Cavan Images

The strong and rapid improvement in Puerto Rico’s economy will likely drive First BanCorp’s (NYSE:FBP) loan growth and keep provisioning below normal through the end of 2023. Further, the rising rate environment will have some effect on the net interest margin, thereby boosting earnings. Overall, I’m expecting First BanCorp to report earnings of $1.62 per share for 2022 and $1.67 per share for 2023. Compared to my last report on the company, I’ve increased my earnings estimates for both years mostly because I’ve raised my margin estimates. Next year’s target price suggests a small upside from the current market price. Based on the total expected return, I’m upgrading First BanCorp to a buy rating.

Puerto Rico’s Rapid Economic Recovery Bodes Well for Loan Growth

First BanCorp’s rate of loan growth continued to improve in the third quarter of 2022. The management mentioned in the latest conference call that it expects commercial and consumer portfolios to continue to grow while the residential portfolio declines.

I’m expecting total loan growth to remain at a decent level due to the rapid improvement of Puerto Rico’s economy. As the region is susceptible to natural disasters, it is important to consider the hurricane season when looking at the regional economy. The peak of Puerto Rico’s hurricane season is now behind us without leaving much damage. Due to Hurricane Fiona, electricity and water supply got disrupted. However, LUMA has announced that it had restored services to 99% of its customer base by October 14, 2022.

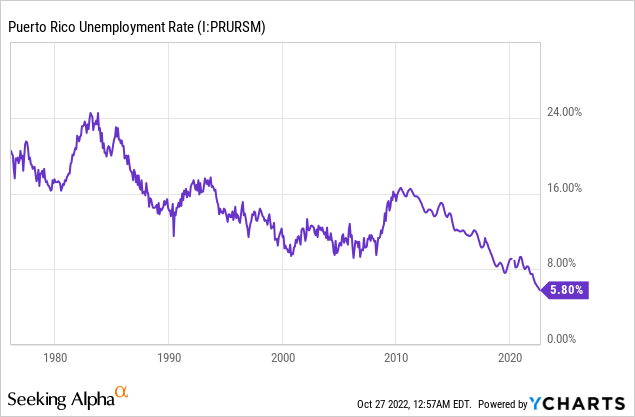

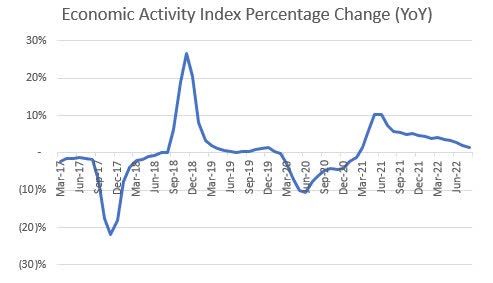

Post-hurricane economic data is not yet available; nevertheless, I’m sure the strong economic recovery will continue. Before the hurricane, Puerto Rico’s economy was rapidly going from strength to strength. The unemployment rate dropped to record lows and economic activity surged, as shown below.

The Economic Development Bank for Puerto Rico

Considering these factors, I’m expecting the loan portfolio to grow by 0.75% every quarter till the end of 2023. Meanwhile, other balance sheet items will grow mostly in line with loans. However, the growth of equity book value will trail loan growth because of unrealized mark-to-market losses on the available-for-sale securities portfolio. The tangible book value per share has already fallen from $9.6 per share at the end of December 2021 to $6.4 per share at the end of September 2022. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Financial Position | ||||||||

| Net Loans | 8,705 | 8,887 | 11,442 | 10,827 | 11,136 | 11,474 | ||

| Growth of Net Loans | 0.6% | 2.1% | 28.8% | (5.4)% | 2.9% | 3.0% | ||

| Other Earning Assets | 2,140 | 2,398 | 4,926 | 6,658 | 6,164 | 6,288 | ||

| Deposits | 8,995 | 9,348 | 15,317 | 17,785 | 16,694 | 17,030 | ||

| Borrowings and Sub-Debt | 1,074 | 854 | 924 | 684 | 386 | 393 | ||

| Common equity | 2,009 | 2,192 | 2,239 | 2,102 | 1,316 | 1,528 | ||

| Book Value Per Share ($) | 9.3 | 10.1 | 10.3 | 9.9 | 7.0 | 8.1 | ||

| Tangible BVPS ($) | 9.3 | 9.9 | 9.9 | 9.6 | 6.7 | 7.8 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

Revising Upwards the Margin Estimate

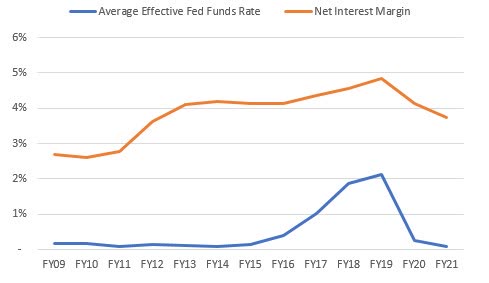

Thanks to the rising rate environment, First BanCorp’s margin has expanded by 70 basis points so far this year. This performance is as good as in previous years when the margin was considerably rate-sensitive, as shown below.

SEC Filings, The Federal Reserve Bank of St. Louis

However, in theory the margin is not as sensitive as in practice. According to the results of the management’s rate-sensitivity model given in the second quarter’s 10-Q filing, a 200-basis points hike in interest rate can boost the net interest income by only 3.11% over twelve months.

I’m expecting the Fed Funds rate to increase by a further 150 basis points till the mid of 2023. Considering these factors, I’m expecting the margin to grow by 20 basis points in the last quarter of 2022 and 10 basis points in 2023. Compared to my last report on First BanCorp, I’ve increased my margin estimate for 2022 and 2023 due to the third quarter’s results.

Provisioning Likely to Remain Below Normal

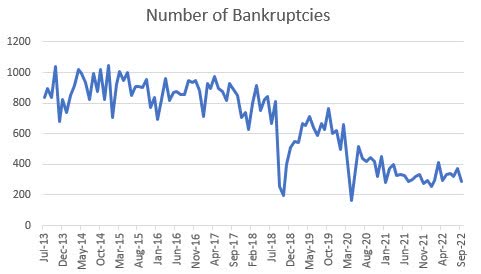

As loan additions increased, the provisioning for expected loan losses also increased during the third quarter on a sequential basis. However, the provisioning was still much below the average for the pre-pandemic years. Going forward, the provisioning will likely remain below normal due to the rapid improvement of Puerto Rico’s economy. Macroeconomic data from Puerto Rico shows that bankruptcies have significantly plunged in the region, as shown below.

The Economic Development Bank for Puerto Rico

Further, the management mentioned in the conference call that the hurricane’s impact on First BanCorp’s customer base has been minimal. Considering these factors, I’m expecting the net provision expense to make up around 0.52% of total loans (annualized) every quarter till the end of 2023. In comparison, the net provision expense has averaged 0.74% of total loans in the last five years.

Revising Upwards the 2022 Earnings Estimate to $1.62

The anticipated loan growth and margin expansion will lift earnings through the end of 2023. Meanwhile, the below-average provisioning for expected loan losses will provide further support to the bottom line. Overall, I’m expecting First BanCorp to report earnings of $1.62 per share for 2022, up 23% year-over-year. For 2023, I’m expecting earnings to grow by 3% to $1.67 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 525 | 567 | 600 | 730 | 805 | 894 | ||

| Provision for loan losses | 59 | 40 | 171 | (66) | 27 | 60 | ||

| Non-interest income | 82 | 91 | 111 | 121 | 123 | 131 | ||

| Non-interest expense | 358 | 378 | 424 | 489 | 451 | 496 | ||

| Net income – Common Sh. | 199 | 164 | 100 | 277 | 305 | 314 | ||

| EPS – Diluted ($) | 0.92 | 0.76 | 0.46 | 1.31 | 1.62 | 1.67 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on First BanCorp, I estimated earnings of $1.58 per share for 2022 and $1.64 per share for 2023. I’ve slightly increased my earnings estimates for both years because I’ve increased my margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Upgrading to Buy Due to a Moderately-High Total Expected Return

Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share in the second quarter of 2023 to $0.14 per share. The earnings and dividend estimates suggest a payout ratio of 32% for 2023, which is close to the 2019-2021 average of 29%. Based on my dividend estimate, First BanCorp is offering a forward dividend yield of 3.6%.

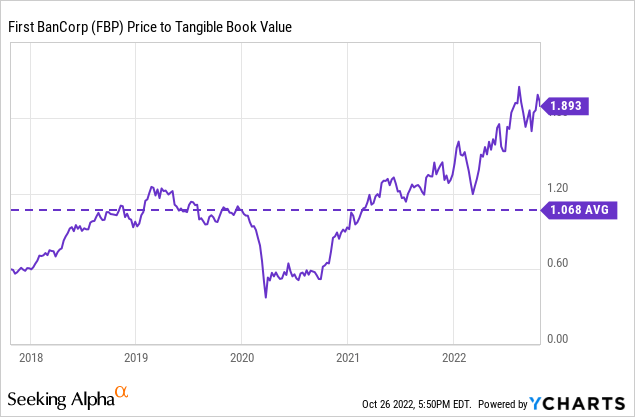

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First BanCorp. The stock has traded at an average P/TB ratio of 1.068 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $7.8 gives a target price of $8.3 for the end of 2023. This price target implies a 44.7% downside from the October 26 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.87x | 0.97x | 1.07x | 1.17x | 1.27x |

| TBVPS – Dec 2023 ($) | 7.8 | 7.8 | 7.8 | 7.8 | 7.8 |

| Target Price ($) | 6.8 | 7.5 | 8.3 | 9.1 | 9.9 |

| Market Price ($) | 15.1 | 15.1 | 15.1 | 15.1 | 15.1 |

| Upside/(Downside) | (55.1)% | (49.9)% | (44.7)% | (39.6)% | (34.4)% |

| Source: Author’s Estimates |

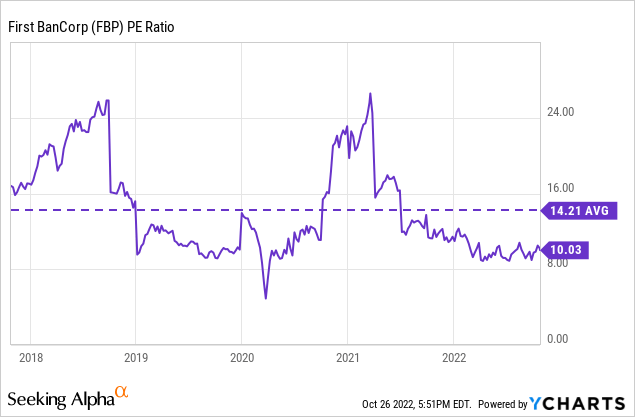

The stock has traded at an average P/E ratio of around 14.21x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $1.67 gives a target price of $23.7 for the end of 2023. This price target implies a 57.5% upside from the October 26 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.2x | 13.2x | 14.2x | 15.2x | 16.2x |

| EPS – 2023 ($) | 1.67 | 1.67 | 1.67 | 1.67 | 1.67 |

| Target Price ($) | 20.4 | 22.0 | 23.7 | 25.4 | 27.0 |

| Market Price ($) | 15.1 | 15.1 | 15.1 | 15.1 | 15.1 |

| Upside/(Downside) | 35.3% | 46.4% | 57.5% | 68.6% | 79.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $16.0, which implies a 6.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.0%.

I adopted a hold rating in my last report on First BanCorp with a target price of $15.5 per share for December 2022. Since then, the market price has declined by more than 6% resulting in a significant upside to next year’s target price. As a result, I’m now upgrading First BanCorp to a buy rating.

Be the first to comment