Spencer Platt

Thesis

FedEx shares are trading 18% below the company’s recent highs and this could be an opportunity to scoop up shares of this household name on the cheap. Investors have recently turned negative on the company’s outlook given the increasing fuel and labor costs, independent contractors publicly voicing their frustration with the company and the softening economic outlook. This is on top of the fact that the company has long been seen as a low margin capital intensive business, with a history of making poor acquisitions and being family controlled.

However, despite all these headwinds, the current price is just too cheap to ignore as FedEx is an exceptionally good business. It has a network that is extremely hard to replicate and the business is moving towards a capex light model. In addition, the company has an opportunity to make some substantial savings from optimizing operations. The management team’s confidence in the business is reflected by the recent aggressive 2025 targets that the company has set itself.

FedEx Overview

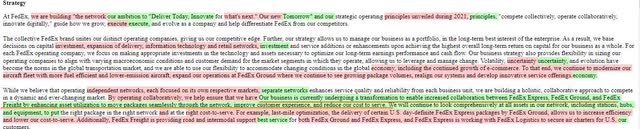

FedEx shares are 18% below their recent peak. This is despite the aggressive guidance the company provided at the investor day in June 2022. The company expects EPS to grow by 14% to 19% per year until 2025. The stock is currently trading at a trailing PE ratio of 10.8x. If the management team is able to hit the target they set themselves, then the stock offers a unique opportunity to own a business that is growing fast, with a strong market position, trading at a PE that is significantly lower than the average S&P 500 PE of 23.2x.

Fiscal 2025 Financial Targets (Comp Pres)

Long-Term Risks

Capital Intensive Business

FedEx has been a capital-intensive business since it was started by Frederick Smith in 1971. The founder was a pioneer in using aircraft to deliver packages, using the hub and spoke model. Packages today are flown to the company’s main hubs in Memphis and Indianapolis, sorted, and sent out for delivery to arrive at a specific time. The FedEx ground operation was started in 1998 and delivers packages which are specified by the day that it is delivered, using largely ground transportation. FedEx also has a large freight business that transports bulk packages. Finally, the FedEx Services segment includes FedEx Dataworks, FedEx Office and FedEx Logistics. Most of FedEx’ businesses are very capital intensive and have traditionally been a drag on the stocks.

Competitive Industry

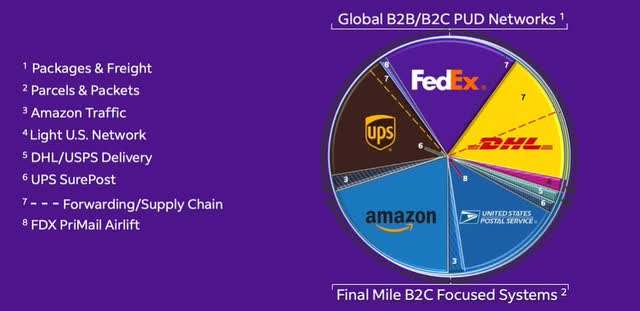

FedEx operates in a capital intensive but also competitive sector. The company’s peers are United Parcel Service (UPS), United States Postal Services (OTCPK:USPS), DHL (DPW.DE) (which is 20% owned by the German government) and Amazon (AMZN).

Market Share Overview (Comp Pres)

Over the last few decades FedEx has been able to grow despite facing competition from the USPS, which has not made a profit in many years. The other competitor that has emerged in recent years is Amazon. For an industry that thought it was almost impossible for new entrants to gain market share, Amazon has shown that it can be done.

However, Amazon’s distribution system is different to that of FedEx. Amazon’s distribution system is more like a retailer with inventory management as shipping of a package across the country for a third party is not currently possible with their network. However, this can and might be changing. FedEx noted, for the first time, in the latest 10-K that Amazon wants to offer their distribution capabilities to third parties. Clearly, they are keeping an eye on them.

Note for 10-K comparison extracts: The green highlighted wording has newly been added to the latest 10-K, the red highlighted wording has been removed in the latest 10-K and the unhighlighted wording has not changed between versions.

It must be noted that Amazon’s retail business has for years been funded through the success of Amazon Web Services and it will be interesting to see if the distribution business is profitable as a standalone business.

History of Making Poor Acquisitions

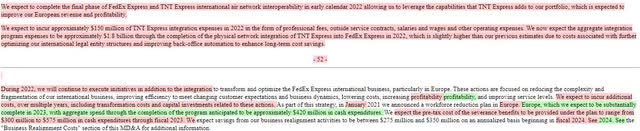

FedEx’s fast growth over the decades has in part been fueled by acquisitions. The most recent being the TNT acquisition in 2016. TNT has enabled FedEx to enter the European market. However, the integration costs have been increasing year on year and was expected to reach $1.8 billion last year, when it was meant to be completed. However, in this year’s 10-K the company says that they expect the integration to be completed only in FY 2023 and the company is expecting to incur an additional $420 million of cash expenditure. The company’s seemingly inability to complete the integration is clearly a headwind for FedEx.

2023 Outlook and TNT Costs (10K)

Family Controlled

The founder, Fred Smith, is a fantastic operator, one of the best businessmen of his generation and is an extraordinary asset to the company. When FedEx started the Ground operations 1998, the company had a 10% market share compared to UPS’s 70%. Today FedEx trails UPS’s market share by only 12%.

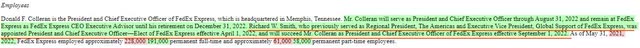

Fred Smith’s 8% ownership stake per the latest proxy filing makes him the largest shareholder of the company. His ownership and family involvement has led investors to see the company as a family controlled company. Fred Smith’s son, Richard Smith, has a prominent role at the company and was appointed as CEO of the Express segment starting September 2022.

Richard Smith Appointment (10K)

The family is involved in a number of activities and in the FY2021 10-K it was noted that Fred Smith sold his 10% ownership of the Washington DC football team. Clearly the benefit of having Fred Smith at the helm comes with some elements that makes FedEx different from other corporations. Something that investors should continue to be mindful of.

Related Party Transaction (10K)

Short Term Risks

More recently the volatile economic and geopolitical landscape has had repercussions for the company too.

Rising Input Costs

The shipping company’s costs are expected to increase as fuel prices rise. Fuel costs have been between 2.5% and 4.1% of the company’s revenue since 2018. The company is also a very large employer and the recent wage inflation will provide added cost pressure. The company has however historically been good at offsetting increases in costs by implementing surcharges. The surcharges can be for higher labor costs during the peak November and December holiday season or for an increase in fuel prices. The company revealed in the latest 10-K that instead of being a profit drag, the higher fuel prices was in fact a benefit for the company, as price increases from surcharges outpaced the increase in fuel costs.

Independent Contractors Complaints

The FedEx Ground segment contracts with 6,0000 independent service providers that complete the last mile delivery for the segment. The use of independent contractors enables FedEx to scale up and down quickly, as volumes change, through this capital light model.

However, recently independent contractors have been complaining about FedEx’s shipping forecasts, higher costs of fuel, wages and vehicle maintenance. Contractors have said they should receive a larger chunk of the fuel surcharge and some have abandoned their routes after protracted losses.

These complaints will make it harder for FedEx to recruit future contractors, limiting the business ability to grow. In addition, the public stance of the contractors and the negative headlines is headwind for the stock.

Risks Factors Added to the Latest 10-K

The company’s aggressive targets for 2025, that includes an increase in EPS of 14% to 19% per year, runs a real risk of not being achieved. The company has for many years aimed to increase operating margins to 10% and some analysts seemed skeptical about the targets being met at the investor day. The company recognizes that meeting the targets is a real risk and in the latest 10-K inserted a new risk factor pertaining to the new goals not being achieved.

New Risk Factor on Goals (10K)

Outlook

However, despite all these headwinds, the current price is just too cheap to ignore as FedEx is an exceptionally good business. It has a network that is extremely hard to replicate and the company is moving towards a capital light model. In addition, the company has an opportunity to make some substantial savings from optimizing operations and overlapping networks.

Valuable Network

FedEx has an extraordinarily strong worldwide network that has been built for many years. This network is hard to replicate and represent a Warren Buffett type moat. There have been many attempts by new players to enter the market.

In the 1990s, there were a number of companies that tried to replicate FedEx’s hub and spoke model, however the majority of these companies disappeared. Similarly, DHL tried and failed to compete with FedEx and UPS in the US market and exited the business in 2008, with a $3.8 billion write-off.

Good Long-Term Industry Dynamics

The most recent change that the industry has undergone has been the significant increase in e-commerce volumes over the last 4-5 years. This growth is expected to continue and FedEx expects the current 57 million pieces a day, outside of the Amazon volume, to increase to 67 million pieces by 2025.

Over the past decade FedEx Ground has been growing at 8.5% compared with the Express segment growing at 0.5%. FedEx believes that e-commerce will account for 90% of the future growth. To accommodate the expected increase in Ground volumes, FedEx has added 73 facilities over the last three years, building out regional networks and adding 17 regional sorting facilities. The smaller facilities are more cost-effective to operate, and they provide overnight services for key e-commerce shoppers.

The e-commerce growth has increased above trend during the pandemic and the rate of growth is expected to slow in the short term. However, over the long-term FedEx is well positioned to help deliver more residential packages.

Integrating the Businesses

FedEx originally started as an air cargo business, adding ground and other businesses later. This resulted in separate networks that served different customer services. These segments and their overlapping networks have grown to such an extent that these are now a drag on the operations of the company and are sub-optimal in their current configuration. The company is in the process of integrating these three networks as they pointed out in the latest 10-K.

Strategy to Integrate Networks (10K)

Management has indicated that the Ground segment will largely be incorporating the Express segment into its facilities. This makes sense as the company expects most of the future growth to come via the Ground segment. Changes to be made include updating Ground facilities to handle air freight containers. The combination of the businesses won’t be easy and could take a long time and is expected to cost $2 billion over a 5 year period. Ultimately the company expects to save between $3 to $4.5 billion dollars by 2025.

FY 2025 Targets (Comp Pres)

The savings are expected to come from reducing routes by 10%, removing 100 stations and increasing linehaul efficiency between networks. Other profit improvements should come from the European business. Finally, the lower cost due to the completion of the fleet modernization program will also result in cost savings.

Capex-Light Business Model

The integration of the segments will also result in a lower need for high capex spending on aircraft and the ability to sweat existing assets more. At the recent investor day management was noticeably clear that they will be focusing on more capital light growth going forward. The company expects capital intensity (capex divided by revenue) to go down from the historical figure 8% to 6.5% by 2025. In addition, in the latest 10-K strategy section the company removed prior year references to capital spending on aircraft and facilities.

Strategy to Removed Focus on Capex Spending (10K)

The lower capex spend will be aided by the completion of the aircraft modernization program, the completion of the Memphis and Indianapolis express facility modernization programs and lower capacity investments in the Ground segment.

These moves are encouraging as the high capex spending has been a drag on the company’s ability to pay out dividends and repurchase shares. The return of capital to shareholders should be a priority for this investment grade rated business. It is encouraging that the company added the expected buyback for 2023 in the latest 10-K.

Valuation

The adjusted EPS for 2022 was $20.61. The current share price is $222, resulting in a trailing PE ratio of 10.8x. The company’s guidance is for EPS to grow between 14% and 19% until 2025. If we assume the midpoint of 16.5% EPS growth is achieved, this will result in a 2025 EPS of $32.60, or a 2025 P/E multiple of 6.8x.

Assuming a long-term growth rate for FedEx of 5%, and a 10% discount rate, and a 2025 EPS of $32.60 as calculated above. I calculate a valuation of near $500 per share for FedEx, far above the current stock price of $220. The stock is at the moment giving you a 10% earnings yield and pricing-in no future growth.

Conclusion

FedEx shares are trading 18% below the company’s recent highs and this could be an opportunity to scoop up shares of this household name on the cheap. Investors have recently turned negative on the company’s outlook given the increasing fuel and labor costs, independent contractors publicly voicing their frustration with the company and the softening economic outlook. This is on top of the fact that the company has long been seen as a low margin capital intensive business, with a history of making poor acquisitions and being family controlled.

However, despite all these headwinds, the current price is just too cheap to ignore as FedEx is an exceptionally good business. It has a network that is extremely hard to replicate and business is moving towards a much more capital light model. In addition, the company has an opportunity to make some substantial savings from optimizing operations. The management team’s confidence in the business is backed up by the recent aggressive 2025 targets that the company has set itself.

Be the first to comment