vivalapenler/iStock Editorial via Getty Images

First Trust Capital Strength ETF (NASDAQ:FTCS) is an index-based fund offering concentrated exposure to U.S stocks boasting solid cash on the balance sheet, with moderate debt and robust return on equity, perhaps one of the strongest interpretations of the quality factor suitable for the higher rates era, a period when impecunious players that were previously steadily outspending their cash and covering unsuccessful capital allocation initiatives with almost free debt amid ultra-loose monetary policy have serious chances to go under (and I am not even mentioning a cyclical downturn here).

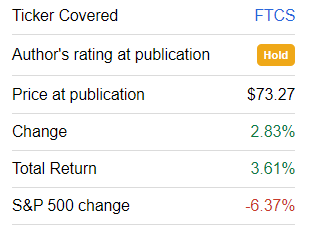

An update on this quality-centered ETF is necessary for a few reasons. First, this fund, based on a quarterly rebalanced and reconstituted index, now has over 27% of the net assets in stocks that it had no exposure to in July when I wrote the first article. This implies remarkable shifts in sector and factor exposure could in theory be uncovered upon closer inspection. Second, FTCS has delivered a surprisingly strong performance since my note, not bowing to bearish pressure that dragged the bellwether S&P 500 lower since then and actually defying my skepticism which was principally caused by its intolerable exposure to seemingly overvalued stocks (more on that shortly).

Seeking Alpha

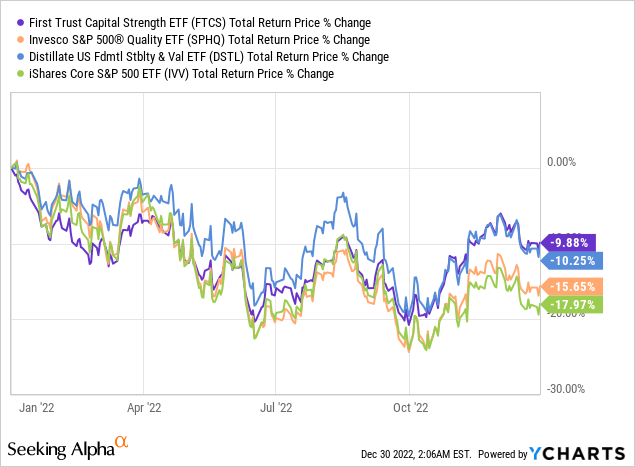

Overall, FTCS is on track to finish 2022 with a modest alpha; it might also outperform the Distillate Fundamental Stability & Value ETF (DSTL) and Invesco S&P 500 Quality ETF (SPHQ), the two interesting profitability-focused funds I wrote about in the past.

So, I should comment on whether this pleasant performance surprise supports an optimistic outlook for 2023.

Investment strategy recap

FTCS’ investment mandate is to track the Capital Strength Index, the equally-weighted benchmark encompassing about 50 constituents.

Rules are relatively tight. First, to outcompete other candidates from the 500 group of the largest and adequately liquid constituents of the NASDAQ US Benchmark Index, a company must have no less than $1 billion in cash or short-term investments. For firms that have such a massive cash pile only because they have issued debt recently and are probably overleveraged, there is a second rule that forbids companies with a Long-term debt/Market cap ratio above 30% from competing. Finally, Return on Equity must be north of 15%, implying the Capital Strength index constituent must not only have an adequate capital structure but also prove it was capable of using the shareholder funds proficiently and delivering sufficient profits.

Ultimately, there is a realized volatility screen when the riskiest stocks, according to the 3-month and 12-month data, are shown the red light.

In essence, this is one of the interesting interpretations of the quality factor, and certainly not the weakest or a meaningless one. Assessed together, debt and ROE make much more sense than taken in isolation as large ROE delivered using excessive debt (which means a lower denominator in the ROE formula) could result in incorrect conclusions. Besides, the preference for less volatile stocks is a tailwind for the Risk profile overall.

Portfolio changes overview

What is the product of this strategy? As of December 23, the fund was long 50 stocks, with the key ten accounting for about 22% thanks to the equal-weight schema of the underlying index. Even though the count of stocks has not changed since my previous note, the portfolio did go through a remarkable recalibration. More specifically, more than 27% of net assets are currently in fourteen stocks that were absent in the July version of the portfolio, namely the following:

| Stock | Weighting | GICS Sector |

| Expedia (EXPE) | 2.14% | Industrials |

| Incyte (INCY) | 2.14% | Health Care |

| Pfizer (PFE) | 2.14% | Health Care |

| Mastercard (MA) | 2.11% | Information Technology |

| Thermo Fisher Scientific (TMO) | 2.02% | Health Care |

| Principal Financial Group (PFG) | 2.01% | Financials |

| Visa (V) | 2.00% | Information Technology |

| Raymond James Financial (RJF) | 1.97% | Financials |

| Accenture (ACN) | 1.83% | Information Technology |

| Corning (GLW) | 1.83% | Information Technology |

| Costco Wholesale (COST) | 1.79% | Consumer Staples |

| Public Storage (PSA) | 1.79% | Real Estate |

| Cognizant Technology Solutions (CTSH) | 1.72% | Information Technology |

| Molina Healthcare (MOH) | 1.72% | Health Care |

We see solid quality stories in this cohort; to corroborate, the median total cash the companies in this set have is $5.47 billion, while the minimum threshold to qualify for inclusion in the index is $1 billion. And also, none is profitless, while the median ROE is 31%.

At the same time, these names failed to meet the stringent criteria and were subsequently removed (weights as of July 28):

| Ticker | Weighting | GICS Sector |

| Parker-Hannifin (PH) | 2.2% | Industrials |

| Danaher (DHR) | 2.2% | Health Care |

| Illinois Tool Works (ITW) | 2.2% | Industrials |

| CSX Corporation (CSX) | 2.1% | Industrials |

| Texas Instruments (TXN) | 2.1% | Information Technology |

| Norfolk Southern Corporation (NSC) | 2.1% | Industrials |

| Aon (AON) | 2.1% | Financials |

| Intercontinental Exchange (ICE) | 2.1% | Financials |

| Mondelez International (MDLZ) | 2.0% | Consumer Staples |

| Laboratory Corporation of America (LH) | 2.0% | Health Care |

| Humana (HUM) | 1.9% | Health Care |

| Garmin (GRMN) | 1.9% | Consumer Discretionary |

| Regeneron Pharmaceuticals (REGN) | 1.8% | Health Care |

| Cincinnati Financial Corporation (CINF) | 1.7% | Financials |

Did this result in a tectonic shift in factor or exposure? In part, not to a degree to justify a rating upgrade.

First, sectors. The fund is still grossly overweight healthcare, with over 32% allocated vs. ~31% in end-July. Industrials are, for now, still in second place, yet with weight almost 9% lower, ~20%. Financials lost its third position to IT, which now has 17.4% vs. 10.6% in July. Please take notice that the weights above are for GICS sectors, not ICB industries.

Second, the size factor. Nothing has changed fundamentally. Almost half of the net assets are parked in mega-caps vs. 41.3% in July. The weighted-average market capitalization rose from $121.8 billion to $145.4 billion. I believe the sizeable presence of mega-caps is something permanent owing to the selection universe and the $1 billion in cash rule, so investors who are considering FTCS should make sure they have a sufficient understanding of the pros and cons of mega-cap (and large-cap) exposure.

Obviously, one of the pros is quality. The capital shortage era has certainly not ended yet (some investors might even point out here that it has just started), so chasing stocks that have fickle profitability profiles is unjustifiably risky.

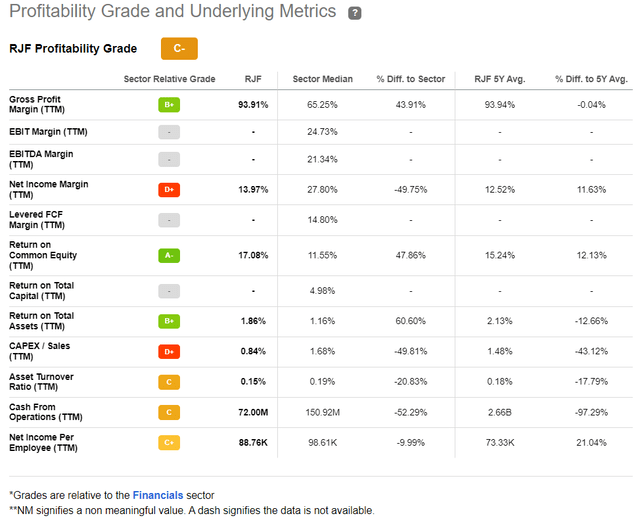

Thankfully, almost all the holdings except for RJF have no less than a B- Quant Profitability rating (almost no changes since July).

There are no loss-making companies in the mix, at all; the median ROE is impressive at 48.3%. The median total cash on the balance sheet is $3.36 billion, which is solid.

What are the cons? Valuation. Let me elaborate on that:

- The weighted-average earnings yield of this mix is around 5%, as per my calculations, which translates into ~18.6x P/E ratio (Last Twelve Months). Meanwhile, the WA Forward EPS growth is only modest, about 10%.

- The Price/Sales ratio (a weighted-average figure again) is approximately 4.46x, while the WA forward revenue growth rate is fairly bleak, less than 8%.

- The median Enterprise Value/EBITDA for the stocks outside of the real estate and financial sectors is 15.2x. For context, the median for the healthcare sector is 14.55x.

- Overall, 84% of stocks have a D+ Quant Valuation grade and worse, while only 5.7% have a B- or better (70.4% and 5.9% in July). This is not a proportion I like.

Final thoughts

To conclude, FTCS has an expensive, quality-heavy, growth-light equity mix.

The ETF has surprised us to the upside since my previous note, finishing ahead of the bellwether S&P 500 index for four full months in a row, partly reflecting strong investor sentiment toward high-quality stocks.

However, I still see no plausible reason for a Buy rating since I favor value and quality, not only the former or only the latter, and FTCS is short on value as has been illustrated above. Assigning a Buy rating to an ETF with a 5% WA EY, 4.5x WA P/S, and over 84% of stocks priced for perfection will be incongruous with my market outlook for 2023. Yet I am by no means arguing against investing in the fund completely or even shorting it as I find its capital strength formula well-designed and nicely balanced. That is to say, a Hold rating is selected as a golden mean.

Be the first to comment