JHVEPhoto

In less than a month, the EU’s sanctions on Russian oil along with a G7 price cap and an insurance ban on tankers that transfer Russian oil will take effect. Thanks to this, we could expect the prices for oil to remain at least at the current relatively high levels, as those sanctions are expected to decrease the overall global oil output in an already tight market. On top of that, those sanctions would also make it hard for Russia to restore its production to the previous levels even if the sanctions would be lifted in the future, leaving the market with even less supply than before during the moment when the consumption is forecasted to increase.

As a result of all of this, there is every reason to believe that Exxon Mobil (NYSE:XOM) would be able to continue to increase its production and generate record returns, as the changing geopolitical landscape continues to favor energy firms that have no connections to Russia and are able to benefit from a tight market at Russia’s expense.

Supply Disruptions Are Not Over Yet

Before the reveal of Exxon’s Q3 earnings results, I wrote a bullish article saying that the company is more than likely going to report a strong performance during the three months, as its business continues to benefit from the rise of oil prices caused by supply disruptions due to Russia’s invasion of Ukraine.

The earnings report that was released two weeks ago showed that to be the case, as Exxon stated that in Q3 it managed to generate $112.07 billion in revenues, up 51.9% Y/Y, significantly above the estimates by $9.11 billion. At the same time, its net income during the period was $19.66 billion, which translated to a non-GAAP EPS of $4.45, above the estimates by $0.65.

Considering the latest developments, it appears that in the following months Exxon would be able to continue to generate record profits due to the continuous disruption of oil supplies to the global market. Despite the ongoing quantitative tightening, the International Energy Agency in its flagship October report forecasted that the oil demand would continue to increase by 0.8% per year until the end of the decade and is expected to peak at 103 million barrels per day shortly after 2030.

At the same time, while the world’s average production in September was 101.2 million barrels of oil per day, the latest decision of OPEC+ to cut their oil production by 2 million barrels of oil per day already ensured that the oil prices won’t be able to significantly depreciate anytime soon. Even though the actual cut is expected to be around 1 million barrels of oil per day, as a significant portion of the OPEC+ countries were producing oil below their quotas, that still means that ~1% of the daily global oil supplies are about to disappear from the market.

On top of all of this, a lot of people wrongfully think that the sanctions that the western governments imposed on Russia are ineffective and are not affecting Kremlin’s war chest. That thinking is flawed since the European Union, which is Russia’s main customer of oil, will implement an embargo on Russian oil only on December 5. Therefore, it makes no sense to say whether such an action has been successful or not before it’s even been implemented in the first place.

The embargo itself will prevent the European Union, which has imported ~2.2 million barrels of oil per day in 2021 from Russia, from seaborne imports of Russian crude oil, which accounts for more than 70% of total imports of crude oil from Russia. While Bulgaria and Croatia are exempt from the embargo for a while in order to be able to export that oil to landlocked non-EU countries from the Western Balkans, their share of Russian oil imports is relatively small in comparison to how much Germany or other bigger economies of the economic block import and consume.

At the same time, while the imports of Russian oil through pipelines haven’t been banned, there’s a possibility that some EU countries won’t be able to continuously receive oil from them. Earlier this year, the transfer of oil from one of the longest and biggest oil pipelines in terms of capacity called Druzhba was disrupted after Poland found a leak there. In addition, the second branch of that pipeline that goes through Ukraine experienced disruptions as well, and since the whole of Ukraine is a war zone at this stage, there’s always a possibility that the supply of oil through the country would be disrupted too.

On top of that, one of the major developments happened last week when the G7 nations decided to start implementing a floating price cap on Russian crude oil from December 5, when the EU’s oil embargo takes effect. The major intention behind the price cap is to prevent Russia from generating record revenues due to high oil prices to finance its war efforts in Ukraine. The catch is that the G7 nations would stick with their respective embargoes and won’t be buying the Russian crude oil whatsoever, while at the same time third parties such as India, China, Turkey, and others would be able to buy the Russian oil at below the market prices.

At the same time, the G7 nations have the ability to enforce the price cap as well, since the EU and UK companies combined account for the 90% of the global maritime insurance market. Any oil tanker without insurance won’t be able to enter a port to collect the oil, which makes it impossible for the buyer and the seller to conduct business if they don’t follow the new rules.

While there might be skepticism about the effectiveness of such an embargo and a price cap, the previous packages of sanctions that were implemented earlier this year already begin to negatively affect Russia’s financials. The latest data suggests that the country is about to experience a budget deficit despite making fortunes at the beginning of this year thanks to the high oil prices, as the surplus has been steadily decreasing in recent months. In addition, the IEA is saying that Russian oil production is about to decline in the following years due to those sanctions and embargoes, which could lead to $1 trillion in lost export revenues by the end of the current decade.

On top of all of this, there’s always a possibility that Russia decides not to comply with the price cap. However, then it won’t be able to sell its oil into most of the markets due to logistical constraints despite the growing dark fleet of tankers. What’s important here to understand is that it doesn’t matter much whether Russia decides to play by the new rules or not, as it’s more than likely that we would experience additional supply disruptions and a loss of oil from an already tight market one way or another. The only difference between those two options is the scale of disruptions.

What’s Next For Exxon Mobil?

Since it appears that additional supply disruptions would continue to take place in the following months and keep the oil market tight, Exxon is more than likely going to generate record profits in the foreseeable future. On top of that, one of the biggest upsides for the company is that it can also continue to increase its own production without creating an oversupply in the market due to those disruptions. The latest earnings report showed that in Q3, Exxon not only generated record revenues and profits but also managed to increase its total daily oil output by 50,000 barrels of oil per day to 3.7 million barrels of oil per day, mostly thanks to the increase in production in Guyana and the Permian Basin.

At the same time, the company’s management has been smartly using the current favorable environment to strengthen the business’s balance sheet. The latest data shows that in Q3, Exxon had $39.25 billion in long-term debt on its books, down from $43.64 from a year ago, while its liquidity stood at $30.4 billion, up from $4.77 billion a year ago.

With a stronger balance sheet, Exxon would be able to better tackle the upcoming challenges and the only question right now is whether its stock offers any upsides to its shareholders at the current market price.

To figure this out, back in June I made a DCF model, which showed that Exxon’s fair value is $99.15 per share. Then later in August, I updated the model, which then showed the business’s fair value to be $104.77 per share. However, in both of those scenarios I’ve used the street’s top-line growth assumptions from that time and said that it’s more than likely that the upside could be significantly higher, as the market is underestimating how big of an effect sanctions and an embargo on Russian oil can have on the overall oil market.

I was correct when I said that, as we’ve seen how in Q3 Exxon managed to outperform even the most optimistic assumptions and beat the street’s revenue estimates by $9.11 billion. What’s also important to note is that no sanctions on Russian oil have been placed during that time. Considering that the embargo and a price cap on Russian oil are about to be implemented in early December, we could once again see Exxon outperforming even the most optimistic street assumptions in Q4 and beyond, as there’s a possibility that the market once again underestimates how big of an impact those things could have on the oil industry.

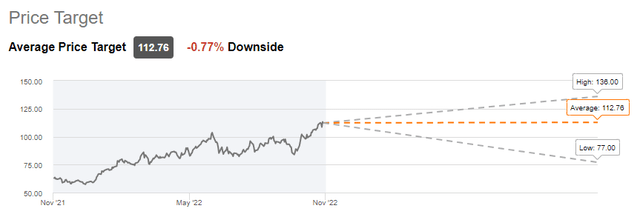

Therefore, even if the consensus currently is that Exxon’s fair value is $112.76 per share, which is already higher than it was even a month ago, there’s a possibility that we could see an upward revision later this year when an already tight market starts to experience additional supply disruptions and pushes Exxon’s shares higher.

Exxon’s Consensus Price Target (Seeking Alpha)

The Bottom Line

There’s clearly an indication that the Western governments are interested in stripping Russia from its oil profits in order to decrease its ability to wage war in Ukraine. The upcoming sanctions without a doubt would provide a serious blow to Russia’s war efforts, as logistical constraints along with the loss of its biggest customer are more than likely to negatively affect its war chest.

At the same time, those sanctions provide companies like Exxon the ability to increase their own production and continue to benefit from relatively high oil prices at Russia’s expense. Therefore, even though Exxon and its domestic peers face some serious risks, there’s an indication that they still have a few months to continue to generate record profits before the market stabilizes.

Be the first to comment