Darren415/iStock via Getty Images

Thesis

Exponent, Inc. (NASDAQ:EXPO) is a scientific research and consulting company with a tremendous historical performance pattern, and the valuation is falling back to tolerable levels for adding shares. As one of my favorite holdings, it had a favorable trading pattern in 2020-21 thanks to strong upward momentum. However, the high valuation was due for a pullback and this is occurring here in late 2022.

After selling in 2021 at prices above $100 per share, I will discuss the ranges that may again lead to a bull phase moving forward. Or, since Exponent is a healthy, stable company, this data can also support long-term investors who continue to slowly add to their positions over time. This is particularly important as the historical valuation levels are far below current levels, and a reset may lead to significant decline. The key will be for Exponent to continue operations successfully, and for the market to remain positive on the outlook and fundamentals.

Qualitative Factors

First, I will begin by assessing the recent performance as the data is quite relevant to the future valuation trend. One of the problems that I had with Exponent’s recent bull run is that the performance in 2020 and 2022 did not equally correspond to the rapid valuation increase. This is due to the fact that investors likely knew that Exponent would with no doubt rebound after the pandemic, along with the general economic state of stimulus and low interest rates. This indeed is what occurred by the end of 2021 with revenue growth returning positive, but the recent pullback of ~20% from highs has not brought the valuation back down to pre-pandemic averages.

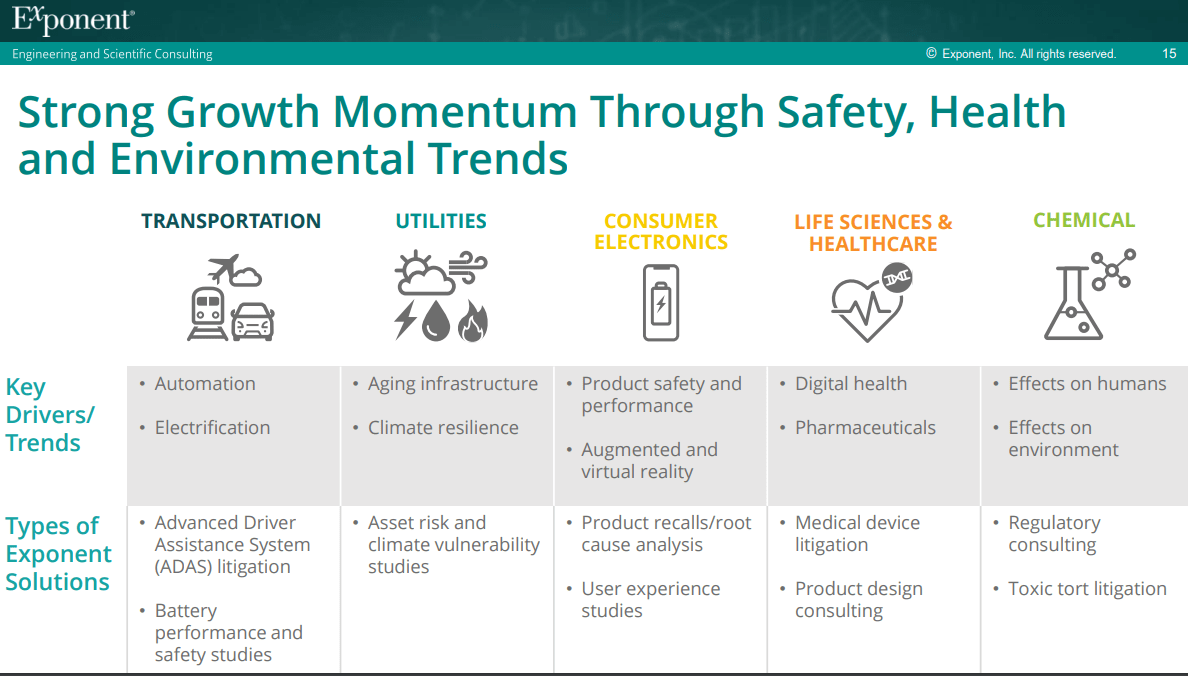

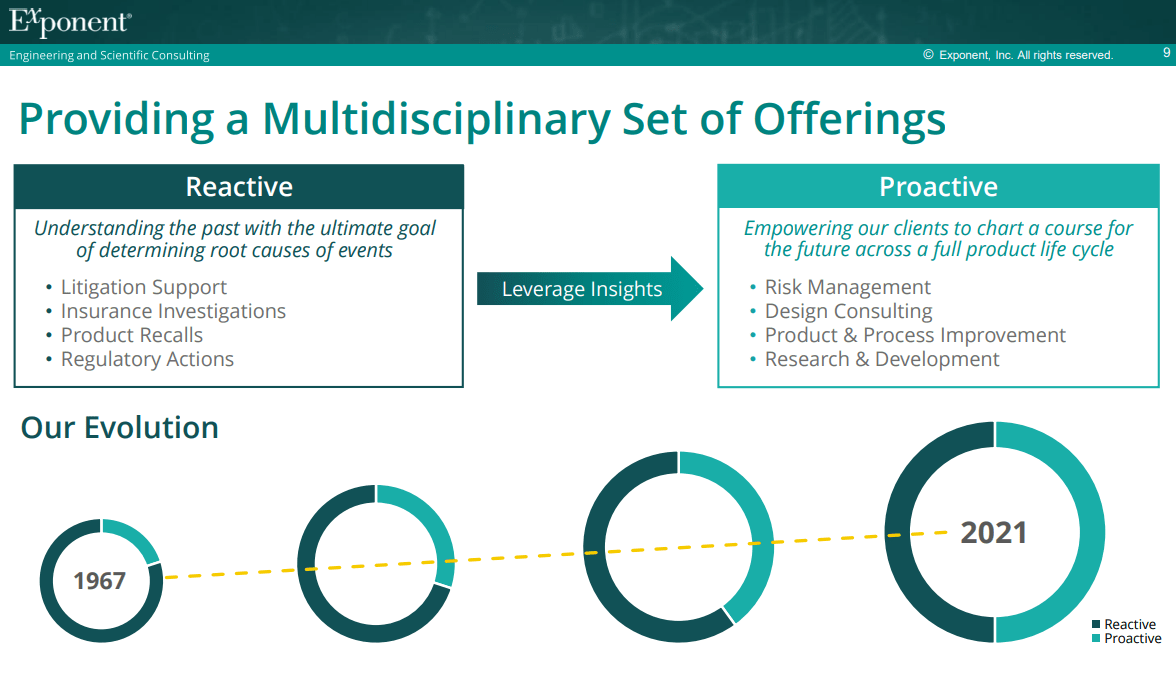

Thankfully, the elevated valuation of the last 5 years is the result of operational improvements and a sticky business that continues to grow organically. These organic growth paths are also set to continue to be available due to the growing diversity of client projects. These can be assessed in the image below, and include important fields of research such as electric vehicle battery safety and efficiency, digital health product design, and environmental analysis and remediation. As the CEO discussed in the most recent earnings release:

Our business model continues to demonstrate our resiliency amidst an evolving macroeconomic environment, as evidenced by the strong demand we are seeing for our services across the business. As society demands increasingly higher standards for safety, health and the environment, Exponent remains a critical advisor to clients, who leverage our engineering and scientific expertise to help solve their most pressing challenges.

Exponent Investor Presentation Exponent Investor Presentation

Quantitative Data

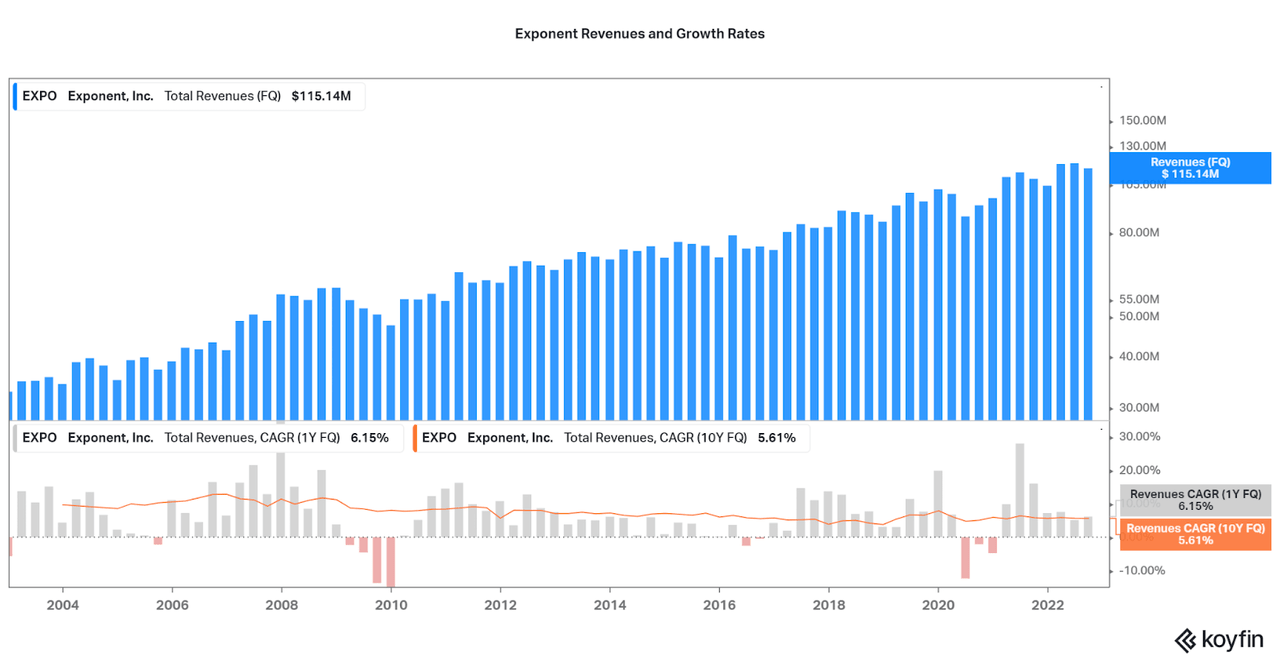

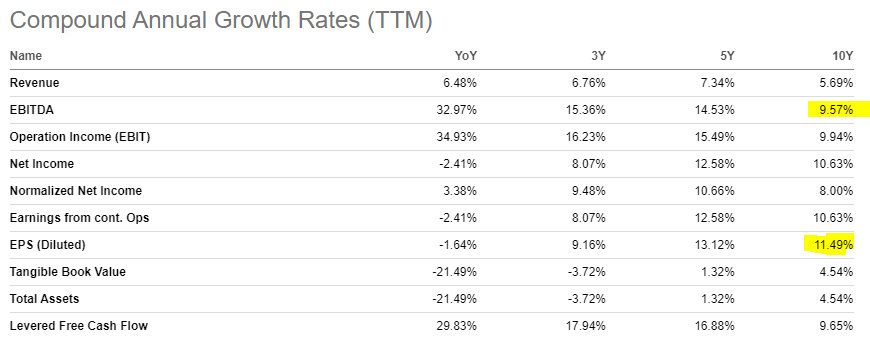

As the operational duty mix improves over time, we have seen the financial performance reflect the positive benefits of diversification. Most importantly, it seems that the new areas of research, especially proactive projects, are able to earn higher margins and organic growth due to the recurring nature and high value impacts of the output data. As shown in the revenue chart below, these improvements have been able to buck the downward annual growth rate trend, and the rate is now remaining at the 5-5.5% per year mark. The longer Exponent is able to keep revenue growth at this level the better as the combination of margin improvements will end up quite fruitful for investors.

Koyfin

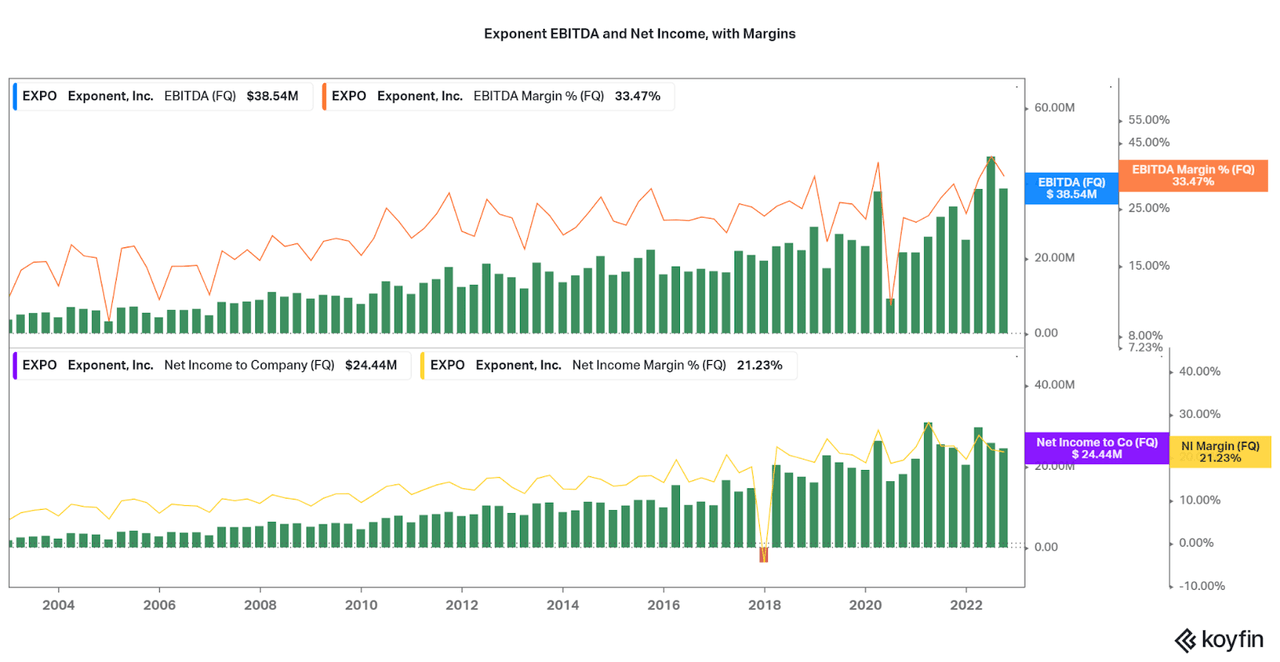

At the same time, margins have been steadily improving across both EBITDA and Net Income and are some of the most competitive in the market. The margin improvements have allowed net income to increase at twice the annual rate of revenues over the past year. Then, when combined with share buybacks, diluted EPS have increased at over 11% per year over the same time period. The bull case now relies on this pattern to continue, and the CFO is remaining quite positive despite economic headwinds:

We are encouraged by the influx of new engagements and strong pipeline of high-quality talent coming into the business despite a competitive and ever evolving macro environment. Looking ahead, we remain focused on growing our world-class team, which will enable sustained growth and enhance our scale across various end-markets.

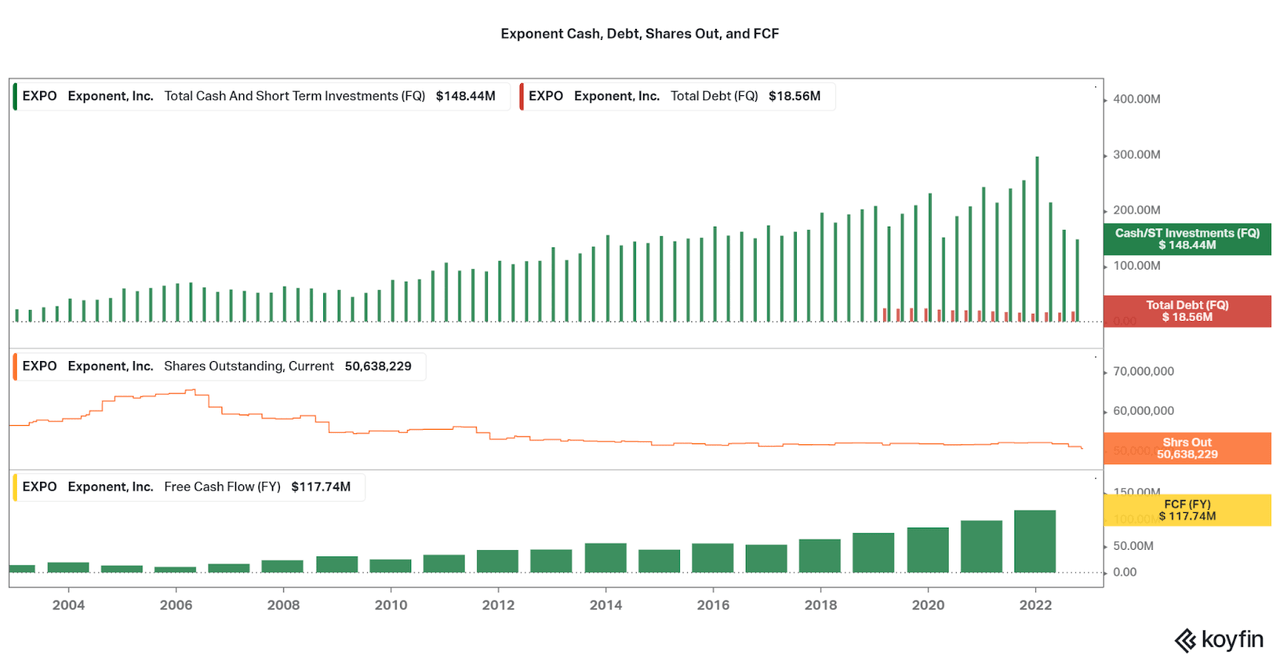

Koyfin Seeking Alpha

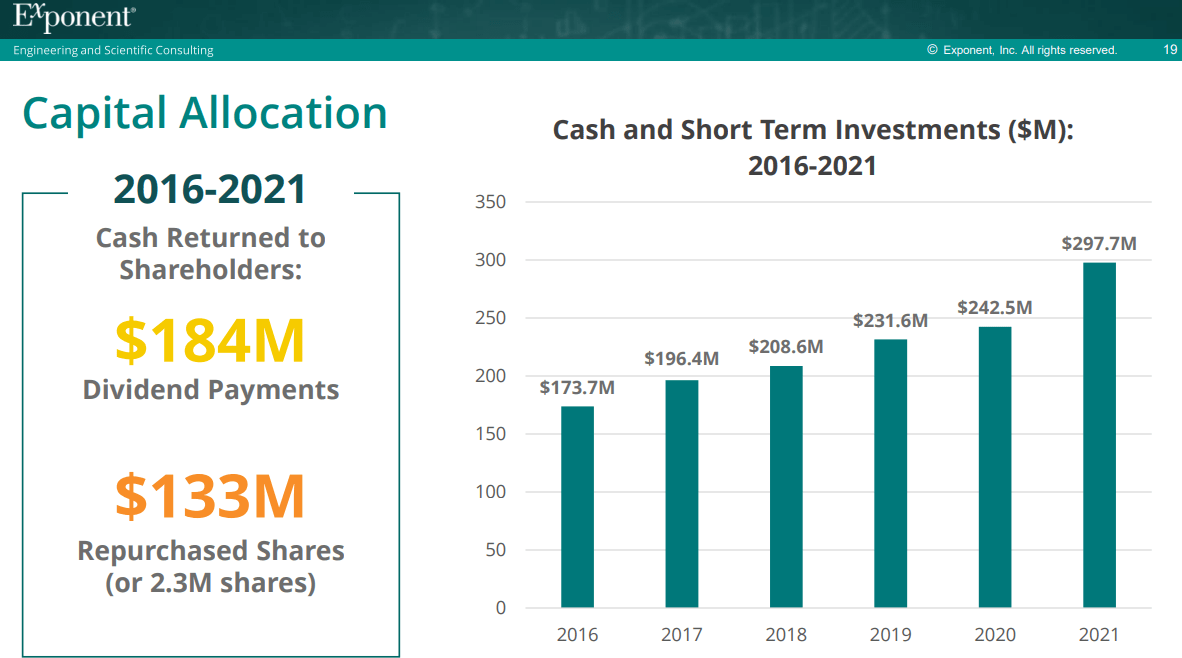

Along with favorable growth metrics, Exponent’s balance sheet also remains healthy. Most importantly, there is negligible debt to hinder momentum, and cash remains at $150 million. Over the past year, the company has repurchased over $140 million in shares outstanding, hence the drop in total cash on hand. However, full year FCF remains growing every year and supports continued shareholder benefits.

I expect that if the shares continue to fall, more buybacks will occur. If not, then perhaps an acquisition is on the tables. At the moment, the company has been focusing on attracting and maintaining their talent pool, an important factor for research and consulting firms, along with paying their low-yield, but healthy dividend.

Koyfin Exponent Investor Presentation

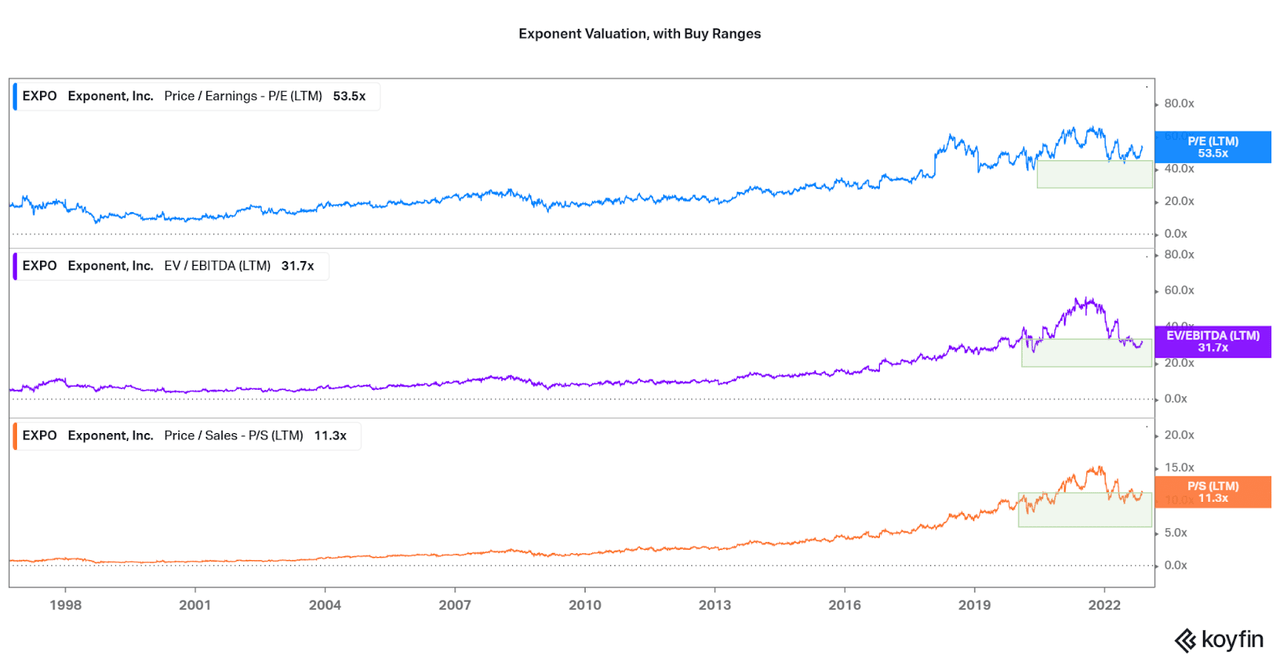

The question now is how do these financial metrics stack up against the valuation. Well, I believe that the financial performance has improved (maintained revenue growth and higher margins) and there should be a premium compared to years prior. However, the current valuation remains elevated above levels that I suspect are above a sustainable threshold, and I highlight my areas of undervaluation in the chart below. While the valuation may not fall below those levels, investors do need to understand that much of the total return over the past decade+ can be attributed to this significant increase in valuation, rather than fast growth.

A likely scenario for EXPO would be a plateaued valuation spread over the next few years as peak market pessimism comes and goes. This is due to a combination of factors: the support of highly profitable businesses in a bear market, continued financial improvement that allows for a premium valuation, and perhaps most importantly, increased operational scale and diversification that allows for reduced volatility and increased transparency.

Unfortunately, on the chance that the valuation does return to prior average levels, the stock would plummet over 50%. Therefore, it is important for management to maintain positive expectations and the investment is less suited for short-term focused investors. I recommend adding on a recurring basis as the company has not been volatile historically, but if shares do fall, investors can reduce their cost average.

Koyfin

Conclusion

Exponent is performing well. All that needs to happen is for the valuation to hold, and investors are likely to see strong returns as EPS growth remains above 10% per year. Some may look unfavorably on the recent $150 in buybacks over the past year as a negative indicator, and I may agree if growth declines. Hindsight is 20-20, but perhaps a bolt-on acquisition would have been a better use of capital. Thankfully, management and investors remain positive even as the market falls, allowing the bull case to remain.

For me, I believe that the risk-reward in the intermediate term remains unfavorable, and I will be waiting to add at lower prices/valuation. However, I can also suggest that long-term investors that have little need to time their buys are still best suited adding on a recurring basis as EXPO has traditionally traded with lower volatility. As I discussed in an article on the Smartest Investments in the market, sometimes there is more than financials baked into a company’s price.

Thanks for reading.

Be the first to comment