miniseries

Last time, we analyzed Expedia very well (NASDAQ:EXPE) providing six long-term-upside to our compelling investment case. Despite that, the company lost more than 40% of its entire market cap. Something is not right.

Expedia: U.S. Exposure And Travel Recovery Will Play In Its Favour

Source: Mare Evidence Lab’s previous publication

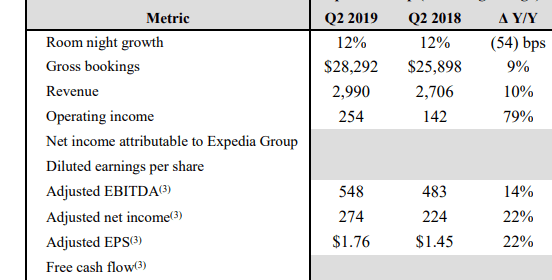

For the first time, we are going deep into the 2019 Q2 results providing a comps analysis with the just released 2022 Q2 numbers. No buy case recap today but from time to time we will refer to the six points in our previous analysis.

Half-year 2019 versus half-year 2022

- Gross bookings reached $28.3 billion in the first half year of 2019;

- Gross bookings recorded $26.1 billion in the first half year of 2022;

2019 results had a superior performance but looking at the details we note:

- Net revenue stood at $2.99 billion in 2019 whereas the company just recorded $3.1 billion in 2022. At ceteris paribus, this means that Expedia improved its fee margins (superior performance versus competitor – point 2 in our previous analysis).

- Going down to the P&L, we see better trend margins at the EBITDA level but also at the operating profit level. Numbers in hand, Expedia recorded an adj. EBITDA margin of 8.49% and 20.37% in 2019 and 2022 respectively. That’s remarkable. In our initiation of coverage, we emphasized the cost-saving initiatives (points 4, 5 and 6).

- On the contrary, at that time Expedia was less indebted. However, the difference is just $3 billion and the company has a much higher free cash flow generation so we are forecasting almost one billion less semester after semester.

Expedia 2019 Q2 results

Source: Expedia 2019 Q2 results

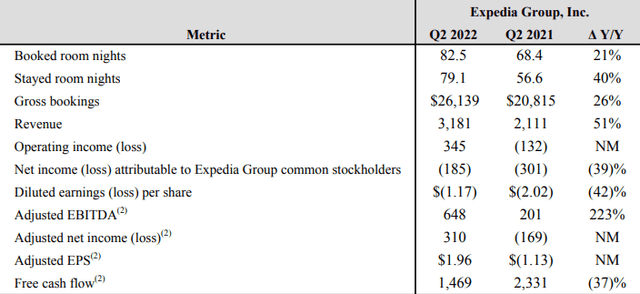

Source: Expedia 2022 Q2 results

Q2 2022 bookings were the highest in Expedia’s history and the company is taking full advantage of travel recovery. We recently analyzed Ryanair Holdings, Air France-KLM and Deutsche Lufthansa and the numbers look very promising for the future. Still looking at the comps analysis with 2019 accounts, the lodging bookings increased by 9%, 9% and 5% in April, May and June respectively. The company beats consensus at the operating income level and we are not surprised. In the last year, Expedia’s integration strategy has led the company to streamline operations and costs. We should note that Expedia plans to expense more on marketing as well as on a new loyalty program. During the call, the management stated that there will be more focus on Expedia’s app to make it more user-friendly. Thus, Expedia is working for the long-run trading some margins versus the short-term horizon.

Conclusion and Valuation

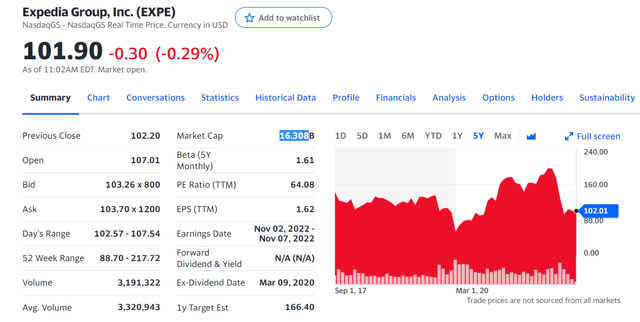

Regarding the valuation, we are decreasing our target price from $240 to $230 maintaining a buy rating. After the Q2 release in 2019, Expedia was trading at more than $130 per share versus the current price of $100. In the meantime, a global pandemic happened and the company was only able to navigate the storm but also to increase net revenue, margins, and FCF generation.

Source: Yahoo Finance

The risks to our price target are the following:

- Health crisis deterioration;

- FX development – a strong US dollar is not great for Expedia;

- Higher competition (in particular from Google and Bookings);

- Changing consumer preferences for accommodation (from hotel to Airbnb);

- Fee renegotiations.

Be the first to comment