naphtalina/iStock via Getty Images

I entered 2022 bullish energy and cautious technology while maintaining an overall defensive posture with a lot of cash. I’m even more defensive now.

Late last year, the Fed was signaling higher interest rates and an end to QE. Now, they’re screaming it from the rooftops. I think everyone should listen.

Q1 Performance and 2022 Outlook

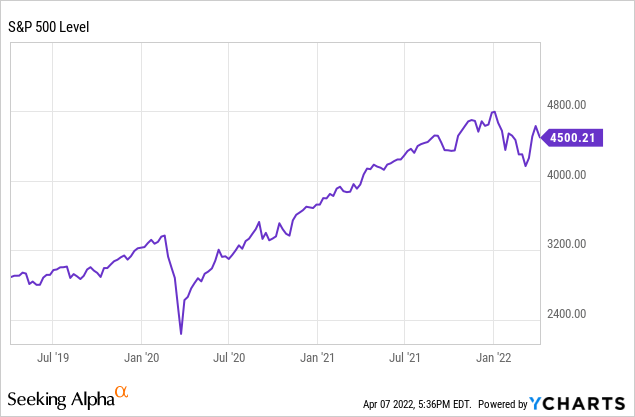

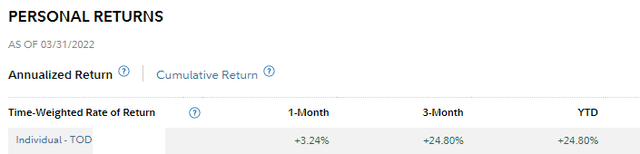

I was +24.8% versus -4.6% for the S&P 500 (SPY) primarily driven by strength in Cenovus (CVE) and getting lucky bailing on a lot of my longs early in the Russia/Ukraine situation.

I’m extremely cautious right now and my cash position has risen from 24% to 30%. I believe there are times in the market where the risk/reward is very favorable, like last year, and other times where the risk/reward is unfavorable, like right now.

Over the past week, I think the Fed has signaled stronger than ever that it needs inflation lower. They seem to be abandoning, at least temporarily, what I consider to be their other unofficial mandate, which goes along with the official dual mandate of full employment and stable prices. That unofficial 3rd mandate is high asset prices.

Short-term rates are going much higher. Open market operations are going from injecting $80 billion a month to withdrawing $95 billion a month.

There are still things to like: the labor market is extremely strong, housing is still hot in spite of higher interest rates, and I believe supply chain will start to improve soon. But inflation, especially in food and fuel, will eventually start to cause pain. I’m keeping a sharp eye on demand destruction from higher oil prices (I believe so far, it’s mild.)

The Fed is strongly signaling that it needs to cool the market, yet the S&P500 is barely 5% away from its all-time high.

To me, the risk/reward here is poor. The Fed backstop is gone for now. So I’m defensive.

For those reading this and thinking “you can’t time the market!”, well, I disagree.

New Positions

Bank of NY Mellon (BK) – 5% position – Opened around $51

Re-entered this position around $51 after selling at $60.

Slightly underwater as BK has dropped with the rest of the banks. I believe they could earn $5+ this year and $6+ next year based on interest rates. Share repurchases should help in Q2. I’m realistic that this could fall further with the broader market, so I’m not super bullish, but I like the risk/reward.

CVR Partners (UAN) – Wrote $115 April and May puts for ~$17 when the shares were at $105.

Special situation fertilizer producer that I got the opportunity to enter in mid-March around $105. I wanted to outright buy this, but the juicy options premiums and my propensity for getting in at a low basis got the best of me. At the time, I thought there may be a faster resolution to the Russian/Ukraine situation, which drove my cautiousness.

These puts will likely expire worthless for a significant gain, but I would have made a lot more just being simple and purchasing the units.

Closed Positions

Citigroup (C) – Closed around $63 for a small profit

In my last update, I noted that sentiment in banks can change quickly. Sentiment was getting bullish heading into Q1 as higher interest rates are good for banks. But sentiment turned quickly with the Russia situation and I was lucky to get out with a profit here. Shares have been straight down ever since.

If the shares fall much more from here, I may re-enter. Sentiment in the banks is poor and seem to be pricing in 100% odds of a recession, and the discount to tangible book value is high.

PaySign (PAYS) – Closed around $2

My 2nd most bullish position entering 2022 and written up as Paysign: My Top Rebound Pick For 2022. I was disappointed in Paysign’s Q1 earnings and FY22 guide. Pharma growth did not resume as I expected and the Plasma guidance was disappointing since I believed this environment would be very supportive.

Fellow SA author Microcapbros, who was also bullish and wrote Paysign: The Plasma Toll Booth, warned that the Duopoly between Paysign and Wirecard is being challenged with Bank of America (BAC) entering the space. After the FY22 guide, I’m concerned that Bank of America may be undercutting PaySign and winning over accounts.

My thesis here broke, so I sold. Still a big win up 30% in a quarter when the broader market was down. That said, it was up 60% for me at one point.

BMW (OTCPK:BMWYY) – Closed at $31.20

Still like my thesis on this and think the company is a winner, but I reacted quickly on the Russia situation and sold for a tiny loss. This is disappointing because the position had been up 15% for me.

ZIM Integrated Shipping (ZIM) – sold at $69 post dividend (equivalent of $86.)

Since my end of year update, ZIM had run from $57 to $86 on the back of particularly strong FY22 guidance. This was a double in 6 months for me. I sold primarily because I thought all of the good news was fully priced in, and their lease renewals would come at much higher prices. With the shares doubling, I felt the margin of safety has shrunk.

I would re-enter this or purchase Danaos (DAC), which owns a huge stake in ZIM, if shares drop further and shipping rates remain stable or improve.

Existing Positions

Cash (30%)

Far more than I want, but I’m playing defensive right now.

Cenovus Energy (30%)

My top position heading in 2022, established at an average price of $9. I haven’t added; the increased position size is a result of the higher share price.

I thought Q4 Earnings were good, and I’m not concerned about the hedging losses. Oil companies can’t win sometimes – if they hedge and the price of oil goes up, they’re foolish, if they don’t hedge and the price drops, they’re reckless.

ConocoPhillips (COP) has liquidated a 15% stake in Cenovus over the past 5 quarters, with the final selling likely finished in March. Cenovus will approach their $6 billion final net debt target this quarter. From there, all of their excess cash flow should go towards repurchases and a higher dividend, both of which should be supportive for the share price.

Based on my estimates and current strip pricing, Cenovus finishes the year nearly net debt free and trading at 3-3.5x next year’s free cash flow. It’s just too cheap, with too many catalysts, and I believe it will significantly re-rate by year end.

At 30% of my liquid net worth, risk management is completely out the window for me here, and I don’t care.

Berkshire Hathaway (14%)

Berkshire Hathaway (BRK.A) (BRK.B) is an anchor in my portfolio and I consider it to be an extremely safe stock, even if it isn’t nearly as cheap as last year.

I was considering adding to Berkshire for the first time in a while using deep in the money calls for inexpensive leverage, but never pulled the trigger. This was a miss, especially considering how much cash I am holding.

H&R Block (8%)

A big winner in 2021 for me and silently outperforming in 2022 with shares near $27. I have not sold any and still believe it is a buy. It has decreased as a percentage of my portfolio as other names have risen faster.

Forward P/E of ~9, yield of 4.1% while buying back 5-6% of outstanding shares annually for a recession proof business. They issued $500 million of 2.5% 2028 notes at a great time last year and will retire $500 million of 5.5% notes this November, saving $15 million a year in interest in 2023.

Still have concerns about their expense structure and corporate strategy, but the core business remains solid and it’s inexpensive. In this environment, why not.

Energy Transfer (9%) – Added 35% to my position at $9.80

I finally wrote up my bullish thesis for Energy Transfer (ET) in Energy Transfer Stock: Reasons To Buy Right Now As Oil Reaches A 7-Year High.

I think it’s even more compelling than when I wrote it up in early February. Domestic energy security is going to be popular again, especially if the Republicans take back both houses in November which I expect.

I’m still considering adding here, and almost certainly would if I didn’t have so much money in Cenovus already.

Banks: JPMorgan (5%)

In my last update, I said

I’m bullish, but not wildly bullish for banks for 2022. While higher interest rates will be a benefit, it’s only a benefit if the economy stays strong, and I do think there’s some broader risk here with the withdrawal of stimulus.

This concern and the Russian conflict made me sour on banks, so I sold Citigroup. My cost basis on JP Morgan is $80, which is why I held. Every single time I hold something because I don’t want to pay taxes on it, I regret it.

Conclusion

In my last update, I said

My portfolio is usually heavy in deep-value names, but more than ever going into this year. In 2022, I want to own established companies that have pricing power and can benefit from (or at least can respond to) inflation. I think energy outperforms the broader market, and am cautious on technology, especially for firms where profits are years into the future.

This was a great call and I still feel the same way. I believe now is a time to play defense, and that’s what I’m doing, while building up a watchlist.

The only reason I’m not adding hedges at this point is because of the November elections. If the market is still this strong in the Fall, I may start adding them.

Stay safe out there!

Be the first to comment