jetcityimage

Exxon Mobil Earnings Overview

Exxon Mobil Corporation (NYSE:XOM) is set to report its second quarter earnings results before the market opens on Friday. Exxon Mobil’s shares have fallen sharply from their 52-week high in June.

Exxon Mobil Current Chart (Finviz)

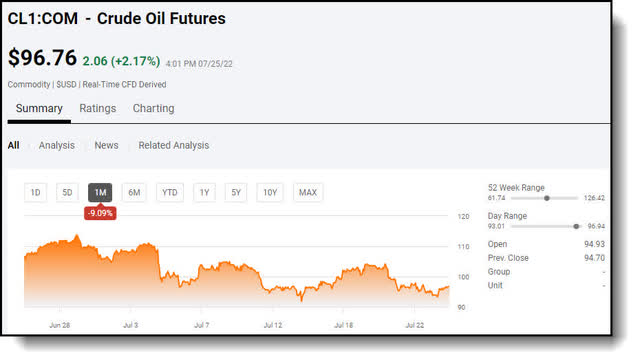

Since that point, the stock has dropped 15% in sympathy with crude oil, which is down nearly 10% for the month at the time of this writing.

WTI Crude Current Chart (Seeking Alpha)

Exxon Mobil reports Q2 2022 earnings on July 29, 2022

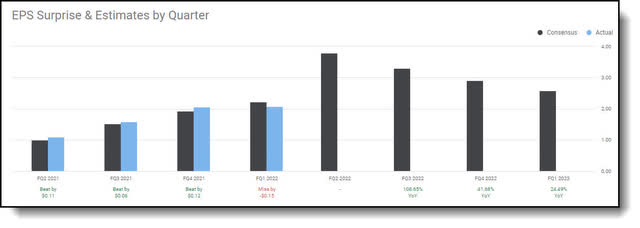

Exxon Mobil has missed EPS expectations only once in the past year, (last quarter).

Exxon Mobil Earnings Results History (Seeking Alpha)

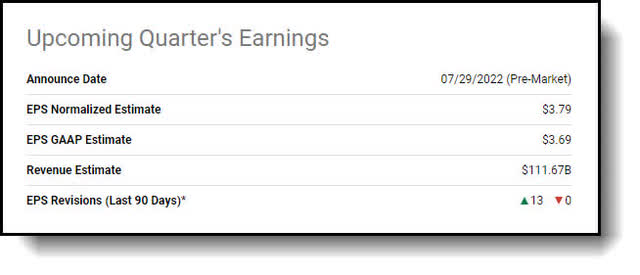

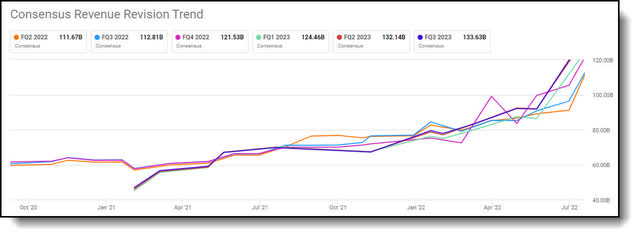

The following earnings expectations chart is for the fiscal period ending on June 30, 2022. This is Exxon Mobil’s fiscal second quarter of 2022, to be reported on July 29, 2022 before the open.

Exxon Mobil Q2 Earnings Expectations (Seeking Alpha)

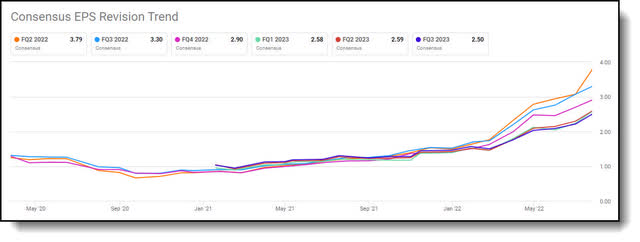

The consensus EPS estimate is $3.79, implying 244% year-over-year growth over the $1.10 EPS reported last year. The low estimate is $1.65 EPS and the high is $4.10 EPS on $111.67 billion in revenue.

Out of the 13 analysts covering the stock, there were 13 upward revisions for both revenue and EPS.

Consensus Revenue Revision Trend

Consensus Revenue Revision Trend (Seeking Alpha)

This candidly confirms the prolific performance analysts are expecting.

Consensus EPS Revision Trend

Consensus Earnings Revision Trend (Seeking Alpha)

There is a panoply of positives heading into earnings at present. First, let’s take a closer look at last quarter’s report and guidance to set the table.

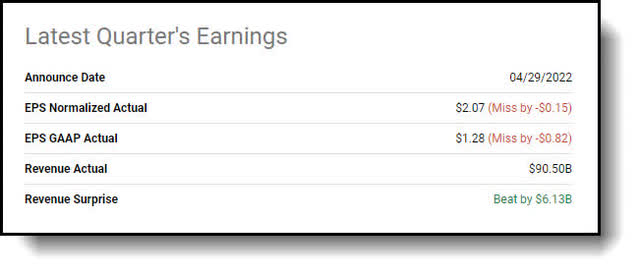

Previous quarter – Q1 2022 earnings results

Exxon Mobil missed on EPS by $0.15 cents, coming in at $2.07

Exxon Mobil Last Quarter Results (Seeking Alpha)

Yet, the Texas oil titan beat on revenues by $6.13 billion, coming in at $90.50 billion. Most importantly, cash flow was solid at $11 billion in free cash flow for the quarter.

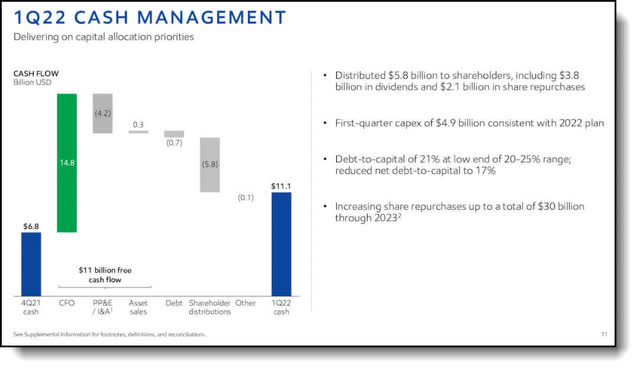

Cash management review

Exxon Mobil returned $5.8 billion to shareholders, of which about two thirds was in the form of dividends and the remainder in share repurchases, consistent with the oil giant’s previous program.

Cash Management Review (Exxon Mobil)

Exxon Mobil stated during its Corporate Plan Update in December that the company expects to repurchase $10 billion shares. Just recently, Exxon actually announced a huge increase to the share buyback program, upping it to $30 billion shares in total through 2023. This move confirms the confidence Exxon Mobil has in the strength of its balance sheet and future prospects for profits.

The fact of the matter is this quarter’s results are important, but it will be the guidance given going forward that will augur the stock price one way or the other. Let’s delve into what lies ahead at this time, shall we?

What Lies ahead for Exxon Mobil?

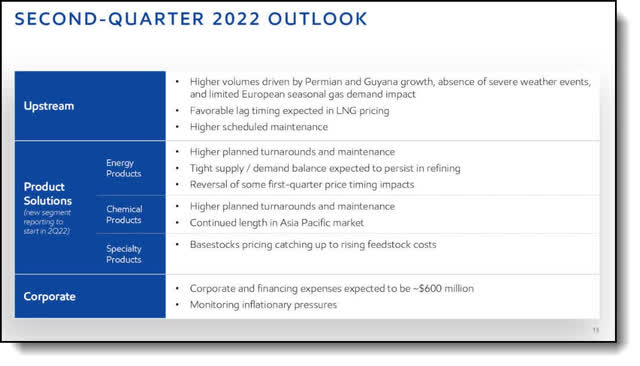

Guidance

Exxon Mobil stated recently that second quarter refining profits have jumped by as much as $5.5 billion, while earnings from its oil and gas production have climbed as much as $3.3 billion. This points to very strong results when the company releases its quarterly earnings this Friday morning, hence all the recent upgrades.

Exxon Mobil Guidance (Exxon Mobil)

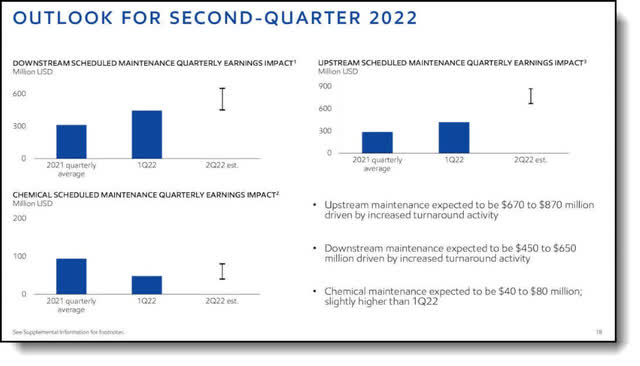

In an SEC filing released recently, the company said rising refining margins likely added $4.4 billion to $4.6 billion during the quarter, while the value of unsettled derivatives may have provided an additional $700 to $900 million. The below slide details the expected quarterly maintenance earnings impacts as well.

Maintenance Outage Guidance (Exxon Mobil)

Further, Exxon Mobil anticipates the loss of Russian production impacting second quarter results by $100 to $200 million. According to Bloomberg, Citi analyst Alastair Syme stated:

“The high-frequency demand data we see shows little sign that consumers are unwilling to pay, [leaving] high product prices/refining margins set to stay for some time, at least through next year’s first half.”

With the largest refining footprint of all the Big Oil companies at a time of rising margins and increasing demand for gasoline and diesel, the benefits of a continuing tight supply/demand environment bode extremely well for Exxon’s second quarter bottom line.

Current market environment backdrop

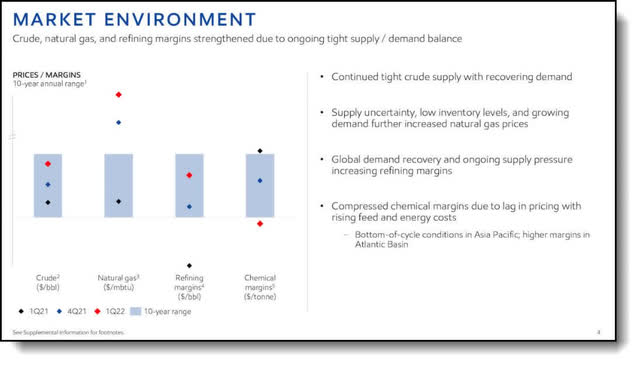

A tight supply/demand environment has developed primarily due to low investment levels during the pandemic. The low supply, coupled with a substantial increase in demand as the pandemic faded, contributed greatly to the rapid increases in prices for crude, natural gas, and refined products.

Current Environment (Exxon Mobil)

What’s more, the events in Ukraine added uncertainty to what was already a tight supply outlook. Brent crude rose by about $22 per barrel, or 27% versus the fourth quarter of 2021. Today, natural gas prices remain well above the 10-year historical ranges, driven by tight global market conditions and ongoing European supply concerns.

Moreover, tight supplies to manufacturers have pushed refining margins to the top of the range. Nevertheless, chemical margins in Asia have fallen sharply, with product prices lagging the steep increases in fees and energy cost. Based on all the recent newly provided inputs, the oil giant received a major upgrade in recent days by Piper Sandler.

Exxon upped to Buy at Piper Sandler with refinery results poised to hit records

Piper Sandler recently upgraded shares to Overweight from Neutral with a $109 price target, seeing the setup for U.S. energy stocks as “increasingly attractive” heading into the second quarter earnings season. It remains bullish generally on refiners and integrated oil companies. Piper analyst Ryan Todd said he is “constructive” on Exxon Mobil, driven by robust downstream performance and greater-than-expected resilience in the chemicals business. Todd stated:

“The upgrade reflects the significant transformation underway at the company, increasingly advantageous asset portfolio, attractive portfolio mix (overweight refining and strong exposure to international gas with bullish 18-month outlooks for both) and attractive relative valuation.”

After first quarter downstream results that were a noticeable lag particularly for Exxon and Chevron (CVX), “Q2 results seem positioned to make up for it… with a vengeance,” foreseeing refining and marketing earnings at record levels and Exxon as the largest beneficiary, Todd went on to say.

But wait, there is more. The company is implementing a series of organizational changes to streamline processes leveraging scale to improve the effectiveness of their operations.

Series of streamlining organizational changes

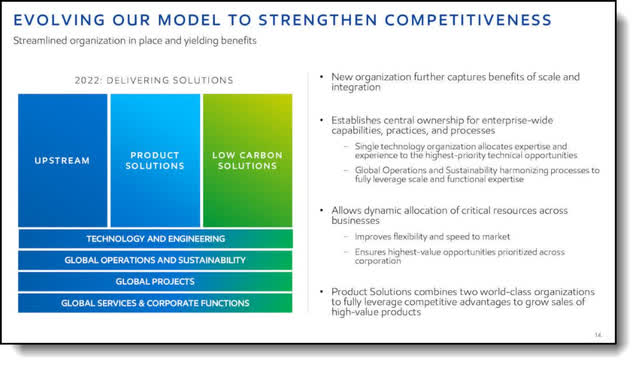

CEO Darren Woods detailed during the first quarter earnings call a series of organizational changes to further leverage the scale and integration of the corporation to improve the effectiveness of operations to better serve its customers.

Streamlining Organization (Exxon Mobil)

“We combined our Downstream and Chemical operations into a single Product Solutions Business. This new integrated business will be focused on developing high-value products, improving portfolio value and leading in sustainability. As a result of these changes, our company is now organized along 3 primary businesses: Upstream, Product Solutions and Low Carbon Solutions.”

These 3 businesses are supported by corporate-wide organizations, including projects technology, engineering, operations, safety and sustainability.

Exxon Mobil is a corner stone holding in my sleep well at night (“SWAN”) retirement income portfolio. Therefore, it would be remiss of me to not review the state of affairs as it relates to the dividend safety and growth prospects. Needless to say, the state of affairs is strong.

Dividend review

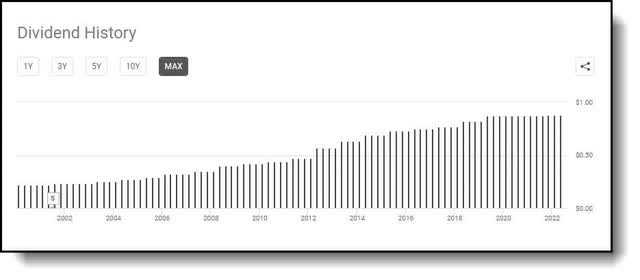

Exxon Mobil is a dividend aristocrat with 40 years of consecutive dividend payments.

Exxon Mobil Dividend Payout History (Seeking Alpha)

As a former Texas oil man myself, I have a certain affinity for the Texas oil titan. I can say without doubt the company is dedicated to paying the dividend come hell or high water.

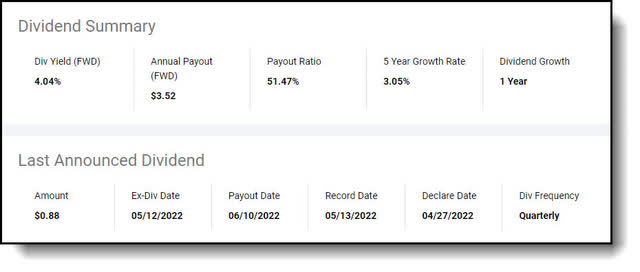

Dividend summary

Exxon Mobil Dividend Summary (Seeking Alpha)

In fact, it has been overtly expressed by management that the company’s top priority at this time is return of capital to shareholders as well as long-term capital investments in production to keep the cash flowing in for years to come. The follow slide details analyst’s dividend growth estimates for the coming two years.

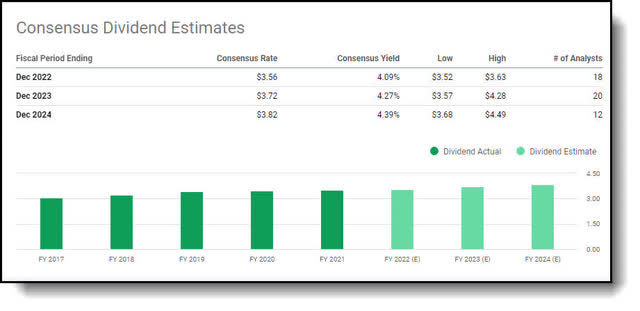

Consensus Dividend Estimates

Consensus Dividend Growth Estimates (Seeking Alpha)

Now let’s take a look at the current fundamentals

Fundamental review

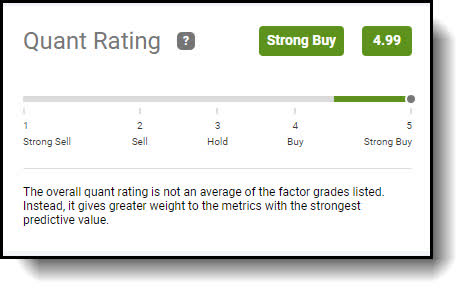

First of all, Exxon is basically trading for a song at the present valuation. Exxon’s forward P/E of 8.76 is approximately half of the current S&P 500 forward P/E of 16. The stock is incredibly trading for a PEG ratio of 0.60, anything less than 1 is considered to be vastly undervalued. Finally, the Texas oil titan is a free cash flow machine, ($10 billion last quarter), which is currently trading for approximately 14 times fee cash flow, where anything less than 15 times is considered cheap. Moreover, Seeking Alpha’s Quant analysis rates Exxon Mobil as a Strong Buy with A scores for growth, and profitability.

Exxon Mobil Quant Rating (Seeking Alpha)

Now let’s wrap this piece up with the key investor takeaways.

Key investor takeaways

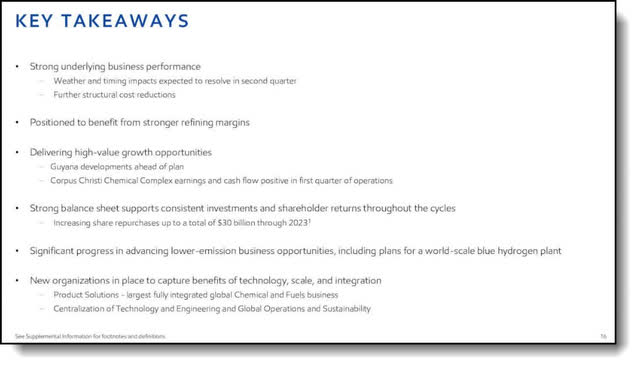

Exxon Mobil had a strong first quarter. The impact of weather on the upstream volumes and derivatives coupled with the timing impacts in the downstream refining business obscured the company’s strong underlying performance and strength. Based on the recent updates from the company, these past impacts seem to have been resolved. Moreover, strong refining margins should position Exxon Mobil very well going forward.

Key Takeaways

Key Investor Takeaways (Exxon Mobil)

CEO Woods stated on the conference call:

“We are making outstanding progress on our high-value growth developments in Guyana, the Permian and LNG. Our new Corpus Christi Chemical Complex is up and running ahead of schedule and generated positive earnings and cash flow in its first quarter of operations.

We have strengthened the balance sheet and are creating value for shareholders through an attractive dividend and increased share repurchases. We are advancing hydrogen, biofuels and other low carbon solutions consistent with our intention to lead in the energy transition, leveraging our competitive advantages of scale, integration and technology.”

Exxon’s management is evolving the organization from a holding company to an operating company in an attempt to better serve its customers’ evolving needs as well as to continue to grow long-term shareholder value.

Now, based in the plethora of recent earnings and revenue upward revisions, a lot of the positive from earnings will most likely be priced in. So, I am not expecting a huge pop on earnings. In fact, Exxon Mobil is often predominantly flat after it reports earnings. Nevertheless, I do see the stock regaining its all-time highs as the supply/demand imbalance begins to reveal itself over the coming months. That is why I stated in the headline do not miss this boat.

I see now as an excellent opportunity to get in at the recent lows. With 22% upside to $109 and a 4% dividend yield, I am anticipating a solid 25% total return opportunity over the next 12 months.

Those are my thoughts on the matter, I look forward to reading yours! And remember, always layer into any position and use articles such as these as a starting point for your own due diligence.

Be the first to comment