jetcityimage/iStock Editorial via Getty Images

To me, one of the most interesting industrial suppliers on the market is a company called Fastenal Company (NASDAQ:FAST). Over the past several years, management has done well to grow the business at a nice pace. The firm’s innovative business model has helped to push revenue and profits up, with a portion of this driven by vending machines and related offerings. The one bad thing about this firm is that the high quality attracts a lot of investors, leading to a high trading multiple for the enterprise. Even today, with the market having declined recently, shares of the business are still trading at rather lofty multiples. Because of this, while I do believe the firm’s long-term prospects are positive, I have to maintain my ‘hold’ position on the firm. Though depending on what management reports when they reveal financial results covering the first quarter of the company’s 2022 fiscal year on April 13th could change that picture.

Recent developments at Fastenal are revealing

Back in December of last year, I wrote my most recent article about Fastenal. At that time, I extolled the quality of the business, detailing how it is an excellent firm that likely should generate significant amounts of value for investors in the long run. At the same time, however, I acknowledged that shares of the business were rather costly. Even though sales and cash flows were rising at a rapid pace, I could not bring myself to pull the trigger on the business. Fast forward to today, and the company has performed at a level that more or less matches my expectations. While the S&P 500 has resulted in a decline of 4.4%, shareholders in Fastenal would have experienced a loss of 4.9% over the same window of time.

Author – SEC EDGAR Data

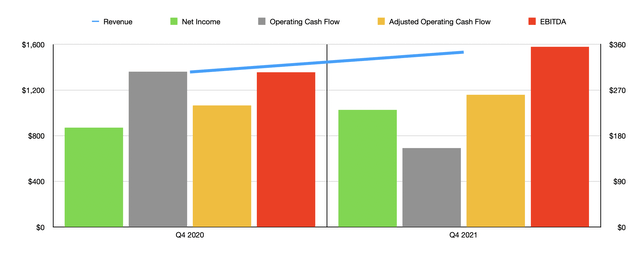

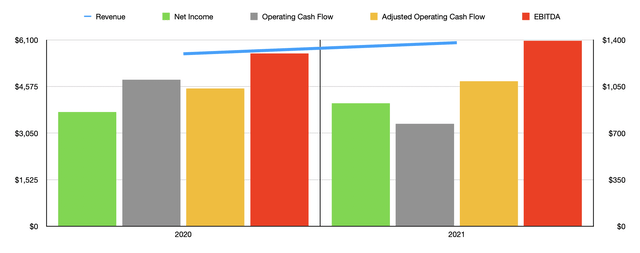

Generally speaking, when a company sees its share price decline, the first thought is that financial performance at the firm might be suffering. Fortunately for investors, that is not the case today. In fact, management continues to do well in growing the company’s top line and bottom line. As an example, we need only look at the final quarter of its 2021 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the firm. For that quarter, sales came in at $1.53 billion. That represents an increase of about 12.8% over the $1.36 billion the company generated the same time one year earlier. As a result of this strong quarter, total sales for the 2021 fiscal year hit $6.01 billion. That is up 6.4% over the $5.65 billion to the company reported one year earlier.

Author – SEC EDGAR Data

A big portion of the company’s revenue growth recently has come from its Fastenal Managed Inventory, which consists of a couple of different programs. At this time, the business has three main managed inventory operations. One of these is called its FASTStock program, while the extension of this is referred to as FASTBin. The company also has its own industrial vending machines referred to as FASTVend that help to provide customers with improved product monitoring and control. Over the years, the company has significantly increased the number of machines that it has an operation.

Adjusting for unit capacity, the company had, at the end of its 2021 fiscal year, 92,874 FASTVend and FASTBin units installed across its network. That was up 10.6% compared to the 83,951 the business reported one year earlier. What’s more, it also represents an increase of 2.6% over the 90,493 that were installed just one quarter earlier. As a result of this expansion, the company has seen more and more of its revenue attributable to these operations. For the full 2021 fiscal year, for instance, the combination of these units with the FASTStock sales included, came out to 32% of revenue. That compares to the 24.3% the company reported for its 2020 fiscal year. For the final quarter of the year alone, however, this number was as high as 35.1%, up from the 27.2% seen one year earlier. It’s also worth noting that the company has provided sales data for January and February of this year. In January, sales came in at $540.49 million. That’s up 20.7% compared to the $447.95 million reported one year earlier. And in February, sales totaled $530.94 million. That is 21.3% above the $437.70 million reported in February of 2021.

As revenue has risen, so too has profitability. For the final quarter of the year, net income came in at $231.2 million. That compares to the $196.1 million reported one year earlier. As a result, this brought total net profits for the year up to $925 million. That stacks up against the $859.1 million reported for the company’s 2020 fiscal year. Other profitability metrics have also fared well. Although operating cash flow did decline, falling from $1.10 billion in 2020 to $770.1 million last year, the adjusted figure that removes changes in working capital actually increased from $1.04 billion to $1.09 billion. Meanwhile, EBITDA for the company expanded from $1.30 billion to $1.39 billion.

What to watch for in Q1 earnings and how to value FAST stock

On April 13th, before the market opens, management is due to report financial results for the first quarter of the company’s 2022 fiscal year. As we have seen already, the company is well on its way to a solid quarter. For the quarter as a whole, analysts are currently anticipating sales of $1.69 billion. This implies a year-over-year growth rate of 19.3% compared to the $1.42 billion the company reported one year earlier. Profits are also expected to rise, climbing from $0.37 per share to $0.45 per share. That would result in net income rising from $210.6 million in the first quarter of its 2021 fiscal year to $259 million this year.

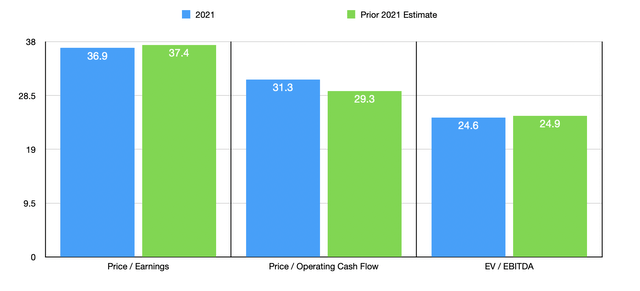

Although all of these figures are positive, this does not mean the company makes for a great prospect at this time. Despite seeing its share price drop recently, the company is still trading at a rather lofty multiple. Using the company’s 2021 results, we can calculate that it is trading at a price-to-earnings multiple of 36.9. This is only marginally lower than the 37.4 multiple it was trading at when I last wrote about the firm. The price to adjusted operating cash flow multiple actually increased, rising from 29.3 to 31.3. And the EV to EBITDA multiple for the company moved down only modestly, from 24.9 to 24.6.

Author – SEC EDGAR Data

To put the pricing of the company into perspective, I did decide to compare it to the same five firms that I compared it to when I last wrote about it. On a price-to-earnings basis, these firms ranged from a low of 2 to a high of 19.7. Meanwhile, on an EV to EBITDA basis, the range was from 1.8 to 8.9. In both of these scenarios, Fastenal was the most expensive of the group. Then, using the price to operating cash flow approach, the range was from 4.2 to 232.9. In this scenario, three of the five firms were cheaper than our prospect, while another was tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fastenal | 36.9 | 31.3 | 24.6 |

| Veritiv Corporation (VRTV) | 14.2 | 13.4 | 8.9 |

| BlueLinx Holdings (BXC) | 2.0 | 4.2 | 1.8 |

| Hudson Technologies (HDSN) | 9.1 | 232.9 | 7.4 |

| Herc Holdings (HRI) | 19.7 | 5.9 | 7.4 |

| GMS Inc. (GMS) | 8.8 | 31.3 | 7.0 |

Takeaway

If I had to make a list of the highest quality companies on the market today, I would certainly put Fastenal in the top 10%. The company is definitely a great player and it will likely create attractive value for its investors in the long run. Having said that, the multiples the company is trading for just don’t seem all that appealing to me. I would rather wait for the opportunity to buy the stock cheaper, while simultaneously capitalizing on other prospects that might offer more upside in the near term.

Be the first to comment