gesrey

By Stephanie Rowton

S&P Dow Jones Indices (S&P DJI) launched the S&P 500® ESG Leaders Index in February 2022. The index sits within our S&P ESG index offerings, which have been designed to offer different solutions to reflect the wide range of ESG index investment needs. Sustainable investing continues to gain traction for a multitude of reasons – one being a desire to align investments with investor values. However, despite a surge in the prominence of ESG investing, clients are all at different stages of their ESG journey, meaning there is no “one-size-fits-all” solution.

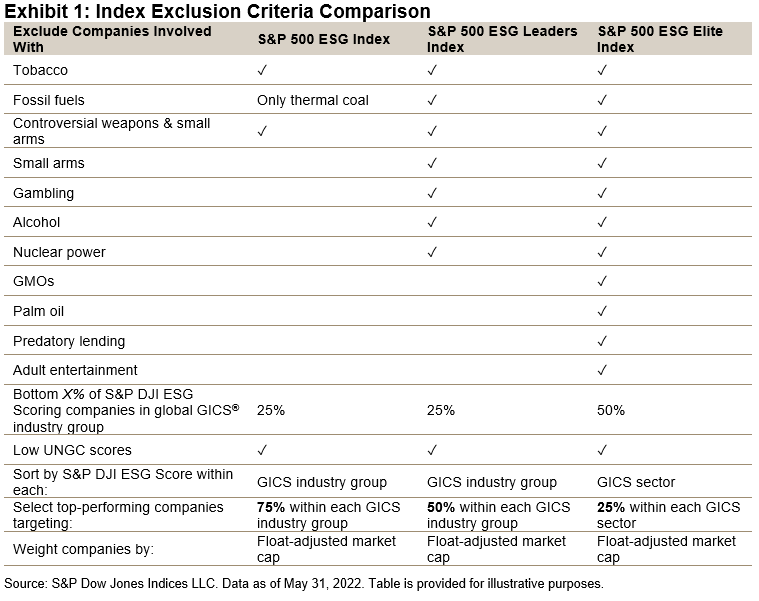

The S&P ESG index offerings enable users to access a broad and diversified index benchmark while removing:

- Business activities that may be deemed controversial

- Violators of UNGC principles

- Companies that perform poorly relative to their industry group peers when considering E, S, and G criteria

The S&P 500 ESG Leaders Index sits between the less prohibitive exclusions of the S&P 500 ESG Index and the stricter exclusion criteria of the S&P 500 ESG Elite Index. Some may consider it Goldilocks choice of the S&P ESG index offerings – not too hot, not too cold, but just right.

Author

Exclusions Follow a Rules-Based Methodology

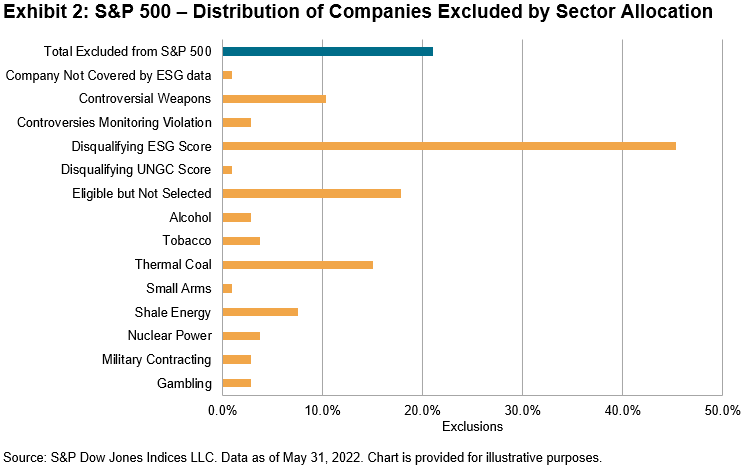

April 2022 rebalance resulted in roughly one-fifth (21%) of companies within the S&P 500 being excluded from the S&P 500 ESG Leaders Index. Of those excluded, 45% were removed due to having an ineligible S&P DJI ESG Score (see Exhibit 2). This is because the S&P 500 ESG Leaders Index removes the companies in the bottom 25% by S&P DJI ESG Score in the global GICS industry group. By implementing this screen, the index removes global ESG laggards when compared to their industry group peers.

Unlike the S&P 500 ESG Index, the S&P 500 ESG Leaders Index includes screens for shale energy and nuclear power. Of the exclusions, 8% were due to these screens, resulting in companies such as ConocoPhillips (COP), Marathon Oil (MRO), Occidental Petroleum (OXY), and NextEra Energy (NEE) all being removed.

Gambling is another screen within the index, resulting in the removal of three companies: MGM Resorts International (MGM), Las Vegas Sands (LVS), and Caesars Entertainment (CZR).

Author

Eligible ESG Credentials But Not Selected

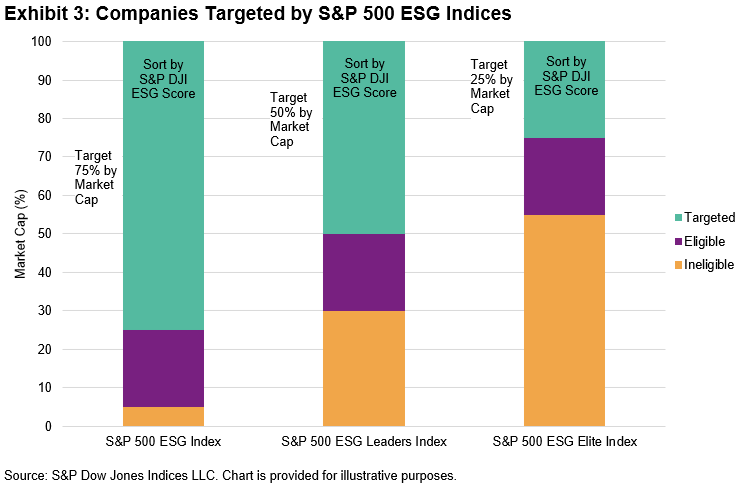

The S&P 500 ESG Leaders Index targets the top 50% of companies by S&P DJI ESG Score in decreasing order within each GICS industry group. This results in several companies being eligible for inclusion, but not selected. For example, Warner Bros. (WBD), J.M. Smucker (SJM), and American Airlines (AAL) are all eligible for selection and are included in the S&P 500 ESG Index, which targets the top 75% of companies by S&P DJI ESG Score. However, they do not hit the 50% threshold needed for inclusion within the S&P 500 ESG Leaders Index.

Author

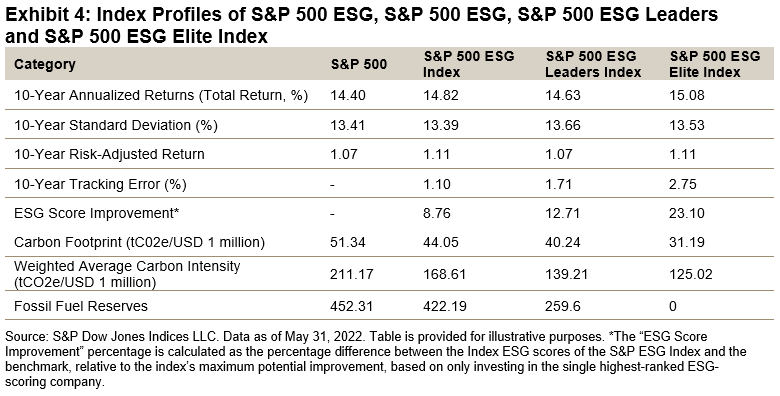

Similar Historical Performance with a Stronger Carbon Profile

Despite having stricter exclusions than the S&P 500 ESG and more lenient thresholds than the S&P 500 ESG Elite Index, the S&P 500 ESG Leaders index still offers a diversified and broad sector allocation with strong ESG credentials. The index also offers a lower carbon footprint, lower weighted average carbon intensity and lower exposure to fossil fuels than the S&P 500 (see Exhibit 4).

Author

Conclusion

When it comes to ESG indices, there is no one-size-fits-all solution – what is right for one investor does not necessarily fit the needs of another. As investor attitudes toward ESG investing continue to differ, it remains essential for market participants to understand their ESG conviction to choose a solution that enables them to reflect their beliefs in their investment needs. The S&P 500 ESG Leaders Index has been designed for those who seek the broad and diversified exposure typically offered by the S&P 500, while also taking a harder stance when it comes to excluding unsustainable business activities.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment