG

Thus, while interest rates look to rise further signifying that investing in FLOT makes sense, one has to take into consideration that the Fed may turn dovish in case of a sudden worsening of economic conditions. In this case, depending on liquidity conditions, investors will likely seek the safety of AGG’s investment-grade assets. Thus, bearing in mind the uptrend in interest rates on the one hand and deteriorating economic conditions on the other, it is better to consider both AGG and FLOT.

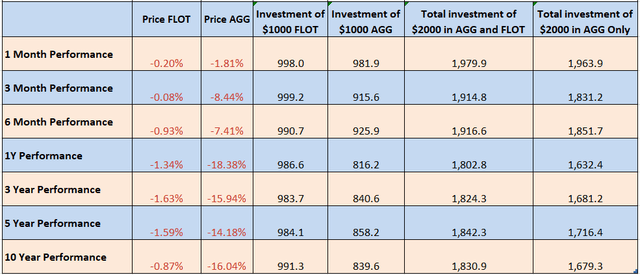

For illustration purposes, the price performance, as well as the investment results over a ten-year period, are shown in the table below, with each row corresponding to a specific time period with an investment of $1000 made in FLOT and AGG respectively.

Price Performance and Returns on Investment of $1000 (www.seekingalpha.com)

Going into details and looking at price performance, investors will notice that FLOT has relatively outperformed AGG for each time period starting in November 2012. Thus, $1000 invested in the floating rate ETF has suffered from less capital depreciation than an equivalent amount invested in core bonds.

This means that you obtain better capital appreciation through floating rates. Equally important, when interest rates fell abruptly between August and November 2019 (as shown in the chart below), FLOT’s share price still managed to deliver 0.15% while AGG outperformed by 1.57% over the three months period.

Now, one major difference between 2019 and 2022 is the sticky inflation which means that the Fed is unlikely to bring interest rates down abruptly like five years ago.

Conclusion

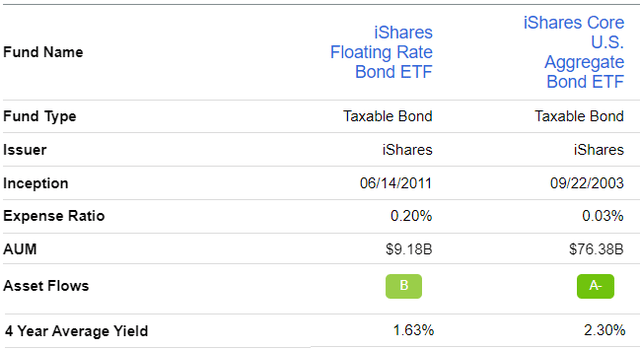

Therefore, with interest rates not likely to be brought down in an abrupt manner unless there is a recession, FLOT which helps to capture the benefits of rising rates should not suffer too much as inflation remains persistently high. As for AGG, prices may not have bottomed, but, it pays higher dividend yields as shown in the table below, and charges lower fees too. Therefore, over a long period of time, AGG can offer better total returns, which include the price performance and dividends in case these are reinvested.

Comparing (www.seekingalpha.com)

Taking these factors into consideration, it would make sense to split your investment between fixed and floating. For this purpose, the above price performance table shows that a combined AGG-FLOT portfolio consisting of an initial investment of $2K split equally between the two ETFs performs better than one consisting exclusively of $2K of AGG’s shares, and this, over all the time periods.

Finally, both ETFs are seeing inflows as seen with AGG and FLOT scoring A- and B respectively, but things may turn around rapidly, depending on economic indicators or how the market interprets Jerome Powell’s speech during the next FOMC meeting on December 13-14.

Be the first to comment