Chunumunu

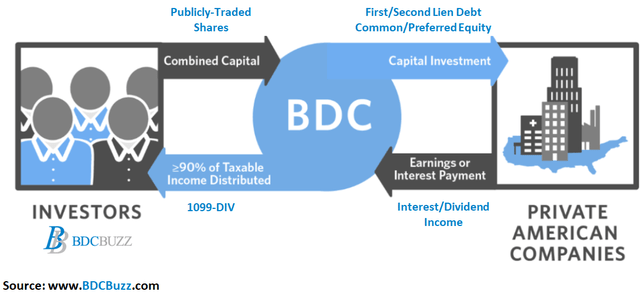

Quick Introduction To Business Development Companies (“BDCs”)

Business development companies (“BDCs”) invest shareholder capital in privately owned, small- and medium-sized U.S. companies. BDCs aim to generate income and capital gains when the companies they invest in are sold, much like venture capital or private equity funds. Anyone can invest in BDCs, as they are public companies traded on major stock exchanges.

Investment Grade BDC Bonds/Notes

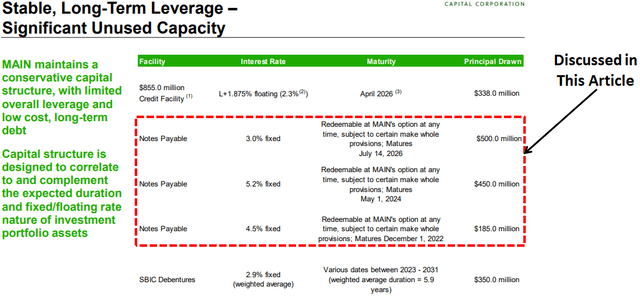

Many BDCs have investment grade (“IG”) bonds/notes for lower-risk investors that do not mind lower yields/returns. Thanks to the recent declines in fixed income, the traditional bond market is now offering some excellent values, especially in the BDC sector, and I will discuss over the coming weeks. However, many of these bonds are now rebounding and I have started making purchases of shorter and mid duration maturities.

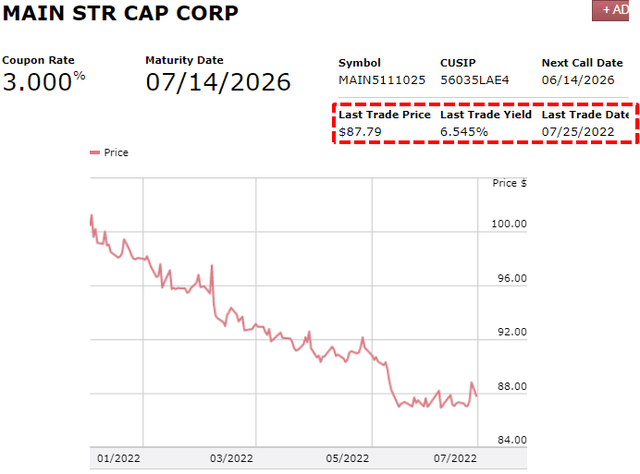

Traditional bonds do not trade on stock exchanges but are available through your brokerage using CUSIP numbers with a face/maturity value of $1,000. These bonds pay interest semi-annually with a pro-rated interest payment on the purchase date. Brokerages express the trading prices as a percentage of the face value. As shown below, MAIN’s 2026 bond is currently priced at $87.79, which implies a current value of $877.90 for each bond. For more information on examples of how to trade bonds using CUSIPs and limit orders, please see the following link.

Most BDC bonds have credit ratings from Moody’s and/or S&P and so far, no BDC has ever defaulted for the reasons discussed last week in:

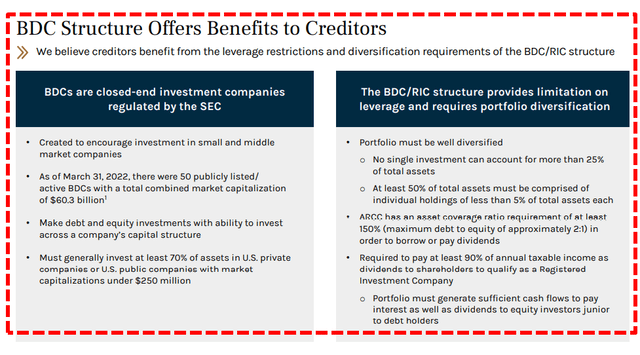

As shown below, BDCs are highly regulated with plenty of protections for investors in the common stock and debt obligations, such as the amount of leverage (asset coverage ratios discussed later), asset diversification, and having a portfolio that can “generate sufficient cash flows to pay interest as well as dividends to equity investors junior to debt holders”:

MAIN Street Capital’s Investment Grade Bonds

Main Street Capital (NYSE:MAIN) has three investment grade bonds (CUSIPs: 56035LAE4, 56035LAD6, 56035LAC8) that are investment grade rated by both S&P and Fitch at BBB- with a stable outlook reflecting:

Main Street’s portfolio focus on senior debt investments, strong portfolio diversification, solid track record in credit and equity investments, above-average asset coverage cushion, consistent operating performance, experienced management team and strong funding flexibility with demonstrated access to the public debt and equity markets.”

Source: Main Street Announces Investment Grade Rating (July 14, 2022)

As discussed in the previously linked article, the “Asset Coverage Ratio” is a financial metric that measures how well a company can repay its debts by selling or liquidating its assets. The higher the asset coverage ratio, the more times a company can cover its debt. Therefore, a company with a high asset coverage ratio is considered less risky than a company with a low asset coverage ratio. BDCs are required to maintain minimum asset coverage of 150% providing strong protection to bondholders, which is one of the reasons that no publicly traded BDC has ever filed for bankruptcy nor defaulted on bond holders in the history of the sector.

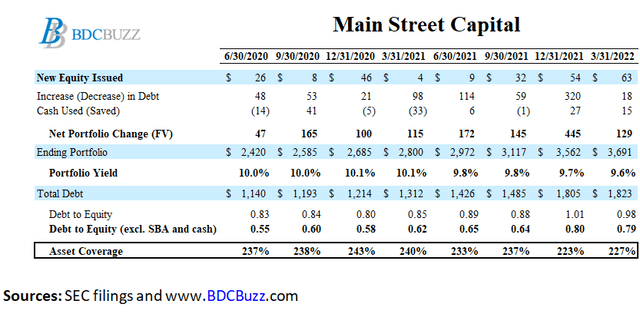

As of March 31, 2022, MAIN’s asset coverage ratio was 227% as shown below:

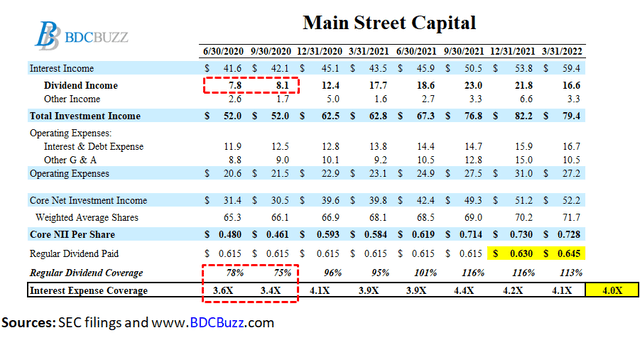

The “Interest Expense Coverage” ratio is used to see how well a company can pay the interest on outstanding debt. Also called the times-interest-earned ratio, this ratio is used by creditors and prospective lenders to assess the risk of lending capital to a firm. A higher coverage ratio is better, although the ideal ratio may vary by industry. When a company’s interest coverage ratio is only 1.5 times or lower, its ability to meet interest expenses may be questionable.

MAIN’s interest expense coverage ratio has historically averaged around 4.0 times, as shown below:

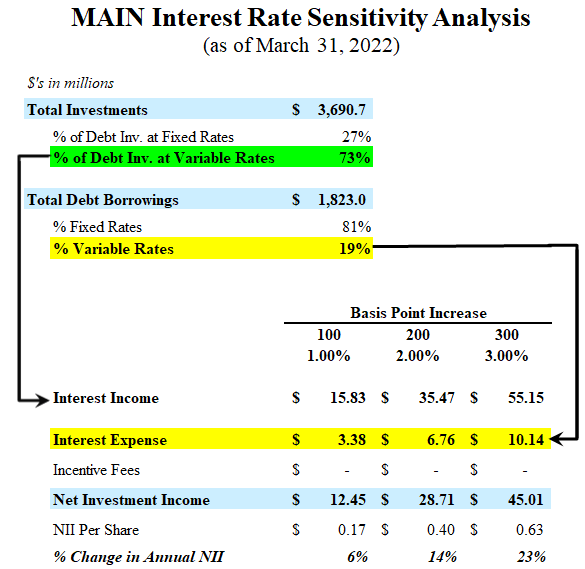

Interest rate sensitivity refers to the change in earnings that may result from changes in interest rates. As of March 31, 2022, around 73% of MAIN’s portfolio debt investments bore interest at variable rates, 93% of which were subject to contractual minimum interest rates and only 19% of borrowings were also at variable rates. There’s a good chance that many BDCs will be increasing dividends over the coming quarters, especially as the Fed will likely increase rates by another 75 points today, driving a significant improvement in this analysis for most BDCs

One additional item that I wanted to touch on is the impact of rising interest rates. With the additional $500 million in low-cost fixed rate notes that we issued in 2021, as of the end of the first quarter, 81% of Main Street’s outstanding debt obligations maintain fixed interest rates. This mitigates our exposure to higher interest expense during a rising interest rate environment. On the other hand, as of the end of the first quarter, approximately 73% of our debt investments bear interest at floating rates with the majority subject to contractual interest rate floors and with a weighted average fall of approximately 105 basis points. As a result, future increases in interest rates will result in increases to interest income, which will exceed the increases to interest expense.”

Source: MAIN Investor Call

BDC Buzz

Current Yields For Common Stock and Bonds

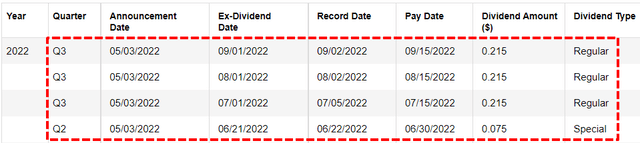

In May 2022, MAIN reaffirmed its regular monthly dividends of $0.215 per share for Q3 2022, plus a supplemental cash dividend of $0.075 per share.

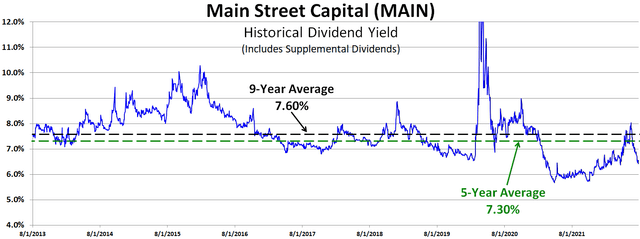

MAIN is considered a ‘safer’ BDC, which is why it has a lower-than-average dividend yield currently around 6.5% compared to an average of around 7.3% over the last 5 years. However, MAIN’s dividend yield has been trending lower, especially after excluding the March 2020 market disruption.

MAIN’s 2026 bond is trading at a significant discount, driving a yield-to-maturity of 6.5% which is above the current dividend yield from its common stock. Also, over the next four years, this bond will slowly appreciate toward par of $1,000 and capital gains will account for a good portion of the yield-to-maturity driving a lower tax liability.

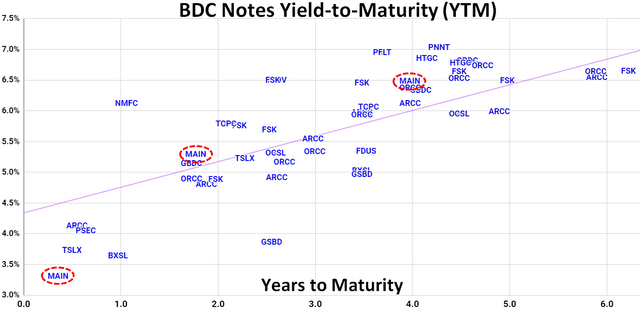

The following chart and table are from the BDC Google Sheets showing MAIN’s bonds. As mentioned earlier, I have started purchasing shorter and mid duration bonds with relatively higher yields (for similar durations).

Over the coming weeks, I will cover many other BDCs listed below, including their asset and interest expense coverage ratios:

Conclusion – Risk-Adjusted Returns

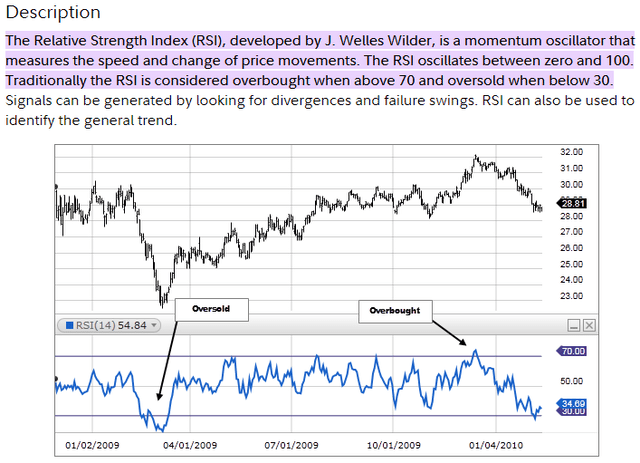

Given the uncertainty of upcoming returns from equity/stock positions, I would suggest that investors take this opportunity to lock in a 6.5% annualized return, at far lower risk, over the next four years. MAIN’s stock price is likely overbought at these levels and its relative strength index (“RSI”) is currently 70, which is typically a firm indicator:

The key risk to the bondholder is a default by MAIN, which is extremely remote given the company’s history/performance:

- MAIN is one of the best-of-breed BDCs with a long track record of returns through previous market cycles

- Asset coverage of debt is 227% and by regulation must be at least 150%

- Interest expense coverage has averaged around 4.0 times, which is much higher than most companies

- MAIN’s bonds are rated investment grade by both S&P and Fitch

- No publicly traded BDC has ever filed for bankruptcy and impaired debt holders in the history of the sector

- A 6.5% locked-in return for the next four years is attractive in an environment of high market volatility and uncertainty of returns

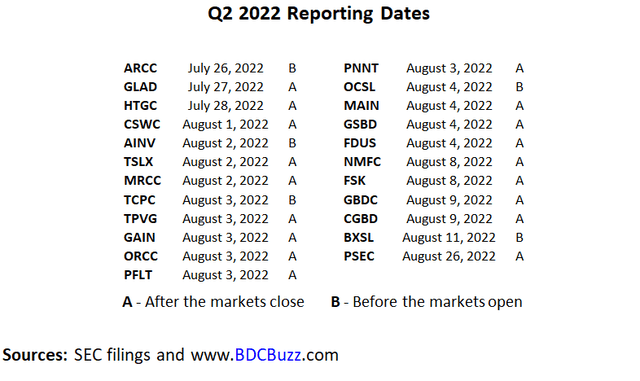

Upcoming BDC Reporting Dates

BDCs have begun reporting Q2 2022 results and I’m expecting improved results relative to Q1 2022, including higher dividend coverage and maintained credit quality but slightly lower NAVs (similar to Q1 2022) simply due to widening credit spreads (not credit quality related). There’s a good chance that many BDCs will be increasing dividends, especially as the Fed will likely increase rates by another 75 points today, driving a significant improvement in the Interest Rate Sensitivity analysis for most BDCs (similar to the previous quarter). This means that projected earnings for Q3 and Q4 will probably need to be increased. Also, most BDCs have been positioning for a recession for a while now and COVID provided a portfolio stress test which most BDCs took advantage of the market rebound to rotate into more secured positions with higher cash flow coverage preparing for higher interest rates and/or an economic slowdown/recession.

Over the coming weeks, I will cover many other BDCs listed below, including their asset and interest expense coverage ratios:

Be the first to comment