Kobus Louw

Summary

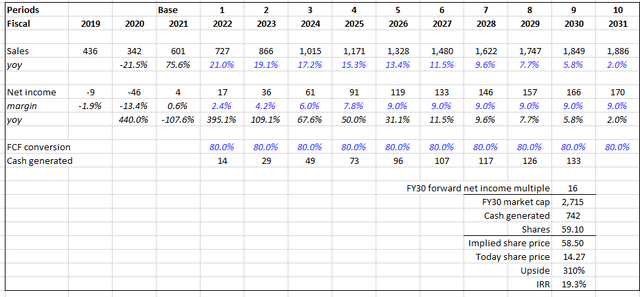

As before, I recommend buying First Watch (NASDAQ:FWRG). My opinion has not changed since I first wrote about FWRG; rather, this piece serves as a follow-up to the thesis in light of the company’s 3Q22 earnings report. In my opinion, the current valuation is still attractive and has the potential to earn investors an internal rate of return of 19% over the long term.

Thesis updates

In spite of the uncertain macro environment, I still view FWRG as a promising full-service dining concept with strong new unit productivity that underpins long-term unit growth and distinctive strategies to drive near-term sales growth and pricing power to protect margins. While I recognize the potential for negative press surrounding secondary share sales, I see incremental liquidity as a positive for shares, anticipate primary share sales being used to fund accretive restaurant acquisitions, and anticipate the business’s fundamental strength to remain unchanged.

Earnings overview

I think FWRG has done very well considering the overall climate. Nonetheless, the market obviously did not share my enthusiasm. Even though FWRG’s 3Q22 earnings beat expectations on the top line thanks to strong sales and industry-leading traffic momentum, the stock didn’t do as well as the market as a whole because of lower restaurant margins and, more importantly, because of uncertainty about the timing of future share offerings (both primary and secondary). However, I see it as a major plus that FWRG has indicated that primary share sales may be used to finance opportunistic franchise location acquisitions rather than general capital needs.

I believe demand is the most important factor for investors to consider, and FWRG is continuing to experience strong consumer demand with positive growth across all day parts, while average check is growing thanks to the alcohol roll-out program and check growth from seasonal menus. I believe that FWRG’s consistent SSS is being driven by positive traffic, compelling menu innovation, and a good value, as evidenced by the growth in both consumer-selected checks and total checks.

Traffic continues to outperform peers

Despite the uncertain economic climate, FWRG’s top line performance in the third quarter reflects strong consumer demand, with management noting that dine-in traffic has returned to more than 93% of pre-pandemic levels and that off-premise sales have maintained momentum, increasing by 15% in total. Amazingly, FWRG is one of the few companies in the industry reporting positive traffic trends versus 2019. I attribute this improvement to the brand’s innovative menu, targeted sales driving initiatives (like fresh juice and alcohol), and the more relaxed work environment that has emerged in the wake of COVID.

Management has also noticed something interesting: traffic is up across the board from the previous year, not just during the brand’s traditionally strong weekend brunch hours but also during the hours targeted for future expansion. Despite the “recession” headline, FWRG has seen neither a decrease in sales nor a decrease in the average order value of its products. This is especially true among the brand’s younger Millennial and Gen Z consumers, who now constitute the majority of the brand’s regular users.

Last but not least, one of the strategic initiatives I’m keeping a close eye on is the alcohol program, which seems to be thriving. As of this writing, 83% of the FWRG system is participating in the new alcohol program, and the company anticipates having the program fully implemented by the end of FY22.

Pressure on margins still present, but signs of stabilizing

Though management has noticed a leveling off in commodity prices, this has not translated to improved restaurant margins. Although FWRG’s gross margin was better than expected, the company’s restaurant margin performance was negatively impacted by higher-than-anticipated labor costs and repair and maintenance expenses. The company noted that food inflation has slowed, in part because higher 2021 prices have been lapped, but it still anticipates inflation of 12-14% in the fourth quarter, most likely due to an increase in egg prices.

Manager staffing is up to the company’s targeted 2.9 per restaurant, from 2.8 in 2Q and 2.7 in 1Q, and management has cited this as one of the driving factors contributing to the higher labor expense line. In particular, I’d like to highlight that the company’s management believes it can stabilize the labor expense line by optimizing the labor model in the upcoming quarters thanks to the impact of kitchen technology roll-outs on efficiency gains. Importantly, I’d like to highlight the correlation between the company’s unit growth algorithm and the number of managers per store, since stores typically hire one extra manager per train car in anticipation of future unit growth.

Technology adoption is still key

I anticipate that technological developments will continue to increase restaurant efficiency and, by extension, profits. More than half of the company’s units will have the new kitchen display systems—which are driving greater back-of-house efficiency—by the end of the year. About 300 restaurants have already adopted the technology. According to my findings, one of the most common trends in restaurants’ third-quarter earnings is increased other opex, with FWRG citing increased contracting expenses related to repair and maintenance as the primary driver of their higher-than-expected costs.

Unit economics continue to be strong

During the third quarter, FWRG opened 11 restaurants in 9 different states, suggesting that the company is making progress on its high unit-growth strategy. The forecast for the number of company-owned units opening in FY22 has been lowered to the low end of the 30-35 range, while the forecast for franchised units has been increased to 14. Additionally, FWRG management said that despite the widespread construction delays experienced across the industry, they are confident in their long-term unit growth guidance and do not foresee changing the development strategy.

Moreover, management has maintained a bullish tone regarding the productivity of new units, with new restaurants reporting run-rate sales of $2.2 million, which is higher than the total system average as stores in both core and new markets outperform expectations.

Valuation update

I believe the current market price still presents a decent entry point for investors to enjoy a long-term IRR of 19% (3% higher than my initial model).

Key changes to model:

- Sales: revised slightly upwards in FY22 to meet the mid-point of management FY22 guidance

Author’s calculations

Conclusion

The earnings for the third quarter have helped me to further confirm my bullish outlook for the stock. As the demand for lunches and other midday meals increases, FWRG will likely continue to gain popularity. Insofar as FWRG’s store count is concerned, it is still relatively low, and the company has already identified more than 2,000 possible locations, giving investors peace of mind. Investors can get in at a reasonable price and expect a long-term internal rate of return of about 19%.

Be the first to comment