choness

Since 2020, the Federal Reserve has pumped trillions of dollars into the financial markets. Much use was made of these monies as debt loads expanded and new uses for funds were found all over the place.

In 2022, as the Federal Reserve began to raise its policy rate of interest and as it began to reduce the size of its securities portfolio, the flow of funds went into a reversal, financially threatening many of the investors and organizations that had benefited from the Fed’s largess.

But, now look at what is happening in the venture capital world.

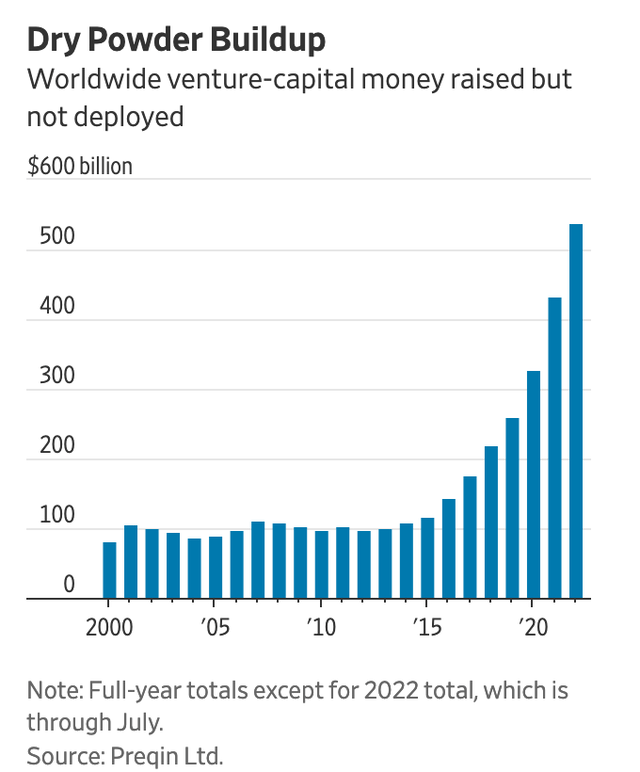

Venture Capitla Funds Raised But Not Deployed (Wall Street Journal)

Note: This is cash sitting on the balance sheets of venture capital funds.

Note also, that this cache of funds began to accelerate in size in 2016 and has not slowed down since.

Furthermore, note that for 2022, the figure is for only one-half of the year.

Venture capital firms have increased their cash balances by more than $100 billion worldwide since the end of last year, reaching almost $539 billion in July.

“Through the first half in the U.S., venture firms raised nearly 90 percent of the amount they raised all of last year… Large funds, in particular, helped propel the increase,” Marc Vartabedian and Berber Jin wrote in the Wall Street Journal.

Why is this buildup occurring?

Well, the word on the Street is that investors remain bullish for the future for the work that the venture firms will do, but that for the time being the high rates of inflation and the rising interest rates pose a concern.

Right now, there the deal flow has lessened and the word on the street is patience.

And, this is what the VCs are doing, being patient.

In the second quarter of this year, firms made only 3,374.

This number was down 24 percent from the prior quarter.

Going Forward

The picture drawn from these data is that the venture world will slow down even further this year and make sure that existing investments have the funds they need to adjust and survive into the future.

It is felt that there will be few initial public offerings and the main purpose the venture funds will serve is to keep the “good performers” supplied with what they need during this time, but don’t extend your reach at a time when there is great uncertainty.

There is another line of thought going through the industry. This train of thought focuses upon the possibility that the United States economy…and, in reality, the global economy, is facing a transformation into a “new” Age.

This “Age” is one in which the focus will be on the growth and spread of information. In other words, intellectual capital will be the driving force going forward.

This transformation will impact almost all areas of the economy and result in the building of platforms and networks that spread throughout the world.

One of the very important aspects of this transformation is that there will not be the “physical” ups and downs of the world as occurred in the era of manufacturing and industry.

The transformations will take place at a more continuous pace.

The world will be different.

Right now, we are having the debate about how severe the coming recession might be. Some analysts see a substantial drop-off because of all the markets that are in disequilibrium. Others think the adjustment may not be so severe.

Those that think the world is moving to the next “Age” see the transition being dominated by flows in the information space, and this, not being as tangible as the physical world of the manufacturing world, will not be as severe as has been the historical pattern.

I believe that the venture capital world see this “new” Age coming on and wants to be prepared to play a large role in the transition.

They are stockpiling their resources to take advantage of the “tech’ based acceleration coming up sometime in the relatively near future.

The “Information” Age

I truly believe that the venture capital world is a very, very important space to watch in the near future.

Venture capitalists are watching and setting aside monies to play a big role in this future.

Again, to me, I think the buildup of cash on the balance sheets of Venture Capital firms is intentional, and, I believe, that these organizations will continue to build up their resources.

To get into the game at the start of the “new” Age will produce major results, not only financially, but also in terms of “being there” when the “new” Age takes off.

Furthermore, these cash balances on the balance sheets of venture capital firms cannot be touched by the Federal Reserve as it works to beat down inflation and get the economy in some better shape.

In fact, the venture capital firms will be in even better relative shape in the economy if the Fed does tighten up on monetary policy and drives interest rates just that much higher.

These cash balances could be a major force in driving the “new” Age into its next phase.

Here, the venture capital industry could very much be in the right spot at exactly the right time.

They are certainly worth watching.

Be the first to comment