chonticha wat

Evolution Mining Limited (OTCPK:CAHPF) is rapidly increasing its mineral resources by acquiring new rights besides exploring new areas. I don’t think most investors did take into account the increase in reserves in their financial models. I designed two discounted cash flow models and obtained a valuation of close to $2.5 per share under my best-case scenario. Yes, even considering environmental risks, lack of new discoveries, or inflation, I believe that the stock price is low at its current price mark.

Evolution Mining

Evolution Mining Limited is a gold miner operating five wholly-owned mines in Western Australia, Queensland, and Canada.

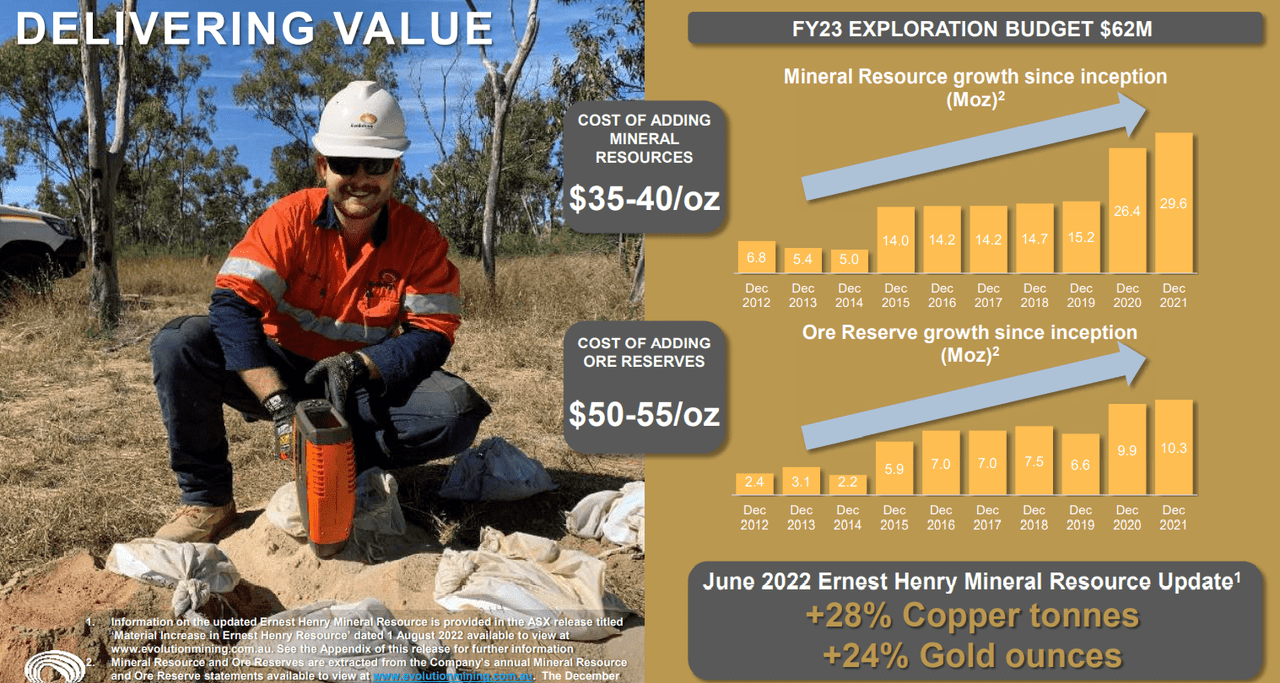

I became very interested in the company’s business profile after having a look at the recent increase in mineral resources and ore reserves growth. In my view, Evolution Mining could see higher stock price marks if the company’s growth continues at the same pace:

The Company increased its Gold Mineral Resources and Ore Reserves as at 31 December 2021, with Mineral Resources increasing from 26.4 million ounces to 29.6 million ounces and Ore Reserves up from 9.9 million ounces to 10.3 million ounces net of mining depletion as at 31 December 2021. Source: 10-Q

Presentation

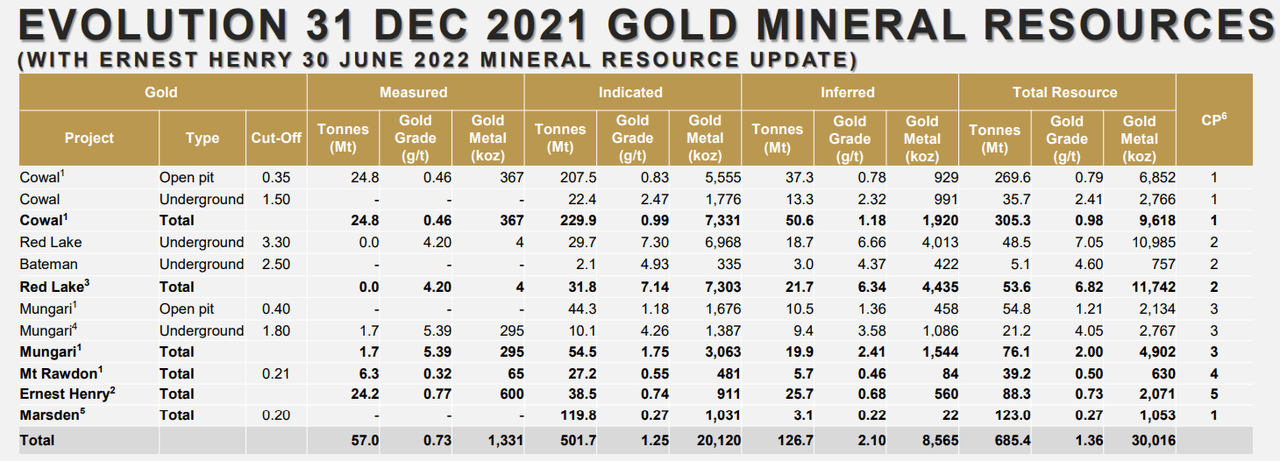

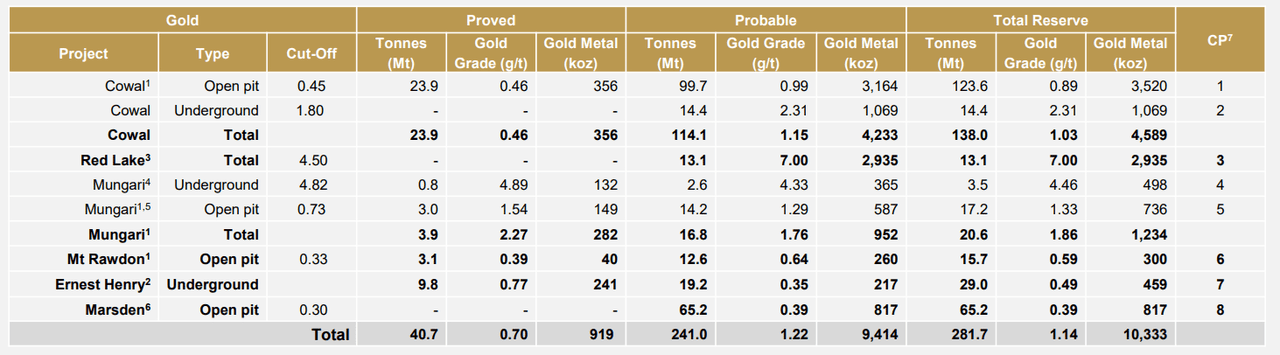

In my view, the valuation of Evolution Mining would be equal to the result of selling the production of the gold and copper to be produced in the future. With this in mind, I carefully assessed the current gold resources reported by management. Evolution Mining reported total gold resources of 30,016 kOz with a gold rate of 1.36 g/t, and indicated resources worth 20,120 kOz. The total ore reserve stands at close to 10,333 kOz.

Presentation

Presentation

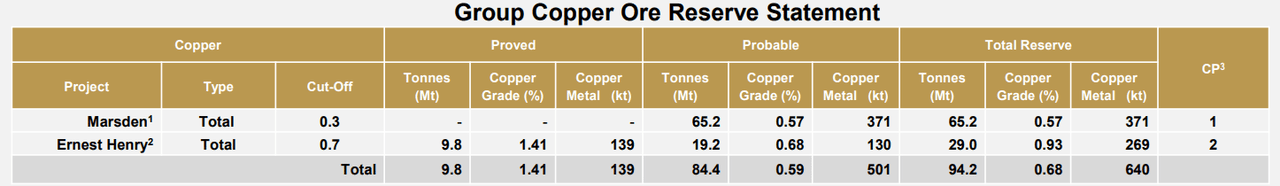

With respect to the company’s core ore reserve, management reported total copper of 640 kt with a grade of 0.68%. I did include in my valuation the production of copper. Let’s note that Evolution Mining also reported some production of silver.

Presentation

Beneficial Expectations, Dividends, Cash Flow, And Good Reports From Financial Analysts

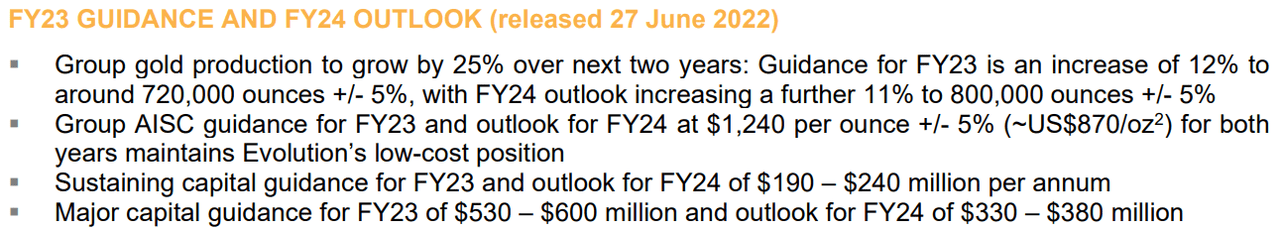

I believe that the most appealing figures received from Evolution Mining were the guidance for 2023 and 2024. The company expected 12% growth in gold production in 2023 and stable 2024 gold production growth. Sustaining capital guidance was also approximately close to the figures reported in the past. I appreciate that the company’s figures don’t change a lot, making revenue and free cash flow (“FCF”) forecasting much easier.

Quarterly Report June

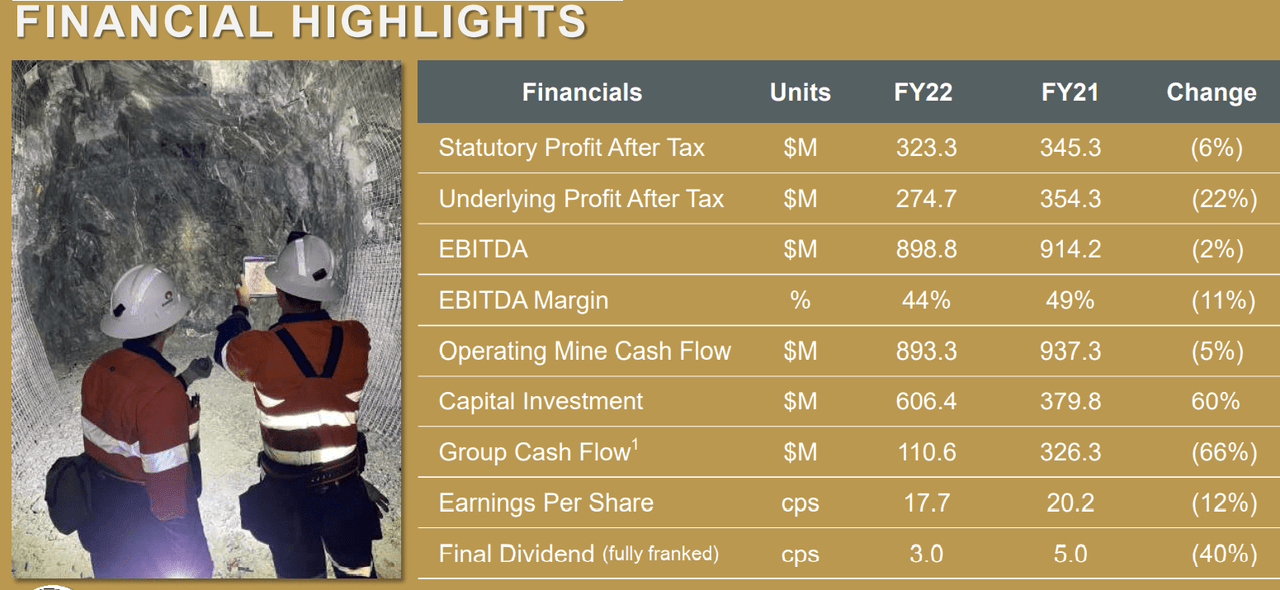

The numbers delivered in the past included a 44%-49% EBITDA margin, CFO close to AUD893 million, and $937 million along with paid dividends. With cash flow from operations and somewhat stable EBITDA, Evolution Mining appears to be an interesting stock to make free cash flow forecasts. I had a quick look at the expectations of other analysts before launching my own financial models.

Presentation

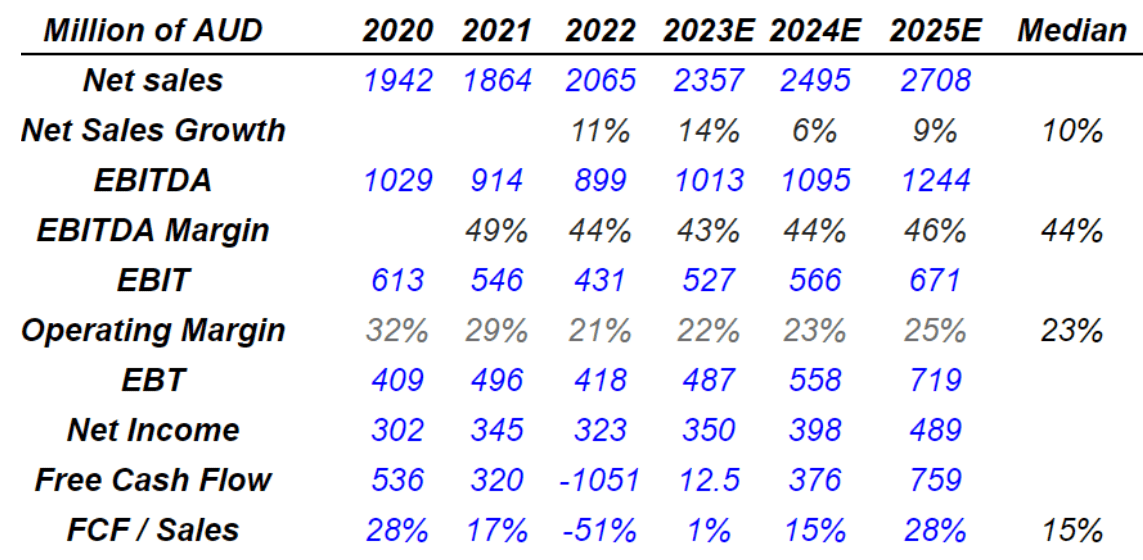

Investment analysts believe that from 2023 to 2025, net sales growth would remain close to 14%-6%. They also expect an EBITDA margin around 43% and 46% as well as 2025 net income of AUD489 million. Finally, let’s also note that the free cash flow is expected to go from AUD12 million in 2023 to AUD759 million in 2025. In 2025, the FCF/Sales would stand at 28%, which is an impressive figure. In my view, as more investors have a look at the income FCF growth, the demand for the stock will likely increase.

marketscreener.com

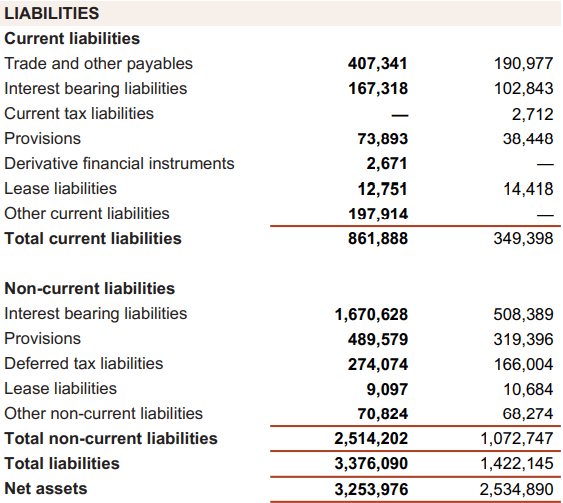

Balance Sheet: I Believe That The Level Of Leverage Is Not Worrying Considering Future EBITDA Figures

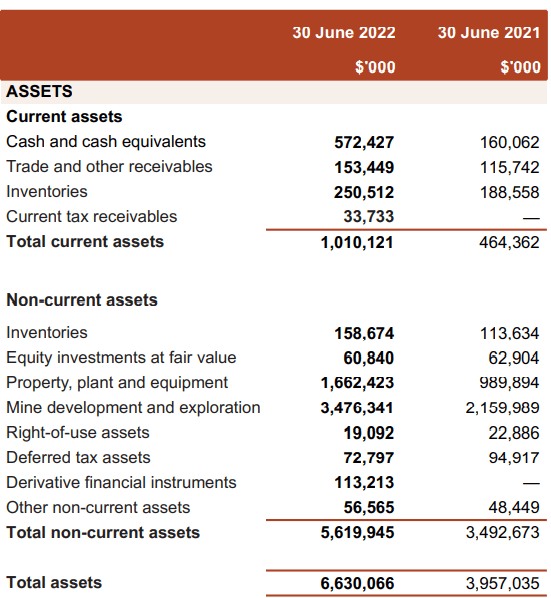

With cash equal to AUD572 million and an asset/liability ratio close to 2x, I believe that Evolution Mining’s financial shape is appealing. Note that the largest assets are represented by property, plant and equipment, and mine development and exploration, which are worth close to AUD5 billion.

10-Q

Evolution Mining finances part of its operations with interest-bearing liabilities worth AUD1.67 billion. I would say that the company’s leverage stands at close to 3x forward EBITDA, which may be worrying for certain investors.

10-Q

If The Company Produces Close To Its Gold Ore Reserves Of 11 Million Ounces, My Implied Valuation Would Be Close To $0.64-$0.65 Per Share

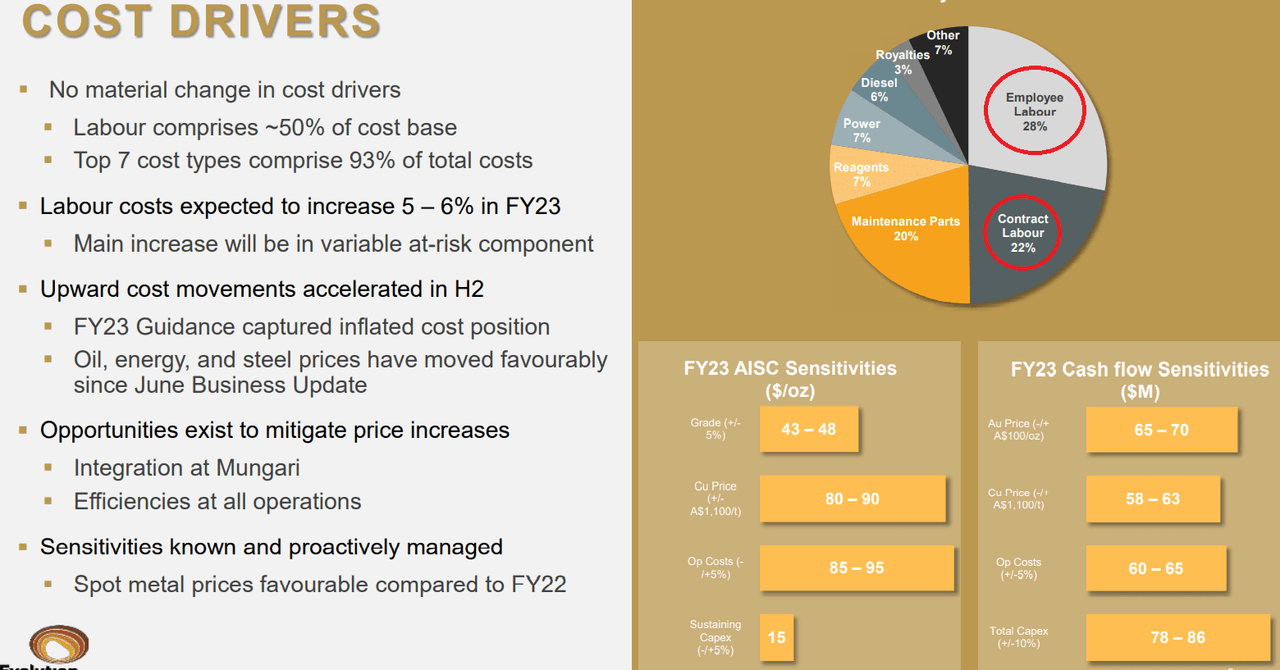

In the future, there will be many cost drivers, which may decrease the company’s profitability. In a recent presentation, management noted that decreases in the grade obtained in the mines, changes in copper or gold prices, and sustained capex or opex could drive profitability down.

Evolution Mining also reported that increases in salaries or electricity costs could affect the company’s EBITDA margin. Besides, I also believe that increases in inflation and lack of certain machinery necessary for mining could lower production, or decrease the FCF/Sales margin. With all these features in mind, under this case scenario, I tried to lower the total amount of production and profitability.

Presentation

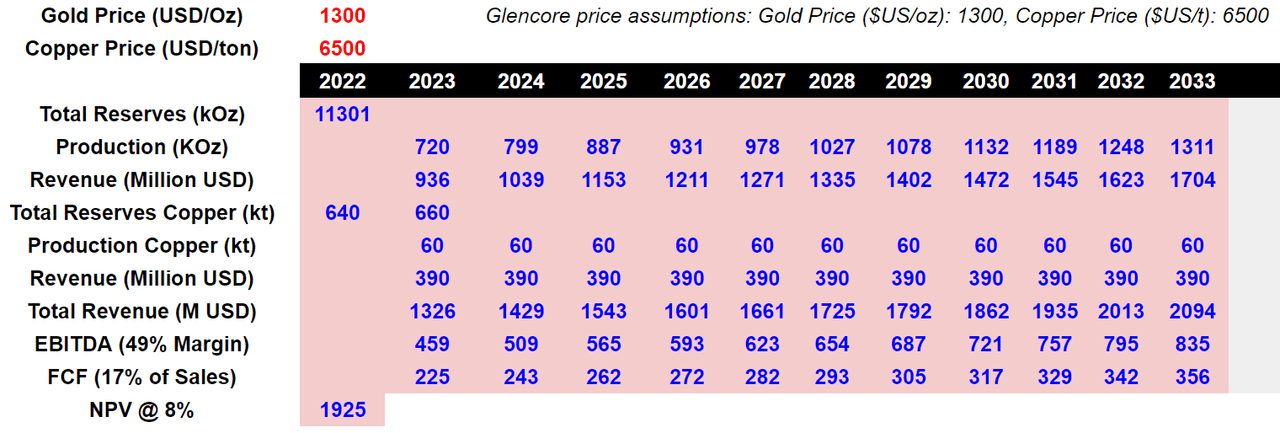

I assumed a gold price of $1300 per ounce, copper price of $6500 per ton, and production from 2023 to 2033. Total reserves would be 11,301 kOz of gold and 640 kt of copper. With around 720 kOz and 1311 kOz of gold production per year in 2023 and 2033 respectively, I obtained revenue per year of $936 million and $1704 million. Production of copper would be around 60 kt per year and $390 million in revenue. I also used FCF/Sales margin around 17% and a discount of 8%.

Chatool’s DCF Model

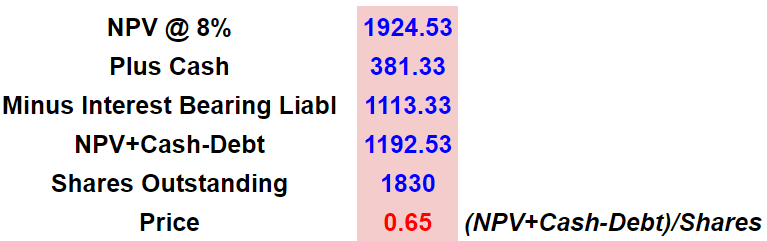

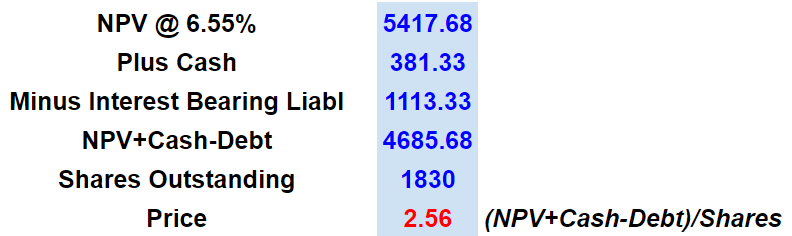

The sum of future FCF discounted at 8%, plus cash in hand, minus debt is equal to $1.19 billion. Finally, the fair price would be $0.65 per share.

Chatool’s DCF Model

My Best Case Scenario With Production Of 30 Million Ounces Of Gold Would Imply A Valuation Of $2.5 Per Share

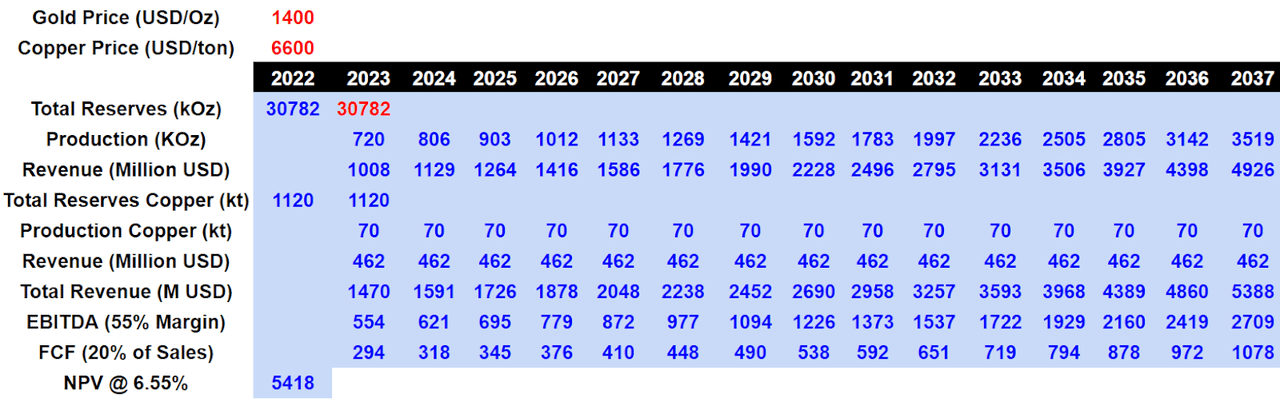

Under this case scenario, I assumed that the company’s total mineral resources of 30 million ounces of gold would be economically viable. Yes, in this case, I am optimistic. I assumed that the gold price would stand at $1400 per ounce and $6600 per ton. Production would go from 2023 to 2038. I included gold production of 720 kOz-3519 kOz per year and copper production of 70 kt per year. My results with an EBITDA margin of 55% and FCF/Sales of 20% include FCF of $294 million-$1 billion.

Chatool’s DCF Model

With a discount of 6.55%, the net present value would be close to $5.5 billion, and the fair price would be $2.5 per share. Under this case scenario, the upside potential in the stock price is impressive.

Chatool’s DCF Model

Risk Factors Include Lack Of New Discoveries And New Environmental Regulation

Evolution Mining will deliver growing production if ore reserves produced are replaced by new discoveries. Evolution Mining may also acquire other companies, or acquire new rights to produce more gold, which would increase total reserves. The company is well-trained in acquisition of new areas and the assessment of new projects. The following are some of the most recent acquisitions:

The Group acquired a 100% interest in the Crush Creek project located 30km south east of Mt Carlton. An initial ownership of 70% was achieved following sole funding $7.0 million of exploration expenditure and acquired the remaining 30% of the project for $4.5 million.

Subsequent to the end of the period on 22 July 2021, The Group announced that it has entered into an agreement with Northern Star Resources Limited. The Group has paid Northern Star $400.0 million in cash to acquire the assets. Source: Source: Annual Report

With that, without new acquisitions or exploration efforts, less proven reserves would lead to lower production expectations and lower free cash flow expectations. Management discussed potential risks from exploration and acquisition activities in the annual report:

Exploration is highly speculative in nature. The Group’s exploration projects involve many risks and are frequently unsuccessful. Once a site with mineralization is discovered, it may take several years from the initial phases of drilling until production is possible. Source: Annual Report

New environmental laws could also affect Evolution Mining’s exploration activities. If management does not receive government permits, or regulation makes mining more expensive, profitability would decline substantially. A reduction in the expected free cash flow would lead to stock declines in the stock price as soon as journalists write about it:

The Group’s mining and processing operations and exploration activities are subject to extensive laws and regulations governing the protection and management of the environment, water management, waste disposal, worker health and safety, mine development and rehabilitation and the protection of endangered and other special status species. Delays in obtaining or failure to obtain government permits and approvals may adversely affect the Group’s operations, including its ability to continue operations. Source: Annual Report

Conclusion

Evolution Mining is rapidly increasing its mineral resources, which would, in my view, imply higher stock prices. Under my best-case scenario, further exploration and acquisition of mineral resources and optimistic conditions could lead to a valuation of $2.5 per share. I obviously see many risks coming from failed geological models, new environmental laws, and gold price volatility. However, I see more upside potential in Evolution Mining’s stock price than downside risk.

Be the first to comment