metamorworks/iStock via Getty Images

A Quick Take On Everbridge

Everbridge, Inc. (NASDAQ:EVBG) reported its Q3 2022 financial results on November 8, 2022, beating revenue and EPS estimates.

The firm provides critical event management solutions to organizations for their emergency operational requirements.

Management appears to be more focused on organic growth and an emphasis on reducing operating losses for 2023.

Given a slowing economy and lengthened sales cycles, I’m on Hold for Everbridge, Inc. in the near term.

Everbridge Overview

Burlington, Massachusetts-based Everbridge, Inc. was founded in 2002 to provide a range of mass notification and related communications technologies to businesses and government agencies.

The firm is headed by president and CEO David Wagner, who was previously president and CEO of email encryption company Zix and prior to that, president of Entrust Datacard.

The company’s primary offerings include:

-

Safety Connection

-

Visual Command Center

-

xMatters

-

Mass Notification

-

Public Warning

-

Crisis Management

-

Others.

Everbridge acquires new customers via its in-house sales, marketing and business development efforts as well as through select strategic partners and ecosystem relationships.

Everbridge’s Market & Competition

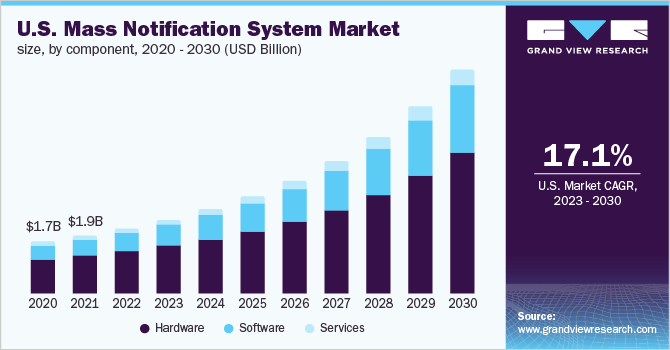

According to a 2023 market research report by Grand View Research, the market for mass notification software and services was an estimated $10.34 billion in 2022 and is forecast to reach $48.8 billion by 2030.

This represents a forecast CAGR of 21.4% from 2023 to 2030.

The main drivers for this expected growth are growing demand from organizations for the ability to manage their critical event management responses.

Also, the chart below shows the historical and projected future growth trajectory of the mass notification market size in the U.S.:

U.S. Mass Notification Market (Grand View Research)

Major competitive or other industry participants include:

-

BlackBerry Limited

-

Blackboard

-

Desktop Alert

-

Eaton

-

Honeywell International

-

Motorola Solutions

-

OnSolve

-

Singlewire Software

-

xMatters.

Everbridge’s Recent Financial Performance

-

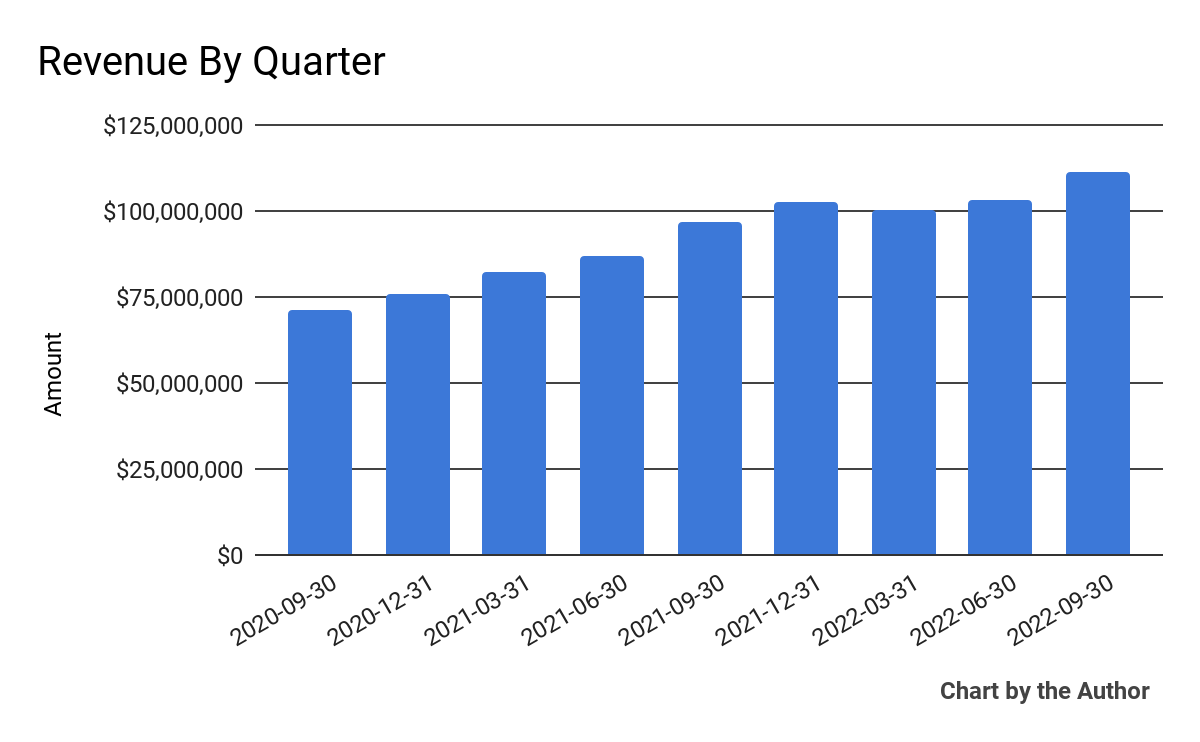

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Financial Modeling Prep)

-

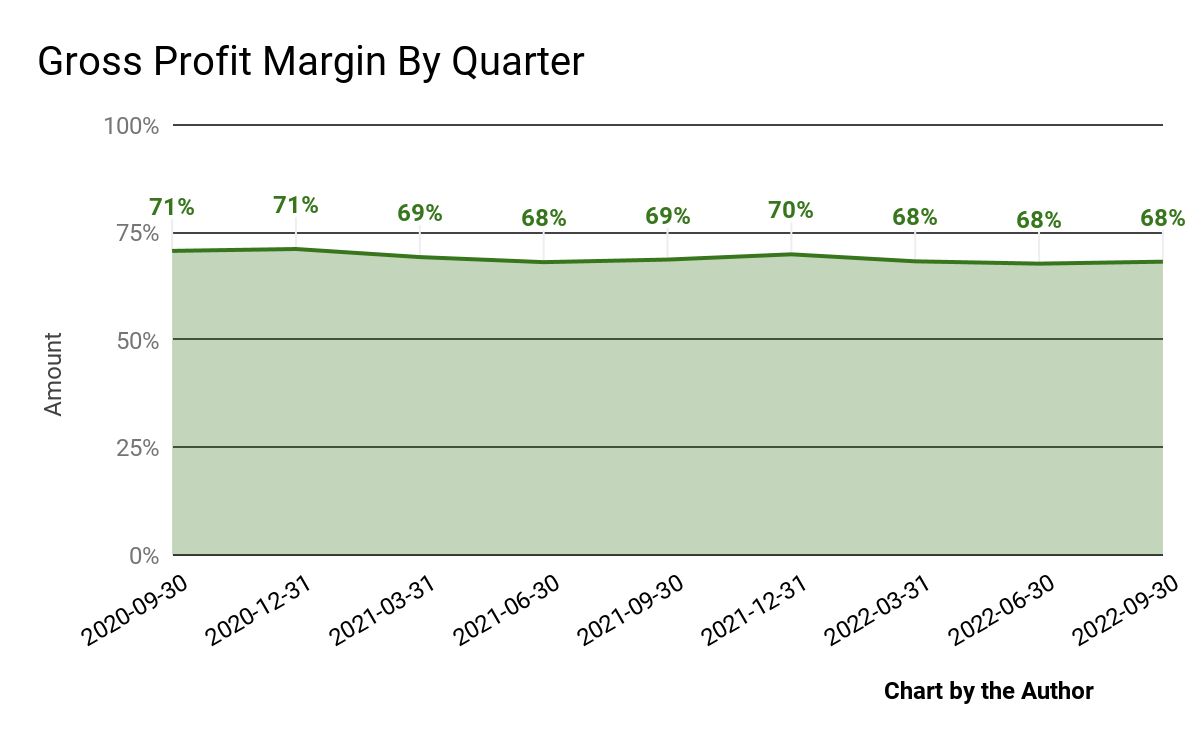

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

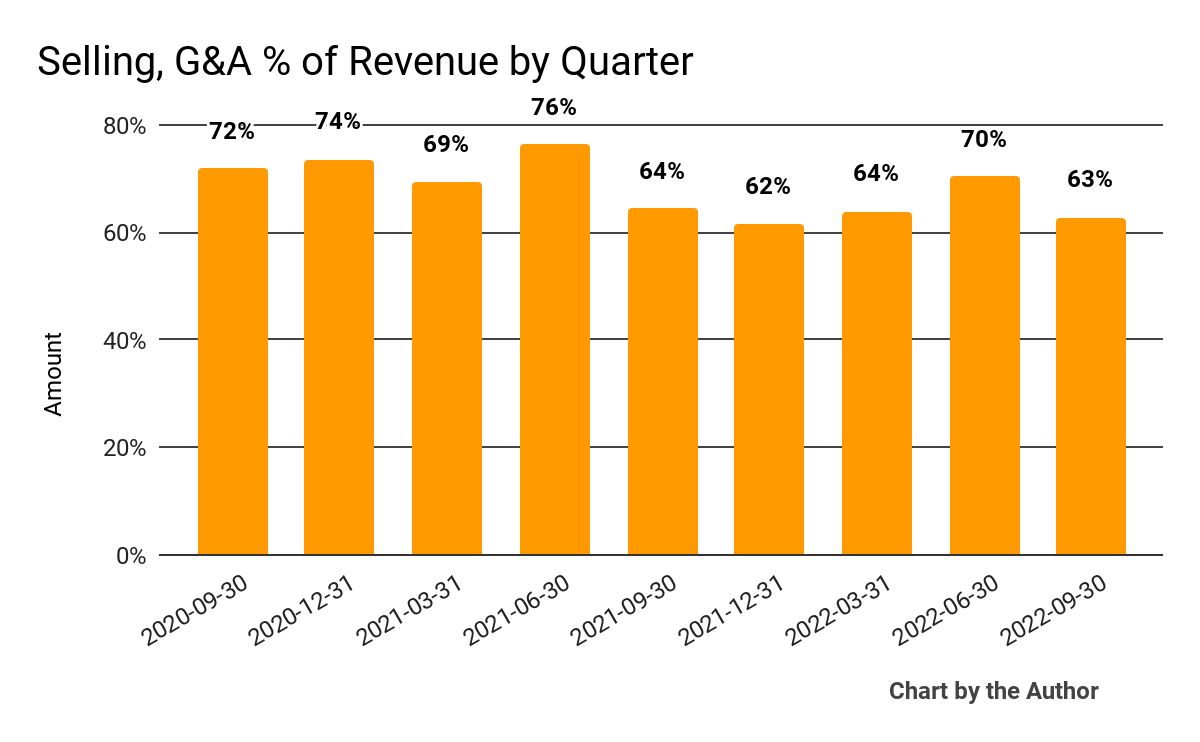

Selling, G&A expenses as a percentage of total revenue by quarter have also trended slightly lower recently:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

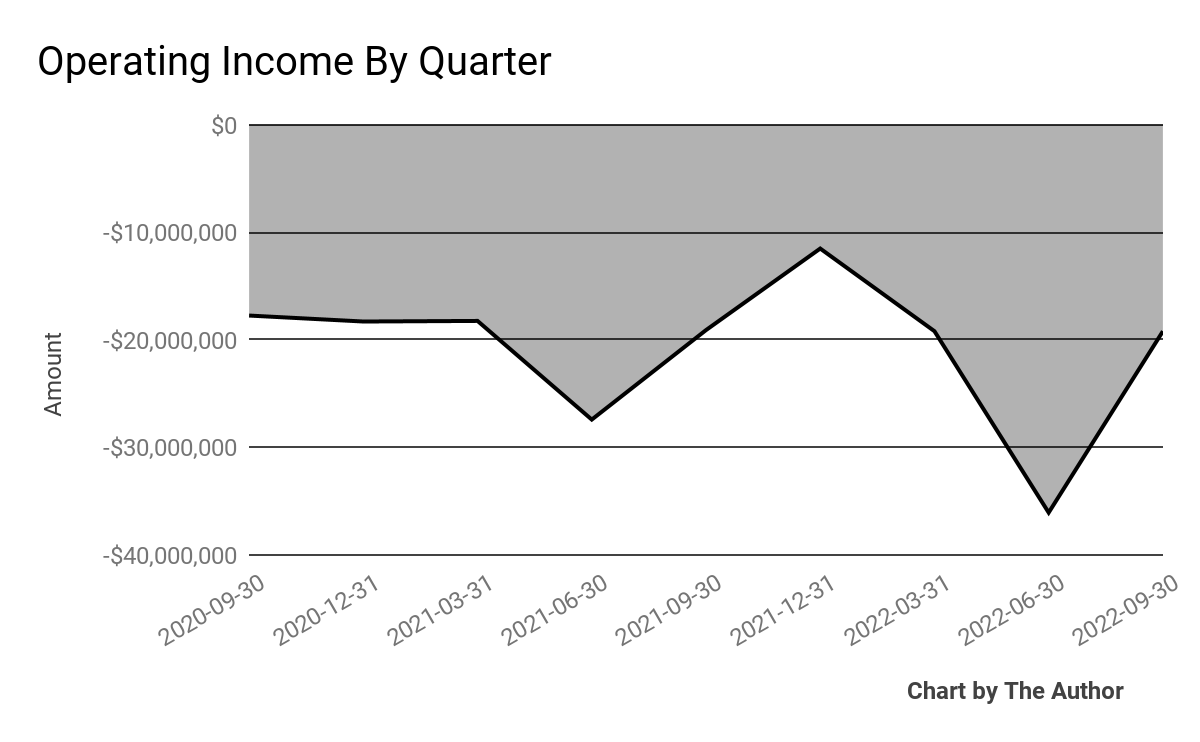

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

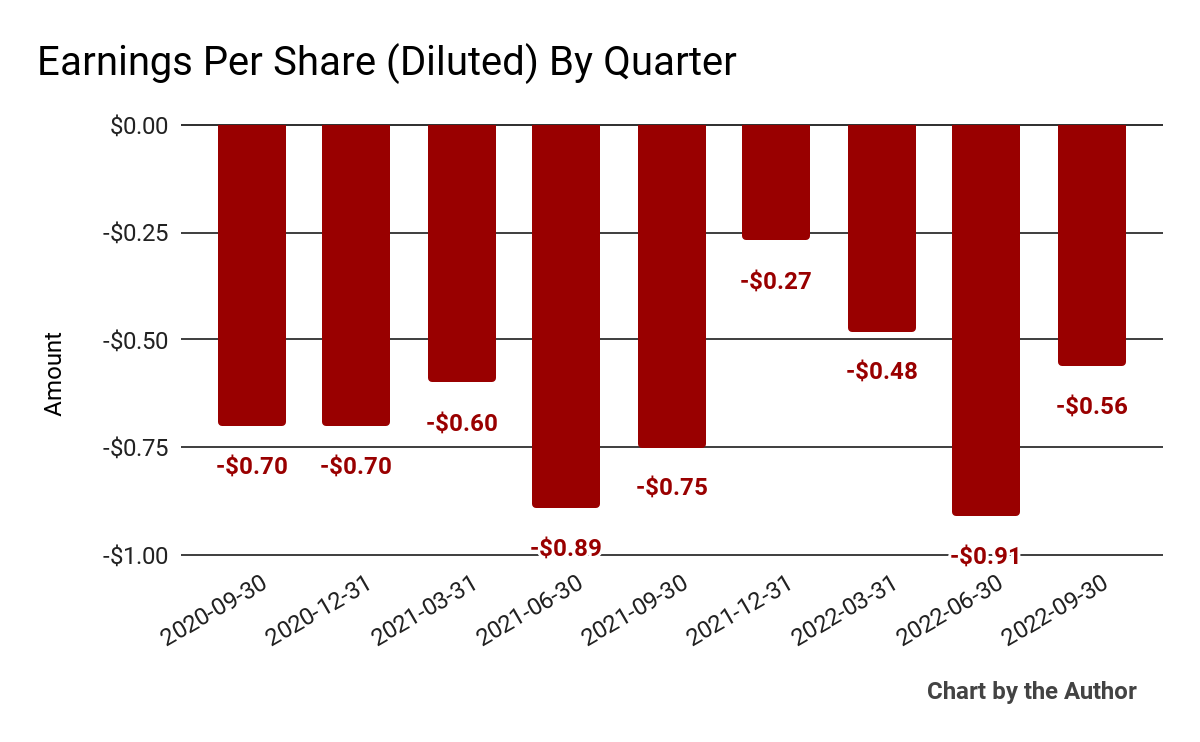

Earnings per share (Diluted) have remained substantially negative, as shown below:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP.)

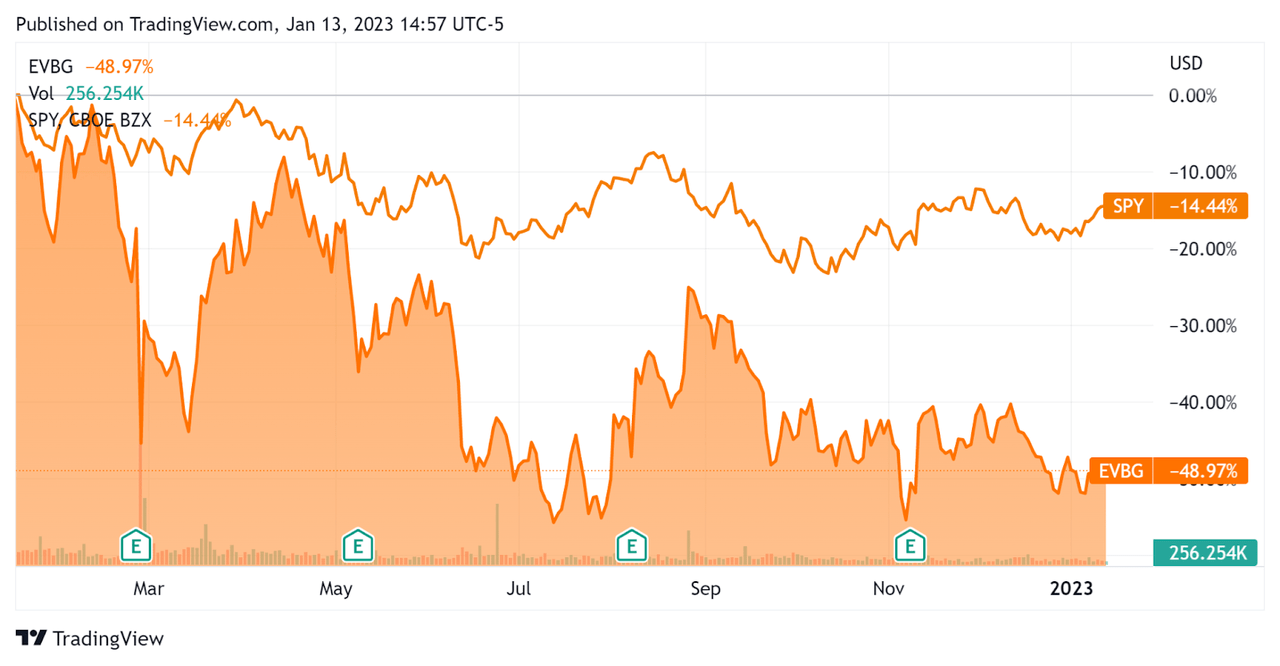

In the past 12 months, EVBG’s stock price has dropped 49% vs. the U.S. S&P 500 Index’s (SP500) drop of around 14.4%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Everbridge

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.5 |

|

Enterprise Value / EBITDA |

-90.1 |

|

Revenue Growth Rate |

22.4% |

|

Net Income Margin |

-21.0% |

|

GAAP EBITDA % |

-3.9% |

|

Market Capitalization |

$1,142,670,720 |

|

Enterprise Value |

$1,462,662,446 |

|

Operating Cash Flow |

$26,025,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.22 |

(Source – Financial Modeling Prep.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EVBG’s most recent GAAP Rule of 40 calculation was 18.5% as of Q3 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP [TTM] |

Calculation |

|

Recent Rev. Growth % |

22.4% |

|

GAAP EBITDA % |

-3.9% |

|

Total |

18.5% |

(Source – Financial Modeling Prep.)

Commentary On Everbridge

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted an expected lower growth rate in 2023 as the company focuses on organic revenue growth.

The firm is also further reducing headcount by another 200 positions by the end of 2022.

Management also expects to “simplify, modernize and optimize” the company’s internal processes and platform while pausing material acquisition activity.

As to its financial results, total revenue rose 15% year-over-year while adjusted EBITDA was up significantly to $15.2 million.

The company’s net retention rate continues to track at or above 110% and indicates solid product/market fit and reasonable sales & marketing efficiency.

The firm’s Rule of 40 results have been mediocre, with a positive revenue growth result dampened by a negative operating result.

Operating losses are near all-time highs, while earnings per share continue to be heavily negative.

For the balance sheet, Everbridge, Inc. ended the quarter with $486.9 million in cash and equivalents and $812 million in total debt.

Over the trailing twelve months, free cash flow was $22.2 million, of which capital expenditures accounted for $3.8 million. The company paid a hefty $38.2 million in stock-based compensation.

Looking ahead, the firm expects Q4 2022 revenue of around $116 million and adjusted EBITDA of $18.3 million at the midpoint of the range. Note that adjusted EBITDA doesn’t include stock-based compensation, which is a significant expense for Everbridge.

Regarding valuation, the market is valuing EVBG at an EV/Sales multiple of around 3.5x.

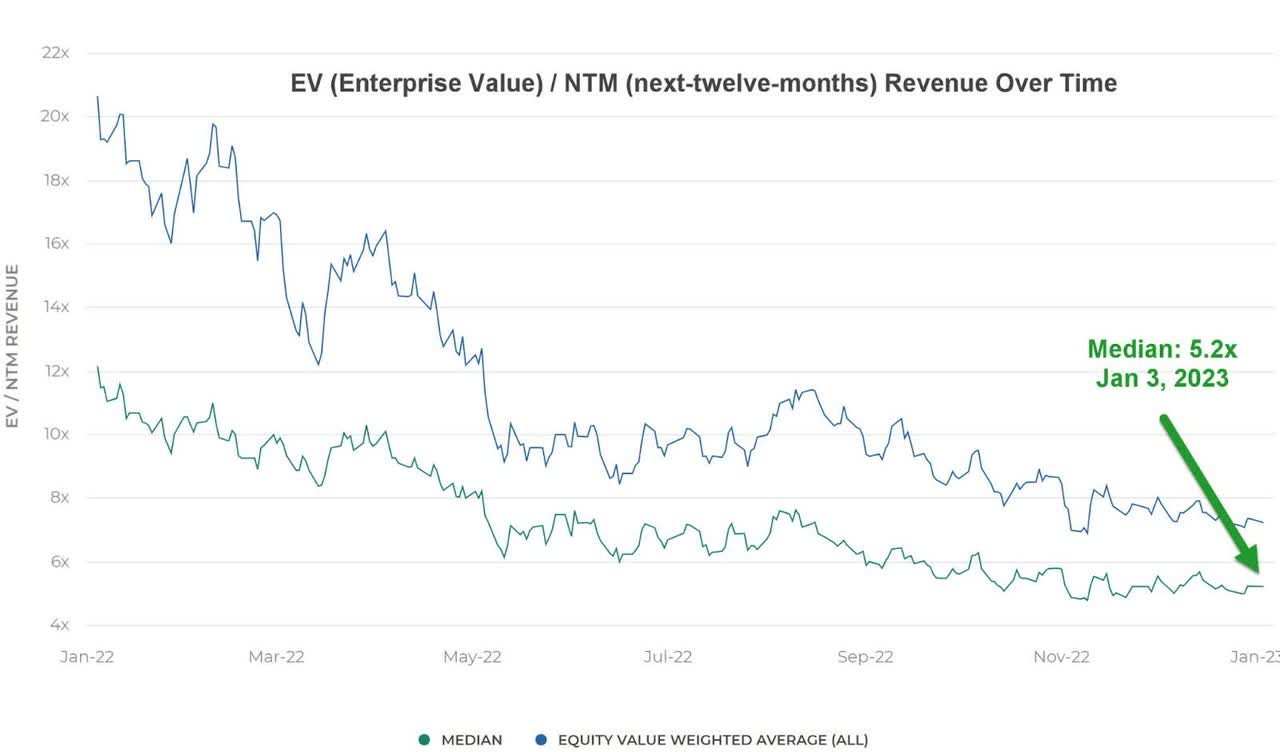

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 5.2x on January 3, 2023, as the chart shows here:

EV / Forward 12 Months Revenue Multiple (Meritech Capital)

So, by comparison, EVBG is currently valued by the market at a 33% discount to the broader Meritech Capital Index, at least as of January 3, 2023.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, slow down its sales cycles and reduce its revenue growth trajectory.

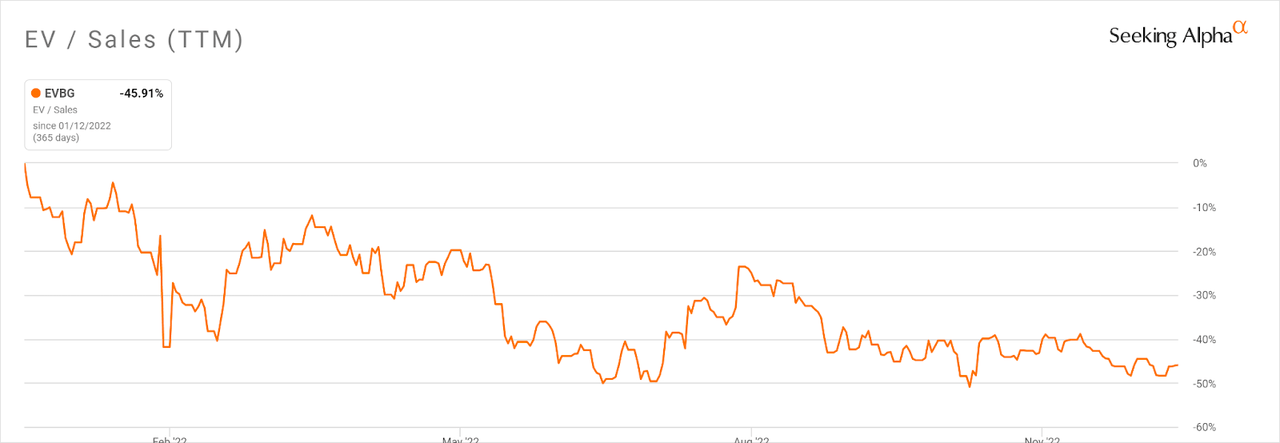

Notably, EVBG’s EV/Sales multiple [TTM] has compressed by 45.9% in the past twelve months, as the Seeking Alpha chart shows here:

Enterprise Value / Sales Multiple History (Seeking Alpha)

With 2023’s revenue expected to be between 6% – 7% from an organic focus and leadership appearing to manage toward operating breakeven rather than growth, I don’t expect a major catalyst to Everbridge, Inc. stock from organic sources.

As such, my outlook on Everbridge, Inc. in the near term is on Hold.

Be the first to comment