AsiaVision/E+ via Getty Images

Introduction

Even though Floor and Decor (NYSE:FND) are down 46% YTD, in my personal opinion, this is not a bad time to go long. First, the company has demonstrated that it can pass on high inflation to the end consumer. Secondly, thanks to rising product prices and effective cost management, the company is showing strong trends in operating margins. Also, I believe that the company is trading below the fair level.

Projection

Gross Margin Forecast: I believe the company will be able to maintain gross margin at a stable level in the coming quarters, then I forecast a gradual recovery to healthy levels.

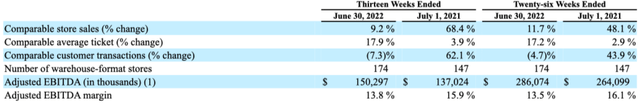

Despite the fact that the company detects a decrease in traffic, we see that sales in the same store are in a positive zone of observation, which is that:

1) the company is able to pass on the increased level of costs to the end consumer

2) the company’s consumer less sensitive to price increases than other sectors

Sales and store operating: In my personal opinion, the level of expenses (% of sales) will remain at historical levels, as the company has already increased wages in view of increased competition for labor. The growth of the average check allows it to control the level of expenses more effectively.

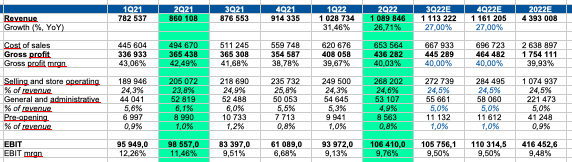

Quarterly projections

Personal calculations

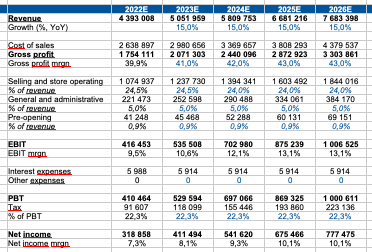

Yearly projections

Personal calculations

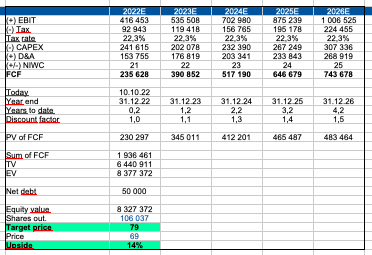

Valuation

To value a company, I prefer to use the DCF model and calculate multiples because:

1) The company has a long history of reporting, so I can research past periods and make assumptions based on historical data

2) The company’s business is stable, so it’s easier to make assumptions about future growth rates

3) Based on historical data, macro data and management forecasts, I can make assumptions about cost growth and profitability

WACC: 10.7%

Terminal growth rate: 3%

Personal calculations

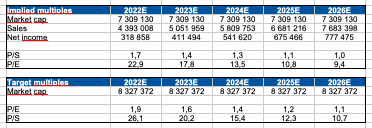

Multiples

Personal calculations

Drivers

Macro: decrease in inflation and recovery in consumer confidence will support consumer spending and support the company’s revenue in the coming periods.

Growth: the growth in traffic and average check, as well as the successful opening of new stores, can have a positive impact on the company’s revenue growth rate too.

Margin: effective cost control can help a business maintain operating margins.

Risks

Macro: continued tightening of monetary policy, lower consumer confidence and lower real incomes could have a negative impact on revenue growth due to lower consumer spending in the discretionary segment.

Margin: rising prices for raw materials, commodities, energy, and transportation may lead to a decrease in the operating profitability of the business

COVID: the return of the COVID pandemic could have a negative impact on operations because new restrictions could disrupt supply chains

Conclusion

The company continues to successfully pass on price increases to the end consumer, which supports the operating and financial results of the business in the face of pressure on consumers’ discretionary spending. In addition, effective cost management helps maintain operating profitability. I believe that the company is currently trading below fair value, and my target price is $79 (upside potential is 14%).

Be the first to comment