Win McNamee

It’s a tale of two recessions. Some Wall Street research firms call for at least two consecutive quarters of negative GDP growth, a so-called “technical recession,” between this year and next, but the National Bureau of Economic Research (NBER) will make the ultimate call. NBER takes a different approach. That group will review economic data, namely employment changes, after the fact to determine if the U.S. economy indeed contracted – NBER pays little attention to the “rule of thumb” technical recession concept.

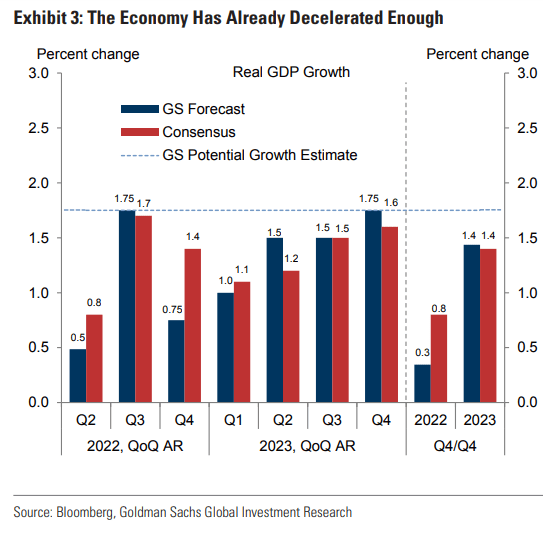

Right now, the consensus forecast reveals a major GDP growth rate slowdown, according to Goldman Sachs.

GDP Growth Rate Outlook: Below Trend

Goldman Sachs Investment Research

Meanwhile, inflation is still running exceptionally high. June’s 9.1% headline CPI advance from the year prior is unmistakable evidence that the Fed is behind the curve. The upshot is that significantly lower commodity prices, falling shipping rates, and inventory growth among retailers are clues that inflation might have topped out.

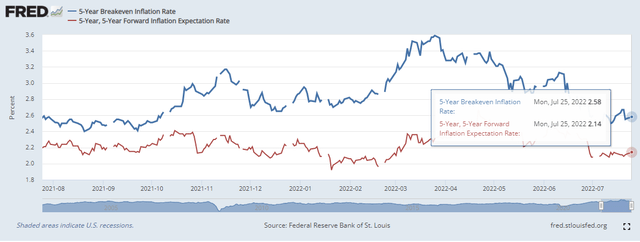

Inflation expectations, as measured by the difference between the yield on TIPS and comparable-maturity Treasures, have retreated. Five-year inflation is expected to be 2.58% while the rate over the five-to-10-year period (the “5y5y”) is slightly under 2.2%, according to data from the St. Louis Federal Reserve.

Inflation Expectations Are Off The Highs

To put a bow on it, the market might have done a lot of the Fed’s dirty work for them now that growth expectations are low, but not in recession-territory (yet) while inflation expectations have declined meaningfully. Moreover, an extraordinarily strong U.S. dollar might have partially bailed out the Fed. A strong greenback stymies net exports to help settle the economy and inflation, all else equal.

U.S. Dollar Index Near 20-Year Highs

Growth and inflation. Those are the two key economic barometers the Fed looks to when determining its interest rate policy and open market operations. With seemingly little fanfare of quantitative tightening beginning last month, all eyes are on the Effective Fed Funds Target Rate.

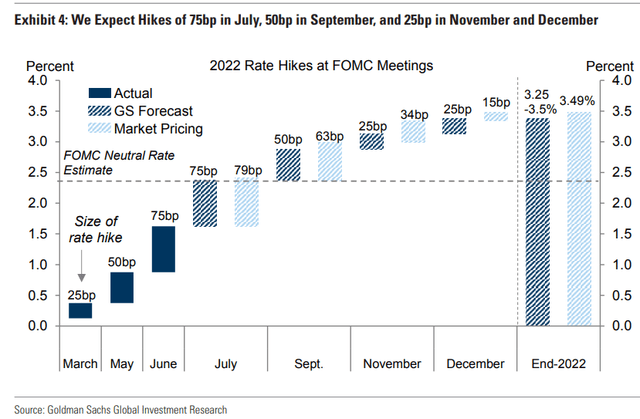

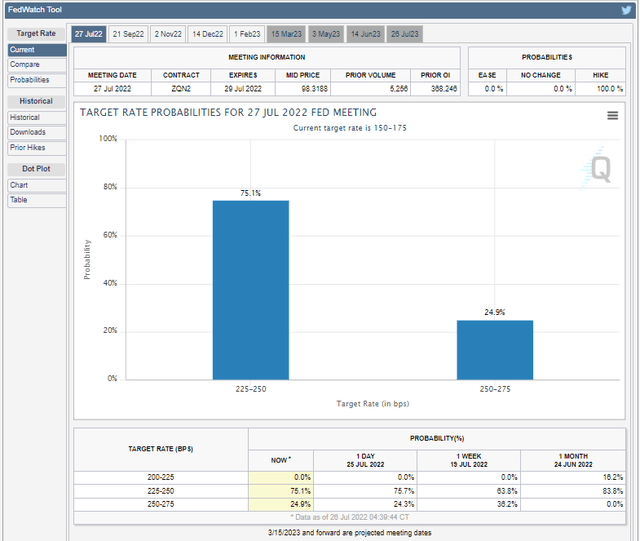

The FOMC’s two-day meeting culminates in a widely expected 0.75 percentage point hike to be announced Wednesday afternoon. There is a material chance that Chair Powell could announce a whopping 100 basis point increase, according to Fed Funds futures.

A 0.75% Hike Expected Wednesday Afternoon, But 1% On The Table

With recession fears mounting, traders have reined in their previous outlook for a very hawkish FOMC. In fact, traders now see monetary policy turning looser in 2023 via rate cuts. Between now and then, though, economists at Goldman Sachs see the Fed hitting a target range of 3.25% to 3.5%, slightly below market pricing at year-end.

75-50-25-25?

Goldman Sachs Investment Research

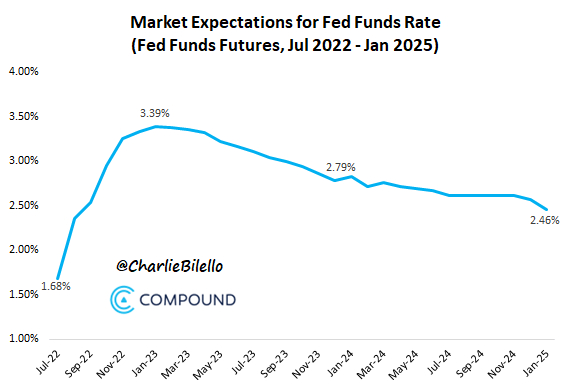

Further out, according to data gathered by Charlie Bilello, the Effective Fed Funds Rate is seen as falling throughout 2023 and 2024 as anemic GDP growth tames inflation risks.

Higher Rates, Then Lower Rates

Charlie Bilello

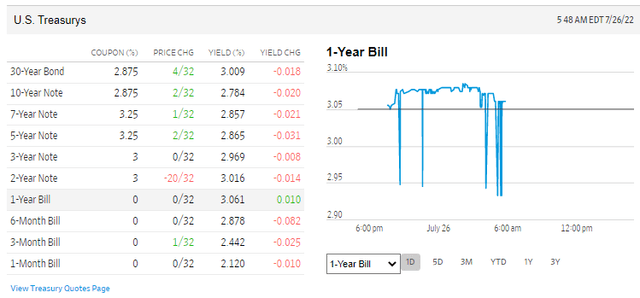

Heading into the Fed’s decision Wednesday afternoon, Treasury rates are off their mid-June highs. The one-year yield is more than five basis points higher than the 30-year bond rate. Soon, we might see ultra-short-term Treasury yields above long-term bond rates.

An Inverted Treasury Yield Curve

For a while, I have been preaching the benefits of owning something like the iShares 1-3 Year Treasury Bond ETF (SHY). That play has worked well over the last three months with short-term rates hovering near 3%. With the policy rate climbing to around 2.5% this week, owning an even shorter-term Treasury fund could be the prudent move.

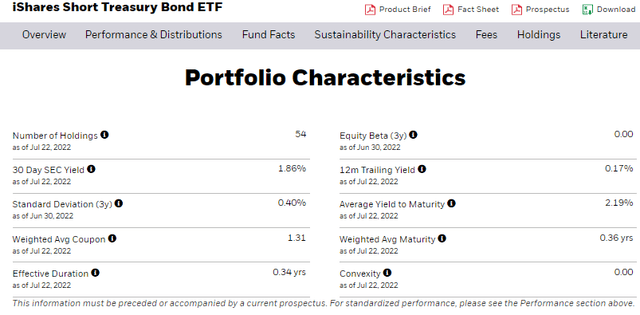

Enter: SHV. The iShares Short Treasury Bond ETF (NASDAQ:SHV) has an effective duration of just 0.34%, according to iShares. So, there’s very little interest rate risk. SHY, in contrast, inches out on the interest rate risk curve with a 1.84 effective duration. I expect the yield to maturity on SHV to rise above 2.5% later this month after the Fed’s move and then above 3% by the end of 2022.

SHV: The Play On A High Fed Funds Rate

The Bottom Line

The market sees a 75% chance of a 0.75 percentage point rise in the Fed Funds rate this week, but there’s a one-in-four possibility of a full percentage point hike. The Fed’s statement will be critical to parse through to find how the Fed sees growth and inflation playing out in the months ahead. With recession fears on the rise and clear signs of easing inflation, traders see the policy rate falling in 2023.

Be the first to comment