Alex Wong

Fisker (NYSE:FSR) is just over 2 months to its tentative start-of-production date in mid-November 2022 for its first model, the Ocean SUV, launched in partnership with Magna Steyr (MGA). Fisker has some heavyweights in its corner as it aims to scale production of the Ocean and launch its second model, the PEAR, at a more-attractive, sub-$30,000 price point in 2024. Assuming no major delays in launch timelines, Fisker and Magna could quickly scale production of the Ocean throughout 2023, potentially reaching over 30,000 units. At such levels, Fisker would be on track to generate over $1.5 billion in revenues, in its first full year of deliveries.

Backed By Heavyweights

While other EV startups are struggling to get off the ground and scale production, including Faraday Future (FFIE) and heavy-hitter Lucid Motors (LCID) among others, Fisker has entrenched itself with production/manufacturing and supply contracts with industry heavyweights. Fisker has teamed up with Magna (MGA) for production of the Ocean, Foxconn (OTCPK:FXCOF) for production of the Pear, and CATL for annual battery supplies for the Ocean.

Fisker has outlined that its agreement with Magna Steyr aims to produce 50,000 vehicles in 2023, tripling that to 150,000 units in 2024. Fisker and Foxconn plan to begin production of the Pear in Ohio in 2024, and “intend to build a minimum of 250,000 PEAR vehicles a year once the plant ramps up production.” Fisker and CATL have an agreement for the supply of ~5 GWh of batteries annually for the Ocean, which amounts to ~50,000 units per year; over the course of the next three years, Fisker could see upwards of 150,000 units secured via this battery supply deal.

The three partnerships put Fisker on a solid path to ramp production to tens of thousands of vehicles in 2023, to over 100,000 in 2024 assuming supply chain issues and parts shortages do not derail production to a high degree, as it has done to peers this year. Fisker is in a unique situation to rapidly mass produce and scale deliveries over the course of the next 12 to 24 months, with the ability to generate in excess of $1.5 billion in revenues in 2023 and $5 billion or more in revenues for 2024, in a modest projection.

Pre-orders Accelerating

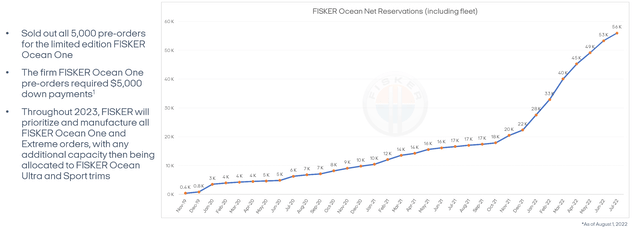

Behind Fisker’s production plans is a surge in pre-orders for the Ocean SUV, accelerating throughout 2022 as SoP nears. Fisker logged about 28,000 pre-orders at the beginning of the year, doubling to the current 58,000 pre-orders as of August.

Fisker

As pre-orders potentially near 61,000 moving into September, Fisker has a very solid order book to grow from — nearly double Lucid’s amount — of which it expects a majority to fill throughout 2023. Fisker is projecting about 80,000 pre-orders to end the year.

Fisker had announced earlier in August that it had “sold out of its 2023 US allotment of the Fisker Ocean Sport and Fisker Ocean Ultra trim levels.” Fisker also is considering that its “current production figures of 50,000 may expand due to increasing enthusiasm for Fisker Ocean worldwide.” Fisker CEO Henrik Fisker said that his firm and Magna “are working diligently on expanding production numbers beyond the current projection of 50,000 units per year.” This expansion would be set for 2024, according to the announcement.

Although Fisker is looking to prioritize deliveries of its upper trims for the Ocean, the One and the Extreme, the firm has said that it will allocate extra production capacity to its lower trims. Fisker is not breaking down its pre-order volumes by trim, but given its willingness to seek ways to increase annual production beyond 50,000 suggests that demand for all Ocean trims is healthy and robust.

Strengthening pre-order demand combined with confidence in securing enough supply to hit and possibly expand production volumes gives Fisker a rapid ramp in revenues as the year moves on.

Strong Revenue Growth Ahead

Fisker looks poised to hit the ground running in 2023 with the potential to generate in excess of $1.5 billion in revenues should it be able to scale volumes to ~60% of its planned 50,000 unit guidance under its agreement with Magna. As other EV startups have faced challenges scaling production due to chip and supply chain constraints, Fisker believes it has enough supply to hit its initial targets. Although ASP is expected to fall farther in 2024 as volumes of Fisker’s lower-priced trims account for a larger portion of the product mix, revenues are still set for tremendous growth in 2023 and 2024.

With just the 5,000 Ocean One models, Fisker has approximately $350 million in revenue booked and set for recognition in 2023 — deliveries for 2022 are likely to be minimal at best, with just six weeks between SoP and the end of the year.

Fisker has previously said in believes it can “potentially sell out capacity through most of 2023 with purchase orders of premium models.” For 2023, this equates to production volumes scaling while keeping ASPs in excess of $60,000, a very attractive picture for revenue growth.

Basing projections off of an ~30,000 unit forecast for 2023 is a relatively conservative take compared the 50,000 unit volume under the agreement. It also is more reflective of the current headwinds facing the industry. Even so, the 30,000 unit projection still spells out quite a positive picture for Fisker.

With an average ASP near $66,000 for 2023, assuming Fisker does allocate and sell some of its lower trims next year, Fisker would be on track to generate ~$1.98 billion in revenues.

Rival Lucid, after slashing production output this year by over 60%, is on track to generate just ~$850 million through 2022 with an ASP near $130,000, in its first full year after production.

Taking a quick comparison, the upside potentially looks to predominantly favor Fisker in this scenario — revenues are projected to be more than double of Lucid’s, putting Fisker at a very attractive 1.3x sales multiple ahead of continued strong growth in deliveries and revenues in 2024; Lucid is valued at over 29x sales in its first year of its delivery ramp.

This relative valuation mismatch suggests that the market is either a) concerned that Fisker will be unable to scale to that degree, or b) attaching lower multiples to the EV industry as a whole (a theme that has been seen already this year).

Moving on to 2024, Fisker aims to be producing 150,000 units volume of the Ocean SUV with Magna, while starting production of the PEAR with Foxconn during the year; as such, growth in 2024 is expected to be well above +100% y/y for deliveries and revenues.

Projecting into 2024, sticking with a more conservative production volume target (~40% lower than Fisker’s), likely can account for any risks to production volumes stemming from industry headwinds. As such, this would put Fisker’s Ocean volume at ~90,000 units, still a substantial jump from the ~37,500 units forecast for 2023. Keep in mind that this level of growth may still be a bit difficult to achieve, as peers like NIO (NIO) grew from 43,000 vehicles in 2020 to 91,000 vehicles in 2021. For the PEAR, a preliminary 2,500 unit estimate is used, given uncertainty about the exact SoP date.

Working with 90,000 units volume for the Ocean and 2,500 units for the Pear, at an ASP of ~$59,000 and ~$32,000 respectively, Fisker’s 2024 revenue projection comes out to $5.4 billion. At a 2x sales multiple, still quite cheap for the ~180% y/y revenue growth delivered (with net losses and negative EBITDA), Fisker could be worth ~$10.8 billion. A valuation of that degree represents about 350% upside.

Outlook

As Fisker approaches its start-of-production date for the Ocean, limiting disruptions and adverse impacts to scaling production and preparing for 2024’s volume is key for the company to be able to generate meaningful returns for investors. Any delays are likely to not be received well, given Fisker’s confidence in supply levels and broader industry trends.

Revenue and delivery commencement is just around the corner, starting in about two months, with substantial growth projected in 2023 as Fisker aims to quickly scale volume higher. 2024 is expected to bring more growth as Fisker works to roll out two more models.

Even so, maintaining conservative levels in forecasts protects against unforeseen risks while still offering upside for shares. For 2023, a more conservative 30,000 unit projection (compared to Fisker’s 50,000 unit goal) works out to ~$1.98 billion in revenues. This take still comes out to about 100% upside when using a 2.5x sales multiple. For 2024, projecting about 40% below Fisker’s intended 150,000 unit volume for the Ocean along with some minimal sales from the PEAR could generate ~$5.4 billion in revenue, or ~350% upside on a 2x sales multiple, which may not be attainable until macro headwinds ease.

Be the first to comment