NoDerog

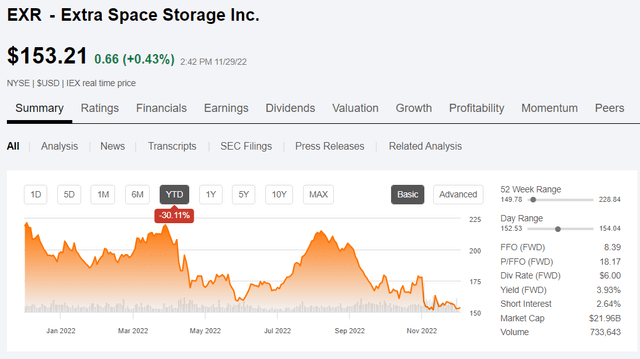

About a year ago I wrote about the extreme overvaluation of Extra Space Storage (NYSE:EXR) so it is time to update that thesis. In that article I suggested the FFO multiple should come down from 30X to 20X and with a 30% drop to market price and some increase to FFO/share, EXR has blown through that threshold, now trading at 18X forward FFO.

So is it cheap now?

No, 30% down is not enough.

The short thesis

Extra Space is currently substantially over-earning the earnings potential of their properties. Excessive existing customer rate increases (ECRI) were facilitated by the pandemic resulting in rent that is well above the sustainable level. With above market rents and significant excess supply being delivered to key EXR markets, I anticipate negative adjustments to both rate and occupancy going forward.

At 18X forward FFO EXR is trading well above the median REIT and thus is pricing in significant growth that I think will not materialize due to the aforementioned factors. In this article, I intend to demonstrate the unsustainability of current rates but let me begin by showing how COVID facilitated rates getting here in the first place.

A COVID beneficiary along the lines of Peloton or Zoom

The market has long since learned its lesson on pricing COVID-related growth as if it was secular growth. Most of the pandemic darlings like Peloton (PTON) and Zoom Communications (ZM) have gotten clobbered once it became clear that the growth during the pandemic was event driven and clearly not sustainable.

I believe self-storage real estate will be the next in line for this realization. So far, the market is not fully recognizing the extent to which self-storage growth was temporarily boosted by the pandemic with much of the sector still trading at a premium valuation. I think the entire sector will underperform going forward, but this article is focused on Extra Space because it has the most premium valuation.

At over 18X, its multiple is roughly in line with that of Public Storage (PSA), but on an implied cap rate basis, EXR is trading at a 4.28% cap rate on 2022 estimated NOI while PSA is at a slightly less egregious 4.98% implied cap rate.

In a world where 2 year treasuries are over 4%, real estate does not trade at 4% cap rates unless there is substantial growth ahead. This is evidence that the market still thinks self-storage will grow. It is pricing in the pandemic related growth as secular in nature.

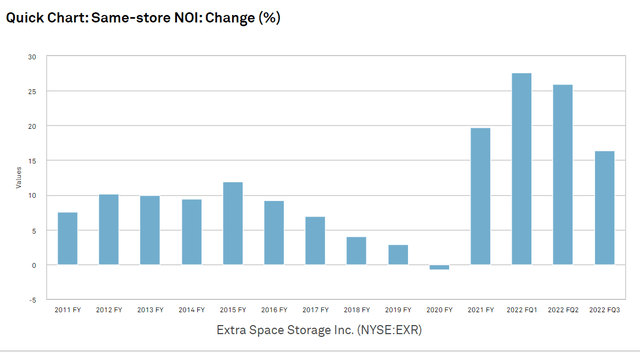

I see significant evidence to the contrary. Self-storage growth was on the downswing until the pandemic came along and temporarily reinvigorated it. Take a look at the chart below and I think this is quite clear with same store NOI actually trending negative until the pandemic inspired growth.

S&P Global Market Intelligence

To understand the nature of the pre-COVID downswing in growth, here is a bit of history on the sector. Decades ago it was a highly fragmented industry run almost exclusively by mom and pop owners. The REITs, PSA initially and then later EXR started to come in and consolidate the space. The mom and pop owners were badly mismanaging the properties with deferred maintenance and rents that were far too low. In consolidating and picking the low hanging fruit, the REITs had tremendous returns on their investment. Decades of impressive growth ensued.

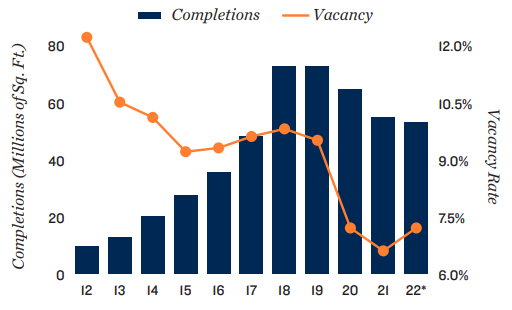

Seeing the success of the space, developers started to get inspired and deliver more product. Starting in 2016, it was becoming clear that oversupply was on the horizon. Industry veterans like Dean Jernigan of the since acquired Jernigan Capital were talking about their hopes for a “soft landing scenario”. The hope was that supply growth would moderate soon enough that growth would merely approach zero rather than turning negative.

The construction did not moderate and remains quite excessive today.

However, the industry got rescued by the pandemic which was the single biggest stimulant of self-storage demand in my lifetime. Suddenly, demand was outpacing supply despite the rampant construction.

Unlike Zoom and Peloton which benefitted immediately, the pandemic boost to self-storage was more of a 2021 and 2022 event and the reasoning for this is quite simple. The world was frozen in place for much of 2020. People stayed at home, didn’t venture out and didn’t move during the early stages of the pandemic.

It was the adjustments that were made starting in late 2021 that benefitted self-storage with the 2 biggest being:

- Rampant domestic migration

- Work-from-home

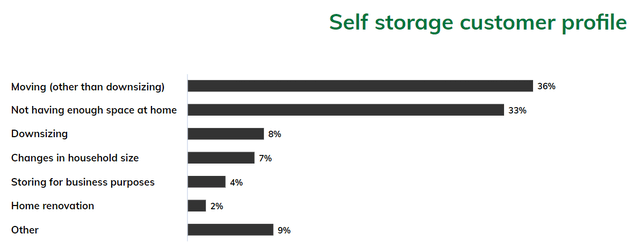

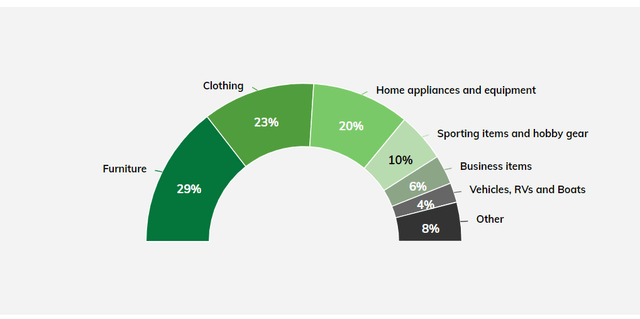

Below are the reasons that customers use self-storage.

So, work-from-home caused people to need an extra office at home. Many did this by clearing out their home storage and moving it to a self-storage unit. Indeed, this sort of thing is 33% of self-storage customers.

Also inspired by work-from-home was the mass moving to lower cost of living areas. Moving is of course the number 1 driver of self-storage at 36% of customers.

Combined, this was a huge influx of demand.

That is what rescued EXR from the slightly negative same store NOI growth heading into the pandemic and bumped them all the way up to the roughly 20% same store NOI growth in the post-pandemic era.

The world is now approaching a point of renewed stability. COVID has become endemic rather than pandemic and its influence on our day to day lives is waning. As such, cracks in self-storage demand are starting to show.

Guidance cut

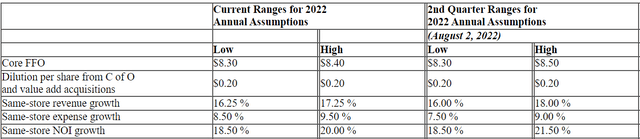

In its 3Q22 earnings report, EXR cut guidance by 5 cents at the midpoint.

The culprits responsible for the cut were higher expenses and same-store reduced to a range of 18.5%-20% from 18.5%-21.5%.

Keep in mind that this is full year guidance and EXR had been beating guidance through 3Q so 4Q looks like it is going to come in very weak.

Here is how it was described on the conference call:

Joe Margolis, CEO:

“In September, we started to experience a return of seasonality, putting some pressure on occupancy and new customer rates, which were both modestly lower than our third quarter forecast. As we evaluate our standard metrics to measure demand, we see the moderation we have typically expected in the fall that did not occur in 2021. While traffic is lower year-over-year, demand is in line with pre-COVID levels.”

It looks like the COVID boost is over. Demand is returning to normal, but the excess of supply built to service the higher level of demand is still there.

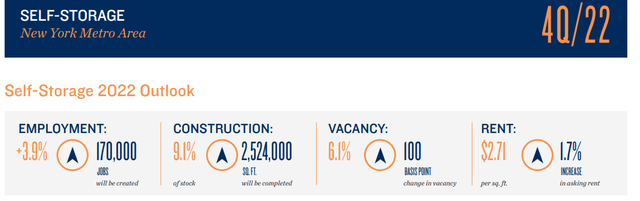

Another 50 million square feet are expected to be delivered in 2022.

Marcus and Millichap

A significant portion of the supply is hitting markets like NYC which alone has 2.5 million square feet to be delivered in 2022.

That is 9.1% of standing inventory.

It so happens that EXR derives about 11% of its NOI from New York. I anticipate a significant hit to occupancy and rates in the area.

Out of control rental rates for self-storage

Rental rates for real estate are usually determined by fundamentals of the property. They depend on the cost to build, location, quality of property, amenities and other such features. The better the property the higher rent the landlord can charge.

Rexford Industrial (REXR) leases warehouse space for an average price of just under $13 per foot annually. Most industrial properties would be leased for closer to $7 per foot.

There is nothing special about REXR’s physical properties, but there is something special about the location. Tenants will pay that extra $5 per foot to be located in the Inland Empire where they can be close to their customers. The higher price point is protected by the land scarcity of the area. So, while the buildings themselves are cheap to build, development is held down by the extreme cost of land.

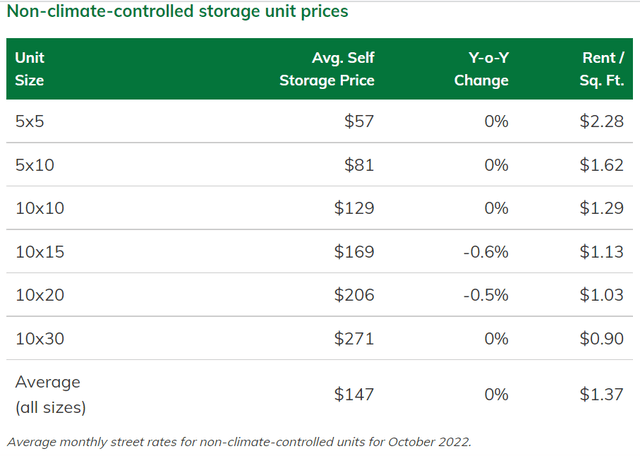

Due to the pandemic, self-storage rental rates have skyrocketed to a level that is actually higher than REXR’s advantaged rental rate.

The numbers above are quoted in monthly rates while most real estate analysts quote rent per foot in annual terms. A standard 10X10 box costs $1.29 per foot per month or about $15.48 per foot per year.

A few things of note here:

- This is for non-climate-controlled facilities.

- It is the national average

This is the most basic real estate on the planet. It is a concrete slab with thin metal walls and roof with a single garage door. It is far simpler than the logistically optimized real estate of Rexford and the locations of self-storage properties are not special. This is the national average rental rate and many self-storage properties are just randomly located out in the boonies wherever the former mom and pop owners happened to own land.

How did rental rates for self-storage get to such an astronomical level?

- The pandemic boost

- A pricing model based on ECRI

Existing customer rate increases are made possible by the high barriers to exit. To stop using self-storage, one has to physically haul all of their stuff back out of storage and then have somewhere else to put it.

Successful self-storage operators take advantage of this by offering low rates up front to get someone in the door and then they jack rates up once the person is a captive audience. In fact, more than 100% of EXR’s same store NOI growth in the 3rd quarter seems to be from ECRI.

An analyst inquired about going in rates on the conference call.

Juan Carlos Sanabria

If I can sneak in one quick one on the third quarter new customer rate. How did that trend throughout the quarter? And if you could just give us the year-over-year changes to where [ kind of to speed on what ] changed and kind of what pace throughout the third quarter?

P. Scott Stubbs

So in July, we saw rates down about — or achieved rates. This is achieved rates on new rentals. They were down about 7%, 8% in August and then low double digits in September. So we averaged about negative — just about 10% negative in the third quarter.

So despite double digit same store NOI growth, asking rents were actually down double digits in the third quarter.

The difference was not made up in occupancy either as occupancy was down in the quarter

- Reported same-store occupancy of 95.2% as of September 30, 2022, compared to 96.7% as of September 30, 2021.

Occupancy is down a further 30 basis points in October.

P. Scott Stubbs

So what we have in October, maybe just to give a bit of an update for October. Our October numbers, our occupancy is down about 30 bps from September, so not significantly different from the end of September, and our rates have been steady through the month of October.”

So with occupancy down and asking rates down seemingly more than 100% of the same store NOI growth came from jacking rates up on existing customers.

At a certain point you can’t keep raising without creating high churn. I believe that level has been reached and EXR seems to be seeing it too as they admit that ECRI will be lower going forward.

Joseph Daniel Margolis

So COVID and the restrictions the states put on our ability to increase rents, coupled with the rise in street rates created that unusual situation of an extra-large gap between what street rates were and what people were paying. And we have largely made up that gap. So we will not see — well, we still will see attractive ECRI going forward, we’re not going to see those outsized increases that we experienced over the last year or so.”

At thousands of dollars a year, the price tag on a simple storage facility has reached the breaking point. The average EXR customer stays for roughly 3 years making it a total price tag of $4-$10 thousand depending on location.

Most of what customers store is furniture, clothing and old appliances.

The value of the goods stored is not even close to the cost of storing them.

At some point rational pricing will be restored and that rental price per square foot will be significantly lower than where it is now.

Hats off to EXR on extracting so much value from their properties. They have done a phenomenal job maximizing earnings, but unfortunately that level of earnings does not appear to be sustainable. It was bolstered by the temporary pandemic tailwind and as that extra demand falls off, the oversupply will become more obvious. Competition will increase and bidding wars will ensue as self-storage operators try to maintain occupancy.

Earnings growth will be hard to maintain if asking rents start dropping and ECRI is getting churn pushback. In this environment I think 18X forward FFO is far too much to pay for EXR.

It is a good company, but the environment is challenging and I think the entire sector should trade at a discount to the REIT average, not a premium.

Be the first to comment