muhammet sager

For many years, master limited partnerships have been among the most popular vehicles for investors that are looking to generate income from their portfolios. This makes a lot of sense, since these entities enjoy certain tax advantages with respect to their distributions and tend to pay out a large enough percentage of their cash flows to provide a very high yield.

However, there are some problems with them. One of the biggest problems is that it can be very difficult to put these companies into a tax-advantaged account such as an IRA or a 401k due to American tax laws. In addition, it can be difficult to put together a diversified portfolio of these companies without having access to a significant amount of capital. Fortunately, there are some solutions to both of these problems. One of the best is to invest in a closed-end fund (“CEF”) that specializes in investing in master limited partnerships. These entities are nice because they provide easy access to a professionally run portfolio of assets that can in many cases boast higher yields than any of the underlying partnerships. These funds can also be easily included in retirement accounts without any difficulty.

In this article, we will discuss the First Trust New Opportunities MLP & Energy Fund (NYSE:FPL), which is one such CEF in this category. This fund yields 7.41% as of the time of writing, which is a reasonably respectable yield. I have written about this fund before, but a great deal of time has passed since then, so obviously much has changed. This article will focus specifically on these changes as well as provide an updated analysis of the fund’s finances in order to determine if it could still be a good fit for a portfolio.

About The Fund

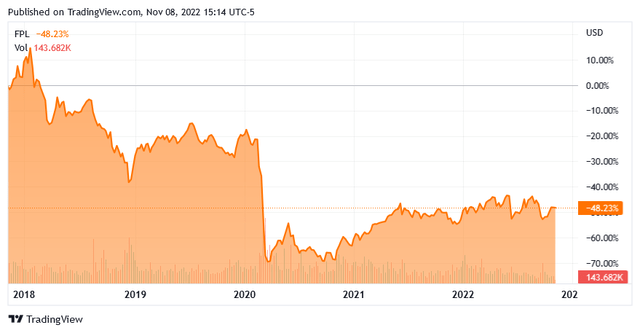

According to the fund’s webpage, the First Trust New Opportunities MLP & Energy Fund has the stated objective of providing investors with a high level of current income with an emphasis on current distributions paid to investors. This is hardly surprising for an equity fund, since most of them focus specifically on total return. This is because equities are by their very nature a total return instrument. After all, we generally invest in equities to get both distributions from the company and capital gains. The fund is targeting that as well, although it does state that it will focus specifically on delivering its returns to the investors in the form of current income. We can therefore assume that the fund will be paying out its income and capital gains to the investors while its own share price remains relatively flat. At least, that is its goal but we can see that the share price has certainly not been flat over the past five years:

We can see a steep decline for FPL in 2020, but the fund has at least partially recovered from that. It still trades well below its pre-pandemic level though. This is fairly typical among funds of this type, as the pandemic and the resulting lockdowns caused the price of both crude oil and natural gas to collapse, along with the share prices of anything remotely connected to the energy industry. Unlike some of the companies in the sector though, the fund has not fully recovered from that collapse, which is probably because it paid out much of the capital gains that it got over the past eighteen months so its net asset value is lower than it was back in 2019. This is unfortunate but anyone buying today does not really have to worry about the past. We are only concerned about the future and as we will see over the course of this article, the future for the traditional energy sector and midstream partnerships is actually fairly positive.

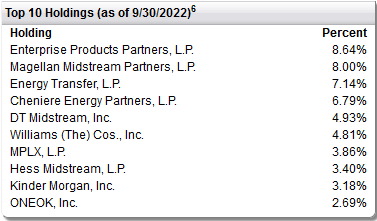

As my regular readers are no doubt well aware, I have devoted a considerable amount of time over the years discussing energy companies and especially master limited partnerships here at Seeking Alpha. As such, the largest holdings in the fund are likely to be familiar names. Here they are:

First Trust

The only companies on this list that I have never published an article on are Cheniere Energy Partners (CQP) and Hess Midstream (HESM). Cheniere Energy Partners is just a partnership that actually owns the Sabine Pass LNG facility and the Cheniere Creole Pipeline, which are both controlled by the much larger Cheniere Energy (LNG). I have discussed the parent company multiple times and generally speaking the parent company is the better investment unless you want the much higher yield of the partnership. Hess Midstream is a drop-down midstream partnership controlled by Hess Corporation (HES) that is mostly a way for Hess to recoup some of the money that it spends in constructing the midstream infrastructure needed to support its business while still retaining much of the cash flow from those assets. The remainder of the companies on the list are all traditional pipeline operators.

It is important to understand the business model of pipeline operators as these are not affected by many of the trends that other companies in the traditional fossil fuels business are. In particular, midstream companies’ cash flows are not affected very much by changes in energy prices, even though their unit prices in the stock market are. These companies instead enter into long-term contracts with their customers in which they agree to transport the customer’s crude oil, natural gas, and other hydrocarbon products through their infrastructure. In exchange, the customer compensates the pipeline operator based on the volume of resources transported, not on their value. The business model is much more akin to a toll road than it is to an oil and gas company.

These companies also use things such as minimum volume commitments that specify a certain volume of resources that must be transported or paid for anyways in order to protect themselves against declines in transported volumes that may accompany a fall in energy prices. As I pointed out in numerous articles over the past few years, the actual cash flows of most of these companies were not affected very much by the crash in energy prices that occurred back in 2020. This business model is the reason why that was the case.

There were quite a few changes to the largest positions list since we last looked at the fund about eighteen months ago. TC Pipelines, Sempra (SRE), Public Service Enterprise Group (PEG), TC Energy (TRP), Enbridge (ENB), and Plains All American Pipeline (PAA) were replaced with Energy Transfer (ET), DT Midstream (DTM), MPLX (MPLX), Hess Midstream, Kinder Morgan (KMI), and ONEOK (OKE). I cannot say that all of these changes are bad choices as it appears that the fund is focusing its efforts more on natural gas-focused pipeline operators as opposed to those that primarily operate crude oil pipelines. The fundamentals for natural gas are much better than those for crude oil going forward so this makes a lot of sense and indeed, it has generally been my recommendation over the past year or two.

All of the changes could lead one to believe that this fund has a fairly high turnover, though. This would not be an incorrect assumption, as the First Trust New Opportunities MLP & Energy Fund currently has a 126.00% annual turnover, which is fairly high for any fund. This could result in decreased performance because it costs the fund money to trade assets, which is ultimately billed to the shareholders. Thus, management must generate sufficient returns to both overcome the increased expenses and still deliver the performance that shareholders expect, which is a very difficult task. This is one of the reasons that index funds are so popular since they do minimal amounts of trading and incur minimal expenses. This does not, however, mean that a fund with a high turnover will necessarily underperform but it does make it much harder for management.

As my regular readers on the topic of closed-end funds are certainly well aware, I do not generally like to see any individual asset account for more than 5% of a fund’s portfolio. That is because this is approximately the level at which an asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if an asset accounts for too much of the portfolio, then this risk will not be completely eliminated.

Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market itself does not, and if the asset accounts for too much of the portfolio, then it may end up dragging the entire fund down with it in such a scenario. As we can see above, there are four companies that each account for a somewhat outsized proportion of the portfolio so investors should ensure that they are willing to take on the risks of these companies individually before acquiring a position in the fund. With that said, it is not unusual for a midstream fund to have a substantial proportion of its assets invested in only a few companies. This one is not nearly as bad as some other funds in this respect.

Fundamentals Of Midstream And Energy

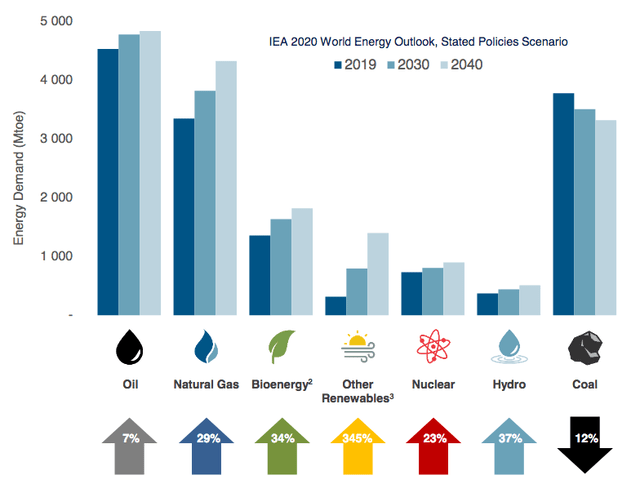

Earlier in this article, I stated that the fundamentals for natural gas were much better than the fundamentals for crude oil going forward. This is because the demand for both substances will grow going forward but the demand for natural gas will grow substantially more. This is something that may admittedly surprise many people considering that we continue to hear from politicians and the media that the consumption of fossil fuels will soon be a relic that is in the past. However, the International Energy Agency projects that the global consumption of crude oil will increase by 7% and the global consumption will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2020 World Energy Outlook

Perhaps surprisingly, the growing consumption of natural gas will be driven by international concerns about climate change. As everyone reading this is no doubt aware, these concerns have induced governments all around the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective emissions. One of the most popular of these policies is to encourage utilities to retire old coal-fired power plants in favor of renewable sources of power. Unfortunately, renewables have one major problem, which is their lack of reliability. After all, wind power does not generate electricity when the air is still and solar power does not work when the sun is not shining. Thus, to ensure the reliability of the electric grid, utilities have been supplementing their renewable plants with natural gas turbines. This is because natural gas is reliable enough to ensure the performance that people expect from the modern electric grid and burns cleaner than any other fossil fuel. This is expected to continue to happen until renewable sources of power finally advance sufficiently to power the grid on their own, which is not likely to occur prior to 2050.

The projected demand growth for crude oil might be a bit more difficult to understand, particularly considering that many governments are trying to reduce the consumption of crude oil within their borders. However, it is a very different story in the various emerging nations around the world. These nations are expected to benefit from tremendous economic growth over the projection period. This will naturally have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will begin to desire a lifestyle that is much closer to that of their counterparts in the developed nations than their lifestyles today. This will result in a growing consumption of energy, including energy derived from crude oil. As the populations of these nations are much greater than those of the developed nations, the growing consumption of crude oil in these nations will more than offset the stagnant-to-declining consumption in the world’s developed markets.

The midstream companies that comprise most of the fund’s portfolio will benefit from these trends even though they do not produce any resources themselves. This is because North America is one of the few regions of the world that can significantly increase its production of hydrocarbon resources to fulfill this demand due to the wealth of regions like the Permian Basin and Marcellus Shale. However, there is no reason for upstream companies to do this if they cannot get the incremental resources to the market. That is the role that midstream companies perform so they should be seeing a growing volume of handled resources. As the cash flows of these companies directly correlate to volumes, they should see growing cash flows going forward. We will directly benefit as investors in the First Trust New Opportunities MLP & Energy Fund.

Distribution Analysis

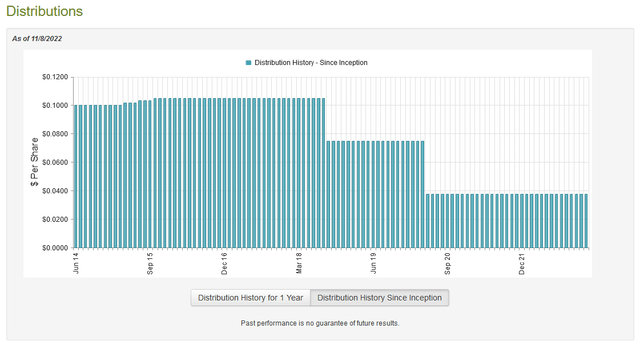

As stated earlier in the article, the primary objective of the First Trust New Opportunities MLP & Energy Fund is to provide its investors with a high level of total return. However, the fund aims to deliver its total return primarily through the distributions that it pays out to investors. In addition, many of the midstream master limited partnerships that the fund invests in boast remarkably high distribution yields. As such, we can assume that the fund also boasts a very high yield. This is indeed the case as it pays out a monthly distribution of $0.0375 per share ($0.45 per share annually), which gives it a 7.41% yield at the current price. Unfortunately, the fund’s distribution history leaves something to be desired as it has cut its distribution twice in the past:

The fact that the fund has cut its distribution twice since inception is unlikely to appeal to many of those investors that are looking for a reasonably safe and secure source of income to use to pay their bills. We can admittedly excuse the distribution cut back in 2020 as that was a time of great uncertainty for the industry as a whole and many midstream partnerships reduced their distributions in order to conserve money as nobody knew how long the pandemic restrictions and their effect on energy prices would last. These forced funds invested in those companies to also cut their own distributions because of the reduced income. The earlier distribution cut is harder to forgive, however. It is important to note that the fund has been very consistent about its distribution over the past two years though and new money invested in the fund today would receive the current distribution at the current yield so the fund’s past is not really a big deal. The important thing for us today is how well the fund can maintain its distribution going forward.

Unfortunately, we do not have an especially recent report to consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will not give us much insight into how well the fund performed in the past several months. However, the first few months of 2022 were a period of incredible strength for the energy industry so this report will give us a good idea of how well the fund took advantage of that strength. During the six-month period, the First Trust New Opportunities MLP & Energy Fund received a total of $1,920,562 in dividends and $40 in interest from the assets in its portfolio.

It is important to note that distributions received from master limited partnerships, which account for the majority of the fund’s assets, do not count as income for this purpose. We will discuss the implications of that shortly. The fund was able to cover its expenses out of its income, leaving it with $218,837 left over for investors. However, the fund actually had substantial tax benefits that allowed it to actually report a net investment income of $4,585,648 during the period. This was not enough to cover the $5,542,445 that it actually paid out in distributions, however. At first, this is likely to be something that looks very concerning.

However, the fund does have other ways to get money to pay the distribution, such as through capital gains. In addition, since distributions received from partnerships are not considered income, we ultimately want to look at how the fund’s net asset value changed during the period. The fund reported total net realized gains of $1,253,749 and another $14,448,152 net unrealized capital gains. This alone was enough to cover the distribution when combined with the fund’s income. It was also enough to cover the $2,640,487 worth of its own stock that the fund bought back during the period. After accounting for all inflows and outflows, the fund’s assets increased by $12,104,617 during the period in question. Thus, the distribution was easily covered and there is nothing to worry about with respect to its sustainability.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the First Trust New Opportunities MLP & Energy Fund, the usual way to value it is by looking at its net asset value. The net asset value is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. That is fortunately the case with this fund today. As of November 8, 2022 (the most recent date for which data is currently available), the First Trust New Opportunities MLP & Energy Fund had a net asset value of $7.10 per share. However, the shares only trade for $6.07 per share. This gives the shares a 14.51% discount at the current price. This is slightly better than the 14.37% discount that the shares have had on average over the past month and it is admittedly one of the largest discounts possessed by any fund. Overall, the price certainly looks very attractive today.

Conclusion

In conclusion, there is a lot to like about the First Trust New Opportunities MLP & Energy Fund today. This is especially true for people that want to include midstream partnerships in their retirement accounts but otherwise cannot because of tax problems. The fund admittedly suffered quite a bit a few years ago but that seems to be behind it and right now the fundamentals for the industry are quite strong. They are likely to remain that way for a while as well so there is plenty of time for anyone to generate profits off a fund like this. The fact that it is trading for an enormous discount only improves its proposition. Overall, there may be a reason to buy FPL today.

Be the first to comment