Steve Jennings

As volatility continues to dominate the market and traders are split on the direction of the major indices next year, there has never been a better time to be a stock picker. In particular, I’d focus my buying on deeply-bashed tech stocks that still have strong fundamental profiles. Valuation multiples have sunk to lows that, in my view, compensate more than enough for any business or macro risk.

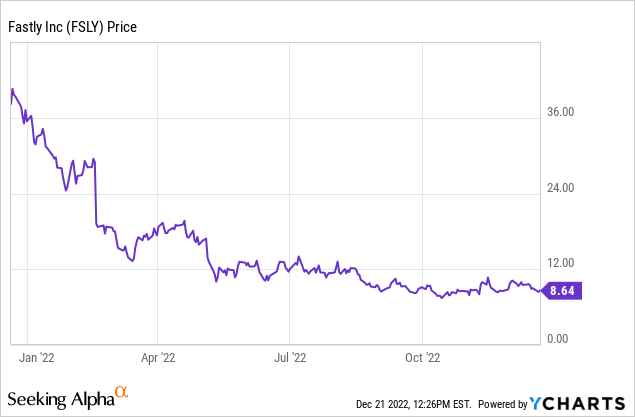

Fastly (NYSE:FSLY), in particular, is a company worth watching. This content delivery platform, which is the service through which websites and other content owners deliver their content to end-users, has seen its share price crumble by more than 75% this year. It’s a good time for opportunistic investors to pick up the pieces:

A lot of bad news is in the rear-view mirror for Fastly. The severe service outage that the company suffered last year is behind us. Growth deceleration and margin pressure have settled in, yes – but expectations for Fastly have also reset a lot lower, with its share price virtually underwater. And a new CEO (Todd Nightingale) with Cisco (CSCO) leadership expertise has taken over the reins, and so far, quarterly results have seemingly gotten a slight boost since Nightingale took the helm.

I remain bullish on Fastly. While it has been frustrating to hold onto this stock during its steep decline this year, I think the combination of A) its improved growth rate to the mid-20s and B) its ultra-low valuation will help Fastly’s rebound outpace tech peers next year.

As a refresher, here is my full bullish thesis for Fastly:

- Fastly’s usage-based business model opens the door to tremendous growth- Fastly, alongside other software/technology peers like Twilio (TWLO), were among the companies that could fully take advantage of the pandemic and the increase in internet traffic that came with it. Because Fastly’s pricing is based on volumes of content delivered, as the underlying customers continue to grow their websites and traffic, Fastly’s revenue will also grow proportionally. Fastly’s net revenue retention rates recently clocked in at 122%, indicating that the average Fastly customer increases their usage by 22% in the following year.

- Greater customer diversification- 2020 caused a big disruption for Fastly when it lost its biggest customer, TikTok. Since then, however, Fastly has proven its “horizontal” nature by landing customers of various industries, and the fact that it is still growing revenue in the mid-20s proves that it has reduced its reliance on single large customers. The company now has a base of approximately 3,000 total customers, with about ~500 enterprise customers between them.

- Best of breed- Though CDN is not a new technology category, with companies like Cloudflare (NET) and Akamai (AKAM) preceding Fastly by several years (and in Akamai’s case, decades), Fastly is one of the most highly regarded CDN vendors. Fastly’s addition of Signal Sciences and its web application firewall (WAF) tools also flesh out Fastly’s offering. The company was also recently recognized as a Challenger by the influential Gartner Magic Quadrant reviewers.

From a valuation perspective: at current share prices just under $9, Fastly trades at a market cap of just $1.04 billion. After we net off the $719.1 million of cash and $704.0 million of debt on the company’s most recent balance sheet, Fastly’s resulting enterprise value is $1.02 billion.

For next fiscal year FY23, meanwhile, Wall Street analysts (data from Yahoo Finance) are expecting Fastly to generate $490.9 million of revenue, representing 15% y/y growth (considering the acceleration to 25% y/y growth in Fastly’s most recent quarter, there may be some upside opportunity to next year’s consensus estimates). Taking consensus at face value, however, Fastly’s resulting valuation is just 2.1x EV/FY23 revenue.

The bottom line here: Fastly remains an incredibly appealing tech stock with greenfield growth potential, aligned to the continued growth of internet content and traffic. Take advantage of the current cheap price to load up.

Q3 download

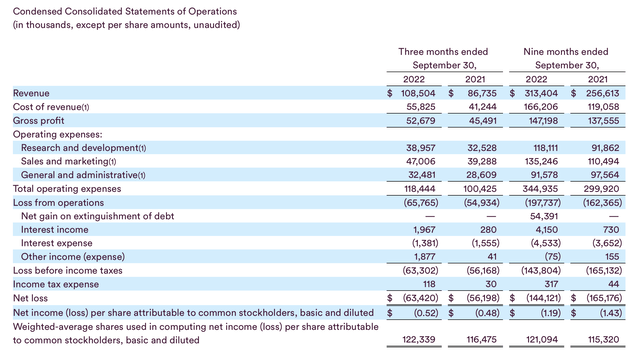

Let’s now go through Fastly’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Fastly Q3 results (Fastly Q3 earnings release)

Fastly’s revenue in Q3 grew 25% y/y to $108.5 million, beating Wall Street’s expectations of $103.7 million (+20% y/y) by a five-point margin. Note as well that the company’s revenue accelerated five points versus 20% y/y growth in Q2, as well as four points over 21% y/y growth in Q1.

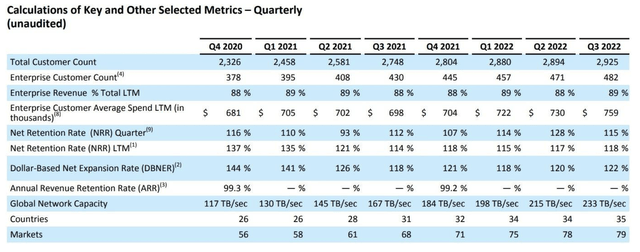

As shown in the chart below, Fastly grew total customers by 31 to end Q4 at 2,925 total customers – an improvement over just 14 net adds in Q2. The company also added 11 new enterprise customers in the quarter, with enterprise customers representing 89% of total trailing twelve-month revenue.

Fastly customer metrics (Fastly Q3 earnings release)

The company also saw net expansion rates tick up by two points to 122%, the highest rate since Q1 of 2021 – indicating strong upsell activity and usage rates by the existing customer base.

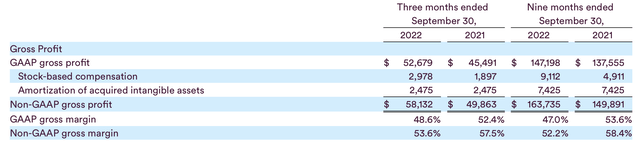

Equally impressive in the quarter was the sequential improvement in pro forma gross margins – which was one of the key targets that Fastly set out at the beginning of the year, and falling in line with the company’s promise that gross margins in the second half of FY22 would lift. Pro forma gross margins of 53.6% in Q3 lifted 320bps from 50.4% in Q2:

Fastly gross margins (Fastly Q3 earnings release)

And per CFO Ronald Kisling’s prepared remarks on the Q3 earnings call, the company expects a further 200bp sequential improvement in Q4:

Our gross margin was 53.6% for the third quarter, compared to 50.4% in the second quarter of 2022. Recall that excluding onetime true-up costs, the gross margin for the second quarter would have been approximately 52%. This sequential improvement in gross margin reflects our prior expectations that it would lift in the second half of 2022.

As we previously discussed, this is due to the discontinuance of site implication expenses in the first half of 2022, improvements in our network investment capacity planning to more closely match our traffic patterns and demand and a focus on reducing the cost of components of our cost of revenue, including in the third quarter, a reduction in our bandwidth cost. As a result, we expect gross margin improvement of roughly 200 basis points in the fourth quarter relative to the third quarter. We do not see any meaningful changes, positive or negative to our pricing in the third quarter as compared to the prior quarter.

I appreciate your patience through this phase of our gross margin volatility. As Todd stated, we will continue to be focused on gross margin improvement and efficiency through 2023 as our planned investment in our next-generation network architecture, ongoing management of network investments in line with respected traffic, continued improvement in efficiency and traffic handling and management of our cost positions us for further gross margin improvements in the medium to long term.”

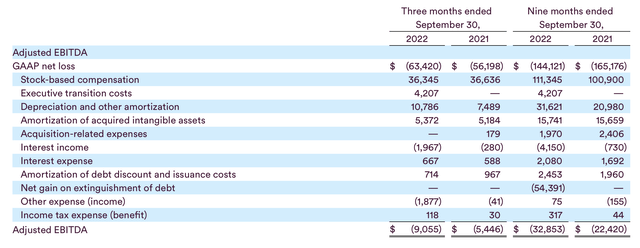

Unfortunately, the company’s investments in sales and marketing – which helped to produce the revenue acceleration we saw this quarter – pulled down the company’s adjusted EBITDA margins, which clocked in at -8.3% this quarter: 200bps worse than -6.3% in the year-ago quarter.

Fastly adjusted EBITDA (Fastly Q3 earnings release)

With expected gross margin lifts in FY23, plus management’s commitment to chasing efficiencies in general and administrative / general corporate overhead spend, we should hopefully start seeing adjusted EBITDA improvements next year as well.

Key takeaways

Accelerating growth rates, line of sight to improving gross margins, and a usage-based business model that has already seen high net expansion rates – there’s a huge case for Fastly to rebound in 2023, especially at its current low ~2x forward revenue valuation. Stay long here.

Be the first to comment