Scott Olson

Utilities got taken to the woodshed in September as the safety-trade unwound amid rising interest rates. The move did not change the valuation situation for the sector too greatly, however.

One of its components, Exelon (NASDAQ:EXC), features a below-sector PEG ratio, but is the stock a buy here after a Q3 swoon? Let’s shed light on the situation.

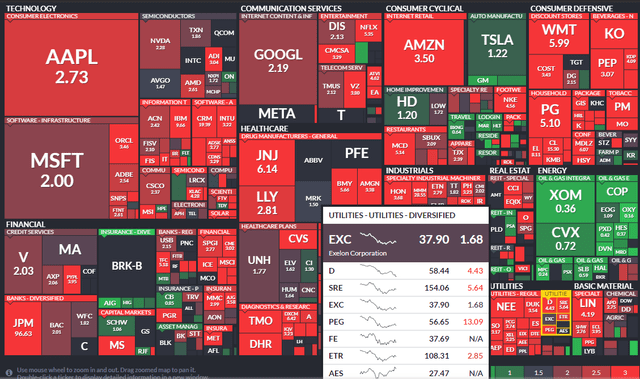

S&P 500 Price/Earnings/Growth (PEG) Ratios: EXC Somewhat Cheap

Finviz

According to Fidelity Investments, Exelon Corp, a utility services holding company, engages in the energy generation, delivery, and marketing businesses in the United States and Canada. It owns nuclear, fossil, wind, hydroelectric, biomass, and solar generating facilities. The company also sells electricity to wholesale and retail customers; and sells natural gas, renewable energy, and other energy-related products and services.

The Illinois-based $37.8 billion market cap Electric Utilities industry company within the Utilities sector trades at a near-market GAAP price-to-earnings ratio of 17.6 and pays a 3.5% dividend yield, according to The Wall Street Journal.

Exelon has surprisingly strong EPS growth in the 6% to 8% range, per BofA, along with a solid dividend yield. While many utilities trade at a high earnings multiple both on an absolute and relative basis, EXC is coming off a lower valuation base right now, trading at a slight discount to its peers.

Having divested its merchant power operations, there is some uncertainty as to how its profit profile may look in the years ahead. With many firms in the utilities sector, unfavorable regulatory and legislative changes can be a risk to earnings. It is also critical that Exelon executes capex plans well given a much higher cost of capital now. Storms and natural disasters always pose risks to these capital-intensive companies and changing tax rates can be problematic.

The company beat earnings estimates in its Q3 report earlier this month, and shares generally rose, but the move was not steep. It narrowed its full-year 2022 operating earnings, so there is more certainty there.

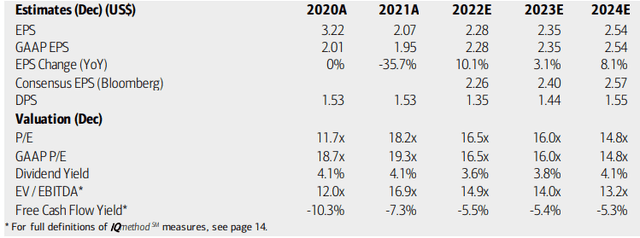

On valuation, analysts at BofA see earnings climbing by a solid 10% this year while 2023 per-share profit growth is seen at just 3%. The Bloomberg consensus forecast is about on par with what BofA expects, including a rebound in 2024 with 8% EPS growth.

Dividends, meanwhile, are expected to rebound over the next two years after EXC separated its merchant power company. The stock trades at an elevated EV/EBITDA multiple and has negative free cash flow (which is somewhat common in the sector). Seeking Alpha rates Exelon with a decent B- valuation, better than some of its peers.

Exelon: Earnings, Valuation, Dividend Forecasts

BofA Global Research

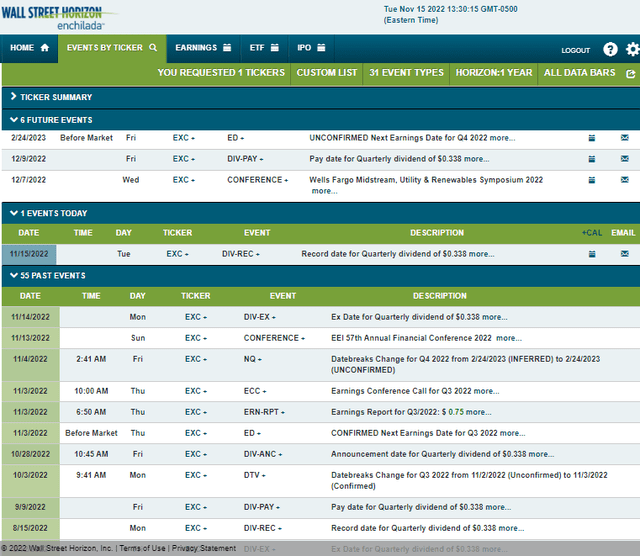

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Friday, February 24. Before that, though, the management team is slated to speak at the 2022 Wells Fargo Midstream and Utilities Symposium on December 7-8. Industry news often breaks at these events, so investors should pay attention to what EXC might divulge.

Corporate Event Calendar

Wall Street Horizon

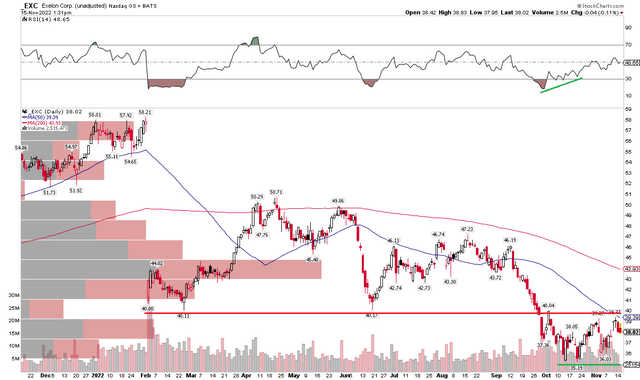

The Technical Take

I was bullish on EXC earlier this year, but that was not the right call. I noted a few price points to watch on the downside, and shares dropped right through those. So, analyzing the stock now with fresh eyes is important. I see resistance near $40 while $35 to $36 is support. Notice, though, that EXC’s RSI at the top of the chart is rising as shares consolidate – that’s a bullish feature, but ultimately, the price must climb above $40 before this one looks bullish technically.

A move above $40 would trigger a price objective to near $45 based on the $35 to $40 current range.

EXC: Shares Under $40 Support But Bullish RSI Trends

Stockcharts.com

The Bottom Line

I continue to generally like EXC’s valuation and yield, but there is now technical work that must be done by the bulls to make for a more favorable outlook.

Be the first to comment