Mrinal Pal/iStock Editorial via Getty Images

Investment thesis: As I explained in a recent article, the EU’s decision to go ahead with a complete ban on ICE-powered car sales by 2035 is likely to decimate an already embattled EU domestic car industry. BMW (OTCPK:BMWYY) does have a number of advantages that could potentially tip the scales in its favor, albeit within the context of a shrinking domestic market. A number of factors, including the fact that it is a luxury brand, should allow for a much higher conversion rate of its existing customer base, given that EVs, especially the ones that offer comparable utility to conventional cars, sell at a similar price. A strong, healthy financial position and recent performance relative to some of its peers should help it navigate and adapt to the challenges ahead. Lastly, it has a robust international presence in terms of both sales & manufacturing, which should help to keep BMW in the game of ICE-powered vehicles, even if the EU will go through with its 2035 plan. While the overall investment environment in Europe is looking increasingly grim, BMW may be one of those exceptions worth taking a look at.

Financial health and profitability remain intact, despite the challenging European business environment.

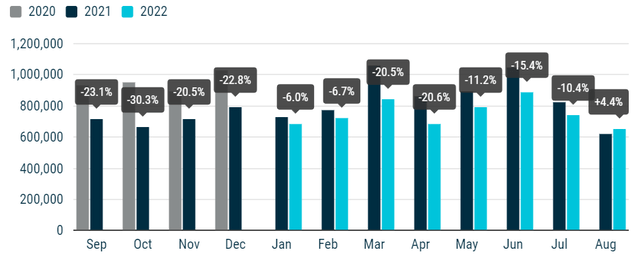

Europe’s auto sales have been cratering this year, which is yet another sign that Europe’s overall economy is suffering through some very difficult times.

Despite the overall challenging situation in BMW’s domestic as well as other markets around the world, it posted a decent Q3 result in my view. Net profits were up almost 23% to 3.2 billion euros Y-O-Y. Revenues were up 35% for the same period to 37.2 billion euros. Profit margins were therefore about 8.6%. Total deliveries totaled 1.75 million units for the first nine months of the year, which is a decline of 9.5% compared with the same period in 2021. Some specifics of note that are relevant to the wider topic of the continued push towards EVs, BMW’s pure EV sales surged this year compared with last year. For the first nine months of 2022, it sold 128,000 pure EVs, which is an increase of about 115% compared with last year.

The EU 2035 ICE-powered car sales deadline, BMW’s assets, and other advantages can help it thrive within an otherwise challenging situation for the next decade and perhaps beyond for the EU and global auto industries.

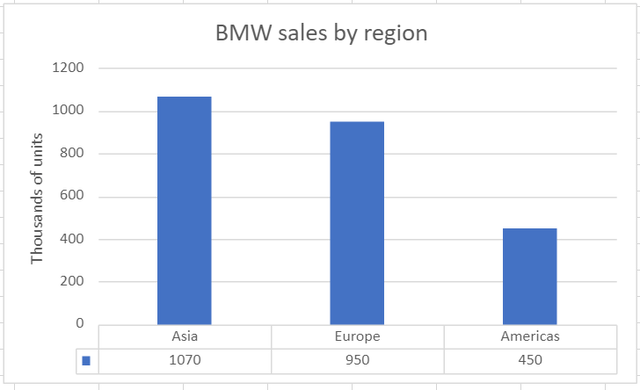

While the 2035 ICE-powered vehicle sales ban is important to BMW, it should be noted that its home base region is not its largest market.

BMW 2021 sales by region (Car Sales Statistics)

If for instance, Asia does not follow Europe in banning ICE-powered vehicle sales, BMW can still produce and sell such models in Asia, as well as in the Americas most likely, given that I do not see such a ban taking effect in most legal districts on this continent. I doubt that BMW will continue to produce ICE-powered cars in Europe, given that the entire supply chain needed to produce those cars will likely disappear in the next decade.

In the event that Europe’s consumers, thus their representatives will at some point realize that this ban is hurting individuals, households, and the overall economy to a degree that is not tolerable, BMW does have the capacity to switch back to selling ICE-powered cars in Europe, while perhaps exporting EVs produced in Europe to other markets. The latest production facility that it is building in Hungary will have the capacity to produce 150,000 EVs and it will be ready by 2025. This plant alone will account for the equivalent of about 1/6 of all of BMW’s vehicle sales in Europe in 2021. This new plant concept is said to be very efficient in many ways, including in terms of energy use. My guess is that BMW will follow this model to set up other future facilities in Europe. With Europe’s auto supply chains also transforming into one that will work to exclusively meet the needs of EV production, Europe could become one of the most cost-effective EV-producing regions on the planet and BMW could excel within that region, with a strategy focused on efficiency in place.

It should be noted that the new BMW plant concept that is implemented in Hungary is meant to rely on green energy, as well as storage facilities for most of its electrical needs. This becomes a very relevant detail within the context of the EU energy crisis we are seeing unfold before us. While renewable energy power is ordinarily seen as more expensive when all costs are included, and it is also seen as being more unreliable compared with other sources of energy, within the context of Europe potentially seeing power generation shortfalls, this might actually favor BMW’s operations in Europe on both price and enhanced reliability of power supplies. It should be noted that Hungary might be one of the least-affected countries given its nuclear power plant project, as well as being one of the few European countries tied to the Turkstream gas pipeline, which is still operational and likely to remain so. So at least that one plant that BMW is currently building is seemingly in a position to be shielded by the overall energy chaos that is affecting most of Europe.

I have no doubt that BMW will see declining vehicle sales in the European space within the one-decade transition period, just as is the case with most of the rest of the industry. Assuming that the entire project will play out more or less the way I explained in my article on the subject, which I cited at the top of the current article, it is entirely possible that the whole thing could play to BMW’s advantage. It could end up exporting EVs made in Europe to other parts of the world, while continuing production of ICE-powered cars in places like Asia or in the Americas could allow it to ship some of those cars to Europe, in the event that at some point along the way the ban will be repealed, as I expect it to happen, right around the time when it is supposed to fully come into force. While there are some significant risks to the scenario playing out the way I laid it out, I feel that the case for BMW coming out of this period of upheaval in the auto industry and arguably for the entire global economy in decent shape are decent.

Investment implications:

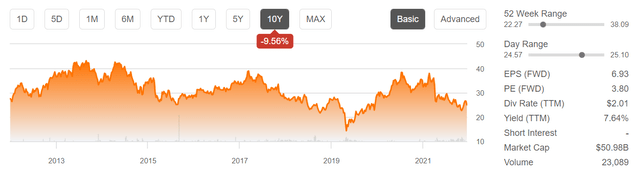

While I feel that there is a very good chance of picking up BMW stock at a much more favorable price next year, I decided to take up a very small initial position in this stock, based on what I am seeing in terms of its current financial performance & health, as well as its long-term prospects. The way I see it, BMW could be one of the top EV sellers globally within a decade or so, while it currently trades at only about 5% of the market cap that Tesla (TSLA) trades at, and more or less at the same market cap level with the likes of Rivian (RIVN). It currently trades at a forward P/E ratio of less than 4, and unlike a company like Rivian, it is well-positioned to surge in terms of EV sales, as well as remaining an important player in the global ICE-powered vehicle market, assuming that the world will not go all-in on EVs as many might expect.

The main risk to BMW’s positive long-term story at the moment is the very real possibility that Europe might experience a full socioeconomic & financial meltdown this decade. Between its economic divorce from Russia, a lack of innovation, and a green energy policy that could backfire spectacularly, leading to a collapse in what is left of its industrial base, on top of other problems, such as an arguably dysfunctional monetary union, a catastrophic outcome cannot be excluded and it should be factored in as a very real risk to this otherwise compelling investment opportunity.

Even though I am prepared to buy more BMW stock in the coming months, assuming that a better buying opportunity will arise going forward, I intend to keep my exposure to it limited to around 1% to 2% of my overall portfolio, which is also the case with my stock position in the other two EU-based companies, namely Nokia (NOK), and Fusion Fuel (HTOO). While the risk may be elevated on BMW, I also feel that the potential upside, given its valuation and other factors could also be worth the risk, which is why I decided to take a nibble at it and I am potentially poised to add if the opportunity arises.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment