MF3d

On September 21, Fennec Pharmaceuticals (NASDAQ:FENC) announced FDA approval of its sole pipeline asset, PEDMARK. This was very welcome news to investors that have been with the company for some time, as FENC had previously received two CRLs over the past few years (though neither were for drug-related safety or efficacy issues).

PEDMARK is a unique formulation of sodium thiosulfate (STS). It has been developed for the prevention of the devastating ototoxicity (ear damage) that can occur in children (ages 1 month to 18 years) that are treated with chemotherapy agent cisplatin for localized, non-metastatic solid tumors. For decades, the medical community has had no real solution to this crushing side effect of chemotherapy, which can cause devastating hearing loss in at least 50% of pediatric patients.

Research has suggested that the cause of the ototoxicity may lie with the cochlea, the part of the inner ear that enables hearing. Whereas other organs in the body eliminate toxic platinum chemo agents rather quickly, the cochlea is believed to retain these harmful agents, thereby causing hearing loss over time. PEDMARK has been designed to bond with cisplatin in the inner ear to form platinum thiosulfate, which is not cytotoxic and can be readily excreted.

At the moment, there are no FDA-approved therapies for platinum-induced ototoxicity. One option that physicians commonly turn to is a cochlear implant. Whereas a hearing aid simply makes sounds louder, a cochlear implant is surgically connected to the ear and transmits impulses directly to the auditory nerve, thus bypassing the hair cells in the cochlea that were damaged from the chemo.

Unfortunately, cochlear implants can lead to complications such as nerve damage, balance problems, tinnitus (ringing in your ears), etc. Aside from these side effects, efficacy results are mixed. While some patients certainly see an improvement in their hearing, some do not. A cochlear implant is simply not a cure for hearing loss, and the ideal solution is preventing the hearing loss from occurring to begin with.

COG ACCL0431: First PEDMARK Phase 3 Study

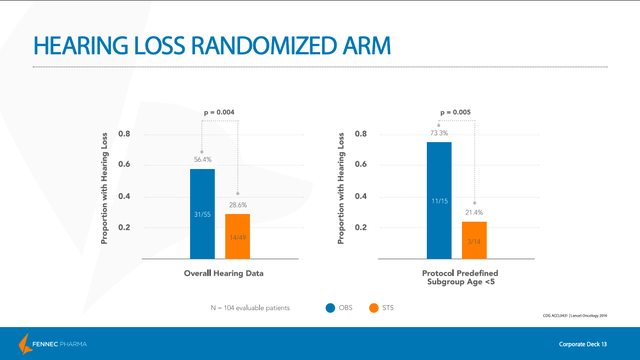

The first phase 3 study that FENC ran was called COG ACCL0431. The study was activated in March 2008 and final results were published in the Lancet Oncology in 2016. The study was open label (unblinded), with 131 patients (125 eligible, 104 evaluable) suffering from heterogenous solid tumors randomized to one of two arms. Arm I patients received PEDMARK over fifteen minutes beginning six hours after the completion of each cisplatin infusion, while arm II patients did not receive PEDMARK. Treatment with PEDMARK continued until the completion of cisplatin therapy. Patients were given audiological assessment at baseline, prior to each course of cisplatin, and then at 4 weeks and 1 year after the last course of cancer treatment ended. After completion of the study, patients were to be followed periodically for ten years.

As we can see on slide 13 of the company’s January 2020 investor presentation, the study met its primary endpoint of a 50% relative reduction in hearing loss as measured by hearing status at four weeks post-therapy. Furthermore, in a pre-defined subgroup of patients under five years old, the efficacy results were even more robust. Also, serious adverse events (SAEs) were not found to be attributed to the use of PEDMARK.

Regarding safety side effects, the most common grade 3–4 hematological adverse event (AE) reported was neutropenia (occurs when you have too few neutrophils, a type of white blood cell). This was seen in 66% (n=117/178) of participant cycles in the PEDMARK group, as compared with 65% (n=145/224) in the control group. The most common non-hematological AE was hypokalemia (lower than normal potassium level in your bloodstream). This was seen in 17% (n=25/149) of participant cycles in the PEDMARK group, compared with 12% (n= 22/187) in the control group.

There were 194 SAEs reported in 26 participants from the treatment group, with the most common SAE being decreased neutrophil count (26 episodes were seen in 14 participants). However, investigators decided that none of them were probably or definitely related to PEDMARK

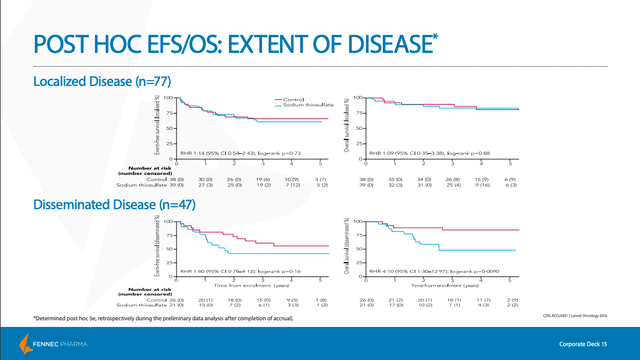

One major concern was always that PEDMARK would demonstrate signs of “tumor protection”, meaning that it would interfere with the cancer-fighting properties of the chemotherapy. Unfortunately, as we can see in the slide below, PEDMARK does seem to demonstrate tumor protection in patients with disseminated (non-localized) tumors. While this does limit the prospective patient pool to those with only localized tumors, FENC only pursued a pediatric label for children with localized, non-metastatic solid tumors only. And as can be seen below, this patient group did not exhibit lower rates of survival, as measured by event-free survival (EFS) and overall survival (OS), even while using PEDMARK in conjunction with chemo.

SIOPEL 6: Second PEDMARK Phase 3 Study

The second phase 3 study that FENC ran was called SIOPEL 6. The study was initiated in October 2007, and final results were published in the New England Journal of Medicine in June 2018.

Just as with the COG ACCL0431 trial, the study was open label (unblinded), and patients (116 participants) were randomized to one of two arms. Arm I patients did not receive PEDMARK, while arm II patients received PEDMARK in conjunction with cisplatin. Patients underwent auditory evaluations at baseline, and at the completion of study treatment or at an age of at least 3.5 years in order to measure any ototoxicity and hearing impairment. After completion of the study, patients were followed periodically for at least 5 years.

In contrast with the COG ACCL0431 study, the SIOPEL 6 study only enrolled patients afflicted by standard risk hepatoblastoma (SR-HB), which is a type of cancer confined to three sectors of the liver.

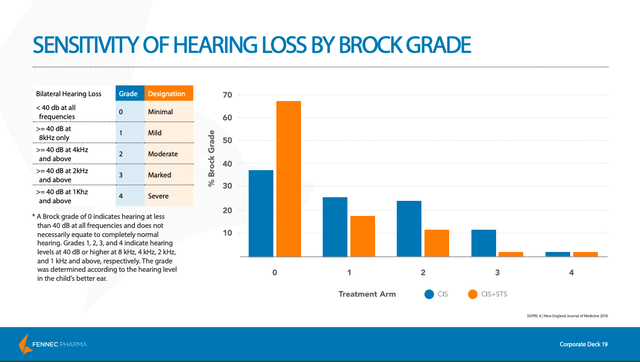

Here, the primary endpoint was the absolute hearing threshold, as measured by pure-tone audiometry and graded by Brock criteria, at a minimum age of 3.5 years (a Brock grade is used to quantify the amount of hearing loss). The Brock grade was measured using the hearing level in the child’s better ear. The best score, a Brock grade of 0, indicates minimal hearing loss (though not necessarily perfect hearing). As we can see below, the PEDMARK (STS) group had a much higher percentage of children that received a Brock grade of 0 as compared with the non-PEDMARK group.

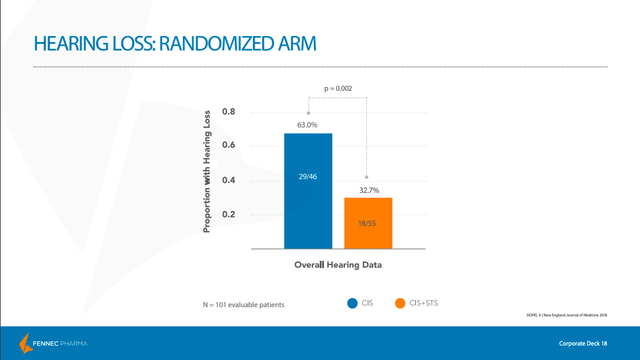

Just as we saw with the COG ACCL0431 study, the results with respect to hearing loss were overwhelmingly positive for the 101 patients evaluated, with the study meeting its primary endpoint.

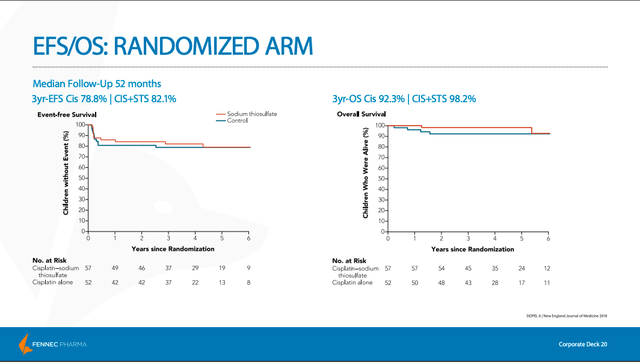

The SIOPEL 6 study also wanted to provide further evidence that PEDMARK does not offer tumor protection. As we can see by the similar survival rates after years of follow-up, the study confirmed that PEDMARK did not interfere with the cancer-fighting properties of chemotherapy.

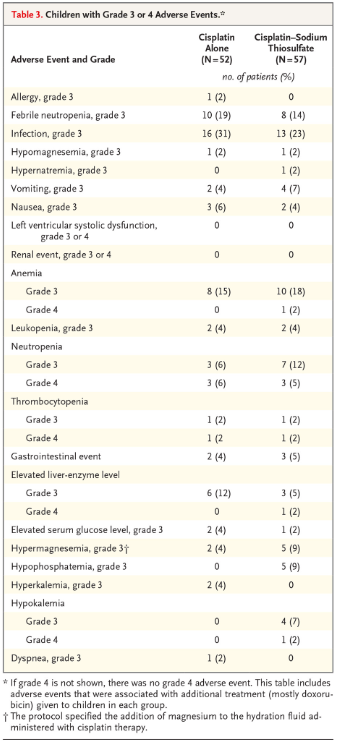

In terms of safety side effects, PEDMARK was generally well-tolerated. However, some grade 3 and 4 AEs did see higher rates of incidence in the treatment group compared with the control group.

New England Journal Of Medicine, June 2018

Of the total 68 SAEs reported, there were sixteen serious adverse reactions. Of these sixteen, half were determined by the investigator as being possibly, probably, or definitely related to PEDMARK. This included grade three infections in two children, grade three neutropenia in two children, grade three anemia leading to transfusion in one child, and tumor progression in two children.

As with the first phase three trial, the investigators concluded that the administration of PEDMARK to pediatric patients with localized hepatoblastoma led to a significantly lower incidence of cisplatin-induced hearing loss. Importantly, no evidence of tumor protection was seen. And while the safety profile of the drug is not perfect, I think the results across the two phase 3 trials show that PEDMARK offers an acceptable risk/reward tradeoff for potential hearing-loss patients.

It does need to be mentioned that neither of their phase 3 trials were blinded, and this can concern biotech investors. The placebo effect is certainly real, and needs to be considered. However, with an objective endpoint such as hearing loss, the lack of blinded studies is not as much of a concern as it normally would be. And judging by the positive reaction of the stock each time phase 3 results were announced, the market also feels that the results of the unblinded studies are meaningful and will add value to the standard of care.

Liquidity

On August 22, FENC announced results for the second quarter, which ended on June 30. They only had cash and cash equivalents of about $15M, with a quarterly cash burn of about $5M. However, on August 1 they had announced a potential investment of up to $45M in convertible notes from Petrichor Health Care Management (see details here). An initial $5M was already funded upon the closing of the transaction, which brings their cash balance to about $20M. Another $20M became available upon FDA approval of PEDMARK, and finally, up to $20M more will become available to be drawn upon until December 31, 2023.

The initial $5M tranche is convertible at the Initial Conversion Price of $8.11/share, which represented a 20% premium to the 5-day volume-weighted average price (VWAP) of the company’s shares as traded immediately prior to the announcement.

The Notes will accrue interest at a rate equal to the greater of A) US Prime Rate (currently 6.25%) or B) 3.5% plus the applicable margin of 4.5% on the outstanding balance of the Notes. Also, for the first twenty-four months following the closing, interest equal to 3.5% on the outstanding balance of the Notes will be paid-in-kind.

The second and third tranches can be converted into shares of common stock at a conversion price equal to a 20% premium to the 5-day VWAP of the company’s common shares as traded prior to the second closing trigger (i.e. PEDMARK FDA approval). This second and third tranche conversion price is capped at 150% of the initial conversion price of $8.11/share, which equates to a max conversion price of $12.17/share.

If the full $45M from Petrichor is drawn upon, it will result in some dilution to existing shareholders. However, I see it as a positive that FENC has financing in place to ramp up commercialization of PEDMARK. The stock has held steady since the Petrichor announcement was made. Given that clinical stage biotechs can easily drop 30%+ on the news of heavily dilutive stock offerings, I think the market also feels that the terms of this financing are acceptable.

Conclusion

At the moment, the competitive landscape is favorable to FENC. There are no other FDA-approved therapies for this indication, and competitors are a bit farther behind trial-wise. Now that PEDMARK has been given the green light, FENC’s Orphan Drug designation should give it 7.5 years of market exclusivity in the US (barring no other drug proves itself to be materially better during that time period). Also, approval in the EU is currently under review by the European Medicines Agency (EMA).

I think PEDMARK is a compelling drug option for pediatric cancer patients at risk of suffering from ototoxicity. I think it will see strong uptake in the US, and eventually in the EU as well (assuming approval). With a market cap of only $216M (as of close on October 21), there is plenty of upside left to go. I think FENC is a Buy.

Be the first to comment