HATICE GOCMEN

Fair Isaac (NYSE:FICO) is a financial services company focused on credit scores. These FICO credit scores can be used for a wide variety of approval decisions for various lending products.

Contrary to what investors might expect, there’s a lot more to Fair Isaac than just the outright scoring product:

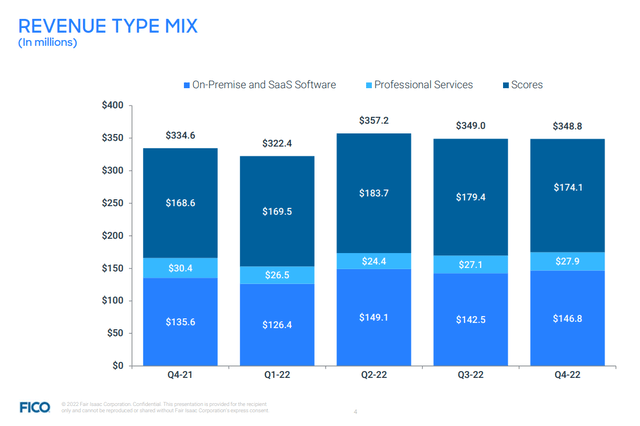

Fico revenues (Corporate Presentation)

In fact, only about half of the firm’s revenues come from credit scores directly. On-premise and SaaS software makes up a big chunk of the revenue pie, with professional services making up the balance.

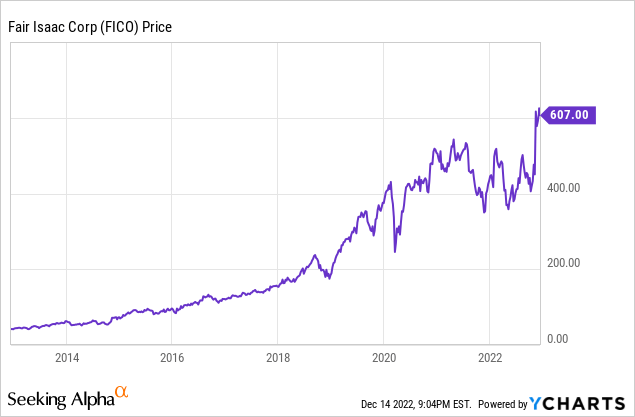

FICO stock has traditionally been a massive winner, enjoying double-digit compounded earnings growth, and a roaring stock price to go with it. As the above revenue chart shows, however, the company’s momentum has slowed recently.

The housing market is a part of that. Fannie Mae and Freddie Mac, which help drive a large part of the U.S. mortgage market, require FICO scores for all loans which are sent to them. This creates a large and reliable market for FICO’s scoring product; however, it is one that will presumably be on the back foot for the next year or two given the sharp rise in interest rates and resulting downturn in prospects for the housing market.

At first glance, this might seem to make Fair Isaac a reasonable play for once the housing market inevitably turns back up. Indeed, I’ve made a similar bullish argument for title insurers such as First American (FAF) which also sell a product that is essential for obtaining a residential mortgage in the United States.

However, unlike, say, the title insurers, Fair Isaac shares haven’t sold off. At all. In fact, shares just jumped to new all-time highs after the company’s most recent earnings report:

Bulls could point out here that mortgage originations made up just 11% of the company’s scores revenues and 5% of its overall revenues this past quarter. Thus, even a further decline in housing activity wouldn’t hit the company too badly.

On the other hand, Fair Isaac has enjoyed additional strength from scoring for the automotive and credit/personal loans markets. I suspect that we may see activity in those latter markets start to slow down as well given the higher interest rates and potentially slowing economy into 2023.

Earnings: Not Good Enough To Support The Enthusiasm

In this past quarter, the company’s scores revenue rose 3% year-over-year. Software revenue was a little better. But at 5% year-over-year growth, this was hardly a tremendous result either.

Fair Isaac did grow earnings at a double-digit clip over the same period, however, which was enough to power shares to new highs despite the soft revenue figures.

How did Fair Isaac manage such powerful earnings growth? The firm has trimmed both sales, growth & administrative expenses, and its research & development spending over the past year. On the one hand, there’s something to be said for making more out of less. That said, there are limits to how far cost-cutting can go to drive earnings growth, especially for a firm like this which should be continually improving its product to remain the best solution for its customers.

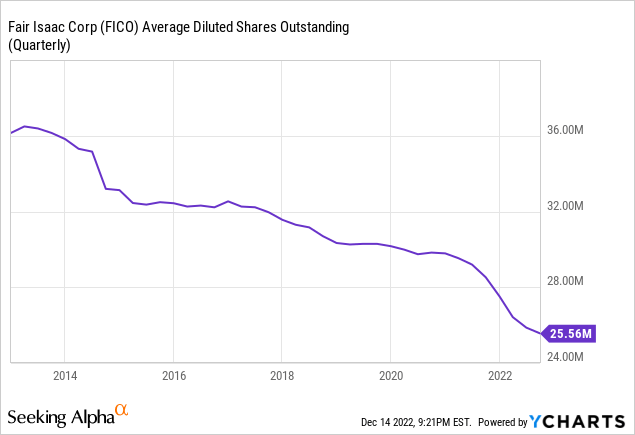

The other lever for earnings growth has been the firm’s ongoing and large share buyback program:

Fair Isaac has reduced its outstanding shares count from 36 million a decade ago to less than 26 million now. The firm got especially aggressive over the past year, retiring more than 10% of its outstanding shares since early 2021.

You might be wondering how a company trading at more than 30x earnings (sub-3% earnings yield) can afford to buy back such a massive pile of stock that quickly. The answer is that Fair Isaac has added a lot of leverage to the balance sheet. It had less than $1 billion of debt in 2020, but this figure has surged to $1.85 billion today.

I believe the company’s debt load is still manageable. However, they have used up some of their flexibility to operate the buyback program so far.

All this to say that Fair Isaac shareholders can’t count on indefinite 15% earnings growth going forward starting from 5% revenue growth. There is only so much the company can achieve from managing costs and running share buybacks. At some point, revenue growth needs to pick back up if the company is to support its lofty valuation.

Valuation

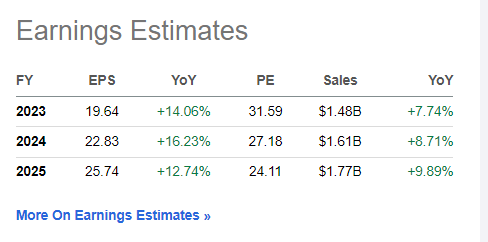

FICO stock is currently trading at 32x projected 2023 earnings:

FICO earnings estimates (Seeking Alpha)

Shares are at 27x and 24x projected 2024 and 2025 earnings. Those figures aren’t too bad, especially given Fair Isaac’s laudable earnings growth history over the years.

However, I’m skeptical that the company will be able to hit these projected numbers.

We already see revenue growth slow down to 5% year-over-year in the past quarter. With the housing market cracking and the overall economy weakening, I’m not convinced that revenue growth is going to move back toward 8-10% a year in the immediate future.

The analyst consensus also assumes that Fair Isaac will be able to put up low teens earnings growth based off this 8% or so annualized revenue growth. Again, the pathway to that much margin expansion seems challenging. The company isn’t going to be able to buy back so much of its stock every year. That’s especially true now that shares have rallied so sharply this year. As a result, Fair Isaac’s buy back will retire less stock in the future given that it is now buying at a much higher starting P/E ratio.

Fair Isaac Is More Expensive Than Other Financial “Compounder” Peers

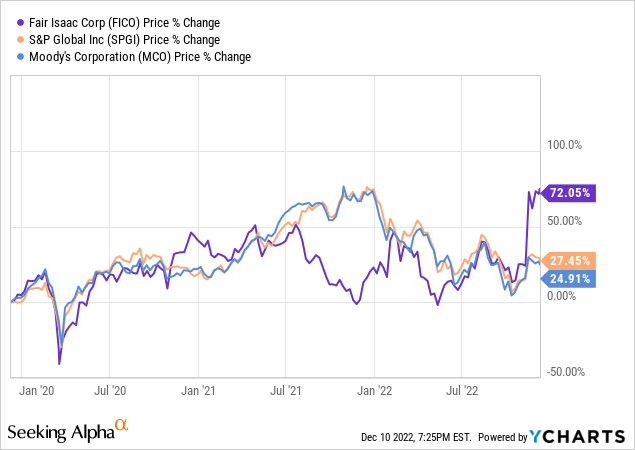

There’s a trio of financial industry stocks that investors often lump together. They have all delivered strong returns over time and seem to have large moats selling specialized financial ratings or information products. These would be Fair Isaac, S&P Global (SPGI), and Moody’s (MCO):

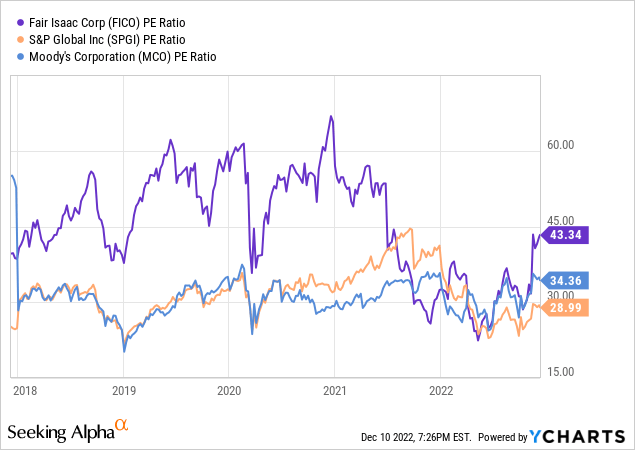

Historically, FICO stock has usually traded at what could be described as ambitious valuation ratios. The company’s trailing P/E ratio spent a great deal of time above the 45x level in recent years, and appears to be heading above that threshold again now. Meanwhile, SPGI and MCO, by contrast, tend to trade only in the low 30s:

FICO stock traded as cheaply as the other two for most of the past year, even being the lowest valued of the three for a brief moment. However, that has now ended, as FICO stock is back up to 43x earnings versus 34x for Moody’s and 29x for S&P Global on a trailing basis.

Going out into the future, the valuation discrepancy appears to narrow. Based on estimated 2024 earnings, FICO stock is selling for 27x, which is only a modest premium to Moody’s at 26x estimated ’24 earnings and S&P Global which is at 23x that year’s projected earnings.

However, as described above, I’m quite skeptical that Fair Isaac will be able to reach its current earnings consensus for the next couple of years.

FICO Stock Verdict

Fair Isaac has been an absolutely tremendous performer. In December 2002, shares traded for $27 each. Fast forward twenty years, and shares are now worth more than $600 a pop. I can’t argue with that level of success.

And I get why shares are up so much this year. Last year, there was an incredible amount of hype around Upstart (UPST) and other digital lending platform companies which were supposedly going to upend Fair Isaac’s core business model.

This ultimately didn’t come to pass, and Fair Isaac’s shareholders are breathing an understandable sigh of relief. If the company’s effective monopoly remains intact, it should continue to be able to generate far in excess of normal returns on invested capital in the business.

That said, just because Upstart seemingly failed to disrupt Fair Isaac doesn’t mean the company’s moat is utterly impregnable. A better run or better funded competitor could give Fair Isaac a more serious challenge. Or government regulation could change the scope and nature of the company’s business opportunity.

I don’t see competitive risks as being an imminent threat to the business. But when you pay this high of a starting valuation for a company, you need to have a fairly high degree of confidence that the business has a long runway to keep growing at a double-digit rate for the foreseeable future.

I’d argue that S&P Global and Moody’s both give you a similar growth runway from more attractive starting valuations. There’s a reason these three companies are often grouped together. They all serve as a sort of tax on key parts of the American financial system, earning gigantic shareholder returns in the process. For now, at least, however, FICO stock is the most expensive of the three, and thus I’d hold off on buying until the share price corrects considerably.

Be the first to comment