CIPhotos

Fate Therapeutics (NASDAQ:FATE) is a leading developer of therapies using induced pluripotent stem cells or iPSCs. Fate develops allogeneic (off-the-shelf) NK cell therapy and CAR-Ts using small molecules which convert normal adult cells to iPSCs, which can then create any type of new human cells, including immune cells. This technology was developed at the Scripps Institute and is licensed to Fate.

Back in 2009, Fate’s scientific founder Dr. Sheng Ding, Ph.D. used recombinant proteins to generate iPSCs using non-viral, non-DNA-based reprogramming methods. A few months later, using a combination of small molecules, Dr. Ding generated iPSCs – a method that significantly improved the speed and efficiency of reprogramming.

“The discoveries, which were made by Sheng Ding, Ph.D., under a research collaboration between Fate Therapeutics and The Scripps Research Institute (‘TSRI), represent a more than 200 fold improvement in reprogramming efficiency and reduce the reprogramming period to two weeks as compared to methods using only the four [genetic] reprogramming factors (Oct 3/4, Sox2, Klf4 and c-Myc).”

Among these small molecules is Thiazovivin, a Rho-associated kinase (‘ROCK) inhibitor. The research, cited above, was published in Nature Methods – here. The other two molecules, which were previously discovered, were SB431542 and PD0325901.

“Thiazovivin, as well as compositions and cell culture media comprising Thiazovivin, are patented under U.S. Patent No. 8,044,201 entitled “Stem Cell Cultures,” to which Fate Therapeutics holds an exclusive license from TSRI in all commercial fields.”

For a thorough understanding of stem cell biology and the role of small molecules, read this reference by Dr. Sheng Ding. To be noted, much of the early founders and BoD – well-known names in the stem cell field – are now gone, but they have been replaced by other well-known academics.

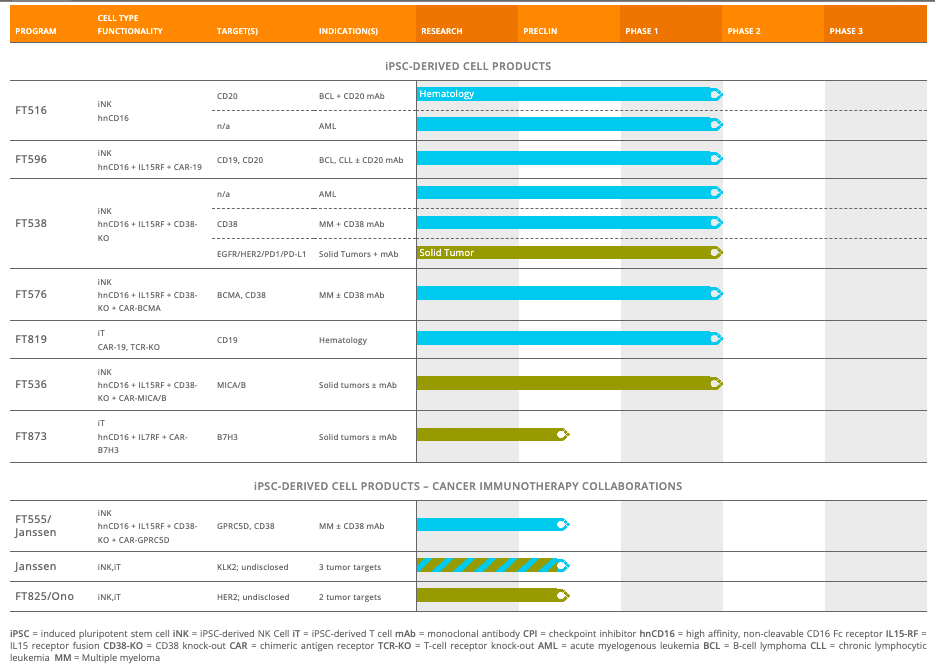

Despite all that science, though, Fate hasn’t done too well. It has multiple programs, but after nearly two decades in existence, the company’s latest stage trials are all in phase 1. One reason for that is that for the first few years of existence, the company pursued a product called ProHema in umbilical cord blood HCT patients. In 2015, they discontinued this product. There was another product called ProTmune, which even got some coverage in Nature. However, that product does not exist in the current pipeline, either. It appears, therefore, that the company went through a number of cycles where it tested a product, found it wanting, and then went for another product. This is why it still has its entire pipeline in phase 1 trials:

Fate Pipeline (Fate Therapeutics website)

The company has presented data from some of these assets. In an earlier piece, I discussed some of the sources of delay in their progress to registration:

Durability of response does not need to become an issue if multiple doses can be given. I think, however, that the company will need to explore how long and at what cost – financial and health-wise – multiple doses can be given to patients. That will be a drawn-out process. They will also need to process the therapeutic differences between a one-time higher dose like 900 million cells here versus the two smaller doses of 90 and 300 million cells given here. That’s a lot of work up ahead before a complete registrational filing can be done.

So, Fate needs to explore durability and repeat dosings, and it needs to explore multiple small dosings versus single large dosing. This will take further research, delaying their process.

Exactly a year ago, the company presented data in solid tumors from FT516 and FT500. FT500 has been quietly removed from the pipeline after pretty poor data, although the page still exists on their website, minus a presence in the site menu. According to Evaluate, “Fate called FT500 and FT516 “pilot programmes” that “started the journey”, and its focus is switching to FT538, an NK construct with additional CD38 knockout.” FT516 still remains on top of their pipeline, but its data was also quite poor, with only “one PR in nine.” FT538 does have most trials ongoing right now – 3 single phase trials, one of them in solid tumors – but once again, everything is so early stage. FT596 produced good data last year, which I discussed earlier. However, the company was overvalued at $9bn last year, and even after this data and a reduction of valuation to $2.23bn, the company still doesn’t instill confidence. And the single reason for that – a lack of orientation towards commercialization. Fate still looks like an academic-oriented R&D company, which thinks it has the leverage to keep changing its pipeline; unfortunately, it doesn’t. The market will only accept so much of trial and error before it wants to see a marketable product.

Financials and other stuff

FATE has a market cap of $2.23bn and a cash balance of $519mn as of the previous quarter. Research and development expenses were $79.8 million for the third quarter of 2022, while general and administrative expenses were $21.6mn. The company earned $15mn in revenue, mainly from its Ono (OTCPK:OPHLF) and Janssen collaborations. At this rate of expenses, the company has a cash runway of 5 quarters.

Just last week, Fate’s partner Ono announced that it is exercising its option for HER2-targeting CAR-T cell therapy called FT825/ONO-8250. The two partners will co-develop and co-commercialize the product in the US and EU, and Ono will do the work in RoW. Fate will be eligible for milestone payments and tiered royalties on ex-US and ex-Europe sales.

This year, Fate has the following two catalysts:

According to Wells Fargo, data expected in November for FATE’s cancer immunotherapies FT536/ FT538 in solid tumors…

…updates on FT538 and FT516/596 in liquid tumors such as acute myeloid leukemia and B cell lymphoma…

Bottom line

So what’s my take on Fate? Like it says on its corporate deck, Fate really has a disruptive technology platform. That’s one. Two, they have produced some poor data, but they have also produced some pretty solid data. Three, they have half a billion dollars in cash and ST. Put all these together, and Fate looks solid. On the risk side, it has 15 years of existence and just phase 1 data to show for it. The stock has tanked to less than a third of its value in the last 12 months. Its pivotal catalysts are nowhere near the horizon. Put all of that together, and you get a risky investment, where a small pilot may be warranted, with further investments as the company puts out more data.

Be the first to comment