Rouzes/E+ via Getty Images

FAT Brands Inc. (NASDAQ:FAT) is an American restaurant franchisor that is attractive on a number of points for value investors. It has a small market cap of $119.31 million and a stock price of only $7.34, its top-line growth has skyrocketed over the last four quarters, there is a steep upward trend in the number of restaurants opening and it has broadened its multi-brand offering with a remarkable investment of over $900 million in acquisition deals over the last year. However, can we trust a company that invests heavily into its business by leveraging itself, lending incredibly large amounts of money, to safely pay back the loans without risking default? With so many new, compatible and global brands under its belt to offer to existing and new franchisees, I believe that investors may want to take a bullish stance on this company because of the immense growth potential for this asset-light business in the next year. Nevertheless, the negative earnings, high level of debt, and risk of negative cash flow cannot be ignored in addition to the uncertainty around the US Attorney investigation into the CEO’s private financing currently taking place.

Company Overview

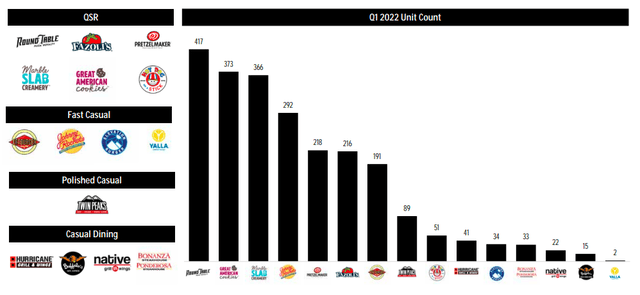

FAT is an American company that now owns seventeen restaurant brands globally in four segments that are all connected to delivering food quickly and/or casually. Seven of these brands have been acquired only since July 2021.

FAT Brands Portfolio (FAT Brands Investor Presentation 2022)

95% of the business is built on its franchise business model, it also runs a small number of wholly-owned restaurants. The company generates revenue from the first franchise fee, which can be anywhere between $0 and $50,000 per store, followed by recurring operating royalties, between 0.75% and 7.00%, in addition to advertising fees based on franchisee sales. This allows it to be asset-light, while benefiting from good profit margins and positive free cash flow. In return for royalty fees, franchisees are provided with growth potential through its large offering of compatible premium and diverse restaurant brands that can be cross-sold and of course the benefits of cost-saving synergies from streamlining and merging processes across the brands.

FAT was set up as a holding company in 2017 for Fatburger, which went from bankrupt in 2009 to a now thriving brand found across the globe. Focusing on international locations rather than purely on the highly competitive USA market was part of the reason for its revival. Since its IPO in 2017 Fat Brands has not stopped making big moves on the growth and acquisition front. In 2020 it acquired Johnny Rockets, a burger chain, at a price of $25 million. In July 2021 FAT acquired the Global Franchise Group which is strategically built up of five different food category brands allowing IT to broaden its offerings for franchisees with the following diverse sweet and savoury food options: Great American Cookies, Hot Dog on a Stick, Marble Slab Creamery, Pretzelmaker, Round Table Pizza.

Brands acquired from the Global Franchise Group 2021

More recently in October 2021 it acquired Twin Peaks, a sports bar and restaurant chain, for $300 million and most recently in May 2022 it acquired Nestle Toll House Café, a dessert café chain, for an unknown amount. These have broadened the offering possibilities for current and new franchisees which can be delivered to a broader range of customers and meet more of their demands.

Valuation

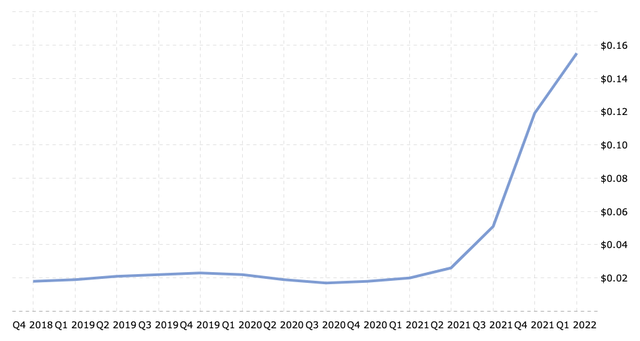

In terms of earnings per share investors have a right to quickly look away from FAT, the company has produced negative EPS for the last nine quarters. Additionally we can see by the high enterprise value to market cap value of 9.411 that it is a risky company to consider with its extremely high debt intake. However this has not stopped FAT from receiving loans and financial backing to aggressively build up its business in a fiercely competitive and fragmented market, especially since 2020. Furthermore, the acquisitions that have taken place have been well received by investors, with stock prices increasing after the various acquisition announcements. Since its IPO in 2017 the stock price has increased by 52.17%, it reached a max price increase of 152% in June 2021. However the price took a sharp drop in February 2022 after it was released that the CEO is under investigation for financial misconduct. Nonetheless over the last month the stock price has increased by 25.86%. This looks promising, especially as the overall stock market trend has been on the decline. The upwards trend could be partly due to strong Q1 revenue results, management addressing legal issues during the Q1 2022 conference call, the company’s confidence in future revenues, a 2022 new acquisition announcement, and visible results of new local and international restaurants opening and performing strongly. The Price to sales ratio, P/S ratio, looking at the company’s market capitalisation divided by its total sales over 12 months is 0.54, this is very low and may indicate that the company is undervalued.

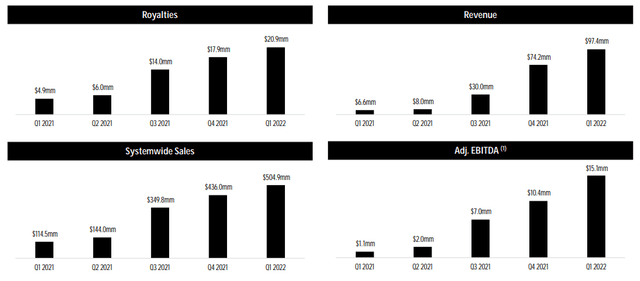

The company has a strong pipeline in place for the rest of the year which management predicts to see a potential incremental EBITDA of $50 million. Costs are reducing as seen by the big jump in gross profits since the major acquisitions in 2021 in the graph below. The company will benefit further from the synergies and economies of scale that can be created across the existing and acquired brands.

FAT Brands Gross Profits (Macrotrends)

FAT, as of Q1 2022, has 761 franchise partners operating over 2360 international locations and there are more than 860 units in the development pipeline, some of which still have to be constructed. Furthermore the company wholly owns 129 restaurants. Total sales growth saw an increase of 341% between Q1 2022 and Q1 2021. Q1 2022 Gross profit is $56.67 million, at a margin of 27.03%

FAT Brands locations (FAT Brands Investor Presentation 2022)

For a company with negative earnings it is very important to establish if the issues are of a temporary rather than a permanent nature. What we see with FAT is that it has been heavily investing into growth through costly acquisitions. This makes me believe that the rest of the year is set on a clear path for increasing revenue numbers with the likelihood of reducing debt and other expenses. Furthermore with rising inflation the company has brought forward the message for franchisees to increase their prices to maintain margins, accordingly FAT’s royalties will increase.

FAT Company Growth Charts (FAT Brands Q1 2022 Investor Presentation)

Risks

Firstly the company does not score well on many of the go-to valuation metrics and a very big flag is its high outstanding indebtedness of $938.2 million as of December 26, 2021. Due to the financing brought in to the company for its acquisitions and operation expenses, the company needs a very large cash flow to cover the leverage. It has strict payments and obligations to meet to avoid a risk of default. There are steep initial and interest payments to be made.

Secondly, the franchise business model is highly dependent on the success of its franchisees for revenue growth. If stores are not running there is a decrease in royalty payments. There is only so much that FAT can control through contract obligations, training and support. Franchisees could negatively impact the business in addition to inaccurately reporting sales. There has to be an ongoing pool of potential suitable new franchisees to recruit from or growth will slow down. Negative brand perception of one franchisee could reduce sales in other restaurants.

Thirdly, COVID-19 forced franchisees to take on one or more of the following actions: they had to close down, reduce in size or minimise their operating hours, and/or change from eat-in to delivery only. COVID-19 made it difficult to hire staff and in many cases restricted supply and added on additional costs. It impacted the company’s growth plan by preventing and creating delays in opening new stores.

Fourthly, a highly competitive retail food industry could have difficulty in the future acquiring new brands or restaurant concepts because of more competing acquisitions, which will accordingly also bring the price up of these types of acquisitions. Competitors are larger, more established and have access to larger portions of capital.

Lastly, there remains uncertainty around the CEO and the US attorney investigations taking place and what impact this may or may not have on the operations of the company. Although the accused denies the allegations, we already saw the drop in stock price it created in February, and therefore can assume the stock price will be sensitive to any further updates.

Future and Conclusions

It is without a doubt risky betting on a company that has not shown positive earnings and more so one that has heavily leveraged itself. However, the business lifecycle is important to take into context. FAT is in a steep growth stage, which we can see with the revenue and gross profit increasing well above the average of not yet profitable companies. The stock price has also positively increased by over 50% since its IPO. Although there are many reasons to remain skeptical of this company, I do believe the reduction in price over the last months has undervalued the company, while on top of that the big acquisitions that have been completed look set to bring in sizeable revenue for the rest of the year. For this reason investors may want to take a cautionary but bullish stance on this high growth company.

Be the first to comment