sandsun/iStock via Getty Images

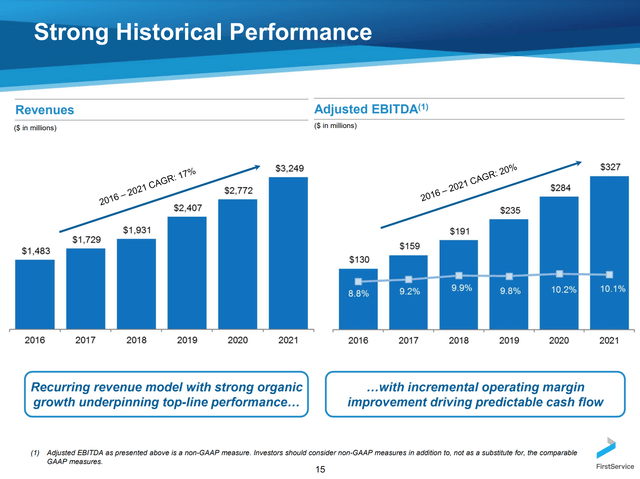

FirstService Corporation (NASDAQ:FSV) has been a terrific investment since being spun off from Colliers (CIGI) in 2015. The company has compounded revenue and EBITDA at a 17% and 20% rate, respectively while its shares have increased 355%, significantly outperforming the Russell 2000 (IWM) and S&P 500 (SPY) over the past 7 years. FSV’s tremendous outperformance has been driven by continued market share gains, overall market growth and steadily expanding profit margins as well as significant multiple expansion as investors have recognized the durable growth characteristics of the business.

Overview

FSV’s Residential Services business (roughly 50% of group EBITDA) is the leading provider of property management services to home owners associations (HOA) serving condo and single-family homes. Almost all condo owners (and many single family/townhome home owners) belong to a home owners association which is responsible for providing a range of services to the building. Condo owners elect a board of directors (fellow condo owners) which select a property management services company to provide a range of services, including:

-Staffing services – front desk /concierge, cleaning, and maintenance

-Amenity maintenance – pool, fitness center

-Procurement – cable/internet, utilities, building insurance

-Project management – bid and oversee large projects such as an elevator replacement or lobby overhaul

-Cost accounting for the above services

This is a recurring revenue business that is economically resilient – these services are essential to the functioning of a building and FSV boasts a mid 90s retention ratio. The value of the revenue stream for an individual building (or neighborhood in the case of a single family/townhome) typically grows around CPI +1-2%.

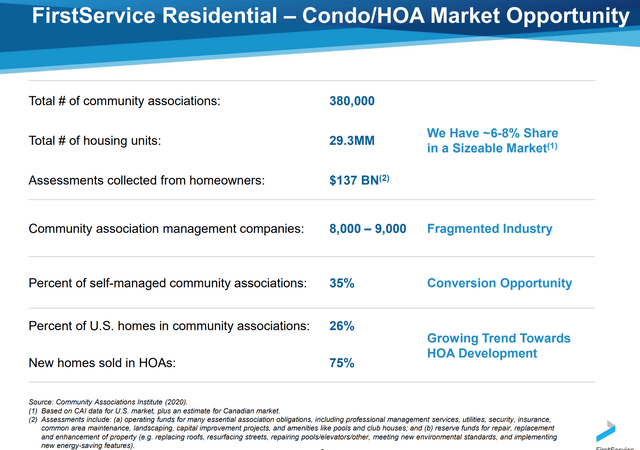

Beyond the embedded growth of FSV’s existing client base, the company has continued to gain market share both organically and through acquisitions. While FSV is the largest provider of these services in North America, today it has just 6-8% of the total market (for condos) and has a long runway for continued growth as it gains market share from other players and benefits from the trend toward outsourcing as internally managed associations increasingly turn to outsourced providers like FSV.

Growth Opportunity (First Service Investor Presentation)

Overall the business should continue to produce low double-digit top line growth (and 13-15% EBITDA growth) through organic and bolt-on acquisitions.

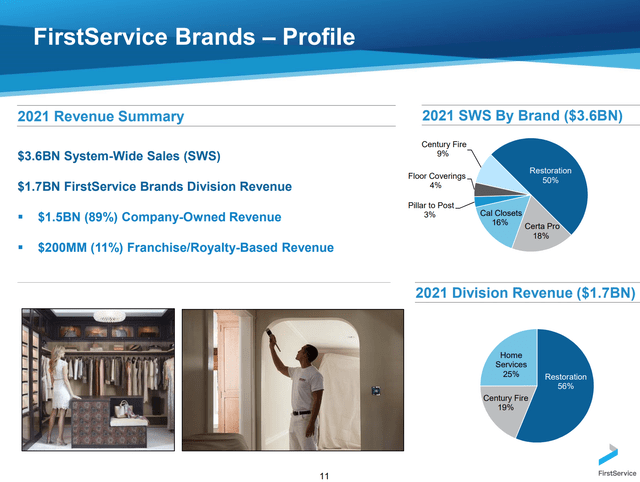

In addition to the residential business, FSV has a ‘Brands’ business which represents about 50% of EBITDA and is comprised mainly of property restoration and the California Closets business.

‘Brands’ Segment (First Service Investor Presentation)

The restoration business, led by the Paul Davis brand, provides services to clean up and repair damage to residential and commercial properties caused by water, fire, mold, storm or other disasters. Overall this is a stable business which is relatively insulated from the broader economic cycle though, as one would expect, the business does experience some fluctuations related to storm activity.

Like the Residential Services business, the Restoration business has grown both organically and through bolt-on acquisitions.

The other significant component of this segment is the California Closets business. This business is more economically sensitive than the Residential Services and Restoration business and may experience some weakness in the near term given the significant slowdown in the US residential housing market. However, since it represents less than 10% of group EBITDA, this shouldn’t dramatically impact overall results.

Valuation & Conclusion

Here is a look at FSV’s valuation:

|

Share Price |

123 |

A |

|

Shares o/s |

45 |

B |

|

Market Cap |

5,535 |

C=A*B |

|

Net Debt |

515 |

D |

|

Non Controlling Interest |

300 |

E |

|

Total Enterprise Value |

6,350 |

F=C+D+E |

|

EBITDA 2023e |

375 |

G |

|

Capex |

60 |

H |

|

EBITDAX |

315 |

I=G-H |

|

EV/EBITDAX |

20.2 |

J=F/I |

|

EBITDAX |

315 |

I |

|

Interest |

25 |

K |

|

Taxes |

58 |

L |

|

Non Controlling Interest |

11 |

M |

|

Net Income |

221 |

N=I-K-L-M |

|

EPS |

4.91 |

O=N/B |

|

P/E |

25.0 |

P=A/O |

As you can see, FSV shares are not statistically cheap, trading at a P/E of 25x. Given the recurring-revenue/non-cyclical nature of the business, fantastic historical performance (shown below), and opportunity for continued growth in excess of GDP, I regard this as being a fair multiple for the company.

Historical Results (First Service Investor Presentation)

While I expect we may see revenue/EBITDA growth slow from the blistering pace of the past five years, in my view it is likely that EBITDA should continue to grow at 10%+ per year over the next 5 years as the residential services/restoration business continue to benefit from inflationary tailwinds and grow share both organically and via acquisitions. This level of growth is supportive of today’s 25x multiple.

Given my view that shares are fully valued, I am not presently an owner of FSV shares. Should overall market weakness cause the shares to fall, I’d be interested in owning the stock around $90 – as a value investor, I typically look to buy positions at a 30% or greater discount to my estimate of fair value.

Risks

As mentioned above, the California Closets business could see weakness due to the slowdown in US housing. That said, this segment represents only about 10% of group EBITDA.

Be the first to comment