BartekSzewczyk

It’s been a rough year for the restaurant industry group and an even worse year for the Renaissance IPO ETF (IPO). However, while the AdvisorShares Restaurant ETF (EATZ) and Renaissance IPO ETF are down 25% and 53% year-to-date, respectively, First Watch (NASDAQ:FWRG) has been swimming against the tide. This is evidenced by its 10% year-to-date decline, which can be attributed to strong execution, managing to grow traffic in H1 2022 vs. declining traffic for the industry. Based on First Watch’s industry-leading growth rate and solid execution to date, I would expect any pullbacks below $13.70 to provide buying opportunities.

First Watch Menu Offerings (Company Website)

Q2 Results Recap

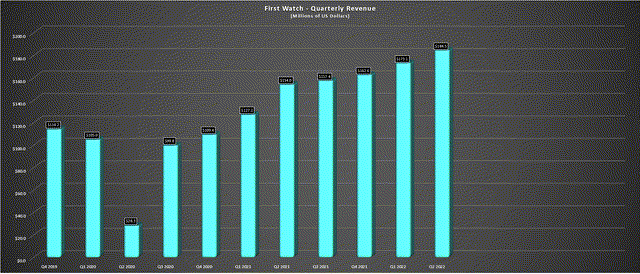

First Watch released its Q2 results in August and had a blow-out quarter. The company reported quarterly revenue of $184.5 million, up 20% year-over-year, helped by steady unit growth and strong same-restaurant sales growth of 13.4% (30.2% vs. Q2 2019). However, the major distinction from other brands reporting comp sales growth was that First Watch’s growth was not driven by aggressive pricing. Instead, we saw the company report 8.1% traffic growth, an incredible figure compared to the industry, which saw a 4.8% decline in comp traffic in June, according to Black Box Intelligence.

First Watch – Quarterly Revenue (Company Filings, Author’s Chart)

This comp sales growth stemming from increased traffic is impressive, suggesting that First Watch is doing several things right, and one of these could be its conservative stance on pricing. Unlike other brands that are looking to hold the line or expand margins with semi-aggressive pricing to offset commodity/wage inflation, First Watch has focused on maintaining its value proposition. The evidence was the company’s choice to take only a modest 3.9% price increase in H1 2022 on the back of no price increases in 2021.

That rate of change in menu pricing (~4.0% since 2020) is running up to 1000 basis points behind some more aggressive brands and well below the industry average. The result is that First Watch’s value proposition is very noticeable (especially relative to smaller independent breakfast chains that may have to be more aggressive due to their lack of scale/limited investments in technology) and also against grocery inflation. So, while the overall pool of discretionary money available for the industry may be shrinking due to a weaker average consumer and low personal savings rates, First Watch looks to be finding a way to gain market share.

In addition to conservative menu pricing, which doesn’t only invite guests back but keeps them happy (no dizzying multiple price increases in a year noticed between visits), the company continues to roll out its alcohol program and excel in menu innovation. The company noted in its Q2 Call that its premium items were received very well by guests (calling out its Crab Cake Benedict) despite this being one of the most expensive items it’s put on the menu. As for juice and alcohol incidences, they are up, leading to growing checks and the exact opposite of what operators monitor closely for change in guest behavior: check management. Overall, this is very encouraging.

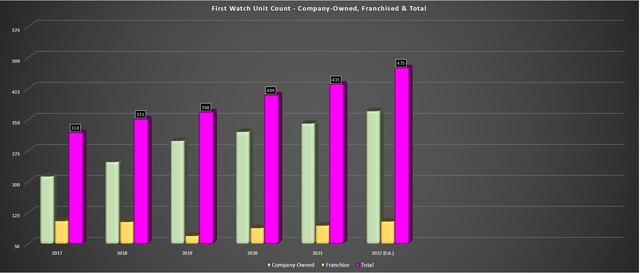

First Watch Unit Count (Company Filings, Author’s Chart)

Finally, on the development front, the company opened nine new system-wide restaurants in Q2, consisting of five company-owned restaurants and four franchised ones. This has resulted in sixteen new openings year-to-date and placed the company on track to meet the lower end of its development guidance range, assuming a slight pick-up in the cadence of new openings. Under these assumptions, the company would finish the year with 475 restaurants, translating to high single-digit unit growth vs. FY2021 (475 vs. 435). First Watch’s growth rate is a key differentiator vs. other full-service brands, with it sporting much higher growth, allowing it to grow revenue/earnings in a slowdown more easily.

Industry-Wide Trends & Recent Developments

If we look at industry-wide trends, the backdrop has been extremely difficult, initially from an operating and margin standpoint and now from a sales standpoint. The issues began with operators having difficulty fully-staffing restaurants due to labor tightness and many leaving the industry post-pandemic. Operators were simultaneously hit with commodity inflation, which combined with wage inflation and bonus payments/higher training costs to ensure adequate staffing levels weighed on margins. The good news is that commodity inflation may have peaked this summer for some items, and applicant flow is improving, as is retention, according to many brands.

First Watch Menu Offerings (Company Website)

The problem is that with these issues potentially in the rear-view mirror, the industry is now dealing with lower traffic, impacted by higher gas, rent, utility, mortgage, and grocery costs. It’s also dealing with the impact of a reversal in the wealth effect, with consumers that feel much less rich than last year (declines in investment accounts/homes) not as anxious to spend. Meanwhile, less affluent consumers are feeling the most pressure, with many not having the money to spend at all and being forced to cut back. This is a major issue that could persist, and we’ve seen its effects on restaurant traffic with negative ~5.0% traffic growth in June/July for the industry, according to Black Box.

So, what does this mean for First Watch?

While the backdrop overall is negative for the industry, suggesting caution when investing in restaurant stocks, First Watch continues to prove that it isn’t dealing with the same traffic declines. The company also noted that it thrived in previously recessionary periods like 2008. Obviously, history doesn’t have to repeat itself, but if one plans to invest in the restaurant industry group, First Watch looks like a solid buy-the-dip candidate. The one last point worth noting is that Q4 results could be a little noisier due to Hurricane Ian due to its heavy Florida presence, but 85 of its restaurants were closed for one day. All but ten had already re-opened as of October 3rd, and fewer than five sustained any significant damage, suggesting minimal impact overall (~1% of store base impacted). Most importantly, its employees are safe.

Valuation

Based on 59.1 million shares, net debt of ~$45 million, and a share price of $14.90, First Watch trades at an enterprise value of ~$925 million. If we compare this figure with current estimates for FY2023 EBITDA of ~$85 million, First Watch trades at just ~10.9x EV to EBITDA, a sharp decline from closer to 15.0x EV/EBITDA at its highs. This is a slight premium to other full-service names like Dine Brands (DIN) and Bloomin Brands (BLMN) at 9.6x and 6.8x FY2023 EV/EBITDA, and a slight discount to Darden (DRI) and Texas Roadhouse (TXRH) at ~12.0x and ~12.2x FY2023 EV/EBITDA estimates, respectively.

At first glance, this might seem like a steep valuation for a less established brand, with its peers having more brands, larger scale, and in Dine Brands’ case, a ~98% franchised model. However, while First Watch may be new to the public markets, it’s been around since the 1980s, its one-brand operation allows it to have laser-focus, and its growth rates are well above that of its peer group in the full-service space. Hence, I believe First Watch can easily justify trading in line with its peers, and I see a forward EV/EBITDA multiple of 14.0 being optimal. Under these assumptions, First Watch’s fair value would come in at $19.35 per share.

First Watch Restaurant (Company Website)

While this represents a 30% upside from current levels, I prefer only entering new positions at a 30% discount to fair value when it comes to purchasing small-cap growth stocks. This is especially true when the overall market is under pressure, with the S&P 500 (SPY) currently in a cyclical bear market. So, while I think First Watch is one of the better buy-the-dip candidates in the sector and among growth stocks, the stock would need to dip below $13.50 to bake in an adequate margin of safety. There’s no guarantee that the stock will head to these levels, but this is where I would view the valuation as being attractive enough to be worth putting capital at risk.

S&P-500 Cyclical Bear Markets (TC2000.com)

Technical Picture

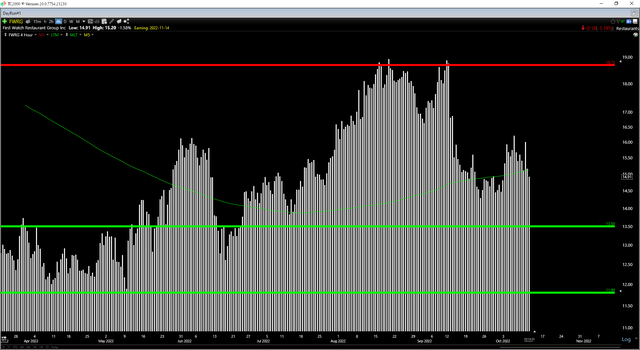

Finally, looking at the technical picture, we can see that First Watch has a new resistance level of $18.70 and strong support at $11.80, with upper support at $13.50. As I discussed in my previous update, there was no reason to chase First Watch above $17.70 per share, given that it was trading in the upper portion of its range, even if it just came off a phenomenal quarter. The good news is that the stock has now pulled back to more interesting levels and is nearing the lower portion of its range.

That said, my preferred way to enter growth stocks in a difficult market backdrop is at or within 2% of support, meaning the low-risk buy zone for the stock would come in at $13.50 – $13.75. Hence, I don’t see FWRG stock as a Buy just yet.

FWRG – 6-Month Chart (TC2000.com)

Summary

First Watch had an incredible first half of the year, outperforming the industry-wide traffic slowdown with ease. In addition, it has historically done well in economic slowdowns despite being in a more discretionary category and not being as much of a trade-down beneficiary (having similar average checks to casual dining). That said, the key to investing in turbulent markets is waiting for the right price or passing entirely, and at a share price of $14.90, I don’t see enough margin of safety just yet. So, while I see FWRG as a name to keep near the top of one’s watchlist, I don’t see a low-risk buy point just yet, with $13.70 or lower being the ideal area to start an initial position.

Be the first to comment