JHVEPhoto

The Fidelity Blue Chip Growth ETF (BATS:FBCG) is a US growth ETF with substantial weighting towards the American megacaps. 33% of the portfolio is accounted for by the top 5 holdings. Here we give our macro comment concerning trends in corporate spending, which have only just now started to decline broadly in the economy with a sign from some of the major advertising-exposed players, as well as some notes on consumer spending in China and crypto, all of which are trends that are going to affect much of this ETF as well as the economy broadly, with crypto being the least impactful of the factors. Whether this is the time to buy FBCG is a different matter – it depends on inflation’s response to the current interest rate regime.

FBCG Breakdown

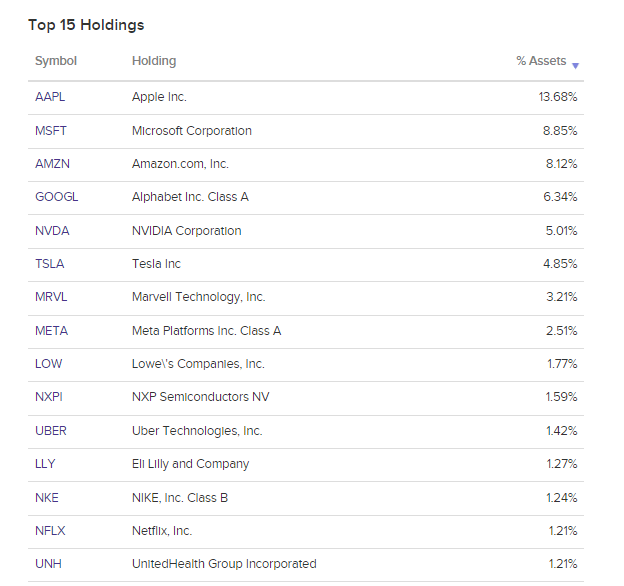

Let’s have a quick look at the FBCG major holdings. The top 5 holdings that account for 33% of the portfolio are Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) (GOOGL) and Nvidia (NVDA).

Top Holdings (etfdb.com)

All of these stocks are staples of value-weighted ETFs, with their large market caps commanding high proportions of value-weighted ETFs that are already skewed towards tech and therefore growth. Almost all of them had very strong earnings seasons in late July/August despite the fact that rates had already risen substantially from the beginning of the year by then, and inflation had been taking their tolls on consumer budgets. At that point there was signs of consumer confidence declines but no declines were happening in businesses that faced enterprises. The issue of declining corporate spending in these major holdings is beginning to appear now, but also other factors that threaten their do-no-wrong status that justifies their high multiples and continued runways for growth despite signs that the economy is dipping.

Important Factors

Google recently reported earnings and pressures have become evident as more companies that sell ads compete for tightening ad budgets. While growth still continues, valuations of the top blue-chip growers are on stilts that can easily be kicked from under them by missed expectations, since horizons are so long for companies’ whose fortunes seem certain. Microsoft also didn’t see performance come as strongly from Azure. Amazon faces both consumers and producers, and was penalised by markets as a result. While a falling number of consumer sales would come out of the commission that Amazon takes on sales to any vendor on its platform (the marketplace subscription is probably solid unless vendors disappear), the AWS revenues were not able to help the company beat expectations in its latest earnings, following suit slightly with Azure. Markets penalised Amazon even harder due to the AWS disappointment, a segment that was regarded as an assured source of success.

In other words, we saw pass through of consumer spending declines into corporate spending and with consumer spending still affected, these decelerations may continue for the next quarters. Indeed, the general economic picture is not great even for the US, where current account improvements thanks to energy export is helping its finances and therefore the dollar, but consumer spending is distinctly softening.

In the case of Nvidia, the crypto crash has really not helped some of its retail sales that were going into crypto, as we predicted more than a year ago was a risk factor. Moreover, building cycles for new PCs have slowed due to supply chain woes still being digested in retail semiconductor and affecting its videogame markets. There, a disappearance of the casual gamer with the reopening may have created a hole in the market too, and this could be contributing in part to the general bloat we are seeing in semiconductor inventories, which went from being in shortage to suddenly in a glut. The worsening outlook for semiconductors confirmed by reports from heavily exposed economies like Taiwan raise questions about a lot of tech exposures that supply semiconductors or supply that industry.

Apple which isn’t exactly a semiconductor company but a consumer staple company at this point, is still contributing to the electronics glut as well as their revise downwards their production plans in China on less than stellar initial reception for the iPhone 14 due to persisting lockdowns in China and bad economic outlook there, where it’s following up in India more quickly than usual to keep momentum. China, which commands a lot of global wallet share, growth stock or not, is really on the decline. Apple and other companies are beginning to onshore activity from there, and this could trap China into middle-income status or send it into decline and deleveraging. China’s worsening position in apart due to constant lockdowns but also less trust by West-destined supply chains is going to be a big problem global companies that very often depend in large part on the Chinese wallet.

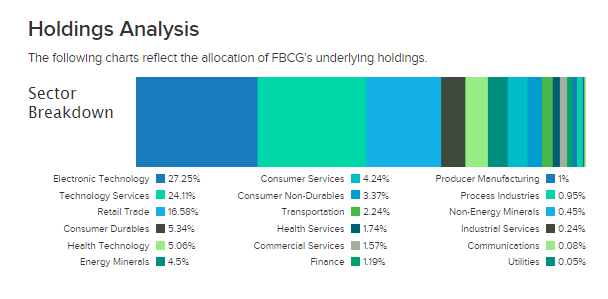

While 50% of the FBCG is in technology, the next 17% is in retail trade, and with the consumer spending declines having been evident from last quarters and only reinforced by spending declines and continued rate hikes in the meantime, these stocks aren’t particularly well positioned either.

Sector Breakdown (etfdb.com)

Bottom Line

A recession affects the whole economy, but FBCG is exposed to American growth stocks which is a market that value growth higher than no other, and therefore those stocks depend a lot on expectations. In some cases, even the crypto declines will matter for business fundamentals, but in most cases, declines in consumer spending will impact fundamentals even of enterprise facing businesses that have now started to feel the burn. Moreover, China’s economic woes, largely self-inflicted and liable to fester due to high leverage in the housing markets there, are going to affect a lot of tech companies in particular, especially the biggest ones that have used China as their latest growth markets, as their wallet share declines.

Consumer confidence has been lower for a while now, essentially showing itself last quarter. The depression in corporate spending has only just started, and could go on for another couple of quarters in all likelihood, even if inflation peaks in the meantime.

However, if inflation peaks as supply chains loosen up and bottlenecks like logistics see some easing, then markets will anticipate the Fed pivot and will jump regardless. A return to form will mean an even stronger reversion for the stocks in FBCG which has these higher Beta elements. That could save this ETF. However, unless you want to speculate on peak inflation, this ETF is not terribly exciting.

Be the first to comment